Finance

What Are The Functions Of Securities Markets

Published: November 26, 2023

Discover the crucial role of securities markets in the world of finance. Learn about their functions, importance, and impact on the economy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Role of Securities Markets in the Economy

- Primary Functions of Securities Markets

- Facilitating Capital Formation

- Providing Liquidity

- Price Determination

- Risk Management

- Efficient Allocation of Capital

- Secondary Functions of Securities Markets

- Information Transmission

- Corporate Governance

- Facilitating Economic Growth

- Conclusion

Introduction

Securities markets play a crucial role in the functioning of modern economies. These markets provide a platform for the buying and selling of various financial instruments, such as stocks, bonds, and derivatives. They serve as a vital link between savers, investors, and companies seeking capital. By facilitating the trading of securities, these markets contribute to the efficient allocation of capital, enabling economic growth and development.

The operations of securities markets are governed by regulatory bodies and exchanges that ensure fair and transparent transactions. Investors and traders rely on these markets to make informed decisions, based on factors such as market conditions, company performance, and economic indicators.

The functions of securities markets extend beyond simply facilitating the buying and selling of securities.

In this article, we will explore the various functions of securities markets and the significant role they play in the economy. Through an understanding of these functions, we can better appreciate the importance of these markets in supporting sustainable economic growth and stability.

Role of Securities Markets in the Economy

Securities markets play a fundamental role in the overall health and stability of an economy. They serve as a vital linkage between those who have capital to invest and those in need of capital for various purposes, such as business expansion, infrastructure development, or new ventures.

First and foremost, securities markets facilitate capital formation. They provide a platform for companies to raise funds by issuing securities to investors. This capital is then used to finance projects, research and development, and other initiatives that drive economic growth. By connecting savers with borrowers, securities markets facilitate the flow of funds from surplus areas to deficit areas in the economy.

Furthermore, securities markets provide liquidity, allowing investors to buy and sell securities easily. This liquidity ensures that investors can easily convert their investments into cash, thereby enhancing the overall efficiency of capital allocation. Additionally, liquidity fosters investor confidence, which is crucial for attracting and retaining investment in the market.

Securities markets also play a critical role in price determination. Through the interaction of buyers and sellers, the market establishes fair prices for securities. Price discovery is essential for both issuers and investors, as it reflects the perceived value and risk associated with a particular security. Accurate price determination ensures transparency and fairness in the market, which are essential for investor protection and market integrity.

Another crucial function of securities markets is risk management. In a diversified securities market, investors can spread their risk by investing in different types of securities across various industries. This diversification helps mitigate the impact of any individual security’s performance on the overall investment portfolio. Additionally, securities markets provide derivative instruments, such as options and futures, that allow investors to hedge against potential fluctuations in prices, interest rates, or other market variables.

Furthermore, securities markets contribute to the efficient allocation of capital. By providing a competitive marketplace for securities, they enable investors to choose the most promising investment opportunities based on risk-return considerations. This efficient allocation of capital promotes economic growth and productivity by directing resources to the most productive sectors of the economy.

In summary, securities markets facilitate capital formation, provide liquidity, determine fair prices, manage risk, and efficiently allocate capital. These functions are crucial for the overall functioning of the economy as they support economic growth, foster investor confidence, and drive innovation and productivity.

Primary Functions of Securities Markets

Securities markets serve several primary functions that are essential for the smooth functioning of the financial system and the overall economy. These functions are crucial for facilitating capital formation, ensuring liquidity, determining fair prices, managing risk, and efficiently allocating capital.

- Facilitating Capital Formation: One of the primary functions of securities markets is to enable companies and governments to raise funds by issuing securities. This capital is essential for financing various activities, such as business expansion, infrastructure development, and research and development. By connecting savers and investors with borrowers, securities markets facilitate the flow of capital, promoting economic growth and development.

- Providing Liquidity: Liquidity is crucial for the efficient functioning of securities markets. Investors need the ability to buy and sell securities easily in order to meet their investment goals and financial needs. Securities markets provide a platform where investors can readily convert their investments into cash, enhancing market efficiency and investor confidence.

- Price Determination: Securities markets play a vital role in determining fair prices for securities. Through the interaction of buyers and sellers, the market establishes prices that reflect the perceived value and risk associated with different securities. This price discovery process ensures transparency and fairness in the market and helps investors make informed decisions.

- Risk Management: Investors face various risks when investing in securities, such as market risk, credit risk, and liquidity risk. Securities markets provide mechanisms and instruments that help manage these risks. For example, diversification allows investors to spread their risk by investing in a variety of securities across different industries. Additionally, derivative instruments, such as options and futures, enable investors to hedge against potential fluctuations in prices or interest rates, reducing their exposure to risk.

- Efficient Allocation of Capital: Securities markets contribute to the efficient allocation of capital by providing a competitive marketplace for investment opportunities. Investors can analyze and compare different securities based on risk-return considerations and allocate their capital to the most promising opportunities. This efficient allocation of capital ensures that resources are directed towards the most productive sectors of the economy, supporting economic growth and productivity.

These primary functions of securities markets are critical for the functioning of the financial system and the overall economy. They promote capital formation, enhance market liquidity, determine fair prices, manage risk, and allocate capital efficiently, contributing to sustainable economic growth and stability.

Facilitating Capital Formation

One of the primary functions of securities markets is to facilitate capital formation. Companies and governments need capital to finance their operations, invest in new projects, and stimulate economic growth. Securities markets provide a platform for these entities to raise funds by issuing securities to investors.

When a company decides to go public and issue stocks, it offers ownership shares to the public in exchange for capital. This initial public offering (IPO) allows investors to become shareholders in the company and provide the necessary funding for its expansion and development.

Similarly, governments issue bonds to raise capital for infrastructure projects, public services, and budgetary needs. A bond is a fixed-income security that represents a loan made by an investor to a government or corporate entity. Investors purchase bonds and, in return, receive periodic interest payments until the bond matures.

By facilitating capital formation, securities markets enable individuals and institutional investors to invest their savings in entities that require capital. This process not only provides a source of financing for companies and governments but also allows individuals to participate in the growth and success of these entities.

Capital formation through securities markets has a significant impact on economic growth. By providing access to capital, companies can invest in research and development, expand their operations, create jobs, and introduce innovative products or services that drive economic progress. Similarly, government bonds enable governments to invest in infrastructure projects, education, healthcare, and other initiatives that contribute to the overall development of a nation.

Moreover, securities markets contribute to capital formation by attracting both domestic and foreign investors. The availability of a well-regulated and transparent securities market encourages investors to deploy their savings, leading to increased capital flow into the economy. This influx of capital stimulates economic activity and promotes sustainable growth.

Overall, the function of facilitating capital formation by securities markets is crucial for providing the necessary funds to fuel economic expansion and development. By connecting investors with entities in need of capital, securities markets play a vital role in supporting entrepreneurship, innovation, and economic progress.

Providing Liquidity

Securities markets play a vital role in providing liquidity to investors. Liquidity refers to the ease and speed at which an asset can be bought or sold without significantly impacting its price. In the context of securities markets, liquidity is crucial for ensuring the efficient functioning of the market and the ability of investors to convert their investments into cash when needed.

One of the primary ways securities markets provide liquidity is through secondary market trading. Once securities are initially issued in the primary market, they can be subsequently traded among investors in the secondary market. This allows investors to buy and sell securities without having to wait for the issuing company or government to issue new securities. The existence of a liquid secondary market makes it easier for investors to enter or exit their positions swiftly.

Securities markets offer a centralized marketplace where buyers and sellers come together to trade securities. Exchanges and electronic trading platforms provide a transparent and regulated environment for market participants. This transparency increases the confidence of investors and encourages trading activity, thereby enhancing liquidity.

Liquidity in securities markets is beneficial for both investors and issuers. For investors, liquidity provides the ability to convert investments into cash quickly, which is particularly important in emergency situations or when faced with immediate financial needs. It also allows investors to take advantage of investment opportunities as they arise. Additionally, liquidity reduces the risk of holding illiquid securities, as investors have the option to sell their holdings in the secondary market if needed.

For issuers, the presence of liquidity in the market is attractive as it increases the demand for their securities. A liquid market encourages investors to purchase the securities issued by companies or governments, as they know they will be able to sell them easily if required. This increases the attractiveness of an issuer’s offering and can lower the cost of capital.

Institutional investors such as pension funds and mutual funds also benefit from liquidity in securities markets. These large investors often hold significant positions in various securities and need the ability to rebalance their portfolios or exit positions efficiently. Liquidity enables them to execute trades without significantly impacting the market price, ensuring that they can align their portfolios with their investment objectives effectively.

Overall, the provision of liquidity in securities markets is crucial for maintaining efficient and smooth trading operations. It allows investors to buy and sell securities easily, provides flexibility and risk reduction, and enhances the attractiveness of securities for both investors and issuers.

Price Determination

Securities markets play a vital role in the process of price determination. Through the interaction of buyers and sellers, these markets establish fair and transparent prices for securities. This price discovery function is essential for both investors and issuers, as it reflects the perceived value and risk associated with a particular security.

Price determination in securities markets is driven by the forces of supply and demand. When there is high demand for a security, its price tends to rise, reflecting the willingness of investors to pay more to acquire it. On the other hand, when there is low demand or excess supply of a security, its price may decline as investors are willing to sell at lower prices.

The process of price discovery occurs through continuous trading in the marketplace. Buyers and sellers come together, submit their orders, and transactions take place at prices that reflect the equilibrium between supply and demand. This continuous interaction enables market participants to adjust their prices and provides an efficient mechanism for establishing fair market values.

Price determination is not solely based on the supply and demand dynamics but also takes into account various fundamental and technical factors. Fundamental factors include company financials, industry trends, macroeconomic indicators, and geopolitical events that can impact the value of a security. Technical factors involve analyzing historical price patterns, trends, and trading volumes to identify potential price movements.

Securities markets provide a transparent and regulated environment for price determination. Market participants have access to real-time market data, such as bid and ask prices, trading volumes, and market depth, which enable them to make informed decisions. This transparency ensures that market prices are fair and reflect the prevailing market conditions.

The accurate determination of prices in securities markets is crucial for both investors and issuers. For investors, fair prices allow them to make informed investment decisions based on the perceived value and risk associated with a security. Investors can assess whether a security is overvalued or undervalued, which can influence their buying or selling decisions.

For issuers, the price determination process provides valuable feedback on the market’s perception of a security’s value. This information is crucial when issuing new securities or conducting subsequent offerings. Accurate price discovery helps issuers in gauging investor demand, setting appropriate offer prices, and ensuring fairness in the capital raising process.

Additionally, price determination in securities markets allows for efficient arbitrage opportunities. If a security is mispriced and its market price deviates significantly from its fundamental value, arbitrageurs can step in and take advantage of the price discrepancy. Their participation in the market helps align prices and contributes to market efficiency.

In summary, securities markets play a crucial role in the determination of fair and transparent prices for securities. Through the continuous interaction of buyers and sellers, these markets establish market values that reflect supply and demand dynamics, as well as fundamental and technical factors. Accurate price determination benefits investors, issuers, and promotes market efficiency.

Risk Management

Securities markets serve an important function in risk management by providing various tools and mechanisms to help investors mitigate and manage risks associated with investing in securities. Investors face different types of risks, including market risk, credit risk, liquidity risk, and operational risk. Securities markets play a crucial role in addressing these risks and ensuring the stability and integrity of the financial system.

One of the key ways securities markets contribute to risk management is through diversification. Diversification involves spreading investments across a wide range of securities or asset classes to reduce exposure to any single investment. By investing in a diversified portfolio, investors can lower their risk as losses in one investment can potentially be offset by gains in another.

Securities markets provide opportunities for diversification by offering a wide range of financial instruments, such as stocks, bonds, mutual funds, ETFs, and derivatives. Investors can allocate their capital across various asset classes based on their risk appetite and investment goals, effectively managing their exposure to different types of risks.

Additionally, securities markets provide derivative instruments that allow investors to hedge against specific risks. Derivatives, such as options and futures contracts, provide investors with the ability to protect themselves against potential adverse price movements, interest rate fluctuations, or changes in currency exchange rates. By hedging their positions, investors can limit their losses and minimize the impact of uncertainties in the market.

Furthermore, securities markets contribute to risk management by providing access to accurate and timely information. Market participants rely on reliable and transparent information to make informed decisions and manage risks effectively. Securities exchanges have stringent disclosure requirements, ensuring that companies provide regular financial reports and other relevant information to the public. This allows investors to assess the financial health and performance of companies, manage their investment risks, and make well-informed investment decisions.

Another important aspect of risk management facilitated by securities markets is the implementation of risk management regulations and oversight. Regulatory bodies monitor and regulate the operations of securities markets, ensuring compliance with rules and regulations aimed at protecting investors. These regulations help maintain market integrity, enhance transparency, and prevent fraudulent activities and market manipulation.

Moreover, securities markets provide mechanisms for risk control and risk assessment. Risk control involves setting limits and implementing risk mitigation strategies to protect against potential losses. For example, market circuit breakers can be triggered to halt trading temporarily in the event of significant market volatility, preventing excessive price swings and allowing investors to reassess their positions.

Additionally, risk assessment tools, such as credit ratings, help investors evaluate the creditworthiness of issuers and assess the default risk of fixed-income securities. This information enables investors to make informed decisions and manage their exposure to credit risk.

In summary, securities markets play a vital role in risk management by providing diversification opportunities, derivative instruments, access to information, regulatory oversight, risk control mechanisms, and risk assessment tools. These functions help investors mitigate and manage risks associated with investing in securities, enhancing market stability and investor protection.

Efficient Allocation of Capital

One of the primary functions of securities markets is to allocate capital efficiently. Efficient capital allocation refers to directing funds to their most productive uses, where they can generate the highest returns and contribute to economic growth. Securities markets play a crucial role in this process by providing a competitive marketplace for securities and enabling investors to make informed investment decisions.

Securities markets facilitate efficient capital allocation by allowing investors to assess and compare different investment opportunities. Investors can analyze the risk-return profiles of various securities, evaluate the financial health and prospects of companies, and make investment choices based on their investment objectives and risk appetite.

The availability of transparent and timely information is essential in enabling investors to allocate their capital efficiently. Securities markets require companies to disclose financial reports and relevant information, which helps investors assess the financial performance, competitive position, and growth potential of companies. With accurate and reliable information, investors can make better-informed decisions, leading to the more efficient allocation of capital.

Efficient capital allocation also relies on the price signals provided by securities markets. The interaction of buyers and sellers in the market leads to the establishment of market prices that reflect the perceived value and risk of securities. Through price discovery, market participants can identify investment opportunities that offer attractive returns relative to their risk. The competitive nature of securities markets ensures that prices reflect the supply and demand dynamics, encouraging the optimal allocation of capital.

Furthermore, securities markets contribute to efficient capital allocation by fostering competition and encouraging innovation. Companies seeking funding must compete for capital by demonstrating their viability, growth potential, and ability to generate returns. This competition incentivizes companies to operate efficiently, innovate, and deliver value to shareholders. Investors can then allocate their capital to the companies that offer the highest potential for growth and return on investment.

Another important aspect of efficient capital allocation facilitated by securities markets is the ability to exit positions easily. Liquidity in securities markets allows investors to convert their investments into cash quickly if needed. This flexibility reduces the impact of illiquid investments and provides investors with the ability to reallocate capital based on changing market conditions and investment opportunities.

In summary, securities markets play a critical role in the efficient allocation of capital by providing a competitive marketplace, access to information, price signals, liquidity, and fostering competition and innovation. Efficient capital allocation ensures that resources are directed to their most productive uses, contributing to economic growth, job creation, and overall prosperity.

Secondary Functions of Securities Markets

Aside from their primary functions of facilitating capital formation, providing liquidity, price determination, risk management, and efficient allocation of capital, securities markets also serve several secondary functions that contribute to the overall functioning of the financial system and support economic growth and stability.

- Information Transmission: Securities markets play a crucial role in transmitting information to market participants. When companies release financial reports, announce corporate developments, or issue earnings guidance, this information is disseminated in the market, allowing investors to make informed decisions. Securities prices reflect this new information, providing investors with a real-time indicator of the market’s perception of a company’s value and prospects. The transmission of information through securities markets helps ensure transparency and efficiency in financial markets.

- Corporate Governance: Securities markets contribute to good corporate governance practices by promoting accountability and transparency. Companies that list their securities on public exchanges are subject to stringent regulatory requirements and disclosure obligations. These requirements ensure that companies provide regular financial reports, disclose material information promptly, and adhere to corporate governance standards. By fostering transparent and accountable business practices, securities markets enhance investor confidence and protect the rights of shareholders.

- Facilitating Economic Growth: Securities markets play a vital role in supporting economic growth by providing an avenue for companies to raise funds for expansion and investment. When companies issue securities to finance their operations or new projects, they stimulate economic activity. This capital inflow helps drive innovation, create jobs, and contribute to economic development. Additionally, securities markets attract both domestic and foreign investments, leading to increased capital flow into the economy and promoting sustainable economic growth.

These secondary functions of securities markets are crucial for ensuring the efficient operation of the financial system and supporting economic growth and stability. Through information transmission, corporate governance, and facilitating economic growth, securities markets foster transparency, accountability, and investment opportunities that promote investor confidence and contribute to the overall well-being of the economy.

Information Transmission

Securities markets play a crucial role in the transmission of information to market participants. As companies release financial reports, announce corporate developments, or provide earnings guidance, this information is disseminated throughout the market. By doing so, securities markets ensure that investors have access to relevant and timely information, allowing them to make informed investment decisions.

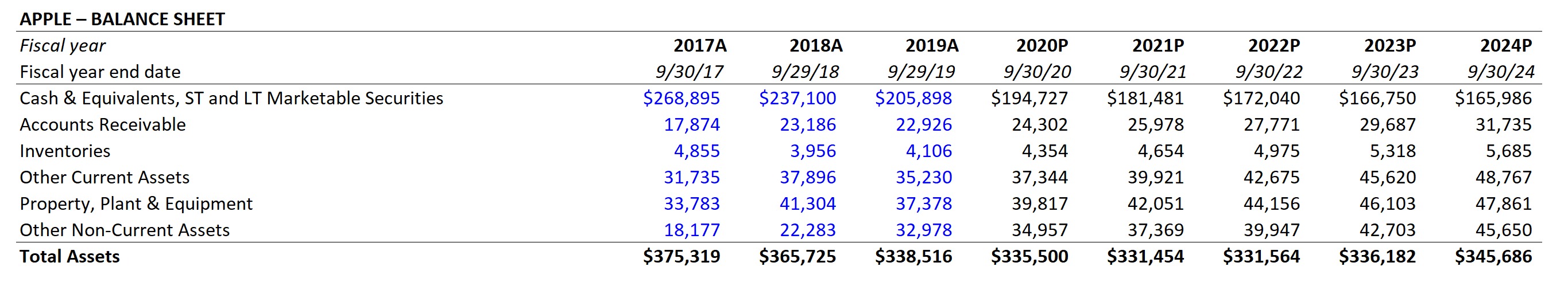

One of the primary ways securities markets facilitate information transmission is through the requirement of companies to disclose financial reports. Publicly listed companies are obligated to provide regular and accurate financial statements, including income statements, balance sheets, and cash flow statements. These reports provide investors with insight into a company’s financial health, performance, and future prospects. They help investors assess the value and potential risks associated with investing in a particular security.

In addition to financial reports, securities markets also serve as a platform for companies to communicate important corporate developments. Companies may issue press releases to announce new products, strategic partnerships, mergers and acquisitions, management changes, or regulatory developments. Such announcements are widely disseminated within the market, ensuring that investors have access to up-to-date information that may impact the value of a security.

Securities markets also provide a medium for companies to provide earnings guidance. Earnings guidance is an estimate of a company’s expected future earnings. By sharing this guidance, companies provide insight into their anticipated performance and allow investors to adjust their expectations and investment strategies accordingly.

The transmission of information through securities markets is crucial for maintaining transparency, efficiency, and fairness in the market. Investors rely on this information to assess investment opportunities, evaluate risks, and make informed decisions. The accuracy and timeliness of information are essential for minimizing information asymmetry and ensuring a level playing field for all market participants.

Moreover, the transmission of information in securities markets is not limited to the disclosure of company-specific news. Securities markets also reflect broader market and economic information. Market indices, such as the S&P 500 or the Dow Jones Industrial Average, provide a snapshot of the overall market performance and serve as indicators of broader economic trends. Economic indicators, such as GDP growth, employment figures, or inflation rates, are closely watched by investors as they have the potential to impact the performance of securities.

Overall, the function of information transmission in securities markets is vital for maintaining an efficient and transparent market. By requiring companies to disclose financial reports, disseminating important corporate announcements, and reflecting market and economic indicators, securities markets ensure that investors have access to the relevant information necessary to make informed investment decisions.

Corporate Governance

Securities markets play a crucial role in promoting good corporate governance practices. Corporate governance refers to the system of rules, practices, and processes by which a company is directed and controlled. It encompasses the relationships among a company’s management, board of directors, shareholders, and other stakeholders. Securities markets provide a framework for enforcing corporate governance standards and ensuring that companies act in the best interests of their shareholders.

Regulatory bodies and stock exchanges set stringent requirements for companies listed on securities markets, aiming to promote transparency, accountability, and fairness in corporate operations. Companies seeking to list their securities must comply with these regulations, such as financial reporting requirements and disclosure obligations.

One of the key components of corporate governance facilitated by securities markets is the protection of minority shareholders’ rights. Minority shareholders, who may not hold significant ownership stakes in a company, rely on securities markets to ensure that their rights and interests are safeguarded. Securities market regulations often include provisions that protect minority shareholders from unfair treatment, such as unequal voting rights or improper related-party transactions.

Securities markets also play a crucial role in enhancing transparency and accountability. Publicly listed companies are required to provide regular and accurate financial reports, which must adhere to standardized accounting principles and be subject to independent audits. These financial disclosures enable investors to assess a company’s financial health, performance, and risk profile. By providing transparent and reliable information, securities markets help investors make informed decisions and hold companies accountable for their actions.

Another important aspect of corporate governance facilitated by securities markets is the role of the board of directors. Companies listed on securities markets are expected to have independent boards that provide oversight and guidance to the management team. The board acts as a representative of the shareholders, ensuring that the company’s interests are aligned with the shareholders’ interests. Independent directors contribute their expertise and provide checks and balances to safeguard against conflicts of interest.

Securities markets also provide mechanisms for shareholder participation and engagement. Shareholders have the right to attend and vote in annual general meetings, where they can express their opinions and concerns, raise questions, and hold the board of directors accountable. This shareholder engagement fosters a culture of transparency and responsiveness in corporate governance.

Furthermore, securities markets encourage corporate social responsibility (CSR) practices by listed companies. CSR involves considering the social, environmental, and ethical impact of corporate activities. Many securities exchanges require listed companies to disclose their CSR initiatives and performance indicators. By promoting CSR practices, securities markets support sustainable and responsible business practices, contributing to the overall well-being of society.

In summary, securities markets play a vital role in promoting good corporate governance practices. Through stringent regulations, protection of minority shareholders’ rights, transparency and accountability requirements, independent boards of directors, shareholder participation, and promotion of CSR, securities markets ensure that companies act in the best interests of their shareholders and stakeholders, fostering transparency, accountability, and confidence in the corporate sector.

Facilitating Economic Growth

Securities markets play a vital role in facilitating economic growth by providing companies and governments with a platform to raise capital for investment and expansion. Through the issuance and trading of securities, securities markets stimulate economic activity, promote entrepreneurship, and contribute to overall economic development.

One of the primary ways securities markets facilitate economic growth is by enabling companies to raise funds for various purposes. When companies issue securities such as stocks or bonds, they are essentially selling ownership stakes or debt instruments to investors in exchange for capital. This capital infusion allows companies to finance their operations, invest in research and development, expand their production capacity, or pursue new growth opportunities.

By providing a mechanism for companies to raise capital, securities markets encourage entrepreneurship and innovation. Start-ups and young companies can access funding through initial public offerings (IPOs) or private placements, which provide the necessary capital to support their growth and bring new products or services to the market. This access to capital fosters competition, drives technological advancements, and fuels economic progress.

In addition to supporting private companies, securities markets also play a role in facilitating economic growth by enabling governments to raise funds for various purposes. Governments issue bonds in the securities markets to finance critical infrastructure projects, public services, and budgetary requirements. The capital raised through these bond issuances contributes to economic development by improving transportation networks, enhancing public facilities, and promoting social welfare.

Securities markets also attract both domestic and foreign investment, boosting capital inflows into the economy and stimulating economic growth. Well-regulated and transparent securities markets provide a favorable investment environment, instilling confidence in investors. This attracts capital from both individual and institutional investors, fostering economic growth through increased investment and job creation.

Furthermore, securities markets contribute to economic growth by improving resource allocation and allocation efficiency. Through the buying and selling of securities, securities markets direct capital to its most productive uses. Investors allocate their capital based on potential returns and risk considerations, driving funds towards companies and sectors with the highest growth potential. This efficient allocation of capital promotes the efficient use of resources, enhances productivity, and supports overall economic growth.

Securities markets also provide economic benefits by acting as a barometer for market sentiment and economic conditions. The performance of stock markets and indices can serve as indicators of economic health and investor confidence. Investors and policymakers closely monitor these markets to gauge market sentiment, identify trends, and make informed decisions regarding economic policies and investment strategies.

In summary, securities markets play a crucial role in facilitating economic growth by providing companies and governments with access to capital, attracting domestic and foreign investment, promoting entrepreneurship and innovation, improving resource allocation, and serving as economic indicators. Their ability to efficiently connect savers with borrowers, allocate capital, and provide a transparent and regulated platform for trading securities contributes to the overall growth and development of the economy.

Conclusion

Securities markets play a critical role in the functioning of modern economies. Through their primary and secondary functions, these markets facilitate capital formation, provide liquidity, determine fair prices, manage risk, and efficiently allocate capital. The functions of securities markets contribute to economic growth, stability, and the efficient operation of the financial system.

By enabling companies and governments to raise capital, securities markets support entrepreneurship, innovation, and economic development. The ability to access funding through securities offerings fuels business expansion, technological advancements, and job creation. Securities markets also attract both domestic and foreign investment, driving capital flow into the economy and promoting sustainable growth.

In addition to facilitating capital formation, securities markets provide liquidity, ensuring that investors can convert their investments into cash easily. This liquidity enhances market efficiency, investor confidence, and flexibility in investment decisions. The price determination function of securities markets ensures transparency and fairness, reflecting the market’s perception of a security’s value and risk.

Risk management is another crucial function of securities markets. Investors can diversify their portfolios, hedge against risks using derivative instruments, and access reliable information to make informed decisions. These risk management mechanisms help protect investors and contribute to market stability.

Securities markets also serve secondary functions, such as information transmission and promoting good corporate governance. The transmission of information through financial reports, corporate announcements, and market and economic indicators ensures transparency, efficiency, and equal access to information. Corporate governance regulations and requirements uphold transparency, accountability, and protect minority shareholders’ rights.

In conclusion, securities markets are an integral part of the global financial system, supporting economic growth, stability, and efficient capital allocation. By facilitating capital formation, providing liquidity, determining fair prices, managing risk, and promoting transparency, securities markets play a vital role in attracting investment, promoting entrepreneurship, fostering innovation, and contributing to the overall prosperity of economies.