Home>Finance>What Is A Settlement Bank? Definition, Functions, And Process

Finance

What Is A Settlement Bank? Definition, Functions, And Process

Published: January 27, 2024

Learn about the definition, functions, and process of a settlement bank in the world of finance. Understand its importance and role in financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Is a Settlement Bank? Definition, Functions, and Process

Welcome to the Finance section of our blog! Today, we are going to delve into the world of settlement banks. Whether you are a seasoned investor or just starting your financial journey, understanding the concept of settlement banks is crucial. In this blog post, we will define what a settlement bank is, explore its functions, and break down the settlement process. By the end of this article, you’ll have a solid understanding of the role of settlement banks in the financial landscape.

Key Takeaways:

- A settlement bank is an intermediary institution that facilitates financial transactions between parties.

- Settlement banks play a crucial role in ensuring the smooth and efficient transfer of funds in various financial markets.

Definition

A settlement bank, sometimes referred to as a clearing bank, is a financial institution that acts as an intermediary in the settlement of financial transactions. It provides a centralized platform for the transfer of funds and securities between parties involved in a transaction. Settlement banks are often used in the context of stock markets, foreign exchange markets, and other financial markets where large sums of money or assets are exchanged.

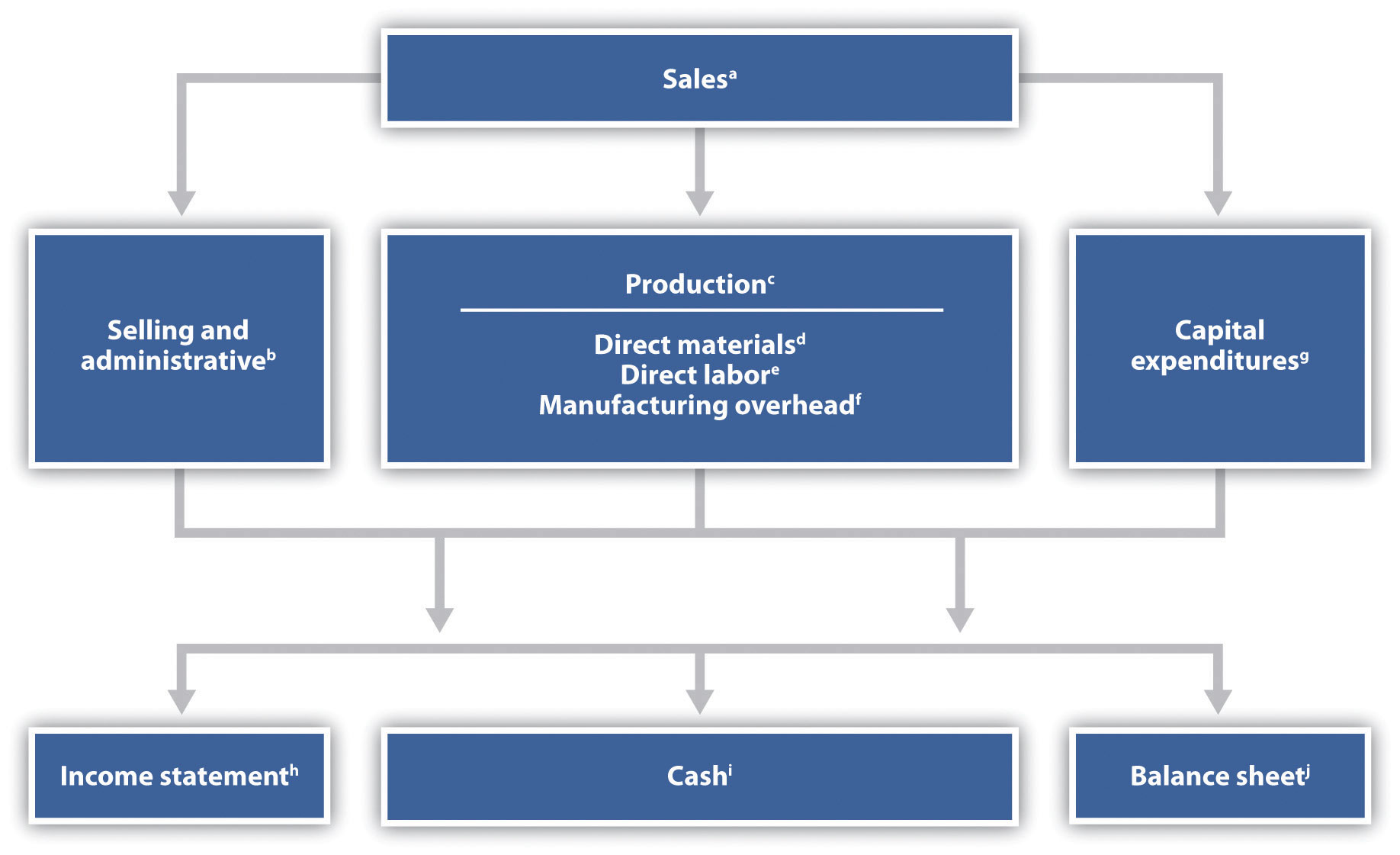

Functions of a Settlement Bank

Settlement banks perform several important functions within the financial system. Let’s take a closer look at some key functions:

- Clearing and Settlement: One of the primary functions of a settlement bank is to facilitate the clearing and settlement process. When a financial transaction occurs, the settlement bank ensures that the funds or assets are correctly transferred between the buyer and the seller.

- Risk Management: Settlement banks play a crucial role in managing risks associated with financial transactions. They monitor and verify the authenticity of transactions, reducing the likelihood of fraud or errors.

- Liquidity Provision: Settlement banks provide liquidity to the financial markets by ensuring the availability of funds for settlement. They act as a source of cash and credit, enabling smooth and efficient transactions.

- Record-Keeping: Settlement banks maintain detailed records of financial transactions, including the parties involved, the amount transferred, and the timing of the settlement. These records are essential for auditing, compliance, and dispute resolution purposes.

The Settlement Process

Now that we’ve covered the definition and functions of settlement banks, let’s walk through the typical settlement process:

- The buyer and seller enter into a financial transaction, such as buying stocks or securities.

- Once the trade is executed, the settlement bank steps in to facilitate the transfer of funds or assets.

- The settlement bank verifies the transaction details and ensures that both parties fulfill their obligations.

- Once the verification is complete, the settlement bank initiates the transfer of funds or assets from the buyer’s account to the seller’s account.

- The settlement bank updates its records to reflect the completed transaction.

- The settlement process is considered complete when the funds or assets are successfully transferred, and the transaction is settled.

Understanding the settlement process is integral to comprehending the role of settlement banks in the financial system.

Conclusion

Settlement banks are the unsung heroes of the financial world. They ensure that the wheels of the financial system keep turning smoothly. By acting as intermediaries, managing risks, and facilitating efficient transactions, settlement banks play a vital role in the functioning of various financial markets. Now, armed with knowledge about settlement banks, you can navigate the complex world of finance with confidence.