Finance

Quick Liquidity Ratio Definition

Published: January 15, 2024

Learn the definition of quick liquidity ratio in finance, its importance, and how it indicates a company's ability to meet short-term obligations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Quick Liquidity Ratio: A Key Finance Metric

When it comes to managing your finances, it’s crucial to analyze various financial ratios and metrics to gain a deeper understanding of your financial health. One such metric that plays a vital role in assessing the liquidity of a company or individual is the Quick Liquidity Ratio, also known as the Acid Test Ratio. In this blog post, we’ll dive into the definition and importance of the Quick Liquidity Ratio to help you make informed financial decisions.

Key Takeaways:

- The Quick Liquidity Ratio evaluates an entity’s ability to meet short-term obligations using its most liquid assets.

- This ratio provides insights into the immediate financial solvency of a company or individual.

Now, let’s delve into the definition of the Quick Liquidity Ratio. Simply put, this ratio measures the ability of an entity to cover its short-term liabilities using its most liquid assets. It focuses on assets that can be quickly converted into cash, such as cash on hand, marketable securities, and accounts receivable.

The formula to calculate the Quick Liquidity Ratio is:

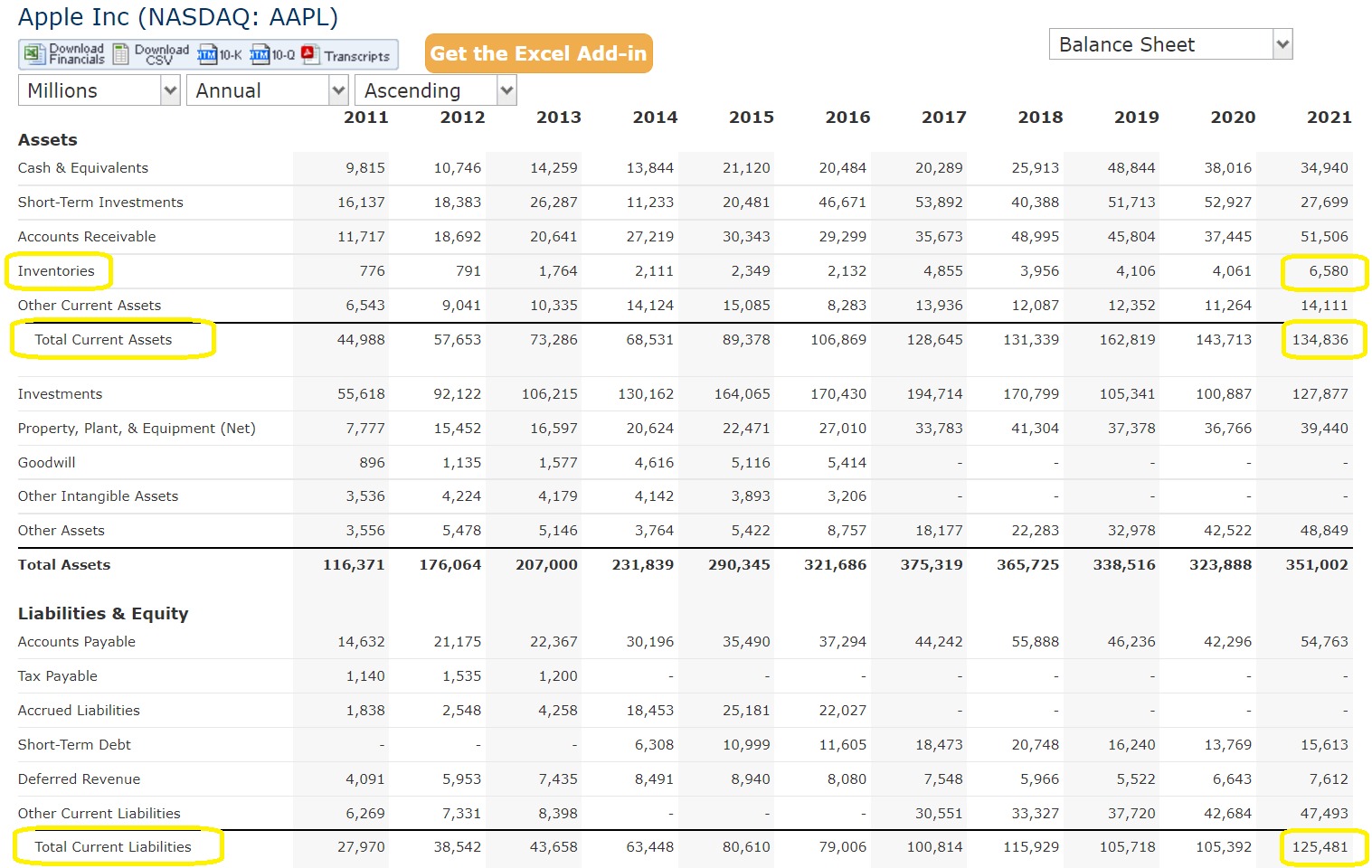

Quick Liquidity Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

By analyzing this ratio, you can assess how well a company or individual can cover their immediate financial obligations without relying on selling inventory or property. It offers a more conservative view of liquidity than other ratios, as it excludes less liquid assets like inventory.

So, why is the Quick Liquidity Ratio important? Let’s explore:

The Importance of Quick Liquidity Ratio

1. Assessing short-term solvency: The Quick Liquidity Ratio allows you to gauge the ability of a company or individual to meet their short-term liabilities promptly. This metric is particularly useful for creditors and lenders to understand the creditworthiness of businesses or borrowers.

2. Identifying potential financial distress: A low Quick Liquidity Ratio indicates a potential risk of financial distress. If an entity’s ratio is below 1, it implies that they may struggle to meet their immediate obligations. This insight can help individuals or organizations take preemptive measures to improve their financial position.

By monitoring and understanding the Quick Liquidity Ratio, you can make more informed financial decisions, evaluate potential investment opportunities, and assess the overall financial health of a company or individual.

Remember, every financial metric should be analyzed in the context of the specific industry and circumstances. It’s advisable to compare the Quick Liquidity Ratio with industry benchmarks and historical data to gain a comprehensive picture of an entity’s financial liquidity.

In conclusion, the Quick Liquidity Ratio provides valuable insights into an entity’s ability to meet short-term obligations using its most liquid assets. By calculating and understanding this metric, you can make more informed financial decisions and assess solvency effectively.