Home>Finance>Profitability Index (PI) Rule: Definition, Uses, And Calculation

Finance

Profitability Index (PI) Rule: Definition, Uses, And Calculation

Published: January 12, 2024

Learn about the Profitability Index (PI) Rule in finance, including its definition, uses, and calculation methods, to make informed investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking Financial Success: Understanding the Profitability Index (PI) Rule

Welcome to our Finance category, where we delve into the world of business strategies, investments, and financial planning. In this post, we will shine a light on a powerful tool that has the potential to revolutionize your decision-making process when evaluating investment opportunities. Introducing the Profitability Index (PI) Rule – the secret weapon for maximizing profitability. Let’s dive in and explore what PI is, how it can be used, and how to calculate it.

Key Takeaways:

- Profitability Index (PI) Rule is a financial tool that helps businesses assess the profitability of potential investments.

- PI is calculated by dividing the present value of future cash flows by the initial investment.

Defining the Profitability Index (PI) Rule

As business owners and investors, we constantly face a multitude of investment options. So how do we determine which ones will yield the highest returns? This is where the Profitability Index (PI) Rule comes into play. The PI Rule is a crucial financial metric used to evaluate potential investment projects by comparing the present value of future cash flows to the initial investment.

The PI takes into account the time value of money, meaning it considers the potential impact of inflation and the opportunity cost of tying up capital. By measuring the profitability of an investment based on discounted cash flows, the PI Rule provides a more accurate representation of the value an investment can bring to your business.

Uses of the Profitability Index (PI) Rule

The PI Rule is a versatile tool that can be used to assess various investment opportunities. Here are some common use cases:

- Capital Budgeting: Businesses can utilize PI to evaluate potential projects and prioritize them based on their profitability. Comparing the PI of different projects enables decision-makers to focus on those with the highest potential return on investment.

- Resource Allocation: PI can help determine the allocation of limited resources among different investment opportunities. By selecting projects with higher PI values, businesses can maximize their profitability within resource constraints.

- Investor Perspective: Investors can use PI to compare the profitability of different securities or assets. By calculating the PI for each investment option, investors can make more informed decisions about where to allocate their funds.

Calculating the Profitability Index (PI)

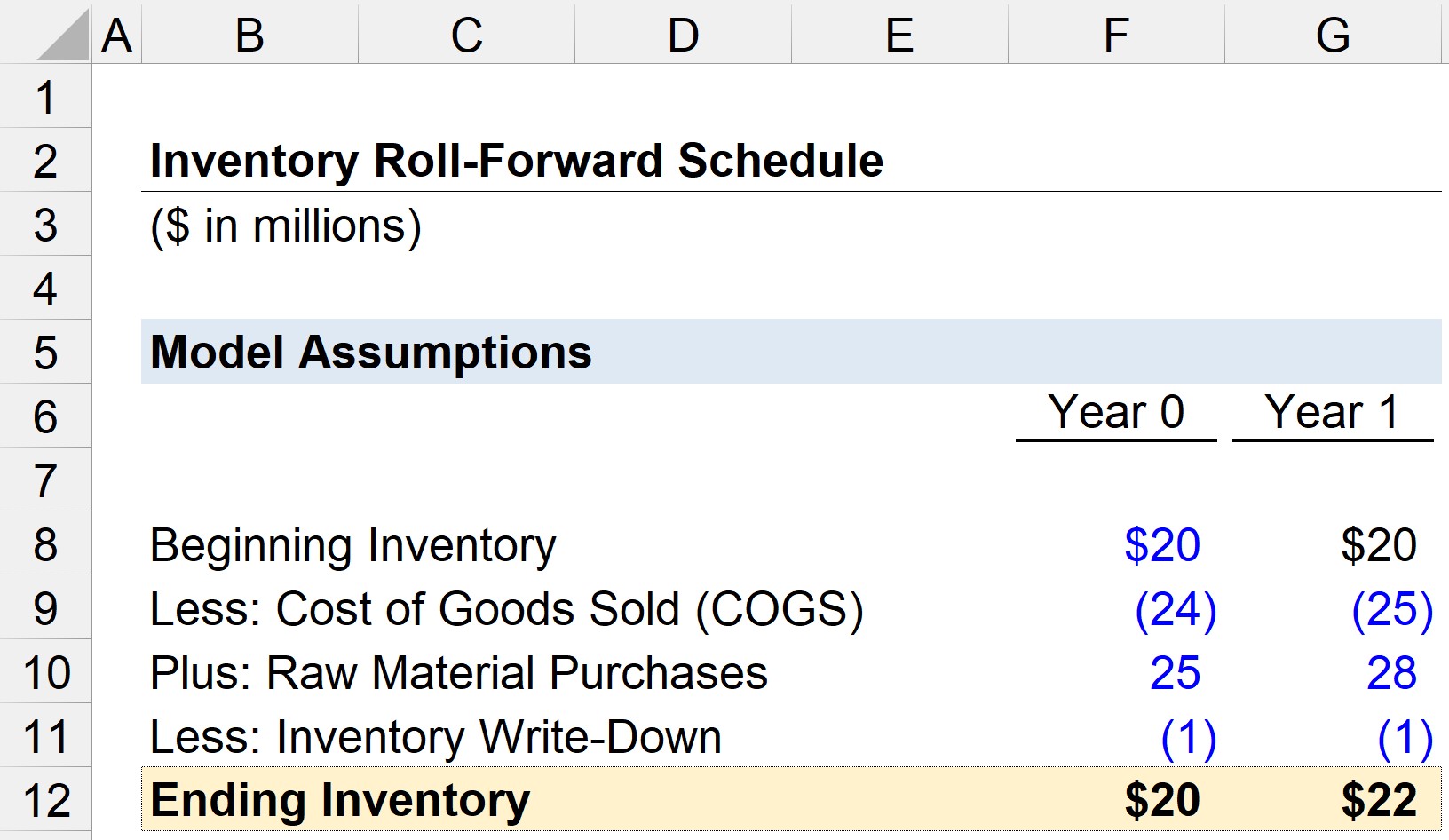

The calculation of the Profitability Index involves two main steps:

- Step 1: Calculate the present value of future cash flows (PV). This involves discounting the expected cash flows using an appropriate discount rate. The discount rate can take into account factors such as inflation, opportunity cost, and risk.

- Step 2: Divide the present value of cash flows by the initial investment (I). This results in the Profitability Index value, which represents the profitability of the investment.

Mathematically, the formula for calculating the Profitability Index is as follows:

PI = PV / I

Businesses and investors can use various software applications or financial calculators to perform these calculations efficiently.

In Conclusion

The Profitability Index (PI) Rule is a fundamental tool for evaluating potential investments. By considering the time value of money and comparing the present value of future cash flows to the initial investment, the PI Rule provides valuable insights into the profitability of investment opportunities. Whether you are a business owner, a budding investor, or a decision-maker, understanding and utilizing the PI Rule can lead to more informed and profitable financial decisions.

So, are you ready to unlock financial success with the Profitability Index (PI) Rule?