Finance

What Is IRS Treas 310 Tax Ref?

Published: November 1, 2023

Learn what IRS Treas 310 Tax Ref is and how it impacts your finances. Find out how to handle this tax refund and maximize your financial benefits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding IRS Treas 310 Tax Ref

- What Does “IRS Treas 310” Mean?

- How Does IRS Treas 310 Tax Ref Work?

- Reasons for Receiving IRS Treas 310 Tax Ref

- Common Scenarios for Receiving IRS Treas 310 Tax Ref

- How to Identify IRS Treas 310 Tax Ref Deposits

- How to Verify and Track IRS Treas 310 Tax Ref Payments

- What to Do if You Receive an IRS Treas 310 Tax Ref Deposit Mistakenly

- Conclusion

Introduction

Welcome to the world of taxes and refunds! If you have recently come across the term “IRS Treas 310 Tax Ref,” you may be wondering what it means and why it appears on your bank statement. In this article, we will delve into the intricacies of IRS Treas 310 Tax Ref and shed light on its significance.

Handling finances and understanding the various codes and acronyms associated with taxes can be a daunting task. However, by gaining knowledge about IRS Treas 310 Tax Ref, you can demystify this code and understand its implications for your financial situation.

Whether you are a taxpayer eagerly awaiting your refund or you simply want to understand the intricacies of the tax system, this article will provide you with the information you need to navigate the world of IRS Treas 310 Tax Ref.

So, let’s dive in and shed some light on what IRS Treas 310 Tax Ref really means and how it affects you.

Understanding IRS Treas 310 Tax Ref

Before we delve into the specifics, let’s first understand the meaning behind “IRS Treas 310 Tax Ref.” This code refers to the Internal Revenue Service (IRS) Treasury 310 Tax Refund. When you see this code on your bank statement, it indicates that you have received a tax refund from the IRS.

The term “Treasury 310” represents the ACH (Automated Clearing House) credit method used by the IRS to deposit tax refunds directly into taxpayers’ bank accounts. ACH is a secure and convenient way for the IRS to distribute refunds, ensuring timely and accurate transfers.

Receiving a tax refund is a cause for celebration, as it means that you have overpaid your taxes throughout the year, and now the IRS is returning the excess amount to you. The IRS Treas 310 Tax Ref deposit is an indication that the IRS has processed your tax return and approved your refund.

It’s important to note that the IRS Treas 310 Tax Ref deposit can only occur if you have filed your tax return and claimed a refund. If you owe money to the IRS, you will not receive this type of deposit.

Now that we have a basic understanding of what IRS Treas 310 Tax Ref means, let’s explore how this process works and the reasons behind receiving a tax refund.

What Does “IRS Treas 310” Mean?

The code “IRS Treas 310” is used by the Internal Revenue Service (IRS) to indicate that a tax refund has been issued. It stands for the Treasury 310 code, which is the ACH credit method used by the IRS for direct deposit of tax refunds.

The “IRS Treas 310” code is a standard way for the IRS to communicate with financial institutions, ensuring that the correct transactions are recorded and properly identified. When you see this code on your bank statement, it means that the IRS has processed your tax return and approved your refund amount.

The Treasury 310 code is part of the electronic funds transfer process, allowing the IRS to deposit refunds directly into taxpayers’ bank accounts. This method is faster and more efficient compared to issuing paper checks, ensuring that taxpayers receive their refunds promptly.

It’s important to note that the “IRS Treas 310” code does not provide any specific details about the amount or reason for the refund. It simply indicates that a refund has been issued and deposited into your bank account.

If you have any questions regarding the amount or eligibility of your refund, it’s recommended to contact the IRS directly or consult with a tax professional for further assistance.

Now that we understand the meaning behind “IRS Treas 310,” let’s explore how the IRS Treas 310 Tax Refund process works and the various reasons for receiving a tax refund.

How Does IRS Treas 310 Tax Ref Work?

The IRS Treas 310 Tax Ref process is a streamlined way for the Internal Revenue Service (IRS) to distribute tax refunds electronically to taxpayers. Here’s an overview of how it works:

- Filing Your Tax Return: As a taxpayer, you are required to file your annual tax return with the IRS, reporting your income, deductions, and credits for the year.

- Processing Your Tax Return: Once you have submitted your tax return, the IRS reviews and processes it to determine the accuracy of the information provided. They verify your income, deductions, and credits to calculate the amount of refund you are eligible for.

- Approval of Refund: If the IRS determines that you are entitled to a refund, they will approve the amount and initiate the IRS Treas 310 Tax Ref process.

- Direct Deposit: Instead of issuing a paper check, the IRS uses the Automated Clearing House (ACH) credit method to directly deposit the refund into your bank account. The ACH process ensures secure and accurate transfer of funds.

- Notification on Bank Statement: Once the IRS has deposited your tax refund, it will be reflected on your bank statement with the code “IRS Treas 310.” This code indicates that the deposit is a tax refund issued by the IRS.

- Accessing Your Refund: You can access your tax refund by logging into your bank account or using your bank’s mobile app. The funds will be available for you to use, whether you want to pay bills, save, or make purchases.

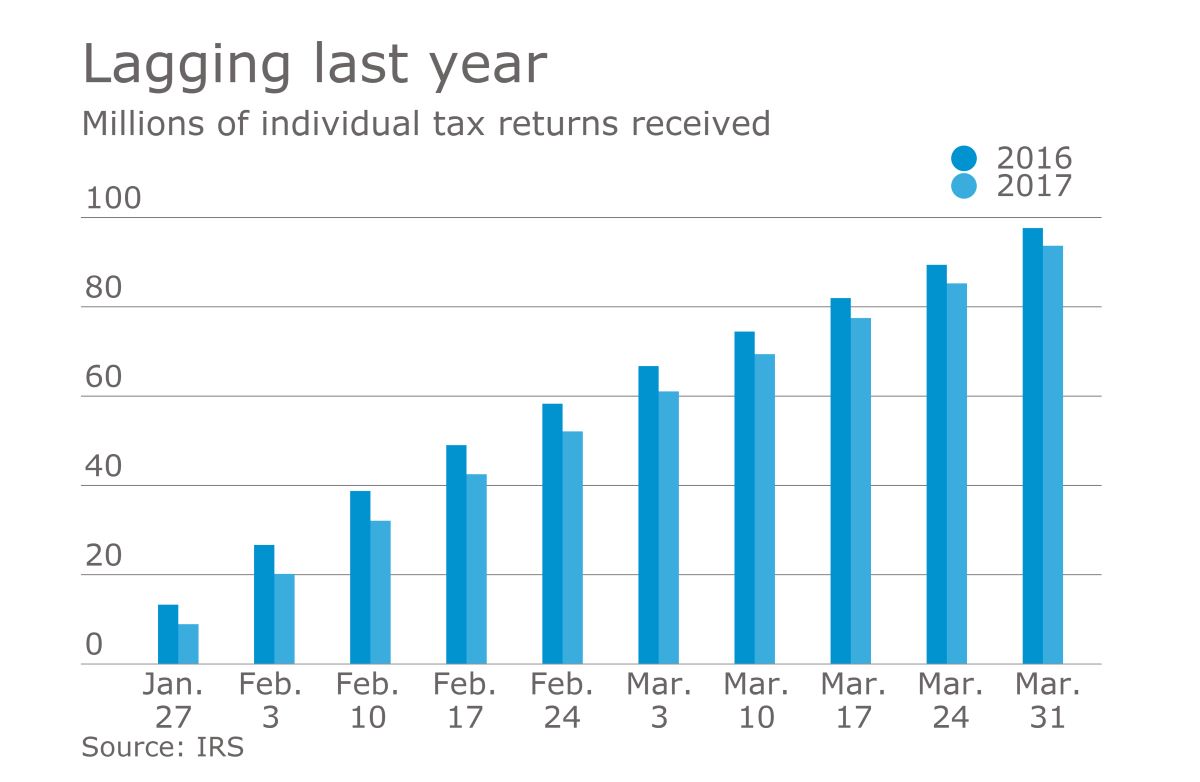

It’s important to note that the processing time for tax refunds can vary. While the IRS aims to issue refunds within 21 days of receiving a tax return, certain factors, such as the complexity of the return or inconsistencies in the information provided, may cause delays.

Now that we have explored how the IRS Treas 310 Tax Ref process works, let’s dive into the reasons for receiving a tax refund.

Reasons for Receiving IRS Treas 310 Tax Ref

Receiving a tax refund marked as IRS Treas 310 Tax Ref on your bank statement can be a pleasant surprise. It means that you have overpaid your taxes throughout the year and the IRS is returning the excess amount to you. Here are some common reasons for receiving a tax refund:

- Excess Withholding: If you are an employee, your employer deducts income taxes from your paycheck based on the information provided on your Form W-4. If you had more taxes withheld than necessary, you may be eligible for a refund.

- Tax Credits: Tax credits are deductions that directly reduce your tax liability. If you qualify for certain credits, such as the Child Tax Credit or the Earned Income Tax Credit, they can result in a refund if the credits exceed the amount of taxes owed.

- Overpaid Estimated Taxes: If you are self-employed or have income not subject to withholding, you may be required to make estimated tax payments throughout the year. If you overpay these estimated taxes, you may be eligible for a refund.

- Amended Returns: If you discovered errors on a previously filed tax return and filed an amended return to correct them, you could receive a refund for any overpaid taxes.

- Tax Treaty Benefits: Non-resident aliens and foreign nationals may be eligible for tax treaty benefits that reduce their U.S. tax liability. If you overpaid taxes due to incorrect withholding or tax treaty eligibility, a refund may be issued.

It’s important to note that the exact amount of your refund will depend on various factors, including your income, deductions, and eligibility for tax credits. To ensure the accuracy of your tax return and maximize your refund, consider consulting with a tax professional or using tax preparation software.

Now that we understand some of the reasons for receiving an IRS Treas 310 Tax Ref deposit, let’s explore common scenarios in which you may encounter this code on your bank statement.

Common Scenarios for Receiving IRS Treas 310 Tax Ref

When you come across the code “IRS Treas 310 Tax Ref” on your bank statement, it typically indicates that you have received a tax refund from the Internal Revenue Service (IRS). Here are some common scenarios in which you may encounter this code:

- Overpaid Taxes: If you have paid more in taxes throughout the year than what you owed, you are likely to receive a tax refund. This often happens when the amount of tax withheld from your paycheck exceeds your actual tax liability.

- Claiming Tax Deductions: When you itemize deductions on your tax return, such as mortgage interest, state and local taxes, or medical expenses, it can lower your taxable income. This may result in a higher refund compared to taking the standard deduction.

- Tax Credits: Eligibility for certain tax credits, such as the Child Tax Credit or the American Opportunity Credit, can significantly reduce your tax liability or even result in a refund if the credit exceeds your tax owed.

- Education Expenses: If you are a student or a parent paying for higher education, you may qualify for education-related tax benefits, such as the Lifetime Learning Credit or the Tuition and Fees Deduction. These can lead to a tax refund.

- Self-Employment and Business Deductions: Self-employed individuals and small business owners can claim deductions for business expenses, such as office supplies, mileage, or equipment purchases. These deductions can lower their taxable income and potentially result in a refund.

- Tax Treaty Benefits: Non-resident aliens or foreign nationals who qualify for tax treaty benefits may be eligible for a refund of overpaid taxes due to incorrect withholding or treaty provisions.

It’s important to note that while these scenarios commonly lead to tax refunds, individual circumstances can vary. The specific details of your tax situation will determine the amount of your refund.

If you have questions about your refund or believe there may be an error, it’s recommended to contact the IRS or consult with a tax professional for guidance and clarification.

Now that we have explored common scenarios for receiving an IRS Treas 310 Tax Ref deposit, let’s learn how to identify these deposits on your bank statement.

How to Identify IRS Treas 310 Tax Ref Deposits

Identifying IRS Treas 310 Tax Ref deposits on your bank statement is essential to ensure that you recognize and access your tax refund. Here are some key steps to help you identify these deposits:

- Review Your Bank Statement: Regularly check your bank statement to look for any deposits labeled as “IRS Treas 310” or similar variations. These labels typically indicate tax refunds issued by the Internal Revenue Service.

- Check the Deposit Amount: The deposit labeled as IRS Treas 310 Tax Ref should match the amount you are expecting from your tax refund. Ensure that the deposited amount aligns with the refund amount listed in your tax return or tax preparation software.

- Confirm the Date of Deposit: Take note of the deposit date on your bank statement to verify if it aligns with the expected timeframe for receiving your tax refund. The IRS aims to process and issue refunds within 21 days of receiving a tax return.

- Consider the Timing: If you recently filed your tax return and the deposit matches the expected refund amount, it is likely that the IRS Treas 310 Tax Ref deposit is your tax refund. However, if you have not filed a tax return or were not expecting a refund, further investigation may be necessary.

- Double-Check the Description: Along with the IRS Treas 310 code, the bank statement may provide additional information about the deposit. Look for descriptions such as “Tax Ref,” “IRS Refund,” or any other reference that confirms it is a tax refund.

- Monitor Multiple Deposits: In certain cases, the IRS may split a tax refund into multiple deposits when there are different refund amounts or if the refund is being shared between multiple individuals. Look for a pattern of multiple deposits labeled as IRS Treas 310 on your bank statement.

By following these steps and confirming the deposit details, you can ensure that the IRS Treas 310 Tax Ref deposit reflects your tax refund. If you have any concerns or discrepancies, it is advisable to reach out to the IRS or seek guidance from a tax professional.

Now that you know how to identify IRS Treas 310 Tax Ref deposits, let’s move on to the next section to learn how to verify and track these tax refund payments.

How to Verify and Track IRS Treas 310 Tax Ref Payments

Once you have identified an IRS Treas 310 Tax Ref deposit on your bank statement, it’s important to verify and keep track of the payment to ensure it aligns with your tax refund. Here are some steps to help you verify and track your IRS Treas 310 Tax Ref payment:

- Confirm the Deposit Amount: Compare the deposit amount to the expected refund amount from your tax return or tax preparation software. Ensure that the deposited amount matches what you were anticipating.

- Check the Payment Date: Confirm that the deposit date on your bank statement aligns with the expected timeframe provided by the IRS for issuing tax refunds.

- Review Your Tax Return: Refer back to your filed tax return to ensure there are no discrepancies or errors in the information provided. Check that your income, deductions, and credits were accurately reported.

- Utilize IRS Resources: Use online tools provided by the IRS, such as the “Where’s My Refund?” tool on the IRS website or the IRS2Go mobile app. These resources allow you to track the status of your tax refund using your Social Security Number, filing status, and the anticipated refund amount.

- Contact the IRS: If you have concerns or questions about your tax refund, you can reach out directly to the IRS. Their customer service helpline can provide assistance and verify the status of your refund. Be prepared to provide your Social Security Number and tax filing information.

- Retain Documentation: It’s advisable to keep copies of your filed tax return, bank statements, and any correspondence with the IRS regarding your tax refund. These documents can serve as evidence and help resolve any discrepancies that may arise.

Tracking and verifying your IRS Treas 310 Tax Ref payment is crucial to ensure that you receive the correct refund amount. If you have any doubts, discrepancies, or concerns, it is recommended to contact the IRS directly or consult with a tax professional for guidance and clarification.

Now that you know how to verify and track your IRS Treas 310 Tax Ref payments, let’s explore what to do if you receive a tax refund deposit mistakenly.

What to Do if You Receive an IRS Treas 310 Tax Ref Deposit Mistakenly

Discovering an IRS Treas 310 Tax Ref deposit in your bank account can be surprising, especially if you were not expecting a tax refund. If you believe that you have received a tax refund deposit mistakenly, here are the steps you should take:

- Don’t Spend the Money: It’s important not to use or spend the funds immediately if you suspect that the IRS Treas 310 Tax Ref deposit was made in error. Keep the money aside until you have resolved the situation.

- Verify the Deposit: Review your filed tax return and double-check any correspondence or notifications from the IRS regarding your refund status. Make sure there were no errors or discrepancies in the information provided on your return.

- Contact the IRS: Reach out to the IRS directly to report the issue and explain that you received a tax refund deposit mistakenly. Contact their customer service helpline and provide them with your Social Security Number and any other relevant information to assist their investigation.

- Follow IRS Instructions: The IRS will provide guidance on returning the funds. They may ask you to send a check or money order for the amount received, or provide instructions for returning the money via electronic transfer.

- Document Communication: Keep a record of all communication with the IRS, including dates, reference numbers, and the names of the representatives you speak with. This documentation can be useful for any future inquiries or disputes.

- Cooperate Fully: Cooperate fully with the IRS during their investigation and follow their instructions for returning the funds promptly. Failure to return a mistaken tax refund can result in penalties or legal consequences.

It’s crucial to handle a mistaken IRS Treas 310 Tax Ref deposit promptly and in accordance with IRS instructions. Returning the funds will help resolve the situation and prevent any potential issues with the IRS in the future.

If you have any concerns or need further clarification, it’s recommended to consult with a tax professional who can provide guidance specific to your situation and advise you on the best course of action.

Now that you know what to do if you receive an IRS Treas 310 Tax Ref deposit mistakenly, let’s conclude our discussion.

Conclusion

Understanding IRS Treas 310 Tax Ref is essential for taxpayers to navigate the complex world of tax refunds. This code represents the Treasury 310 ACH credit method used by the IRS to directly deposit tax refunds into taxpayers’ bank accounts.

In this article, we have explored the meaning behind IRS Treas 310 Tax Ref and how it signifies the issuance of a tax refund. We discussed common reasons for receiving a tax refund, such as excess withholding, tax credits, and overpaid estimated taxes.

We also explored how IRS Treas 310 Tax Ref payments work, highlighting the steps involved in filing a tax return, the approval process, and the direct deposit method used by the IRS to expedite refunds.

Additionally, we provided guidance on how to identify and verify IRS Treas 310 Tax Ref deposits on your bank statement, as well as how to track the status of your tax refund using IRS resources.

If you ever find yourself in a situation where you receive an IRS Treas 310 Tax Ref deposit mistakenly, we outlined the necessary steps to take, including contacting the IRS, returning the funds, and documenting all communication.

Remember, staying informed about your tax obligations and understanding the intricacies of IRS Treas 310 Tax Ref is crucial for managing your finances and ensuring compliance with tax regulations.

If you have specific questions or concerns about your tax refund or any other tax-related matters, it’s always recommended to consult with a qualified tax professional or reach out to the IRS directly for assistance.

We hope that this article has provided valuable insights into IRS Treas 310 Tax Ref and empowered you to navigate the world of tax refunds with confidence.