Home>Finance>Risk Assessment Definition, Methods, Qualitative Vs. Quantitative

Finance

Risk Assessment Definition, Methods, Qualitative Vs. Quantitative

Published: January 21, 2024

Discover the various methods and definitions of risk assessment in finance. Learn about qualitative and quantitative approaches to analyze and mitigate financial risks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Risk Assessment Definition, Methods, Qualitative Vs. Quantitative

Are you familiar with the concept of risk assessment? If you’re interested in the world of finance, understanding risk assessment is crucial. Risk assessment plays an integral role in decision-making processes in various industries, including finance. This blog post will delve into the definition of risk assessment, explore different methods used, and highlight the differences between qualitative and quantitative risk assessment approaches.

Key Takeaways:

- Risk assessment is the process of evaluating potential risks and determining their likelihood and potential impact on a given project, investment, or decision.

- Qualitative risk assessment relies on subjective judgments, while quantitative risk assessment involves the use of numbers and statistical analysis.

What is Risk Assessment?

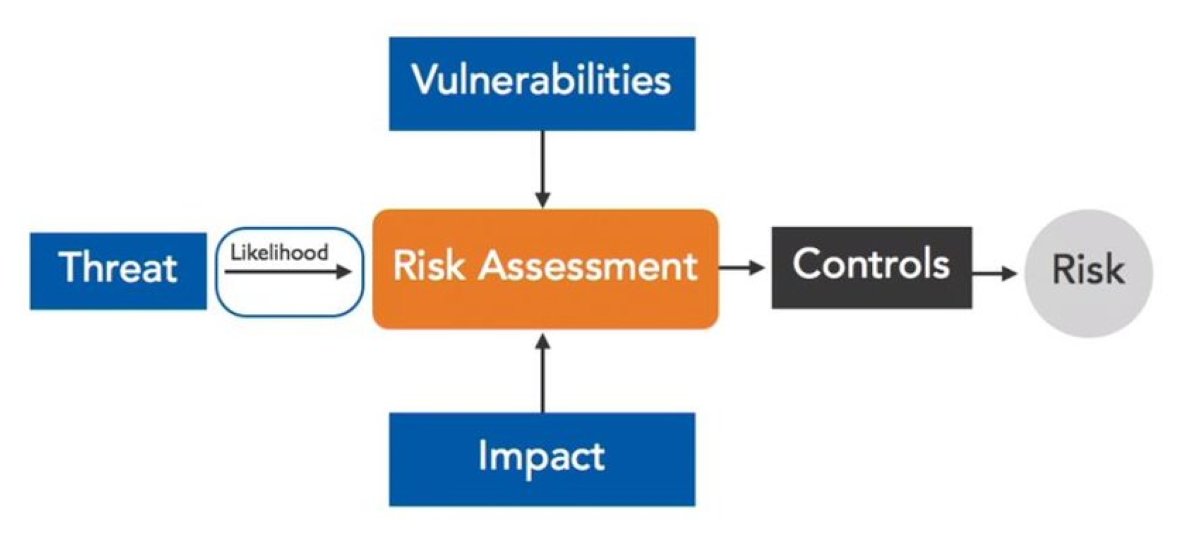

Risk assessment is the systematic process of evaluating potential risks and determining their likelihood and potential impact on a given project, investment, or decision. It involves identifying and analyzing potential risks, evaluating their consequences, and implementing effective strategies to mitigate or manage those risks.

When it comes to financial decision-making, risk assessment plays a pivotal role. It allows individuals and organizations to identify potential risks, understand their potential impact, and make informed decisions based on the evaluation of those risks.

Methods of Risk Assessment

There are various methods of risk assessment employed by financial professionals and organizations. Let’s take a look at some of the commonly used methods:

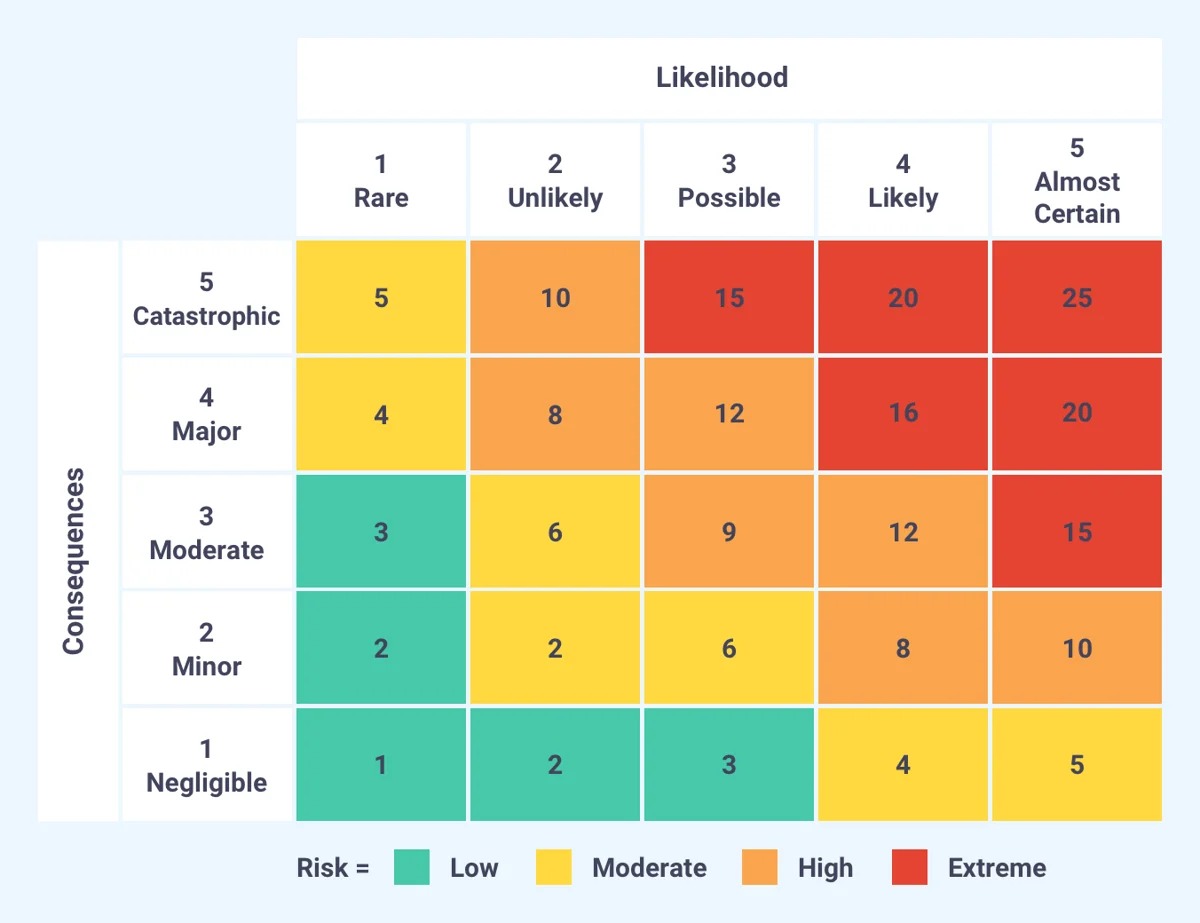

- Qualitative Risk Assessment: Qualitative risk assessment is based on subjective judgments and qualitative measures. It involves identifying and assessing risks based on their likelihood and impact. This method does not involve precise numerical values but relies on expert opinions and experience to evaluate risks. Qualitative risk assessment is useful when dealing with limited data or when assessing risks that cannot be easily quantified.

- Quantitative Risk Assessment: Quantitative risk assessment involves the use of numbers, statistical analysis, and mathematical models. This method assigns numerical values to risks, considering factors such as probability and impact. Through quantitative risk assessment, financial professionals can estimate the potential financial loss or gain associated with specific risks. This method is particularly useful when dealing with large amounts of data, complex financial models, or when precise calculations are required.

Qualitative Vs. Quantitative Risk Assessment

Qualitative risk assessment and quantitative risk assessment are two distinct approaches to evaluating risks. Here’s a breakdown of the key differences:

- Subjectivity Vs. Objectivity: Qualitative risk assessment relies on subjective judgments, expert opinions, and qualitative measures. It evaluates risks based on the experience and knowledge of individuals involved. On the other hand, quantitative risk assessment is based on objective data, numerical values, and statistical analysis, making it more precise and less reliant on subjective opinions.

- Precision and Accuracy: Quantitative risk assessment provides a higher level of precision and accuracy as it involves precise calculations, mathematical models, and statistical analysis. Qualitative risk assessment, while valuable in certain scenarios, may lack the same level of precision.

- Complexity: Quantitative risk assessment can handle complex financial models and large amounts of data effectively. It is suitable for scenarios that require in-depth analysis and precise calculations. In comparison, qualitative risk assessment is often simpler and more straightforward, making it suitable for situations with limited data or when subjective opinions are more valuable.

Both qualitative and quantitative risk assessment methods have their own unique uses and applications. The choice between the two depends on the specific circumstances, available data, and requirements of the decision-making process.

Conclusion

Risk assessment is a critical component of decision-making within the finance industry. By understanding the definition of risk assessment and the methods employed, including qualitative and quantitative approaches, individuals and organizations can make informed decisions while considering potential risks and their impacts. While qualitative risk assessment relies on subjective judgments and qualitative measures, quantitative risk assessment involves precise calculations and statistical analysis, providing a higher level of accuracy. By utilizing the appropriate risk assessment method, finance professionals can mitigate potential risks and maximize opportunities for success.