Home>Finance>What Does It Mean When The IRS Accepts Your Return?

Finance

What Does It Mean When The IRS Accepts Your Return?

Published: November 1, 2023

Understanding what it means when the IRS accepts your tax return is crucial for your finance. Discover the significance and implications of this important milestone.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Filing your tax return is an essential responsibility that every taxpayer must undertake. After gathering all the necessary documents and diligently completing your tax forms, you eagerly await the next step in the process – the acceptance of your return by the Internal Revenue Service (IRS). But what exactly does it mean when the IRS accepts your return? In this article, we will explore the significance of IRS acceptance and its implications for taxpayers.

Submitting your tax return is just the first step in the complex system of tax filing. Once you hit the “Submit” button or mail in your forms, the IRS begins the process of reviewing and verifying the information you have provided. The acceptance of your return by the IRS indicates that they have received your tax documents and have deemed them as valid for further processing.

Why is IRS acceptance important? The acceptance status of your tax return is a pivotal milestone in the tax filing journey. It signifies that the IRS has successfully received your return and considers it as a valid submission. It also indicates that the IRS has initiated the assessment of your tax liability or potential refund.

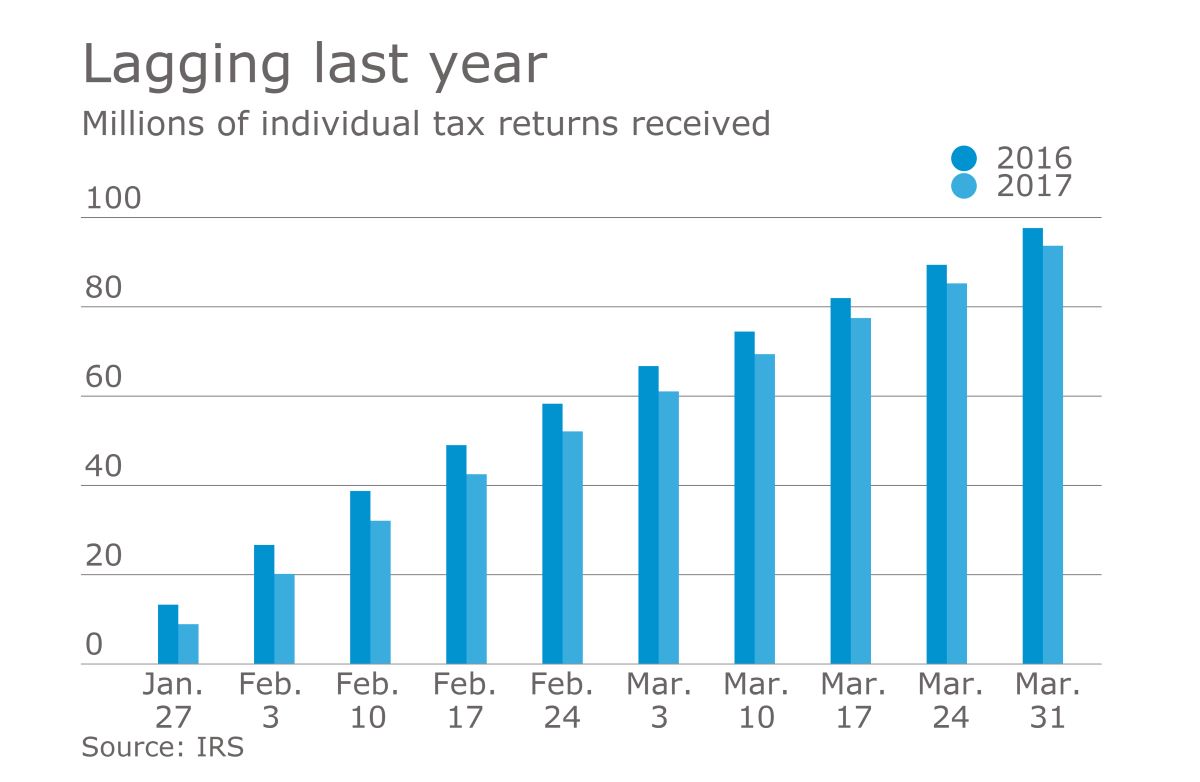

Understanding the acceptance status of your tax return is crucial as it allows you to track the progress of your filing. Once your return has been accepted, you can expect the IRS to initiate further steps, such as the calculation of your taxes owed or the processing of your refund. Typically, the IRS accepts electronic returns within 24 to 48 hours of submission, while paper returns may take longer, usually a few weeks.

Now that we have grasped the concept of IRS acceptance, let’s delve into what happens after the IRS accepts your return. Stay tuned to discover the subsequent stages of the tax filing process and gain insights on how to ensure smooth IRS acceptance of your return.

What is IRS acceptance?

IRS acceptance refers to the status of your tax return after you have submitted it to the Internal Revenue Service (IRS). It signifies that the IRS has received your return and has determined it to be valid for further processing. Upon acceptance, the IRS begins the review and assessment of your tax information to determine your tax liability or refund.

When you file your tax return electronically, the process of IRS acceptance is relatively swift. In most cases, electronic returns are accepted within 24 to 48 hours of submission. This allows for quicker processing and reduces the possibility of delays or errors that may occur when filing on paper.

For those who choose to file their tax return on paper, the timeline for IRS acceptance may be longer. It typically takes a few weeks for the IRS to process and acknowledge the receipt of paper returns. However, it is important to note that the IRS strongly encourages taxpayers to file their returns electronically due to the efficiency and accuracy provided by this method.

Once the IRS has accepted your return, they will commence the next steps of the tax filing process. These steps include assessing your tax liability or determining if you are eligible for a refund. The IRS will carefully evaluate the information you have provided and cross-reference it with other documents, such as W-2 forms and 1099 statements, to ensure accuracy and compliance with tax regulations.

It is essential to understand that IRS acceptance does not guarantee the accuracy of your tax return. While the IRS accepts your return as a valid submission, they may later identify discrepancies or errors during their review process. In such cases, they may issue a notice or contact you for further clarification or adjustments to your tax return.

Overall, IRS acceptance is an important status that marks the beginning of the IRS’s assessment of your tax return. It signifies that your return has been received and is being processed, leading to the calculation of your tax liability or the determination of any potential refund. Understanding the concept of IRS acceptance can help you track the progress of your tax filing and ensure that you meet your obligations as a taxpayer.

Why is IRS acceptance important?

The acceptance status of your tax return by the Internal Revenue Service (IRS) holds significant importance in the tax filing process. It signifies that the IRS has received your return and considers it a valid submission. Here are some reasons why IRS acceptance is crucial for taxpayers:

- Confirmation of receipt: IRS acceptance provides confirmation that your tax return has been successfully received. This eliminates any uncertainty or anxiety about whether your return made it to the IRS or got lost in transit.

- Initiation of processing: Once the IRS accepts your return, they begin the process of reviewing and assessing the information you provided. This includes verifying your income, deductions, credits, and other relevant details. The acceptance status marks the beginning of this crucial phase.

- Calculation of tax liability: After accepting your return, the IRS calculates your tax liability or the amount of tax you owe based on the information provided. This includes considering factors such as your income, filing status, deductions, and credits. IRS acceptance allows the agency to start this evaluation process.

- Determination of refund: For those eligible for a tax refund, IRS acceptance is a stepping stone towards receiving the money owed to you. The IRS verifies your return to determine if you have overpaid your taxes and are entitled to a refund. Acceptance sets the wheels in motion for processing this refund.

- Tracking progress: Knowing the acceptance status of your return enables you to track the progress of your tax filing. You can use online tools, such as the IRS “Where’s My Refund?” feature, to monitor the status of your refund or any potential issues that may arise during processing.

- Early detection of errors: IRS acceptance gives you an opportunity to spot any errors or discrepancies in your tax return. If you receive a rejection notice instead of acceptance, it indicates that there are issues that need to be addressed. This allows you to rectify the errors and resubmit your return promptly.

In summary, IRS acceptance is important as it provides confirmation of receipt, initiates the processing of your return, allows for the calculation of your tax liability, determines the eligibility for a tax refund, enables tracking of your filing progress, and helps in catching any errors early on. Monitoring the acceptance status of your return is a crucial step in ensuring a smooth and successful tax filing process.

Understanding the acceptance status of your tax return

Once you have filed your tax return with the Internal Revenue Service (IRS), it is important to understand the acceptance status of your return. This status indicates whether the IRS has received your return and deemed it valid for further processing. Here are a few key points to help you understand the acceptance status of your tax return:

- Electronic filing: If you filed your tax return electronically, the acceptance status is typically determined within 24 to 48 hours of submission. The IRS uses an electronic acknowledgment process to confirm the receipt and acceptance of your return.

- Rejection vs. acceptance: If your return is rejected, it means that the IRS has identified errors or discrepancies that need to be corrected before they can accept your return. In contrast, acceptance indicates that the IRS has received your return and considers it a valid submission.

- IRS communication: Upon acceptance of your return, the IRS will usually send an acknowledgment letter or electronic notification. This communication confirms the acceptance status and provides additional information on what to expect in terms of processing time and potential refund.

- Processing time: Once your return is accepted, the IRS will begin processing your tax information. The length of time it takes to process your return may vary depending on factors such as the volume of returns being processed and any errors or issues that need to be resolved.

- Online status tools: The IRS provides online tools, such as the “Where’s My Refund?” feature on their website, which allows you to track the status of your return. These tools can provide updates on whether your return has been accepted, whether it is being processed, and the expected date of refund issuance.

- Paper filing: If you filed your tax return on paper, the acceptance status may take longer to determine. It can generally take a few weeks for the IRS to process and acknowledge the receipt of paper returns. You may need to wait for a correspondence from the IRS to confirm the acceptance status.

Understanding the acceptance status of your tax return is important as it allows you to track the progress of your filing and have an idea of when to expect your refund, if applicable. If your return is rejected, it is crucial to address the errors or discrepancies promptly and resubmit your return to ensure timely processing. Monitoring the acceptance status helps ensure that your tax filing is on track and helps avoid any potential issues that could delay the processing of your return.

What happens after the IRS accepts your return?

After the Internal Revenue Service (IRS) accepts your tax return, several important steps follow in the tax filing process. Understanding what happens next can help you anticipate what to expect and ensure a smooth progression of your return. Here’s a breakdown of what occurs after the IRS accepts your return:

- Processing: Once the IRS accepts your return, they begin processing it, which involves reviewing the information you provided. They verify your income, deductions, credits, and other relevant details to determine the accuracy of your return and your tax liability or refund.

- Audit potential: Although rare, your return may be selected for an audit even after acceptance. The IRS uses an automated system that compares returns to detect potential discrepancies or red flags. If your return is chosen for an audit, you will receive a notification from the IRS outlining the next steps.

- Correction of errors: If the IRS identifies errors or discrepancies in your return during processing, they may initiate corrective actions. In some cases, they may make adjustments on your behalf to correct minor errors or to resolve math errors. If significant issues are identified, they may request additional documentation or communicate with you to address the discrepancies.

- Calculation of taxes owed: The IRS uses the information provided on your return to calculate the amount of tax you owe. They consider factors such as your income, filing status, deductions, and credits to determine your tax liability. If you are eligible for any tax credits, they will be applied to reduce your tax burden.

- Determination of refund: If you are entitled to a tax refund, the IRS will determine the amount based on your return. They will verify if you have overpaid your taxes and calculate the refund amount accordingly. Generally, refunds are issued within 21 days of return acceptance for electronically filed returns.

- Notification of payment or refund: Once the IRS completes the processing of your return, they will notify you of the outcome. If you owe taxes, they will provide instructions on how to make the payment. If you are due a refund, you will receive information on when and how it will be issued.

It is important to note that the processing time for the IRS can vary depending on factors such as the volume of returns being processed and any issues or errors that need to be resolved. You can use the IRS “Where’s My Refund?” tool on their website to track the status of your refund and get updates on the progress of your return’s processing.

Understanding what happens after the IRS accepts your return allows you to stay informed and prepared for the next steps in the tax filing process. It ensures that you can address any potential issues or provide necessary documentation promptly, enabling a more efficient and hassle-free experience.

Common errors or issues that may prevent IRS acceptance

Submitting a tax return that is accurate and error-free is essential to ensure a smooth acceptance process by the Internal Revenue Service (IRS). However, there are several common errors or issues that taxpayers may encounter that can potentially prevent IRS acceptance. Here are some of the most frequent reasons why a return may be rejected or delayed:

- Inaccurate personal information: Providing incorrect or incomplete personal information, such as your name, Social Security number, or address, can lead to rejection. It is crucial to double-check and ensure that all personal details are accurate and match your official records.

- Math errors: Simple mathematical errors can cause the IRS to reject your return. Miscalculating your income, deductions, or credits can lead to discrepancies that trigger an automatic rejection. Using tax preparation software or double-checking your calculations can help minimize this risk.

- Filing status errors: Selecting the incorrect filing status, such as single instead of married filing jointly, can result in rejection. It is essential to choose the appropriate filing status based on your marital and family situation to ensure accurate tax reporting.

- Missing or incorrect Social Security numbers: Failing to provide the correct Social Security numbers for yourself, your spouse, dependents, or other individuals you are claiming on your return can lead to IRS rejection. Verify the accuracy of all Social Security numbers before submitting your return.

- Incorrect bank account information: If you are expecting a direct deposit refund, providing incorrect bank account information (such as the routing or account number) can prevent acceptance. Double-check your bank account details to ensure they are accurate and up to date.

- Duplicate filing: Filing multiple returns for the same tax year can result in your returns being rejected by the IRS. Ensure that you only file one tax return for each tax year to avoid duplicate filing issues.

- Failure to include necessary forms or schedules: Neglecting to include required forms or schedules that support the information on your tax return can prevent acceptance. Make sure to include all necessary documentation, such as W-2s, 1099s, and supporting schedules, to validate your income and deductions.

- Incorrectly claiming dependents: Claiming an incorrect number of dependents or claiming individuals who do not meet the IRS criteria for dependents can lead to IRS rejection. It is crucial to understand the IRS rules for claiming dependents and ensure you meet the eligibility requirements.

- Failure to sign and date the return: For paper filers, forgetting to sign and date your tax return before mailing it to the IRS can result in rejection. Electronic filers also need to sign their returns digitally using a Personal Identification Number (PIN) to meet the IRS requirements.

To avoid these common errors and ensure IRS acceptance, it is vital to take your time, double-check all information, and use reliable tax preparation software or seek professional guidance. Verifying the accuracy of your personal details, performing accurate calculations, and including all necessary forms and schedules will help reduce the risk of rejection and ensure a smooth tax filing experience.

Tips for ensuring smooth IRS acceptance of your return

Ensuring a smooth acceptance process by the Internal Revenue Service (IRS) is crucial when filing your tax return. By following these tips, you can maximize the chances of a seamless IRS acceptance:

- Use electronic filing: Electronically filing your tax return is not only convenient but also increases the efficiency and accuracy of IRS processing. The IRS strongly encourages electronic filing as it reduces the chances of errors and ensures faster acceptance and processing times.

- Double-check your information: Before submitting your return, carefully review all personal information, including names, Social Security numbers, and addresses. Any inaccuracies in this information can result in rejection or delays. Take your time to ensure accuracy and consistency with official records.

- Verify math calculations: Math errors are a common reason for IRS rejection. Use tax preparation software or a calculator to double-check all calculations, including income, deductions, and credits. Simple mistakes in arithmetic can lead to discrepancies that trigger rejection.

- Choose the correct filing status: Selecting the appropriate filing status is crucial for accurate tax reporting. Review the IRS guidelines to determine the correct filing status based on your marital and family situation. Choosing the wrong status can result in rejection or incorrect tax liability calculations.

- Gather and include all relevant documentation: Ensure you have all necessary forms and supporting documents before filing your return. This includes W-2s, 1099s, and any other forms specific to your financial situation. Failing to include required documents can delay IRS acceptance or trigger further inquiries.

- Check for dependents: If you are claiming dependents, make sure you meet the IRS requirements for eligibility. Verify the accuracy of their Social Security numbers and ensure you have accurate records of their income and expenses if necessary.

- Sign and date your return: For paper filers, ensure you sign and date your tax return before mailing it to the IRS. Electronic filers must digitally sign their returns using a Personal Identification Number (PIN) to meet IRS requirements. Failure to sign and date can lead to rejection.

- Use accurate bank account information: If you are expecting a refund and providing bank account information for direct deposit, double-check the accuracy of your bank account details. Any errors in routing or account numbers can delay or prevent acceptance of your return.

- File on time: Ensure you file your tax return by the deadline to avoid any penalties or late filing issues. Filing early can also reduce the likelihood of errors due to rushing or last-minute stress.

- Keep copies of your return and related documents: Maintain copies of your filed tax return, as well as any supporting documents, for your records. This will assist in addressing any inquiries or resolving potential discrepancies that may arise after acceptance.

By following these tips, you can enhance the chances of a smooth IRS acceptance of your tax return. Being proactive in verifying information, double-checking calculations, and filing electronically can help reduce the risk of errors or delays. Remember to keep copies of your return and maintain organized records to address any future inquiries efficiently.

Conclusion

Understanding the concept of IRS acceptance and its importance in the tax filing process is crucial for every taxpayer. IRS acceptance signifies that the Internal Revenue Service has received your tax return and considers it a valid submission for further processing. It marks the beginning of the assessment of your tax liability or potential refund. By comprehending the acceptance status and what happens after acceptance, you can navigate the tax filing journey with confidence and clarity.

To ensure a smooth IRS acceptance, it is essential to avoid common errors and issues that may lead to rejection or delays. Double-checking personal information, verifying math calculations, selecting the correct filing status, and including all necessary documentation are important steps. Filing electronically, using accurate bank account information, and signing and dating your return are additional measures that can contribute to a seamless acceptance process.

By adhering to these tips and best practices, you can increase the likelihood of a positive and efficient interaction with the IRS. Remember to keep copies of your return and maintain organized records for future reference. Monitoring the acceptance status of your return allows you to stay informed and track the progress of your filing, whether it is the calculation of your tax liability or the determination of your refund amount.

Filing your tax return is a significant undertaking, and IRS acceptance is a vital milestone in the process. With a thorough understanding of what it means when the IRS accepts your return, you can navigate the tax filing journey smoothly, ensuring compliance with tax regulations and maximizing the chances of a favorable outcome.