Home>Finance>How Long Does It Take For The IRS To Audit You?

Finance

How Long Does It Take For The IRS To Audit You?

Modified: December 30, 2023

Wondering how long the IRS takes to audit? Get insights into the audit process and timelines. Finance your way through IRS audits with our expert guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Factors that Trigger an IRS Audit

- How the IRS Selects Tax Returns for Audit

- Types of IRS Audits

- Initial Contact from the IRS

- Gathering Documentation for an IRS Audit

- Duration of an IRS Audit

- Extending or Speeding Up the Audit Process

- Possible Outcomes of an IRS Audit

- Tips for Surviving an IRS Audit

- Conclusion

Introduction

Filing your taxes is a necessary annual task that can often be stressful and time-consuming. The thought of being audited by the Internal Revenue Service (IRS) is enough to make anyone a little anxious. But how long does it actually take for the IRS to audit you? In this article, we will explore the factors that trigger an audit, how the IRS selects tax returns for review, and the different types of IRS audits.

An IRS audit is a review of your tax return to ensure that you have reported your income and claimed deductions accurately. While the idea of an audit may sound intimidating, it’s important to remember that only a small percentage of tax returns are selected for audit each year. Understanding the audit process can help alleviate any concerns you may have about being audited.

So, let’s dive in and explore the factors that could increase the likelihood of an audit and shed some light on how long the process typically takes.

Factors that Trigger an IRS Audit

While the IRS uses various methods to select tax returns for audit, there are certain factors that can increase the likelihood of your return being flagged for review. Understanding these factors can help you take steps to minimize the risk of an audit. Here are some key factors that may trigger an IRS audit:

- High-income earners: Individuals with higher incomes are more likely to be audited. The IRS focuses its resources on ensuring that high-income taxpayers are reporting their income accurately and paying the correct amount of taxes.

- Income inconsistencies: Large discrepancies between your reported income and the information reported by your employers and financial institutions can raise red flags. Make sure that you accurately report all your income and double-check that it matches the information provided by third parties such as employers and banks.

- Unreported income: Failures to report all sources of taxable income are a common trigger for IRS audits. It is essential to report all income, including freelance work, rental income, and investment returns.

- High deduction claims: Claiming excessive deductions, especially when compared to your income level, can draw attention from the IRS. Make sure your deductions are legitimate and supported by proper documentation.

- Business losses: If you own a business and report frequent losses, it can raise suspicions for the IRS. They may question if the losses are legitimate or if there is an attempt to reduce taxable income through improper deductions.

- Self-employment: Self-employed individuals face a higher risk of audit as they have more opportunities to underreport income or inflate deductions. Keep accurate records and ensure your deductions are well-documented.

- Inconsistent information: Ensure that all the information on your tax return is consistent and matches the supporting documentation you provide. Any discrepancies or inconsistencies can raise suspicion and lead to an audit.

It’s important to note that while these factors may increase the possibility of being audited, they do not guarantee that your tax return will be selected for review. The IRS uses a complex selection process to determine which returns to audit, with a focus on areas where there is a higher likelihood of non-compliance. By understanding these factors, you can take steps to reduce your audit risk and ensure that your tax return is accurate and complete.

How the IRS Selects Tax Returns for Audit

The IRS uses a combination of automated and manual methods to select tax returns for audit. Understanding how the IRS selects returns can give you insight into the audit process and help you prepare in case your return is chosen for review. Here are the primary methods the IRS uses to select tax returns for audit:

- Computerized Selection Process: The IRS employs computer algorithms and statistical models to flag tax returns that deviate from the norm. These models analyze various factors, such as income, deductions, credits, and other financial information, to identify potential discrepancies or non-compliance. Tax returns with unusual patterns or outliers are more likely to be selected for audit.

- Related Examinations: If your tax return includes transactions or entities that are under audit or investigation, it increases the likelihood of your return being selected as well. For example, if you’re involved in a business partnership that is being audited, your individual return may be pulled for review as well.

- Industry-Specific Focus: The IRS may target specific industries or professions for audit due to historically higher non-compliance rates. Industries that handle a lot of cash transactions, such as restaurants and bars, or sectors with complex tax regulations, like real estate or healthcare, may be subject to increased scrutiny.

- Information Matching: The IRS receives information from various third parties, such as employers, banks, and financial institutions, through information returns like W-2s, 1099s, and K-1s. These forms are cross-referenced with the information reported on tax returns. Any inconsistencies or discrepancies can result in the selection of your return for audit.

- Tips and Whistleblower Reports: The IRS receives tips and reports from individuals who suspect tax evasion or fraud. Valid and credible tips can trigger an audit, even if there are no obvious red flags on the tax return itself.

- Random Selection: As a quality control measure, the IRS also conducts random audits. These audits are chosen without any specific reason or trigger and serve to assess the overall accuracy and compliance of taxpayers.

It’s important to note that being selected for an audit does not necessarily mean the IRS has identified any issues with your tax return. Sometimes, returns are chosen purely based on statistical criteria or for random quality control purposes. However, if your return is selected for audit, it’s crucial to respond promptly and provide the requested documentation to address any concerns raised by the IRS.

Types of IRS Audits

When it comes to IRS audits, there are several types that you may encounter. Each type varies in terms of complexity, scope, and level of scrutiny. Understanding the different types of IRS audits can help you prepare and navigate the audit process more effectively. Here are the most common types of IRS audits:

- Correspondence Audit: This is the simplest and most common type of audit. The IRS conducts it by mail and typically involves a request for additional information or clarification on specific items in your tax return. You will be asked to provide supporting documents or explanations for certain deductions, credits, or discrepancies. Correspondence audits are usually limited to a specific issue and can be resolved by providing the requested information promptly.

- Office Audit: An office audit requires you to meet with an IRS examiner at their local office. The examiner will review various aspects of your tax return in detail, including income, deductions, and credits. Office audits are usually conducted for more complex issues or cases that cannot be easily resolved through correspondence. During the audit, you will be asked to provide documentation and answer questions related to the specific items under review. It’s crucial to be prepared and organized for an office audit, as it may involve a more extensive examination of your financial records.

- Field Audit: A field audit is the most comprehensive and intrusive type of IRS audit. An IRS agent will visit your home, business, or accountant’s office to conduct an in-depth examination of your tax return. Field audits are typically reserved for complex cases, high-income earners, or when there is suspicion of significant non-compliance. During a field audit, the IRS agent will examine your financial records, interview you and potentially other individuals involved in your financial affairs. Field audits require careful preparation and may extend over several days or even weeks.

- Taxpayer Compliance Measurement Program (TCMP) Audit: TCMP audits are rare and highly comprehensive. They are conducted to assess the overall accuracy and compliance of a taxpayer population. In a TCMP audit, the IRS will examine every aspect of your tax return in great detail to ensure compliance with tax laws. TCMP audits are typically random and serve as a quality control measure to maintain the integrity of the tax system.

It’s essential to approach any type of IRS audit with diligence, cooperation, and appropriate record-keeping. Understanding the specific type of audit you are facing can help you gather the necessary documentation and provide accurate responses to the IRS’s inquiries. Seeking professional assistance from a tax advisor or CPA familiar with the audit process can also provide valuable guidance and support throughout the audit.

Initial Contact from the IRS

Receiving initial contact from the IRS about an audit can be an unsettling experience. It’s important to understand what to expect and how to respond appropriately. Here’s what you need to know about the initial contact from the IRS:

Typically, the IRS will initiate contact by mail, either through a letter or a notice. The correspondence will provide details about the audit, including the specific items or areas of your tax return under review. It will also specify the timeframe within which you need to respond or provide requested documentation. The initial contact will also mention the type of audit you are facing, such as a correspondence audit, office audit, or field audit.

It’s crucial to carefully read and understand the IRS communication. Take note of any deadlines mentioned and gather all the relevant documents and records related to the areas being audited. Responding promptly and providing the requested information is vital to demonstrate your cooperation and willingness to resolve any discrepancies.

If you receive a notice of audit, it’s recommended to consult a tax professional or CPA to help you navigate the audit process. They can review your tax return, help gather the required documents, and provide guidance on how to interact with the IRS. Having a tax professional on your side can alleviate some of the stress and ensure that you are well-prepared for the audit.

Remember, the initial contact from the IRS does not necessarily mean there is a problem with your tax return. It’s simply an opportunity for the IRS to verify the accuracy and completeness of the information reported. By maintaining open communication, cooperating fully, and providing the necessary documentation, you can help the audit process proceed smoothly and increase your chances of a favorable outcome.

Gathering Documentation for an IRS Audit

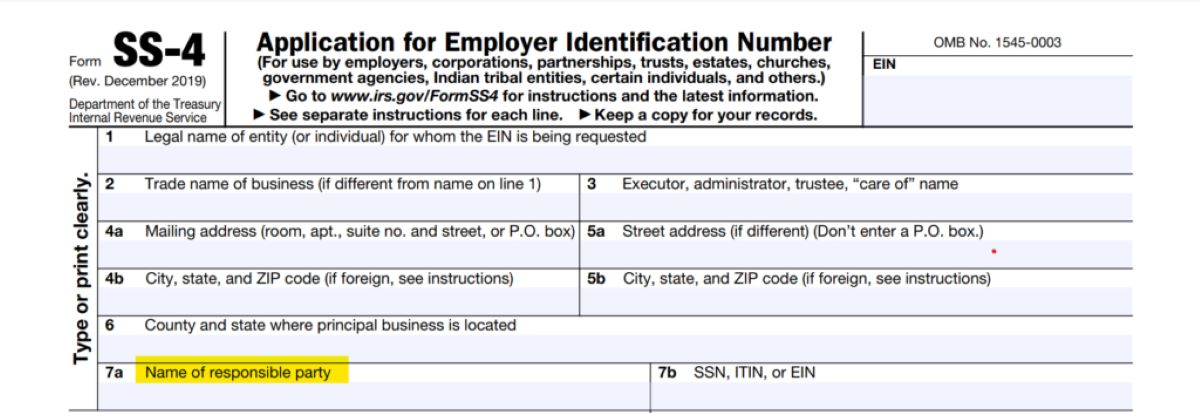

When facing an IRS audit, one of the most critical tasks is gathering the necessary documentation to support the information reported on your tax return. Having organized and comprehensive records can help you navigate the audit process more smoothly and provide the evidence needed to substantiate your claims. Here are some important steps to follow when gathering documentation for an IRS audit:

- Review the audit notice: Carefully read the audit notice to understand which areas of your tax return are being examined. This will give you a clear idea of the specific documents and records you need to gather.

- Compile income documents: Gather all documents related to your income, including W-2s, 1099s, and other income statements. Make sure these documents match the income reported on your tax return and that you have documentation for any additional income, such as rental income or investment earnings.

- Organize expense-related documents: Collect receipts, invoices, and other supporting documents for deductions, credits, and expenses claimed on your tax return. This includes expenses related to business operations, medical costs, charitable contributions, and education expenses, among others. Ensure these documents are organized and readily accessible for review.

- Retain proof of deductions: In addition to receipts and invoices, gather any additional proof or documentation that supports your claimed deductions. This may include mileage logs, travel itineraries, donation acknowledgments, and invoices for business equipment or supplies.

- Maintain adequate records: It’s crucial to have complete and accurate records for any transactions or activities that relate to your tax return. This includes bank statements, financial statements, contracts, lease agreements, and other pertinent documents that support the information reported.

- Seek professional assistance: If you are unsure about which documents to gather or how to organize them, consider seeking assistance from a tax professional or CPA. They can help you ensure that you have all the necessary documentation to satisfy the audit requirements and guide you through the process.

Remember, maintaining thorough and organized records throughout the year is crucial not just during an audit, but also for your overall financial management. By doing so, you can not only ease the burden of an audit but also provide accurate and reliable information on your tax return. Being diligent with record-keeping can help ensure compliance with tax laws and potentially reduce the risk of future audits.

Duration of an IRS Audit

The duration of an IRS audit can vary widely depending on various factors, including the complexity of the audit, the type of audit being conducted, and the availability of both the taxpayer and the IRS. While some audits can be resolved relatively quickly, others may take months or even years to complete. Here’s what you need to know about the duration of an IRS audit:

Correspondence audits, which typically involve simple issues and can be resolved by providing additional documentation by mail, are usually the shortest in duration. These audits generally take a few weeks to a few months to complete, depending on the responsiveness of the taxpayer.

Office audits, which require an in-person meeting with an IRS examiner, can take longer to complete. The duration of an office audit can range from a few months to over a year, depending on the complexity of the issues being reviewed and the availability of both parties. It’s important to be prepared for the office audit and provide all requested documents promptly to help expedite the process.

Field audits, which involve a more thorough examination of a taxpayer’s financial records, are typically the most time-consuming. These audits can last several months to more than a year, especially for complex cases or cases involving high-income individuals or businesses. Field audits often require multiple meetings with the IRS agent, on-site inspections, and detailed analysis of financial documents.

It’s important to note that the duration of an audit can be extended if the IRS identifies additional issues or discrepancies during the course of the audit. Conversely, if the audit reveals no major issues, it may be concluded relatively quickly. Additionally, audits can be put on hold or suspended temporarily if there are extenuating circumstances, such as taxpayer-provided documentation that requires further analysis.

Prompt and cooperative communication with the IRS, as well as providing complete and accurate documentation in a timely manner, can help expedite the audit process. Seeking professional assistance from a tax advisor or CPA who is experienced in dealing with audits can also help ensure that the process is handled efficiently and effectively.

While the duration of an IRS audit can be uncertain and potentially time-consuming, it’s important to remain patient and responsive throughout the process. By cooperating with the IRS and providing the requested information, you can help facilitate the resolution of the audit and move towards a final determination.

Extending or Speeding Up the Audit Process

The duration of an IRS audit can sometimes feel indefinite, but there are ways to either extend or speed up the process. Understanding these options can help you effectively manage the audit and work towards a resolution. Here are some strategies to consider:

Extending the Audit Process:

- The Request for Extension: If you require more time to gather documentation or need to consult a tax professional, you can submit a request for an extension. This can provide you with additional time to prepare a thorough response to the IRS’s inquiries.

- The Appeals Process: If you disagree with the audit findings or proposed adjustments, you have the right to appeal. Engaging in the appeals process can prolong the audit duration, but it allows for a non-confrontational resolution through mediation or negotiation.

- Seeking Legal Assistance: In more complex cases or situations where legal issues arise, it may be necessary to engage the services of a tax attorney. Legal proceedings can significantly extend the audit process, as they involve court appearances, filings, and potential negotiations.

Speeding Up the Audit Process:

- Timely and Thorough Responses: Responding promptly and providing complete and accurate documentation can help expedite the audit process. Timely communication demonstrates your willingness to cooperate with the IRS and resolve any discrepancies.

- Work with a Tax Professional: Enlisting the help of a qualified tax professional or CPA can ensure that you are well-prepared for the audit. They can help you gather the necessary documentation, guide you through the process, and handle communication with the IRS on your behalf.

- Enroll in the Fast Track Settlement Program: For small businesses and self-employed individuals, the Fast Track Settlement Program can speed up the audit process. This program allows taxpayers to resolve issues with auditors early in the process, potentially avoiding lengthy appeals or litigation.

- Cooperate and Be Respectful: Maintaining a cooperative and respectful attitude throughout the audit can foster a smoother and more efficient process. It’s important to provide the requested information promptly and be available for meetings or discussions with the IRS examiner.

It’s crucial to carefully consider the options available to you and choose the approach that aligns with your specific circumstances. While it’s understandable to want to resolve the audit quickly, it’s equally important to ensure that you have thoroughly addressed and supported all claims made on your tax return.

Remember, every audit is unique, and the duration can vary. By following these strategies and seeking professional guidance when necessary, you can help navigate the audit process more effectively and work towards a resolution in a timely manner.

Possible Outcomes of an IRS Audit

After undergoing an IRS audit, there are several possible outcomes that you may encounter. The outcome of the audit depends on various factors, including the accuracy of your tax return, the documentation provided, and the IRS examiner’s findings. Here are the possible outcomes of an IRS audit:

- No Changes: The best-case scenario is when the IRS finds no discrepancies or issues during the audit. In this case, your tax return remains unchanged, and no further action is required. You will receive a closure letter indicating that the audit is complete.

- Agreed Changes: Sometimes, an audit may reveal minor errors or discrepancies in your tax return. If you agree with the discrepancies identified by the IRS, you can sign an agreement form and pay any additional taxes, penalties, or interest owed. The IRS will then make the necessary adjustments to your tax return.

- Proposed Changes: If the IRS finds significant discrepancies or believes that adjustments are necessary, they will issue a proposed adjustment letter. This letter outlines the specific changes they want to make to your tax return. You have the option to agree with the proposed changes, provide additional supporting documentation, or request a conference with the examiner or their supervisor to discuss your concerns.

- Audit Reconsideration: If you believe that the proposed changes are incorrect or inaccurate, you can request an audit reconsideration. This involves providing new information or documentation to support your position and requesting a review of your case by a different IRS examiner.

- Appeals: If you disagree with the findings of the audit, you have the right to appeal the decision. This involves submitting a formal written protest to the IRS Office of Appeals. An appeals officer will review your case and work towards a resolution through mediation or negotiation.

- Litigation: In rare cases where all other resolution attempts fail, you may choose to pursue litigation in tax court. This involves presenting your case before a judge and letting them decide the outcome. Litigation should only be considered as a last resort and is typically undertaken with the assistance of a tax attorney.

It’s important to carefully review and understand the findings of the audit and the available options for resolution. Seeking professional advice from a tax professional or CPA can provide valuable guidance on the best course of action based on your specific circumstances.

Regardless of the outcome, it’s crucial to comply with any documentation or payment requirements outlined by the IRS. Maintaining open and transparent communication with the IRS throughout the process is key to achieving a satisfactory resolution and moving forward with confidence.

Tips for Surviving an IRS Audit

Undergoing an IRS audit can be a daunting experience, but with proper preparation and approach, you can navigate the process successfully. Here are some tips to help you survive an IRS audit:

- Be organized: Maintain thorough and organized records throughout the year. This includes keeping copies of all necessary documents, such as income statements, expense receipts, and supporting documentation for deductions and credits. Having organized records will make it easier to provide the required information during the audit.

- Respond promptly and professionally: Address any correspondence or notices from the IRS promptly. Be professional and respectful in your communication. Timely and cooperative responses show your willingness to resolve any issues and can help expedite the audit process.

- Consult a tax professional: Seeking the guidance of a tax professional or CPA familiar with the audit process can provide valuable assistance. They can help you prepare for the audit, review your documentation, and offer expert advice on how to best represent your case to the IRS.

- Know your rights: Familiarize yourself with your rights as a taxpayer. Understanding your rights can help you navigate the audit process with confidence and ensure that you are being treated fairly. The IRS website provides comprehensive information on taxpayer rights.

- Provide accurate and complete information: It’s crucial to be honest and accurate in your responses during the audit. Providing complete and truthful information helps build trust with the IRS and can lead to a smoother resolution.

- Keep calm and composed: It’s natural to feel anxious during an audit, but maintaining a calm and composed demeanor is important. Avoid being defensive or argumentative. Instead, focus on providing the requested information and addressing any concerns raised by the IRS examiner.

- Document your responses: Keep a record of all communications, documentation submitted, and any discussions with the IRS examiner. This documentation can serve as valuable evidence to support your case in case of any disputes or disagreements.

- Be prepared for appeals: If you disagree with the findings of the audit, be prepared to exercise your right to appeal. Understand the appeals process and be prepared to present your case effectively. Consult with a tax professional experienced in appeals if necessary.

- Review and learn from the audit: Regardless of the outcome, use the audit process as an opportunity to review your tax practices and improve compliance. Identify any areas where you can enhance record-keeping or better understand tax regulations to avoid future audits.

Remember, an IRS audit doesn’t necessarily mean you have done anything wrong. Approach the audit with the mindset of providing the necessary information and working towards a fair resolution. By following these tips and seeking professional assistance when needed, you can successfully navigate the audit and emerge with a satisfactory outcome.

Conclusion

Undergoing an IRS audit may seem intimidating, but armed with the right knowledge and approach, you can navigate the process successfully. Understanding the factors that trigger an audit, how the IRS selects tax returns, and the different types of audits can help you better prepare and respond. Remember that only a small percentage of tax returns are selected for an audit each year, so it’s important to approach the process with a level-headed mindset.

Throughout the audit, be organized and maintain thorough records to support the information reported on your tax return. Respond promptly and professionally to any communication from the IRS, and consider seeking the assistance of a tax professional who can guide you through the audit process.

During the audit, it’s crucial to provide accurate and complete information while asserting your rights as a taxpayer. Keep calm and composed, document all interactions, and be prepared to appeal if necessary. Most importantly, use the audit as an opportunity to review your tax practices and make any necessary improvements to ensure future compliance.

Remember, the outcome of an audit can vary, ranging from no changes to proposed adjustments. However, by cooperating with the IRS and providing the requested documentation, you increase the chances of a favorable outcome. Regardless of the audit’s duration or outcome, maintaining open communication and complying with the IRS requirements are vital to successfully navigating the process.

In conclusion, while an IRS audit may be daunting, it is a manageable process. By staying informed, being prepared, and seeking professional assistance when needed, you can survive an IRS audit with confidence and emerge with a resolution that satisfies both you and the IRS.