Finance

What Is A Threshold In Banking

Published: October 12, 2023

Learn what a threshold in banking means and its importance in finance. Find out how thresholds are used to manage risk and monitor financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Threshold in Banking

- Importance of Thresholds in Banking

- Types of Thresholds in Banking

- Risk Thresholds in Banking

- Regulatory Thresholds in Banking

- Impact of Thresholds on Banking Operations

- Examples of Thresholds in Banking

- Challenges in Implementing Thresholds in Banking

- Conclusion

Introduction

Welcome to the world of banking, where numbers and regulations play a crucial role in the smooth functioning of financial institutions. Within this complex landscape, thresholds emerge as essential tools that help manage risk, ensure compliance, and maintain stability in the banking sector. Understanding what thresholds are and how they impact banking operations is of utmost importance in today’s dynamic financial environment.

A threshold, in the context of banking, refers to a predetermined level or limit that triggers a specific action or requirement. These thresholds can be set by regulatory bodies, internal risk management teams, or financial institutions themselves. They serve as benchmarks and indicators, providing valuable insights into potential risks, compliance issues, and operational needs.

The banking industry is heavily regulated and operates within a strict framework of rules and guidelines. Thresholds are a key component in ensuring risk mitigation and adherence to regulatory standards. By setting specific thresholds, financial institutions can monitor and control various aspects of their operations, including capital adequacy, liquidity, credit risk, and market risk.

Thresholds also play a critical role in decision-making processes within banks. They help management teams assess the health of the institution, identify potential vulnerabilities, and take appropriate actions to mitigate risks. Furthermore, thresholds serve as early warning indicators, allowing banks to proactively address issues before they escalate into significant problems.

There are various types of thresholds in banking, each serving a specific purpose. They can be classified into risk thresholds and regulatory thresholds. Risk thresholds are designed to manage and control different types of risks faced by banks, while regulatory thresholds are set by governing bodies to ensure compliance with industry regulations.

Implementing and monitoring thresholds effectively can be challenging for banks due to factors such as the rapidly changing financial landscape, evolving risk patterns, and customer behavior. However, with the right systems, processes, and technological advancements, banks can overcome these hurdles and harness the benefits that thresholds offer in terms of risk management, compliance, and operational efficiency.

In this article, we will delve deeper into the definition, importance, types, and impact of thresholds in banking. Through various examples and insights, we will shed light on how thresholds shape the banking sector and address the challenges associated with their implementation. So, let’s embark on this journey through the world of thresholds and explore their significance in the realm of finance.

Definition of a Threshold in Banking

In the realm of banking, a threshold can be defined as a predetermined level or limit that, when reached or exceeded, triggers a specific action, requirement, or consequence. These thresholds are put in place to enable risk management, ensure compliance with regulatory standards, and maintain the stability and soundness of financial institutions.

Thresholds serve as benchmarks or indicators that help financial institutions monitor various aspects of their operations and make informed decisions. They can be set by regulatory bodies, internal risk management teams, or the banks themselves. The specific thresholds can vary based on the type of risk being managed or the regulatory requirement being addressed.

Risk thresholds in banking are designed to manage and control different types of risks faced by financial institutions. These can include credit risk, liquidity risk, market risk, operational risks, and more. For example, a bank may set a credit risk threshold to limit exposure to a specific borrower or industry. If the credit risk exceeds this threshold, the bank may need to take actions such as increasing collateral requirements or reducing loan exposure.

Regulatory thresholds, on the other hand, are set by governing bodies to ensure compliance with industry regulations and safeguard the stability of the financial system. These thresholds can include capital adequacy ratios, liquidity requirements, stress testing thresholds, and more. By setting these thresholds, regulators aim to maintain the safety and soundness of the banking sector in the face of potential risks and adverse economic conditions.

It is important to note that thresholds in banking are not fixed values, but rather dynamic parameters that may change over time based on various factors such as the overall risk appetite of the institution, prevailing economic conditions, regulatory changes, and internal risk assessments. Financial institutions constantly review and adjust their thresholds to adapt to changing environments and mitigate emerging risks.

The establishment and monitoring of thresholds in banking rely on robust risk management frameworks and sophisticated systems. By leveraging advanced analytics, models, and technology, banks can set appropriate thresholds, monitor them in real-time, and trigger timely actions or interventions when the thresholds are breached.

In summary, a threshold in banking is a predefined level or limit that serves as a trigger for specific actions, requirements, or consequences. These thresholds play a critical role in managing risks, ensuring compliance, and maintaining the stability of financial institutions. By setting and monitoring thresholds effectively, banks can navigate the complex and ever-evolving landscape of finance with greater confidence and resilience.

Importance of Thresholds in Banking

Thresholds are of paramount importance in the banking industry as they serve several crucial purposes that contribute to the overall stability and success of financial institutions. Here are some key reasons why thresholds play a significant role in banking:

1. Risk Management: Thresholds enable banks to effectively manage and control various types of risks they face, such as credit risk, market risk, liquidity risk, and operational risk. By setting predefined limits, banks can identify and assess potential risks, take proactive measures to mitigate them, and prevent adverse consequences that could impact their financial health and reputation.

2. Compliance: Regulatory bodies impose specific thresholds to ensure banks comply with industry regulations and maintain the overall integrity and stability of the financial system. These thresholds may include capital adequacy ratios, liquidity requirements, stress testing thresholds, and more. Compliance with these thresholds helps protect the interests of depositors, shareholders, and the broader economy.

3. Early Warning Indicators: Thresholds serve as early warning indicators, alerting banks to potential issues or vulnerabilities before they escalate into significant problems. By closely monitoring thresholds, banks can identify deviations, implement timely corrective actions, and prevent or mitigate potential risks or compliance breaches.

4. Operational Efficiency: Setting thresholds for various operational metrics allows banks to evaluate their performance and allocate resources effectively. By establishing thresholds related to key performance indicators (KPIs) such as operational costs, customer satisfaction levels, or transaction volumes, banks can monitor and improve their operational efficiency, identify areas for optimization, and drive sustainable growth.

5. Financial Stability: Thresholds contribute to maintaining the overall financial stability of banks and the broader financial system. By imposing limits on risk-taking activities, capital adequacy, and liquidity ratios, regulators ensure that banks are well-capitalized, have sufficient liquidity buffers, and are less susceptible to shocks or systemic risks. This helps enhance the resilience and soundness of financial institutions.

6. Decision-Making: Thresholds provide valuable information and insights that influence critical decision-making processes within banks. Management teams can use threshold breaches or near-breaches as triggers to evaluate the need for strategic adjustments, resource allocation, risk mitigation measures, or changes in business strategies. Thresholds guide decision-makers in navigating the complex landscape of banking, ensuring actions are taken in a timely and informed manner.

Overall, thresholds in banking are vital tools that enable risk management, ensure compliance, enhance operational efficiency, promote financial stability, and facilitate informed decision-making. By setting appropriate thresholds and continually monitoring them, financial institutions can navigate challenges, seize opportunities, and maintain their position as trusted custodians of public funds while safeguarding the interests of all stakeholders involved.

Types of Thresholds in Banking

Thresholds in banking can be classified into different types, each serving a specific purpose in managing risks, ensuring compliance, and maintaining the stability of financial institutions. Let’s explore some of the key types of thresholds commonly used in the banking industry:

- Credit Risk Thresholds: These thresholds focus on managing and controlling the credit risk faced by banks. Credit risk is the potential loss that may arise from a borrower’s failure to repay their debt obligations. Banks set credit risk thresholds to limit exposure to individual borrowers, industries, or types of loans. If these thresholds are breached, banks may take actions such as increasing collateral requirements, reducing loan exposure, or implementing stricter lending criteria.

- Liquidity Risk Thresholds: Liquidity risk refers to a bank’s inability to meet its short-term obligations due to a shortage of cash or liquid assets. To manage liquidity risk, banks set liquidity thresholds to ensure they have sufficient liquid assets to meet their funding obligations. These thresholds may include maintaining a minimum level of liquid assets, monitoring cash flow ratios, or monitoring the availability of emergency funding sources.

- Market Risk Thresholds: Market risk is the potential loss that banks face due to adverse changes in market conditions, such as interest rate fluctuations, exchange rate movements, or changes in the prices of financial instruments. Banks set market risk thresholds to limit their exposure to such risks. These thresholds may involve monitoring value-at-risk (VaR) limits, stress testing outcomes, or predefined risk tolerance levels for specific asset classes.

- Operational Risk Thresholds: Operational risk encompasses the potential losses arising from inadequate or failed internal processes, people, systems, or external events. These risks can include fraud, system failures, cyberattacks, or legal and compliance breaches. Banks set operational risk thresholds to monitor and control such risks. These thresholds may include tracking key operational risk indicators, setting limits on error rates or transaction delays, or implementing controls to mitigate identified vulnerabilities.

- Capital Adequacy Ratio (CAR) Thresholds: Capital adequacy ratios are regulatory thresholds set by governing bodies to ensure banks have sufficient capital to absorb potential losses. Commonly used ratios include the Basel III framework’s common equity tier 1 (CET1) and total capital ratios. These thresholds ensure banks maintain an adequate capital base relative to their risk-weighted assets, promoting financial stability and mitigating the risk of insolvency.

- Regulatory Compliance Thresholds: Regulatory bodies impose various thresholds to ensure banks comply with industry regulations and maintain the integrity of the financial system. These thresholds may include liquidity requirements, stress testing thresholds, leverage ratios, or thresholds related to anti-money laundering (AML) and know-your-customer (KYC) procedures. Compliance with these thresholds is essential for banks to operate legally and maintain public trust.

It’s important to note that the specific thresholds and parameters can vary based on the risk appetite, business model, and regulatory environment of each bank. Financial institutions continually review and adapt these thresholds to align with emerging risks, changing market conditions, and evolving regulatory requirements.

By leveraging these various types of thresholds, banks can effectively manage risks, ensure compliance, and maintain stability in an ever-changing financial landscape. Implementing robust monitoring mechanisms and systems to track these thresholds in real-time allows banks to proactively address issues, make informed decisions, and navigate the complexities of the banking industry more effectively.

Risk Thresholds in Banking

Risk thresholds play a crucial role in the banking industry by helping financial institutions manage and control various types of risks they face. These thresholds serve as predefined levels or limits that allow banks to assess and monitor the potential risks they are exposed to and take appropriate actions when those thresholds are breached. Let’s explore some common types of risk thresholds in banking:

- Credit Risk Thresholds: Credit risk is one of the most significant risks faced by banks, and credit risk thresholds are designed to manage and control this type of risk. Banks set credit risk thresholds to limit their exposure to individual borrowers, industries, or types of loans. For example, a bank may set a credit risk threshold that restricts the maximum loan amount granted to a specific borrower or limits exposure to a particular industry. If these thresholds are breached, the bank will need to reevaluate its lending decisions and take appropriate actions to mitigate the credit risk.

- Liquidity Risk Thresholds: Liquidity risk refers to a bank’s inability to meet its short-term obligations due to a shortage of cash or liquid assets. Banks set liquidity risk thresholds to ensure they maintain adequate liquidity buffers and can meet their funding needs. These thresholds may involve monitoring key liquidity ratios, such as the loan-to-deposit ratio or the cash-to-assets ratio, to assess the bank’s ability to withstand liquidity stresses. If these thresholds are breached, banks may need to take immediate actions to enhance their liquidity position, such as accessing emergency funding sources or adjusting their lending and investment activities.

- Market Risk Thresholds: Market risk arises from adverse changes in market conditions, such as interest rate fluctuations, exchange rate movements, or changes in the prices of financial instruments. Banks set market risk thresholds to limit their exposure to these risks. Common market risk thresholds include value-at-risk (VaR) limits, which establish the maximum potential loss a bank is willing to tolerate within a given time frame. If a bank’s market risk breaches these thresholds, it may need to adjust its investment portfolio, hedge against certain risks, or take other risk mitigation measures to maintain a desired risk level.

- Operational Risk Thresholds: Operational risk encompasses risks arising from internal processes, systems, or external events. These risks can include fraud, system failures, cyberattacks, or legal and compliance breaches. Operational risk thresholds help banks monitor and control potential operational losses. For example, banks may set thresholds to track key operational risk indicators, such as the number of security breach incidents or the frequency of internal control deficiencies. If these thresholds are breached, banks must identify the root causes, implement corrective measures, and strengthen their operational resilience to prevent further losses.

- Concentration Risk Thresholds: Concentration risk refers to the potential losses that arise from having a large exposure to a specific borrower, industry, or geographic region. Banks set concentration risk thresholds to prevent overexposure to a single risk source. These thresholds could limit the maximum amount of exposure a bank can have to a specific borrower or sector. Breaching these thresholds requires banks to reassess their portfolio diversification strategies, adjust lending practices, or seek risk mitigation measures to reduce concentration risk.

By establishing and monitoring these risk thresholds, banks can effectively manage their exposure to different types of risks and take timely actions to mitigate risk and safeguard their financial stability. Implementing robust risk management frameworks, sophisticated analytics, and regular risk assessments enables banks to set appropriate thresholds, monitor risks in real-time, and respond swiftly to any breaches or deviations from the predefined limits. This proactive approach to risk management helps banks navigate the complexities of the financial industry and maintain a resilient and sustainable business model.

Regulatory Thresholds in Banking

Regulatory thresholds play a vital role in the banking industry, as they are set by governing bodies to ensure compliance with industry regulations and promote the stability and soundness of the financial system. These thresholds establish predetermined levels or limits that banks must meet in order to maintain regulatory compliance. Let’s explore some common types of regulatory thresholds in banking:

- Capital Adequacy Thresholds: Capital adequacy thresholds, such as the Basel III framework’s common equity tier 1 (CET1) and total capital ratios, are regulatory requirements that govern the minimum level of capital banks must maintain in proportion to their risk-weighted assets. These thresholds ensure that banks have a sufficient capital buffer to absorb potential losses and maintain stability in times of financial stress.

- Liquidity Requirement Thresholds: Liquidity requirements are regulatory thresholds that mandate the maintenance of adequate liquid assets to meet short-term funding obligations. These thresholds are designed to ensure that banks have sufficient liquidity to withstand liquidity shocks and disruptions. Regulatory bodies may set specific liquidity ratios, such as the liquidity coverage ratio (LCR) and net stable funding ratio (NSFR), to ensure banks have appropriate liquidity buffers.

- Stress Testing Thresholds: Stress testing is a regulatory requirement that assesses the resilience of banks under various adverse scenarios. Regulatory bodies set stress testing thresholds to ensure that banks can withstand severe economic downturns, market shocks, or other stress events. These thresholds help banks identify potential vulnerabilities, evaluate the impact of adverse conditions, and take necessary measures to enhance their resilience.

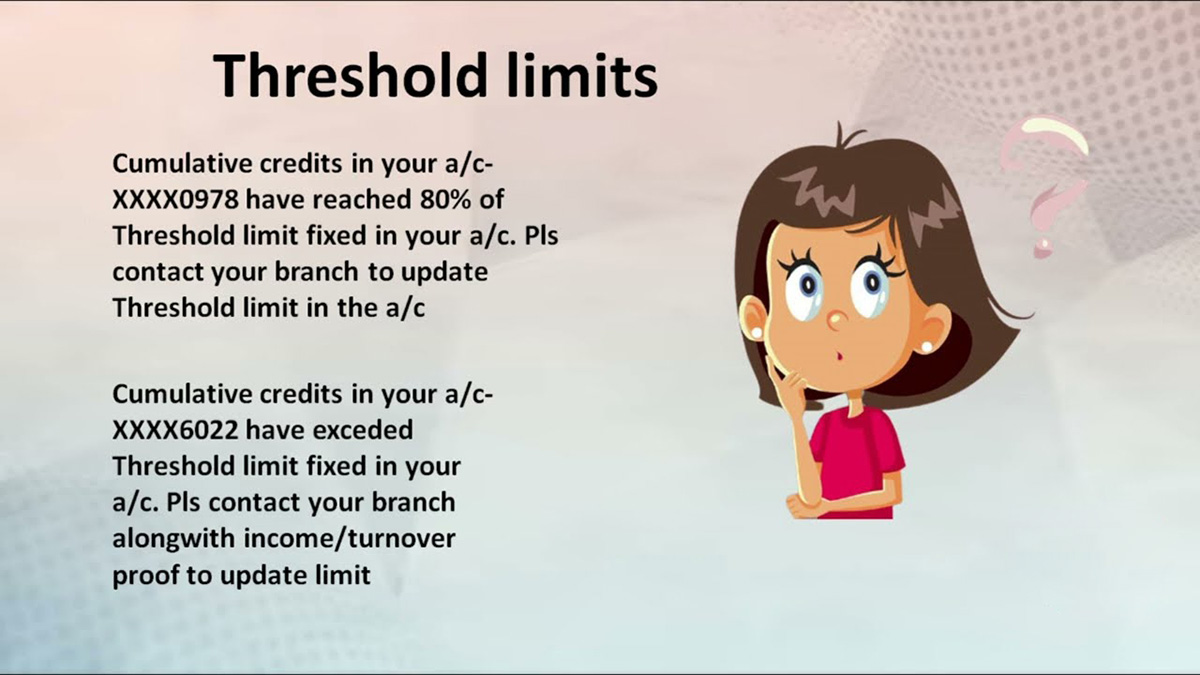

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Thresholds: AML and KYC thresholds involve compliance with regulations aimed at preventing money laundering, terrorist financing, and other illicit activities. These thresholds impose obligations on banks to establish robust customer identification and due diligence processes. Banks must adhere to these thresholds to ensure the integrity of the financial system and mitigate the risk of facilitating illicit transactions.

- Compliance Reporting Thresholds: Regulatory bodies may set thresholds for reporting obligations to ensure banks provide accurate and timely information. These thresholds could include requirements for the submission of financial statements, risk management reports, transaction monitoring data, and other regulatory disclosures. Banks must meet these thresholds to fulfill their reporting obligations and provide regulators with necessary information for oversight and assessment purposes.

Complying with regulatory thresholds is crucial for banks to maintain their license to operate, safeguard the interests of depositors, and uphold the stability and integrity of the financial system. Non-compliance with regulatory thresholds can result in penalties, reputational damage, and even regulatory intervention. Therefore, banks must implement robust compliance programs, establish effective internal controls, and allocate adequate resources to meet these regulatory obligations.

Regulatory thresholds are not static and can evolve with changing market conditions, emerging risks, and advancements in regulatory frameworks. Banks must stay updated with regulatory changes and adapt their operations and strategies to ensure ongoing compliance. By meeting and exceeding these regulatory thresholds, banks can demonstrate their commitment to responsible and transparent banking practices, gain the trust of regulators and customers, and contribute to the overall stability and resilience of the financial system.

Impact of Thresholds on Banking Operations

The implementation of thresholds has a significant impact on the operations of banks, shaping their risk management strategies, compliance practices, and overall decision-making processes. Let’s explore the key ways in which thresholds impact banking operations:

- Risk Management: Thresholds play a critical role in managing risks within banks. By setting predefined limits for various types of risks, such as credit risk, liquidity risk, and market risk, banks can identify potential vulnerabilities, assess risk levels, and take appropriate measures to mitigate risks. Thresholds act as early warning indicators, enabling banks to proactively monitor risk levels and make informed decisions to safeguard their financial stability.

- Compliance: Regulatory thresholds ensure banks meet the required standards set by governing bodies to maintain compliance with industry regulations. Banks must monitor and comply with thresholds related to capital adequacy, liquidity requirements, stress testing, and anti-money laundering and know-your-customer procedures. Failure to meet these thresholds can lead to penalties, reputational damage, and regulatory intervention, with a significant impact on the bank’s operations.

- Decision-Making: Thresholds provide banks with critical information and insights that influence their decision-making processes. When thresholds are breached, it triggers a reassessment of strategies, risk mitigation measures, and resource allocation. For example, if a credit risk threshold is exceeded, the bank may reassess its lending policies, tighten credit standards, or take steps to reduce exposure to high-risk borrowers or industries. Thresholds guide decision-makers in balancing risks and rewards and shaping the bank’s overall business direction.

- Operational Efficiency: Thresholds related to operational metrics can help banks evaluate their operational efficiency and identify areas for improvement. By setting thresholds for key performance indicators such as cost efficiency, customer satisfaction, or transaction processing times, banks can monitor their operational performance and identify opportunities for optimization and cost reduction. Thresholds act as performance benchmarks, driving the bank to enhance operational processes and deliver better service to customers.

- Risk Mitigation: Thresholds facilitate the identification and mitigation of risks within banks. By setting limits for various risk types, banks can take proactive measures to mitigate potential losses. For example, if a liquidity risk threshold is breached, the bank can proactively seek alternative funding sources or adjust its balance sheet composition to improve liquidity. Thresholds guide banks in managing risks effectively, reducing vulnerabilities, and protecting their financial stability.

- Regulatory Oversight: Thresholds play a crucial role in regulatory oversight and assessment of banks. Regulatory bodies rely on thresholds to monitor the financial health and compliance of banks. Banks must regularly report data and information related to their performance against thresholds. This helps regulators assess the level of risk exposure, adequacy of capital, compliance with regulations, and overall stability of the bank. Thresholds enable regulators to identify potential weaknesses or areas of concern and take appropriate actions or interventions when needed.

The impact of thresholds on banking operations is far-reaching, encompassing risk management, compliance practices, decision-making processes, operational efficiency, risk mitigation, and regulatory oversight. Financial institutions must establish robust frameworks, implement effective monitoring systems, and allocate resources to ensure that they meet the required thresholds and manage risks effectively. By doing so, banks can navigate the complexities of the industry, maintain regulatory compliance, and contribute to their long-term sustainability and success.

Examples of Thresholds in Banking

Thresholds in banking play a crucial role in managing risks, ensuring compliance, and maintaining stability within financial institutions. Let’s explore some specific examples of thresholds commonly used in the banking industry:

- Credit Risk Threshold: Banks often set thresholds for credit risk to control their exposure to individual borrowers or industries. For instance, a bank may establish a credit risk threshold that limits loans to a specific borrower to a certain percentage of its total loan portfolio. If a borrower exceeds this threshold, the bank may require additional collateral or impose stricter lending terms to mitigate the credit risk.

- Liquidity Ratio Threshold: Banks maintain liquidity ratio thresholds to ensure they have sufficient liquid assets to meet short-term funding obligations. For example, a bank may set a liquidity ratio threshold of 30%, requiring that 30% of its total assets consist of liquid assets such as cash or government securities. Breaching this threshold would trigger the need to take immediate actions to increase liquidity, like accessing emergency funding sources or adjusting the balance sheet composition.

- Market Risk Value-at-Risk (VaR) Threshold: Banks use market risk VaR thresholds to limit their exposure to volatile market conditions. For instance, a bank may set a VaR threshold of $1 million for a particular portfolio. If the projected loss of the portfolio exceeds this threshold, the bank may need to adjust its risk exposure by diversifying the portfolio, hedging against specific market risks, or reducing trading activities to mitigate potential losses.

- Capital Adequacy Ratio (CAR) Threshold: Regulatory bodies set minimum capital adequacy ratio thresholds to ensure banks maintain sufficient capital to absorb potential losses. For example, under Basel III, banks must maintain a minimum common equity tier 1 (CET1) capital ratio of 4.5%. Breaching this threshold would require the bank to take immediate actions to raise additional capital, such as issuing equity or retaining earnings, to meet the regulatory requirement.

- Stress Testing Threshold: Regulators impose stress testing thresholds to assess the resilience of banks under adverse scenarios. For example, a stress testing threshold may require a bank to maintain a minimum capital ratio of 8% during a severe economic downturn or in the event of a significant market shock. If the bank fails to meet this threshold, it may be required to devise strategies and take necessary actions to improve its capital position and enhance its ability to withstand adverse conditions.

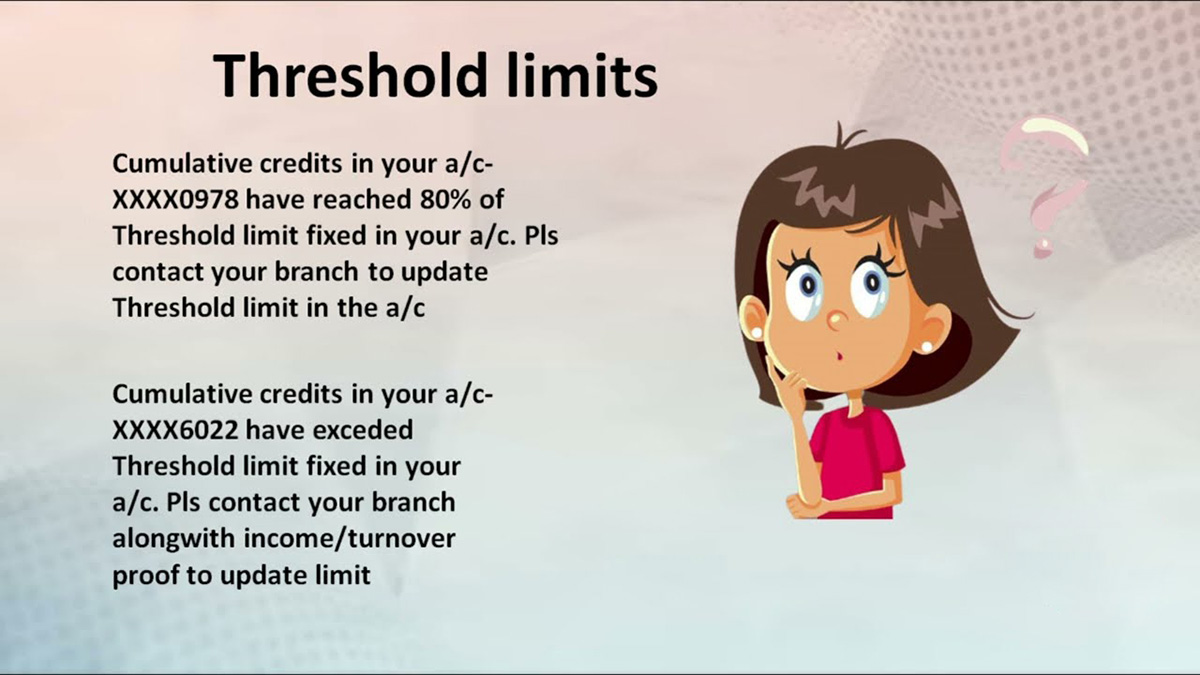

- Anti-Money Laundering (AML) Transaction Threshold: Banks establish AML transaction thresholds to detect and prevent money laundering and other illegal activities. For instance, banks may set a threshold that triggers additional due diligence for cash transactions exceeding a certain amount, such as $10,000. If a transaction surpasses this threshold, the bank must conduct enhanced scrutiny, document the transaction’s purpose, and report it to the relevant authorities as per AML regulations.

These examples illustrate how thresholds function in specific areas of banking, ranging from credit risk and liquidity management to market risk, capital adequacy, stress testing, and anti-money laundering efforts. The specific thresholds set by banks and regulators may vary depending on the institution’s risk appetite, regulatory requirements, and market conditions. By setting and monitoring these thresholds effectively, banks can manage risks, ensure compliance, and maintain stability in their day-to-day operations.

Challenges in Implementing Thresholds in Banking

While thresholds in banking are crucial for risk management and compliance, their effective implementation can pose certain challenges for financial institutions. Let’s explore some of the common challenges faced in implementing thresholds:

- Data Quality and Availability: Accurate and reliable data is essential for setting and monitoring thresholds. However, banks often face challenges in obtaining high-quality data from different sources within their organization. Inconsistent data formats, incomplete information, and data silos can hinder the accurate assessment of risks, leading to challenges in setting appropriate thresholds and making informed decisions.

- Complexity and Interdependencies: The interdependence of various risks and market dynamics can make it challenging to define thresholds accurately. Risks such as credit risk, market risk, and liquidity risk are interconnected, and changes in one area can impact others. Banks must carefully consider these complexities and incorporate them into their threshold frameworks to ensure comprehensive risk management.

- Rapidly Changing Risk Landscape: The dynamic nature of the financial industry brings about new risks and challenges. Banks must continuously assess and adapt their threshold frameworks to address emerging risks effectively. The evolving nature of technology, cybersecurity threats, and regulatory changes require banks to remain agile and responsive to ensure their thresholds are up to date and relevant.

- Technological Infrastructure: Implementing and monitoring thresholds require robust technological infrastructure and data management systems. Banks must invest in advanced analytics tools, risk management platforms, and data integration capabilities to effectively monitor thresholds in real-time. Insufficient technology infrastructure can lead to delays in monitoring thresholds, making it challenging to respond promptly to threshold breaches.

- Complex Regulatory Environment: Banks operate within a complex regulatory environment with multiple overlapping regulations and reporting requirements. These regulations often set their own thresholds, adding complexity to compliance efforts. Banks must ensure they have the necessary processes and systems in place to monitor and meet these regulatory thresholds while aligning with their internal risk thresholds.

- Risk Modeling and Accuracy: Setting thresholds requires robust risk modeling techniques that accurately capture complex risk factors. Banks must ensure their risk models are well-calibrated and tested to provide reliable results. Inaccurate risk modeling can lead to the setting of inappropriate thresholds, exposing the bank to potential risks or leading to unnecessary constraints on business operations.

- Cultural and Organizational Change: Implementing thresholds may require significant cultural and organizational changes within banks. It involves gaining buy-in from stakeholders, driving risk awareness, and embedding risk management practices into the organizational culture. Effectively communicating the importance of thresholds and ensuring their consistent application across the organization can be a challenge requiring dedicated change management efforts.

Overcoming these challenges requires a comprehensive approach that encompasses data governance, technology investments, risk expertise, and regulatory compliance. Banks must commit to ongoing monitoring and improvement of their threshold frameworks, fostering a risk-aware culture, and embracing technological advancements to enhance their risk management capabilities.

Despite these challenges, implementing thresholds in banking is essential for managing risks, ensuring compliance, and maintaining the stability of financial institutions. By addressing these challenges effectively, banks can leverage thresholds as valuable tools to make better-informed decisions, mitigate risks, and navigate the ever-changing landscape of the banking industry.

Conclusion

Thresholds in banking play a crucial role in managing risks, ensuring compliance, and maintaining stability within financial institutions. By setting predefined levels or limits, banks can assess and monitor potential risks, make informed decisions, and take necessary actions to mitigate risks and maintain regulatory compliance.

The various types of thresholds, including credit risk thresholds, liquidity risk thresholds, market risk thresholds, capital adequacy thresholds, AML thresholds, and more, provide banks with valuable tools to enhance their risk management practices and navigate the complexities of the financial industry.

Implementing thresholds in banking is not without its challenges, such as data quality and availability, complexity of interdependencies, rapidly changing risk landscapes, technological infrastructure requirements, the complexity of the regulatory environment, risk modeling accuracy, and cultural and organizational change. However, with dedicated efforts, banks can overcome these challenges and leverage thresholds to drive efficient operations, effective risk management, and regulatory compliance.

By setting appropriate thresholds, banks can proactively identify and measure risks, make informed decisions within acceptable risk tolerances, and strengthen their resilience in the face of potential adverse events. Thresholds enable banks to optimize risk-return trade-offs, enhance operational efficiencies, protect the interests of stakeholders, and maintain the stability of the financial system.

Ultimately, thresholds serve as vital tools for risk management, compliance, and decision-making in the banking industry. As the financial landscape continues to evolve, banks must continually reassess and refine their thresholds, adapt to emerging risks, and embrace technological advancements to ensure their frameworks remain effective in managing risks and maintaining the trust and confidence of their customers and regulatory bodies.