Finance

How To Know If The IRS Is Auditing You

Modified: December 30, 2023

Learn how to determine if the IRS is auditing your finances and how to navigate the process effectively. Gain peace of mind with our expert tips and guidance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dealing with the Internal Revenue Service (IRS) can be an intimidating experience. The thought of being audited by the IRS is enough to make anyone break out in a cold sweat. However, it’s important to remember that the IRS conducts audits to ensure taxpayers are accurately reporting their income and paying the appropriate amount of taxes.

An IRS audit is an examination of an individual or business’s financial records and transactions to verify the accuracy of their tax return. While it may sound like a daunting process, not every taxpayer will experience an audit. The IRS selects a fraction of tax returns for auditing based on a variety of factors, including potential red flags and random selection.

The purpose of this article is to help you understand the basics of IRS audits and provide you with the knowledge to determine if the IRS is auditing you. By being proactive and informed, you can better navigate the audit process and address any concerns or issues in a timely and appropriate manner.

Understanding IRS Audits

An IRS audit is a systematic examination of a taxpayer’s financial records and accounts to ensure that they have reported their income accurately and have paid the correct amount of taxes. The purpose of an audit is to maintain the integrity of the tax system and to identify and address any discrepancies or potential noncompliance.

There are different types of audits conducted by the IRS, including correspondence audits, office audits, and field audits. Correspondence audits are typically conducted through mail, where the IRS requests additional documentation or clarification on certain items on the tax return. Office audits require the taxpayer to visit an IRS office to provide supporting documents and answer questions. Field audits, on the other hand, involve an IRS agent visiting the taxpayer’s place of business or residence to conduct an in-depth examination of their records.

During an audit, the IRS reviews various aspects of the taxpayer’s financial information, such as income, deductions, credits, and expenses. They may also examine supporting documents, such as bank statements, receipts, invoices, and other relevant records. The specific items that the IRS focuses on during an audit may vary depending on the complexity of the taxpayer’s return and the nature of their income and expenses.

It’s important to note that not all tax audits result in a tax liability. In fact, some audits may actually lead to a taxpayer receiving a refund if they were able to provide additional documentation or evidence to support their claimed deductions or credits. However, in cases where discrepancies or noncompliance are identified, the IRS may impose penalties, interest, or additional taxes owed.

It’s crucial to understand that being selected for an audit does not necessarily imply that the taxpayer has done anything wrong. The IRS uses a variety of methods to select tax returns for audits, including computer screening and comparison of information reported by multiple sources. Factors that may increase the likelihood of an audit include discrepancies or inconsistencies in reported income, excessive deductions or credits, involvement in high-risk business activities, and being part of a group that has been identified for audit.

Common Triggers for IRS Audits

While the IRS uses various methods to select tax returns for audits, there are certain red flags and triggers that may increase the likelihood of being audited. It’s important to be aware of these common triggers to ensure accurate reporting and compliance with tax laws. Here are some of the common triggers for IRS audits:

- High-income earners: Taxpayers with high incomes are more likely to be audited, as their financial transactions and tax returns tend to be more complex and require closer scrutiny.

- Inconsistencies in reported income: Discrepancies between income reported on tax returns and information reported by employers and financial institutions can raise suspicion and lead to an audit.

- Excessive deductions and credits: Claiming too many deductions or credits, especially if they are disproportionately high compared to the taxpayer’s income, can be a trigger for an audit.

- Self-employment and cash-based businesses: Businesses that primarily deal in cash, such as restaurants, retail stores, and service-based enterprises, are more likely to be audited due to the potential for underreporting of income.

- Investment income and offshore accounts: The IRS has increased its focus on offshore accounts and investments to detect potential tax evasion. Taxpayers with foreign investments or accounts are at a higher risk of audit.

- Involvement in tax shelters and abusive schemes: Engaging in complex tax shelters or using abusive tax avoidance strategies can attract IRS scrutiny and result in an audit.

- Previous audit history: Taxpayers who have been audited before and have had discrepancies or noncompliance issues may be more likely to be audited in subsequent years.

It’s important to note that these triggers do not guarantee an audit, but they can increase the likelihood of being selected for one. Adhering to proper record-keeping practices, accurately reporting income, keeping documentation for deductions and credits, and consulting with a tax professional can help minimize the risk of an audit.

Signs that the IRS is Auditing You

Receiving a notice from the IRS can be anxiety-inducing, especially if you suspect that you might be under audit. While the IRS won’t explicitly state in their initial communication that you are being audited, there are several signs that can indicate that an audit is taking place. Here are some common signs that the IRS is auditing you:

- Notification letter: The first indication of an audit is usually a letter or notice from the IRS. This letter will typically request additional documentation or information to support certain items on your tax return.

- Follow-up phone call or email: In some cases, the IRS may follow up their initial letter with a phone call or email to discuss the audit further and provide instructions on how to proceed. They may request an in-person meeting or ask for additional documents to be submitted.

- Increased communication from the IRS: If you start receiving regular correspondence from the IRS, such as notices about missing or incomplete information, it may be a sign that they are conducting an audit.

- Specific inquiry about certain items: The IRS may focus their audit on specific areas of your tax return, such as deductions, credits, or self-employment income. If they ask for detailed documentation or explanations related to these items, it could indicate an audit.

- Changes in tax refund status: If you were expecting a tax refund and it suddenly changes to “under review” or “pending,” it could suggest that the IRS is reviewing your return more closely, possibly for an audit.

- Contact from a tax auditor: In some cases, an IRS auditor may contact you directly to schedule an appointment or request an interview. They may want to discuss specific aspects of your tax return or ask for more information about your financial transactions.

- Information requests from third parties: During an audit, the IRS may reach out to third parties, such as your employer or financial institutions, to gather additional information about your income or expenses. If you receive notices or calls from these parties regarding the IRS’s request, it likely indicates an ongoing audit.

It’s important to remain calm and follow the instructions provided by the IRS if you suspect that you are being audited. Maintaining clear and organized records and seeking guidance from a tax professional can help you navigate the audit process effectively.

Steps to Verify if the IRS is Auditing You

If you suspect that you may be under audit by the IRS, it’s essential to take proactive steps to verify whether an audit is indeed taking place. Here are some steps you can take to confirm if the IRS is auditing you:

- Check your mail: The IRS typically initiates an audit by sending a notice or letter to the taxpayer. Regularly check your mail for any communication from the IRS, especially letters with an official logo or “CP” followed by a series of numbers. These letters often provide instructions on how to respond to the audit.

- Review your tax return: Carefully go through your tax return to identify any potential red flags or areas that may attract scrutiny from the IRS. Look for inconsistencies, excessive deductions, or inaccuracies in reporting income. This can help you understand why the IRS may have selected your return for an audit.

- Access your online tax account: If you have an online account with the IRS, log in to check for any notifications or messages related to your tax return. The account may provide information about the status of your return and whether an audit is in progress.

- Contact the IRS: If you have not received any correspondence from the IRS but still suspect an audit, you can contact the IRS directly to inquire about the status of your return. Call their toll-free number or use the “Where’s My Refund?” tool on the IRS website to check if there are any updates or flags on your return.

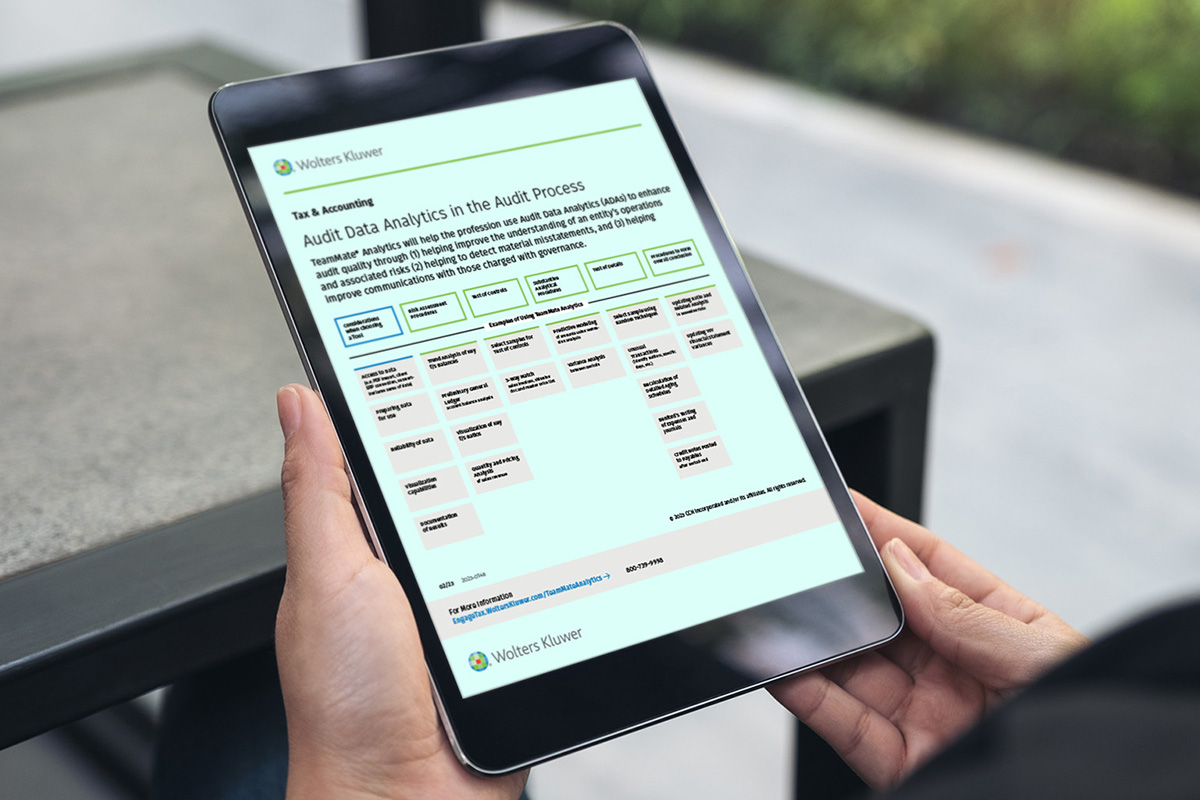

- Engage a tax professional: If you are still unsure or need assistance navigating the audit process, it’s advisable to seek guidance from a tax professional. They can review your situation, analyze your tax return, and communicate with the IRS on your behalf to verify if an audit is underway.

It’s important to remember that the above steps are meant to help you verify if the IRS is auditing you, but they do not guarantee an audit. The IRS selects tax returns for audits based on various factors, and sometimes, suspicions of an audit may turn out to be unfounded. However, by taking these steps, you can gain clarity on the status of your return and prepare accordingly for any potential audit.

What to Do if You Are Being Audited by the IRS

Being audited by the IRS can be a stressful experience, but it’s important to approach the situation calmly and responsively. Here are the steps to follow if you find yourself being audited:

- Read the audit notice: Carefully review the audit notice or letter from the IRS. It will provide details about the scope of the audit, the specific items being examined, and any documentation or information they require from you.

- Gather necessary documentation: Compile all the requested documents, such as receipts, bank statements, invoices, and any other supporting records related to the items being audited. Make sure to organize them in a clear and logical manner for easy reference.

- Understand the timeframe: Take note of the deadline specified in the audit notice for submitting the requested information. It’s crucial to meet these deadlines to avoid further complications or penalties from the IRS.

- Seek professional assistance: Consider working with a qualified tax professional, such as a certified public accountant (CPA) or tax attorney, who has experience dealing with IRS audits. They can help you navigate the process, interpret any complex tax laws, and represent you during communications with the IRS.

- Respond to the audit: Prepare a well-organized and detailed response to the IRS audit. Include any relevant explanations, supporting documentation, or legal arguments that can substantiate your position and resolve any concerns raised by the IRS.

- Be cooperative and professional: Maintain a professional and cooperative attitude when interacting with the IRS. Respond promptly to their requests, provide the requested information accurately, and avoid confrontational or uncooperative behavior. This can help facilitate the audit process and potentially lead to a more favorable outcome.

- Review the audit findings: Once the audit is completed, carefully review the IRS’s findings, including any proposed adjustments or additional taxes owed. If you disagree with the findings, you have the right to challenge them through an appeals process within the IRS or through the court system, if necessary.

- Learn from the audit: Use the audit experience as an opportunity to strengthen your tax compliance efforts. Review your record-keeping practices, ensure accurate reporting, and consult with a tax professional to understand any areas of improvement or potential compliance issues.

Remember, an IRS audit does not automatically imply wrongdoing. It is a process to verify the accuracy of your tax return. By following these steps and seeking professional assistance as needed, you can effectively navigate the audit process and ensure a fair resolution.

Conclusion

Dealing with the possibility of an IRS audit can be daunting, but understanding the process and knowing how to respond can help alleviate some of the stress. By familiarizing yourself with the signs of an audit, the common triggers, and the steps to verify if you are being audited, you can take proactive measures to address any potential issues and ensure compliance with tax laws.

If you find yourself being audited, it is crucial to remain calm and take the necessary steps to respond to the IRS’s requests promptly and accurately. Seeking professional assistance from a tax professional can provide valuable guidance and support throughout the audit process, increasing your chances of a favorable outcome.

Remember, an audit does not necessarily indicate wrongdoing, and it is an opportunity to demonstrate the accuracy of your tax return. By complying with the IRS’s requests, providing well-documented explanations and supporting documentation, and maintaining a professional demeanor, you can navigate the audit process with confidence.

Lastly, use the audit experience as a learning opportunity. Review your record-keeping practices, ensure accurate reporting of income and expenses, and consult with a tax professional to identify any areas of improvement. By staying proactive and staying informed, you can minimize the risk of future audits and maintain compliance with tax laws.

Ultimately, understanding the audit process, knowing your rights, and seeking professional guidance when necessary will empower you to navigate an IRS audit successfully and resolve any issues that may arise.