Home>Finance>What Annual Percentage Do Pension Funds Pay Per Year In Fees?

Finance

What Annual Percentage Do Pension Funds Pay Per Year In Fees?

Published: January 22, 2024

Discover the annual percentage that pension funds pay in fees. Learn about the finance aspects and make informed decisions for your future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding the Importance of Annual Percentage Fees in Pension Funds

Introduction

Pension funds play a crucial role in securing financial stability during retirement years. They offer individuals the opportunity to build a nest egg over the course of their careers, ensuring a steady income stream after they exit the workforce. However, it's essential for pension fund participants to comprehend the impact of annual percentage fees on their overall savings. These fees, often overlooked, can significantly influence the growth of retirement funds and ultimately affect the standard of living during the golden years.

When individuals contribute to a pension fund, they allocate a portion of their earnings to secure their financial future. However, the growth of these contributions can be hindered by the annual percentage fees charged by the fund managers. These fees, typically calculated as a percentage of the total assets under management, cover various expenses associated with administering the fund, including investment management, custodial services, and operational costs.

Understanding the nuances of annual percentage fees is imperative for pension fund participants, as it directly impacts the long-term value of their retirement savings. By delving into the intricacies of these fees and exploring strategies to minimize their impact, individuals can make informed decisions to safeguard their financial well-being during retirement. This article aims to unravel the significance of annual percentage fees in pension funds, elucidate the factors influencing these fees, and provide actionable insights to optimize retirement savings despite the presence of such fees.

Understanding Annual Percentage Fees in Pension Funds

Annual percentage fees, also known as expense ratios, are a critical aspect of pension funds that directly impact the growth and performance of retirement savings. These fees encompass a spectrum of expenses incurred by the fund, including administrative costs, investment management fees, and operational charges. Typically expressed as a percentage of the total assets under management, annual percentage fees are deducted from the fund’s returns, thereby affecting the overall growth of participants’ retirement savings.

It’s essential for pension fund participants to comprehend the breakdown of annual percentage fees to gain a comprehensive understanding of the costs associated with managing their retirement investments. By examining the components of these fees, individuals can discern the value provided by the fund managers and assess the impact of these expenses on their long-term financial goals.

Furthermore, annual percentage fees can vary significantly across different pension funds, reflecting diverse investment strategies, fund sizes, and management structures. A thorough comprehension of these fees empowers individuals to evaluate the competitiveness of their fund’s cost structure and make informed comparisons with other available options. This understanding enables participants to make strategic decisions regarding their pension contributions and investment allocations, optimizing the potential for long-term wealth accumulation.

As pension funds serve as a cornerstone of financial security in retirement, it’s paramount for individuals to grasp the implications of annual percentage fees and proactively manage these expenses to maximize their retirement savings. By unraveling the intricacies of these fees and exploring avenues to minimize their impact, pension fund participants can navigate the investment landscape with confidence, ensuring the preservation and growth of their hard-earned assets for the post-career years.

Factors Affecting Annual Percentage Fees

The determination of annual percentage fees in pension funds is influenced by a multitude of factors that collectively shape the cost structure and financial implications for participants. Understanding these factors is crucial for individuals seeking to optimize their retirement savings while navigating the complexities of fee management within pension funds.

- Asset Size: The total assets under management within a pension fund can significantly impact the annual percentage fees. Larger funds may benefit from economies of scale, allowing for potential fee reductions due to the spreading of costs across a broader asset base.

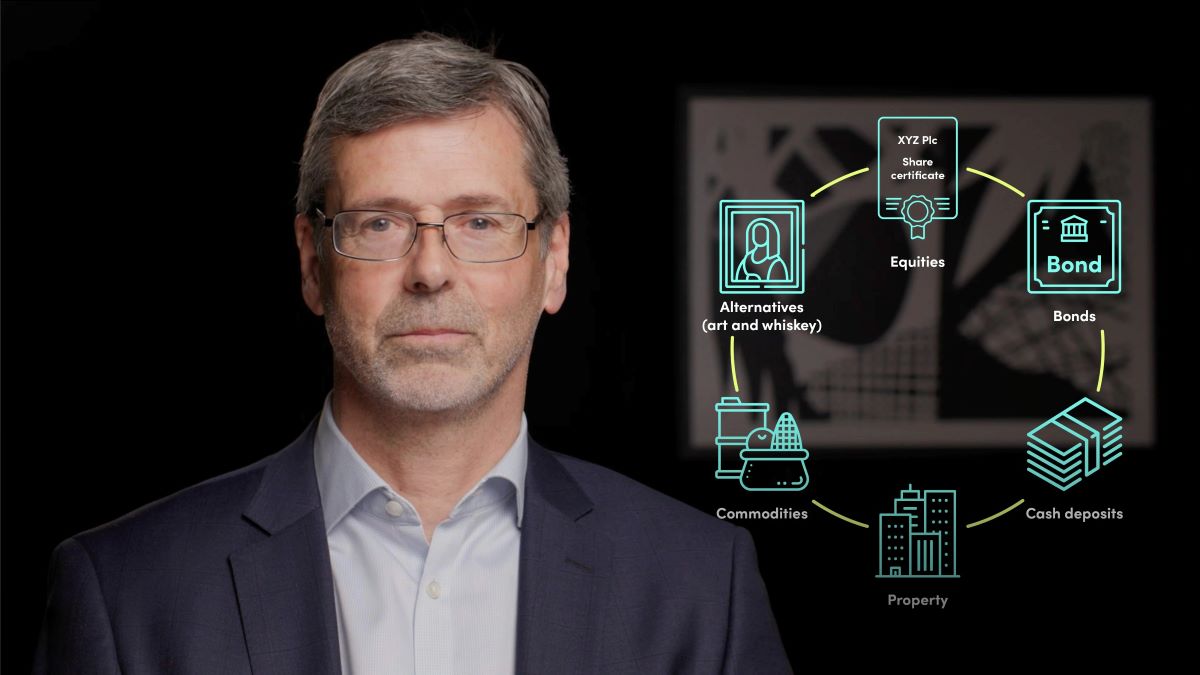

- Investment Strategy and Complexity: Pension funds with intricate investment strategies or those involving a diverse range of asset classes may incur higher annual percentage fees. The complexity of managing and monitoring such investments can contribute to elevated administrative and operational costs.

- Management Expertise and Services: The level of expertise and the array of services provided by the fund managers play a pivotal role in determining annual percentage fees. Funds engaging highly skilled investment professionals or offering additional services, such as financial planning and advisory support, may entail higher fees.

- Regulatory Compliance and Reporting: Pension funds operating within stringent regulatory frameworks or those subject to extensive reporting requirements may experience elevated compliance costs, which can influence the magnitude of annual percentage fees.

- Fee Structure and Transparency: The transparency and clarity of the fee structure employed by pension funds can impact participants’ perceptions of the value derived from the fees paid. Funds that demonstrate a transparent fee schedule and provide clear insights into the breakdown of expenses may foster greater trust and confidence among participants.

By comprehending the factors that underpin the determination of annual percentage fees in pension funds, individuals can gain valuable insights into the dynamics of fee management and make informed decisions to optimize their retirement savings. Evaluating these factors enables participants to assess the competitiveness of their fund’s fee structure, explore opportunities for cost efficiencies, and align their investment choices with their long-term financial objectives.

Comparing Annual Percentage Fees Across Different Pension Funds

When evaluating pension funds, comparing annual percentage fees is a crucial step in making informed decisions about retirement savings. The disparity in fee structures across different funds can significantly impact the long-term growth of participants’ investments. By conducting thorough comparisons, individuals can identify cost-effective options that align with their financial goals while optimizing the potential for wealth accumulation during retirement.

Key considerations when comparing annual percentage fees across pension funds include:

- Expense Ratios: Examining the expense ratios of various funds provides insights into the annual percentage fees charged for managing retirement investments. Lower expense ratios indicate more cost-effective fund management, potentially leading to enhanced returns for participants.

- Fee Transparency: Assessing the transparency of fee disclosures within different pension funds is essential. Funds that offer clear and comprehensive breakdowns of their annual percentage fees enable participants to make well-informed comparisons and understand the value derived from the expenses incurred.

- Comparative Analysis: Conducting a comparative analysis of annual percentage fees across funds with similar investment objectives and risk profiles can reveal cost differentials that may impact the overall performance of retirement savings. This analysis empowers individuals to select funds that offer competitive fee structures without compromising on investment quality.

- Long-Term Impact: Recognizing the long-term impact of annual percentage fees on retirement savings is fundamental. Even seemingly minor variations in fee percentages can translate into substantial disparities in accumulated wealth over extended investment horizons, underscoring the significance of fee differentials in pension fund selection.

By scrutinizing and comparing annual percentage fees across different pension funds, individuals can make well-informed decisions that optimize the growth potential of their retirement savings. Selecting funds with competitive fee structures and aligning these choices with personal investment objectives can contribute to the preservation and enhancement of financial resources for the post-career years.

Impact of Annual Percentage Fees on Retirement Savings

The impact of annual percentage fees on retirement savings is profound, exerting a tangible influence on the growth and long-term value of participants’ investment portfolios. While these fees may appear modest at first glance, their cumulative effect over time can substantially diminish the overall wealth accumulation potential within pension funds.

Key aspects of the impact of annual percentage fees on retirement savings include:

- Diminished Investment Returns: Annual percentage fees directly reduce the net investment returns accrued within pension funds. As these fees are deducted from the fund’s earnings, the compounding effect over time can erode the growth potential of retirement savings, leading to diminished wealth accumulation.

- Extended Time Horizon: Over prolonged investment horizons, the impact of annual percentage fees becomes increasingly pronounced. Participants with longer timeframes until retirement may experience substantial reductions in their ultimate savings due to the continuous deduction of fees from their investment returns.

- Comparative Wealth Erosion: When comparing the growth trajectories of retirement savings across funds with varying annual percentage fees, individuals may observe significant disparities in the accumulated wealth over time. Funds with lower fees can yield higher net returns, resulting in enhanced retirement nest eggs for participants.

- Importance of Fee Management: Recognizing the significance of fee management within pension funds is crucial for participants aiming to optimize their retirement savings. Proactively seeking funds with competitive fee structures and exploring opportunities to minimize the impact of annual percentage fees can safeguard the long-term value of investments.

By comprehending the impact of annual percentage fees on retirement savings, individuals can make informed decisions to mitigate the erosive effects of these fees and maximize the growth potential of their pension investments. Engaging in strategic fee management and selecting funds that offer cost-effective fee structures can contribute to the preservation and enhancement of retirement wealth, ensuring financial security and stability during the post-career years.

Strategies for Minimizing Annual Percentage Fees

Implementing effective strategies to minimize annual percentage fees within pension funds is instrumental in optimizing the long-term growth and value of retirement savings. By proactively managing these fees, individuals can enhance the net returns on their investments and secure a more robust financial foundation for the post-career years.

Key strategies for minimizing annual percentage fees include:

- Cost-Efficient Fund Selection: Conducting thorough research and due diligence to identify pension funds with competitive annual percentage fees is paramount. Comparing expense ratios and fee structures across different funds enables participants to select cost-effective options without compromising on investment quality.

- Embracing Passive Index Funds: Passive index funds often feature lower annual percentage fees compared to actively managed funds. By allocating a portion of their pension contributions to passive index funds, individuals can capitalize on the potential for reduced fees while gaining exposure to diversified market indices.

- Fee Negotiation and Advocacy: Engaging with fund managers to negotiate fee reductions or advocating for transparent and equitable fee structures can yield favorable outcomes for participants. Open dialogue with fund administrators can foster a collaborative approach to fee management, potentially leading to cost efficiencies for pension fund members.

- Regular Portfolio Review: Conducting periodic reviews of investment portfolios within pension funds is essential for assessing the impact of annual percentage fees on overall returns. By scrutinizing the fee-to-performance ratio, individuals can identify opportunities to reallocate assets and optimize fee management within their retirement investments.

- Utilizing Employer-Sponsored Options: Leveraging employer-sponsored retirement plans that offer institutional pricing advantages can lead to reduced annual percentage fees. Collaborating with employers to explore available options for pension fund participation can provide access to cost-efficient investment vehicles.

By embracing these strategies and actively managing annual percentage fees within pension funds, individuals can fortify the growth potential of their retirement savings and cultivate a more resilient financial outlook for the future. Strategic fee management not only enhances the net returns on investments but also fosters a proactive approach to optimizing wealth accumulation within pension portfolios.

Conclusion

As individuals embark on their journey towards securing financial stability in retirement, the impact of annual percentage fees within pension funds emerges as a pivotal consideration in shaping the long-term value of their investments. Understanding the nuances of these fees, along with the factors influencing their determination, empowers participants to make informed decisions that optimize the growth potential of their retirement savings.

While annual percentage fees may initially appear inconsequential, their cumulative effect over extended investment horizons can substantially erode the net returns on pension contributions. By comprehending the impact of these fees and exploring strategies to minimize their influence, individuals can proactively safeguard the growth of their retirement nest eggs and cultivate a more robust financial foundation for the post-career years.

Engaging in thorough comparisons of annual percentage fees across different pension funds, embracing cost-effective fund selection strategies, and advocating for transparent fee structures are pivotal steps in navigating the fee management landscape within retirement investments. Furthermore, the adoption of passive index funds and regular portfolio reviews can contribute to mitigating the erosive effects of annual percentage fees, fostering enhanced wealth accumulation for participants.

By prioritizing fee management and aligning investment choices with strategies to minimize annual percentage fees, individuals can embark on a path towards optimizing the long-term value of their retirement savings. These proactive measures not only enhance the net returns on pension investments but also underscore the significance of informed decision-making in securing a resilient and prosperous financial future.

In essence, the comprehensive understanding of annual percentage fees in pension funds, coupled with strategic fee management, empowers individuals to navigate the investment landscape with confidence, ensuring the preservation and growth of their hard-earned assets for the golden years of retirement.