Finance

Wisconsin School Of Business Definition

Published: February 18, 2024

Discover the world of finance at the Wisconsin School of Business! Gain in-depth knowledge and practical skills in finance through our comprehensive programs and experienced faculty.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Secrets of Finance: A Guide to Managing Your Money

Welcome to the world of finance! Whether you are a seasoned investor or just starting to dip your toes into the vast ocean of financial possibilities, understanding how to manage your money is crucial. At the Wisconsin School of Business, we are committed to providing you with the knowledge and tools to become financially savvy. In this blog post, we will explore the fundamentals of finance and provide you with key insights to help you make informed decisions about your financial future.

Key Takeaways:

- Finance is the management of money, investments, and other financial instruments.

- Understanding finance empowers individuals to make informed decisions regarding their money and investments.

What is Finance?

Before we delve into the intricacies of finance, let’s start with a basic definition. Finance is the study and management of money, investments, and other financial instruments. It encompasses various activities such as budgeting, investing, borrowing, and lending. There are several subfields within finance, including personal finance, corporate finance, and public finance.

The Importance of Financial Literacy

Financial literacy refers to the ability to understand and apply financial knowledge effectively. In today’s complex and ever-changing financial landscape, being financially literate is more important than ever. It empowers individuals to make informed decisions about their money, investments, and financial well-being. Here are two key takeaways about the importance of financial literacy:

- Financial literacy helps individuals set realistic financial goals and create actionable plans to achieve them.

- Being financially literate can protect individuals from falling victim to scams, frauds, and other financial pitfalls.

Finance in Everyday Life

Finance plays a significant role in our everyday lives, whether we realize it or not. Here are a few ways finance impacts our daily activities:

- Budgeting: Creating and managing a budget helps individuals track their income and expenses, ensuring that they live within their means and save for the future.

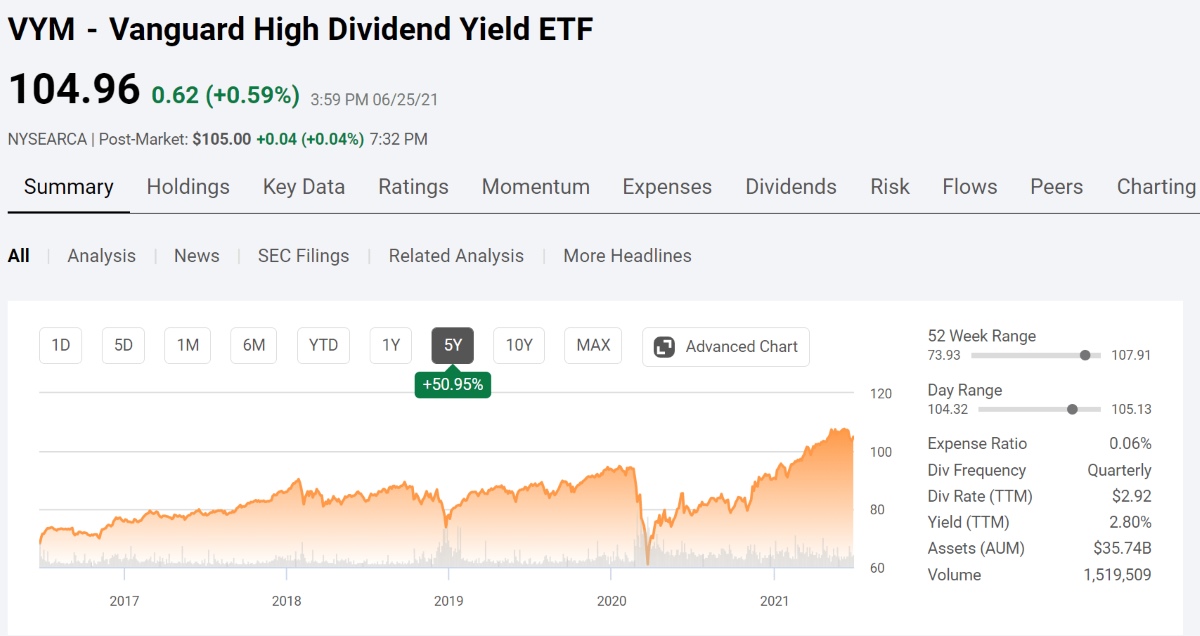

- Investing: Investing allows individuals to grow their wealth over time. By understanding different investment options and risk management strategies, individuals can make smart investment decisions that align with their financial goals.

- Borrowing and Lending: Loans and credit enable individuals to finance large purchases or investments, such as buying a home or starting a business. Understanding interest rates, loan terms, and the implications of debt is crucial in managing borrowing and lending activities.

- Retirement Planning: Planning for retirement involves making long-term financial decisions to ensure a comfortable and secure future. Understanding retirement accounts, investments, and tax implications is vital for effective retirement planning.

Why Learn Finance at the Wisconsin School of Business?

At the Wisconsin School of Business, we offer comprehensive finance programs designed to equip students with the knowledge and skills needed to navigate the finance industry. Here’s what sets us apart:

- Expert Faculty: Our faculty consists of experienced professionals who bring real-world expertise into the classroom, ensuring that students receive a well-rounded education.

- Hands-on Learning: We believe in learning by doing. Our programs incorporate hands-on experiences, case studies, and simulations to provide students with practical skills they can apply in real-world scenarios.

- Networking Opportunities: With our extensive network of alumni and industry connections, students have access to valuable networking opportunities that can open doors to internships and job placements.

- Cutting-Edge Resources: From state-of-the-art financial modeling tools to access to up-to-date financial data, we provide students with the resources they need to excel in the finance industry.

Conclusion

Understanding finance is essential for making informed decisions about your money and investments. By becoming financially literate, you can take control of your financial future and propel yourself towards your financial goals. Whether you are looking to enhance your personal finances or pursue a career in finance, the Wisconsin School of Business is here to support you every step of the way. Start your journey by unlocking the secrets of finance with us today!