Finance

IE Business School Definition

Published: December 6, 2023

Discover the meaning of finance at IE Business School. Learn from expert faculty and gain essential knowledge to excel in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

How to Manage Your Finances Like a Pro

Are you ready to take control of your finances? Whether you are a recent graduate starting your career or someone who wants to improve their financial situation, managing your finances is a crucial skill to master. In this blog post, we will discuss some expert tips and strategies to help you effectively manage your money and achieve your financial goals.

Key Takeaways:

- Create a budget and stick to it

- Build an emergency fund

Create a Budget and Stick to It

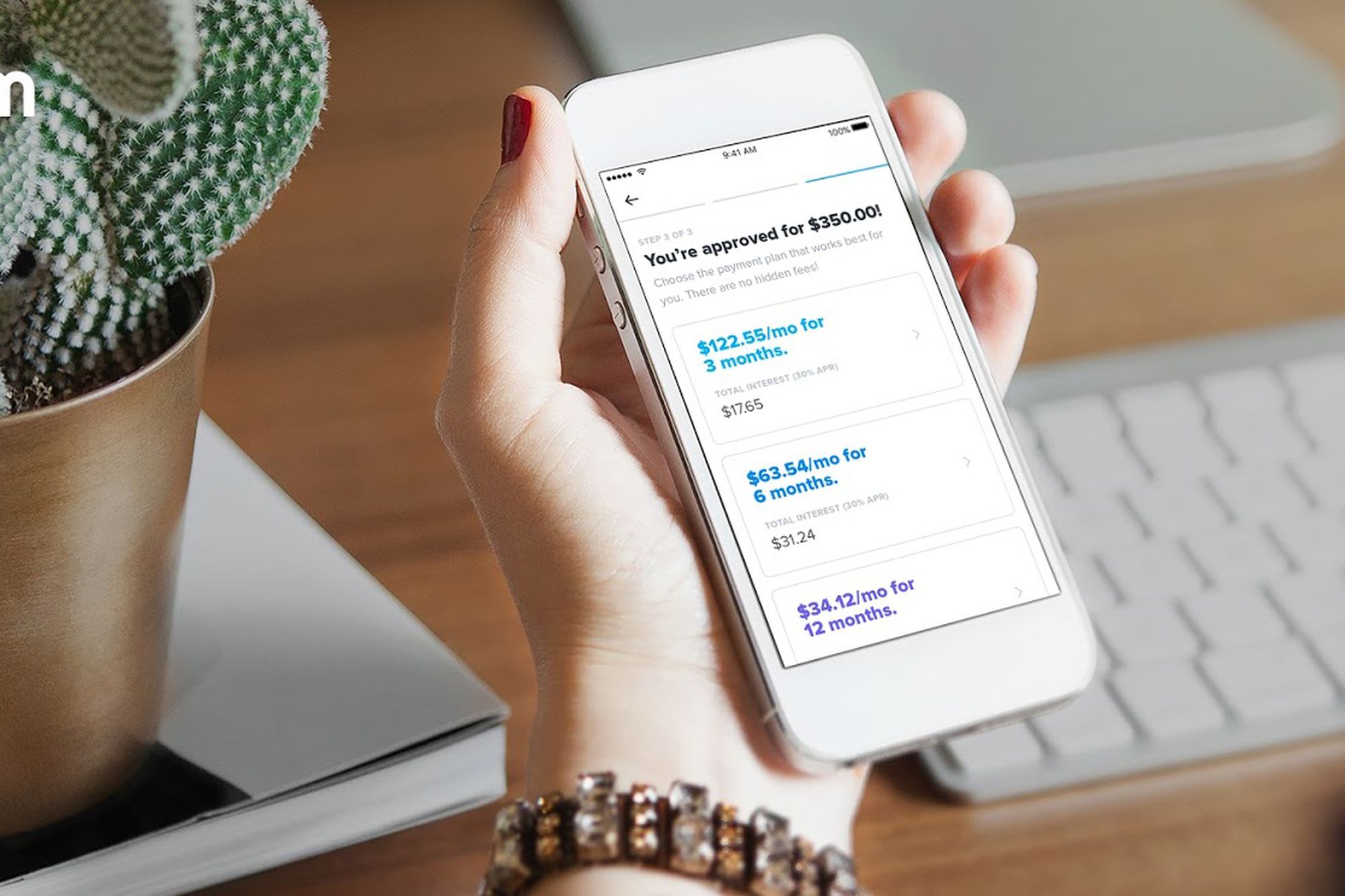

One of the first steps towards effective financial management is to create a budget. Start by evaluating your income and fixed expenses such as rent/mortgage, utilities, transportation, and debt payments. Allocate a reasonable portion of your income towards essential expenses, savings, and investments. Be sure to include some room for discretionary spending, but exercise restraint to stay within your budget.

Once you have established a budget, it is important to track your expenses. Utilize budgeting apps or spreadsheets to monitor where your money is going. Identify areas where you can cut back and make adjustments accordingly. By consistently sticking to your budget, you will gain a clear understanding of your financial situation and be better equipped to achieve your goals.

Build an Emergency Fund

Life is unpredictable, and it is essential to have a safety net to fall back on when unexpected expenses arise. Having an emergency fund can provide peace of mind and protect you from financial stress. Aim to save at least three to six months’ worth of living expenses in a separate account that is easily accessible.

Start by setting aside a portion of your income each month specifically for your emergency fund. Treat this saving as a fixed expense to prioritize it. Cutting back on non-essential expenses and finding ways to increase your income can help you accelerate the growth of your emergency fund.

An emergency fund not only protects you from unexpected expenses but also allows you to take advantage of opportunities that may arise. Whether it’s a sudden job loss, a medical emergency, or an exciting investment opportunity, having a financial buffer will give you the flexibility to navigate these situations without incurring unnecessary debt or stress.

Conclusion

Managing your finances like a pro requires discipline, planning, and a commitment to align your spending with your goals. By creating a budget and sticking to it, as well as building an emergency fund, you can take control of your financial future and achieve your objectives. Remember, financial success is a journey, and these strategies will help you stay on track even during uncertain times. Start implementing them today and watch your financial well-being improve.