Home>Finance>Market Price: Definition, Meaning, How To Determine, And Example

Finance

Market Price: Definition, Meaning, How To Determine, And Example

Published: December 23, 2023

Learn what market price means and how to determine it in finance, with a clear definition and an insightful example.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Market Price: Definition, Meaning, How To Determine, and Example

On your journey to financial success, understanding key terms and concepts is vital. One such term is market price. In this blog post, we will delve into the definition, meaning, how to determine market price, and provide an example to help solidify your understanding of this crucial concept.

Key Takeaways:

- Market price is the current price at which an asset, commodity, or security can be bought or sold in the open market.

- Supply and demand dynamics, investor sentiment, economic factors, and market trends affect market price.

What is Market Price?

Market price refers to the prevailing price at which an asset, commodity, or security is currently trading in the open market. It is the price at which buyers are willing to purchase an item and sellers are willing to sell it. Understanding market price is crucial for investors, traders, and businesses as it directly impacts buying and selling decisions.

Now, let’s explore how market price is determined and the various factors that influence its fluctuations.

Determining Market Price

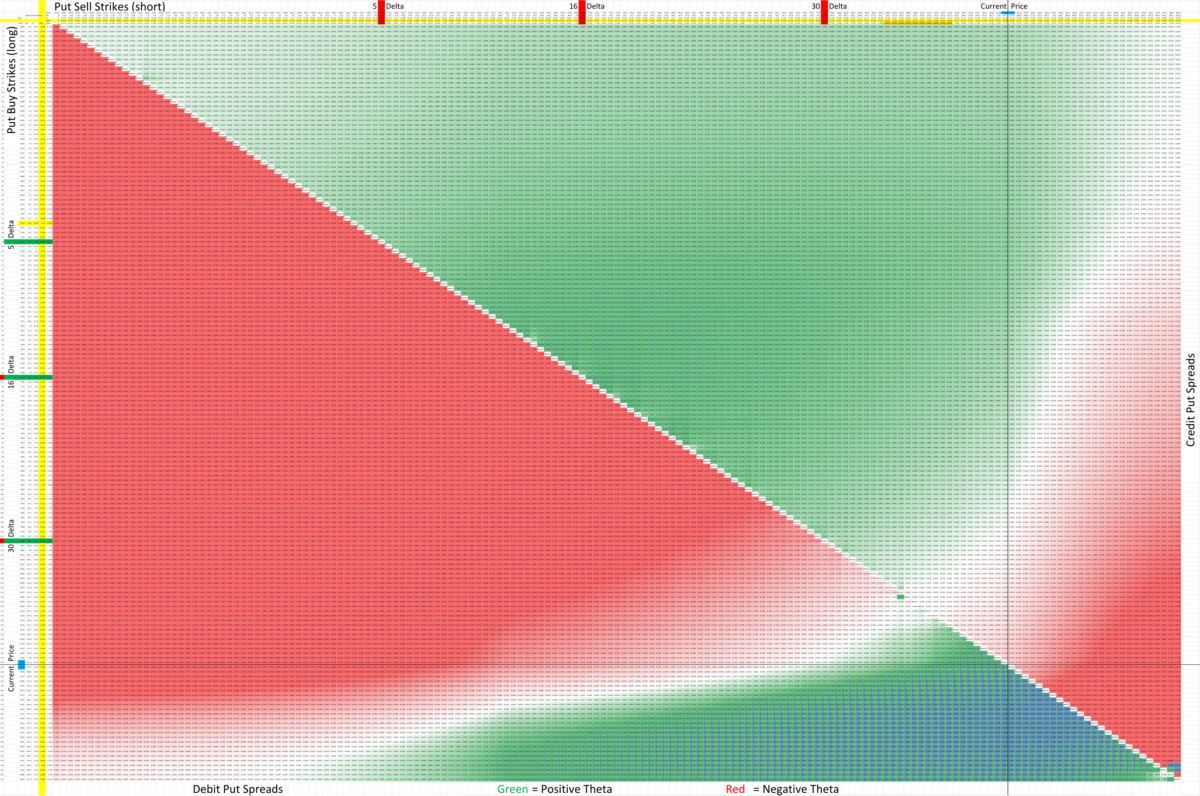

Market price is not set by a central authority or institution. Instead, it is determined by the collective actions of buyers and sellers in the market. The forces of supply and demand play a significant role in establishing the market price, with price fluctuations occurring as these factors shift.

There are several key factors that influence market price:

- Supply and Demand Dynamics: When demand exceeds supply, prices tend to rise. Conversely, when supply surpasses demand, prices usually decline. Market price finds equilibrium at the point where supply matches demand.

- Investor Sentiment: Market price can be influenced by investor sentiment and perception of an asset’s value. Positive sentiment can drive up prices, while negative sentiment can lead to price declines.

- Economic Factors: Economic indicators such as inflation rates, interest rates, GDP growth, and unemployment rates impact market price. Positive economic conditions generally encourage higher prices, whereas negative economic conditions can result in lower prices.

- Market Trends: Trends and patterns within the market can also impact market price. For example, if a certain asset class becomes popular, demand may increase, thus driving up prices.

An Example of Market Price

Let’s consider an example to illustrate how market price works. Imagine you are interested in buying company X’s stock. The stock is currently traded on a stock exchange, and its market price is $50 per share. However, due to positive news about the company’s financial performance and growth prospects, investor demand starts increasing rapidly.

As a result, more buyers enter the market, creating excess demand compared to the available supply. This increased demand pushes the market price upward to $60 per share. Now, the market price reflects the willing buyer’s valuation and the willingness of sellers to sell at that price.

Conversely, if negative news were to emerge, eroding investor confidence and causing selling pressure, the market price might drop to $40 per share, representing a decline in the stock’s value.

Final Thoughts

Understanding market price is essential for making informed investment decisions. By comprehending the factors that influence market price fluctuations, investors and traders can better navigate the complexities of the financial markets. Remember, market price is a result of supply and demand dynamics, sentiment, economic factors, and overall market trends. Stay observant, informed, and adaptable to harness the power of market price to your advantage.