Finance

Trading Software Definition

Published: February 10, 2024

Looking for a reliable finance trading software? Discover the definition of trading software and how it can enhance your financial management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Trading Software: A Comprehensive Guide

Welcome to our finance blog category, where we strive to provide valuable insights and information on various aspects of the financial world. In today’s post, we will be discussing trading software, an essential tool for traders of all levels. If you’ve ever wondered what trading software is and how it can benefit your trading endeavors, you’ve come to the right place!

Key Takeaways:

- Trading software is a computer program designed to facilitate buying and selling securities in financial markets.

- It streamlines the trading process, providing real-time market data, analytical tools, and order execution capabilities.

So, what exactly is trading software? In simple terms, it refers to computer programs specifically created to assist traders in buying and selling financial instruments, such as stocks, bonds, commodities, or currencies. These software solutions are designed to provide traders with the necessary tools and resources to analyze market trends, execute trades, and optimize their trading strategies.

Now, let’s explore some of the key features and benefits of trading software:

1. Real-Time Market Data:

Trading software provides access to real-time market data, including price quotes, order books, trade volumes, and more. This information is crucial for making informed trading decisions, as it allows traders to monitor market movements and react quickly to changes.

2. Analytical Tools:

Trading software offers a wide range of analytical tools and indicators to help traders analyze past and current market trends. These tools assist traders in identifying patterns, forecasting potential price movements, and making data-driven decisions.

3. Order Execution Capabilities:

With the help of trading software, traders can execute their orders swiftly and efficiently. Most trading platforms offer a variety of order types, including market orders, limit orders, stop-loss orders, and more. This flexibility allows traders to implement their trading strategies with precision.

4. Backtesting and Strategy Development:

Many trading software solutions include backtesting capabilities, enabling traders to test their strategies using historical data. This feature allows traders to assess the performance of their trading strategies and make necessary adjustments before risking real capital.

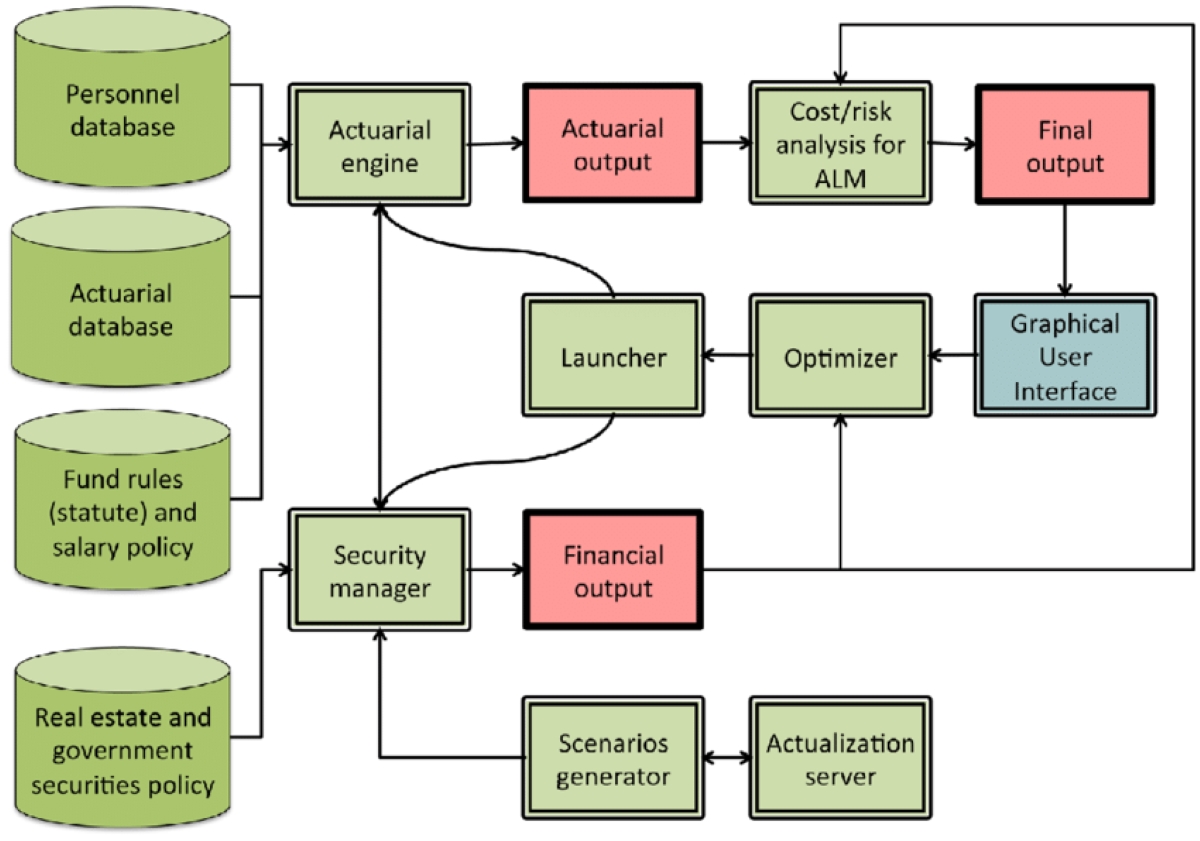

5. Automation and Algorithmic Trading:

Advanced trading software often supports algorithmic trading, where traders can create and execute automated trading strategies based on predefined rules. This enables traders to take advantage of market opportunities even while they are away from their computer screens.

It’s worth noting that there are various types of trading software available in the market, ranging from simple platforms for retail traders to sophisticated solutions designed for institutional investors. Depending on your trading goals, experience, and budget, you’ll find a trading software that suits your needs.

In conclusion, trading software is a valuable tool for traders looking to navigate the fast-paced world of financial markets. With real-time market data, analytical tools, and order execution capabilities, these software solutions empower traders to make informed decisions and optimize their trading strategies. So, if you haven’t already, consider exploring trading software options to enhance your trading experience!