Home>Finance>How Much Does An Echocardiogram Cost With Insurance?

Finance

How Much Does An Echocardiogram Cost With Insurance?

Published: November 15, 2023

Find out how much an echocardiogram costs with insurance coverage. Get financial information and compare prices to ensure you're getting the best deal.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is an Echocardiogram?

- Understanding Health Insurance Coverage

- Factors that Influence Echocardiogram Costs with Insurance

- Average Cost of an Echocardiogram with Insurance Coverage

- Types of Health Insurance Plans and their Coverage

- Deductibles, Copayments, and Coinsurance

- In-Network vs. Out-of-Network Providers

- Seeking Pre-authorization for an Echocardiogram

- Tips for Reducing Echocardiogram Costs with Insurance

- Conclusion

Introduction

When it comes to managing your health, it’s crucial to stay informed about the costs associated with medical procedures. If you have been advised by your healthcare provider to undergo an echocardiogram, you might be wondering about the potential expenses involved. An echocardiogram is a diagnostic test that uses sound waves to produce real-time images of your heart. It is a valuable tool for assessing heart health and identifying any abnormalities or conditions.

However, the cost of an echocardiogram can vary depending on several factors, such as your location, the healthcare facility you visit, and most importantly, your health insurance coverage. Understanding the financial implications of undergoing this procedure can assist you in making informed decisions about your healthcare.

In this article, we will examine how health insurance coverage impacts the cost of an echocardiogram. We will explore the various factors that influence the overall expenses and provide insights into managing and reducing these costs.

By gaining a deeper understanding of the intricacies of health insurance coverage and the different variables that affect echocardiogram costs, you can be better prepared to navigate the financial aspects of your healthcare journey. Let’s dive in and explore the world of echocardiogram expenses and health insurance coverage.

What is an Echocardiogram?

An echocardiogram, also known as an echo, is a non-invasive diagnostic test that uses ultrasound technology to produce detailed images of the heart. It provides valuable information about the structure and function of the heart, helping healthcare providers diagnose and monitor various heart conditions and diseases.

During an echocardiogram, a technician places a small handheld device called a transducer on your chest, which emits high-frequency sound waves. These sound waves bounce off the structures in your heart and create images that can be viewed on a monitor. The technician can analyze these images to assess the heart’s size, shape, and motion, as well as evaluate its valves and chambers.

There are several types of echocardiograms, each serving a different purpose:

- Transthoracic Echocardiogram (TTE): This is the most common type of echocardiogram. It involves placing the transducer on the chest wall to obtain images of the heart.

- Transesophageal Echocardiogram (TEE): In this procedure, the transducer is passed through the esophagus to obtain more detailed images of the heart. TEE is often used when a TTE doesn’t provide sufficient information or when a closer view of the heart is necessary.

- Stress Echocardiogram: This test combines an echocardiogram with physical exercise or medication to evaluate how the heart performs under stress. It helps identify any abnormalities in blood flow to the heart muscle, such as those caused by coronary artery disease.

Echocardiograms are frequently performed to diagnose and monitor various heart conditions, including heart valve abnormalities, heart muscle abnormalities, heart defects, blood clots, and fluid buildup around the heart.

Overall, echocardiograms are safe, painless, and non-invasive procedures that provide essential information to healthcare providers, aiding in the accurate diagnosis and treatment of heart-related issues.

Understanding Health Insurance Coverage

Health insurance coverage plays a significant role in determining the out-of-pocket costs associated with an echocardiogram. It is essential to have a clear understanding of your health insurance policy to anticipate and manage these expenses effectively.

Health insurance policies typically cover a portion of the cost of healthcare services, including diagnostic tests like echocardiograms. However, the extent of coverage can vary based on the specific details of your insurance plan. Here are a few key concepts to consider when understanding health insurance coverage:

- Premium: This is the amount you pay each month to maintain your health insurance coverage. Premiums can vary depending on factors such as your age, location, and the type of plan you have.

- Deductible: The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. For example, if your deductible is $1,000, you are responsible for paying the first $1,000 of your healthcare expenses before your insurance starts covering a portion of the costs.

- Copayment: A copayment, or copay, is a fixed amount you pay for a specific healthcare service or medication. For example, your health insurance plan may require you to pay a $20 copay for an echocardiogram. This is in addition to any deductible or coinsurance you may owe.

- Coinsurance: Coinsurance is a percentage of the total cost of a healthcare service that you are responsible for paying. For instance, if your coinsurance is 20% and the total cost of the echocardiogram is $1,000, you would be responsible for paying $200, while your insurance would cover the remaining $800.

- In-Network vs. Out-of-Network Providers: Insurance plans often have a network of preferred healthcare providers. In-network providers have negotiated contracted rates with the insurance company, which usually results in lower costs for insured patients. Out-of-network providers, on the other hand, may have higher costs or may not be covered by your insurance at all.

- Pre-authorization: Some health insurance plans require pre-authorization for certain procedures, including echocardiograms. This means that you need to obtain approval from your insurance company before undergoing the test to ensure coverage.

It’s essential to review your health insurance policy documents or contact your insurance provider directly to understand the specific details of your coverage. This will help you estimate your out-of-pocket costs for an echocardiogram and make informed decisions about your healthcare.

Factors that Influence Echocardiogram Costs with Insurance

The cost of an echocardiogram with insurance coverage can vary due to several factors. Understanding these factors can help you anticipate the potential expenses associated with the procedure. Here are some key factors that can influence the cost of an echocardiogram with insurance:

- Type of Insurance Plan: Different insurance plans have varying levels of coverage and benefits. Some plans may cover a higher percentage of the cost, while others may require a larger out-of-pocket contribution from your end.

- Healthcare Provider: The choice of healthcare provider can significantly impact the cost of an echocardiogram. In-network providers, who have contracts with your insurance company, tend to have lower negotiated rates. Choosing an out-of-network provider may result in higher costs or limited coverage.

- Geographical Location: Echocardiogram costs can also vary based on your geographical location. Healthcare costs, including diagnostic procedures, can differ significantly between regions or even within the same city.

- Health Insurance Plan Deductible: If you have not met your health insurance plan’s deductible for the year, you may be responsible for paying the full cost of the echocardiogram until the deductible is fulfilled. Once your deductible is met, your insurance coverage will kick in and potentially cover a portion of the cost.

- Coinsurance and Copayments: Even after meeting your deductible, you may still be responsible for coinsurance or copayments. Coinsurance is a percentage of the procedure cost that you must pay, while copayments are fixed amounts for specific services.

- Plan Coverage Limitations: Some insurance plans may have specific limitations or exclusions when it comes to covering certain diagnostic tests or procedures. It’s essential to review your policy documents or contact your insurance provider to understand any such limitations.

- Pre-authorization Requirements: Your insurance plan may require pre-authorization for an echocardiogram. Failing to obtain pre-authorization before the procedure may result in reduced or denied coverage.

- Additional Testing or Services: In some cases, additional testing or services may be required during an echocardiogram. These can include contrast agents, stress testing, or specialized measurements. These additional services may incur extra costs depending on your insurance coverage.

It’s important to keep in mind that the cost of an echocardiogram can vary based on your specific insurance plan and the factors mentioned above. Reviewing your plan documents and discussing the expected costs with your healthcare provider and insurance company can help you plan and budget accordingly.

Average Cost of an Echocardiogram with Insurance Coverage

The average cost of an echocardiogram with insurance coverage can vary widely depending on several factors, including your insurance plan, location, and the specific healthcare provider you visit. However, it’s important to note that insurance coverage typically reduces the overall cost for patients.

On average, the cost of an echocardiogram with insurance coverage can range from $200 to $2,500. The actual cost will depend on various factors, such as your insurance plan’s negotiated rates with healthcare providers and the specific details of your coverage.

It’s worth mentioning that insurance coverage typically reduces the burden on the patient by covering a significant portion of the cost. However, patients may still be responsible for paying deductibles, coinsurance, copayments, or any amount exceeding the coverage limit set by their insurance plan.

Keep in mind that the cost of an echocardiogram can vary depending on whether you are visiting an in-network or out-of-network healthcare provider. In-network providers have negotiated rates with the insurance company, resulting in potentially lower costs for insured patients. Out-of-network providers, on the other hand, may have higher rates or may not be covered at all by your insurance plan.

It’s important to contact your insurance provider and inquire about the specific details of your coverage for an echocardiogram. You can also reach out to the healthcare facility or provider directly to obtain an estimate of the cost before undergoing the procedure. By understanding the potential out-of-pocket expenses, you can better plan for the financial aspect of your healthcare journey.

Remember that costs can vary significantly, and it’s crucial to review your insurance policy and consult with your healthcare provider for accurate and up-to-date information regarding the cost of an echocardiogram with your specific insurance coverage.

Types of Health Insurance Plans and their Coverage

Health insurance plans come in various types, each with its own coverage and benefits. Understanding these different plan types can help you determine how your insurance will cover the cost of an echocardiogram. Here are some common types of health insurance plans and their coverage:

- Health Maintenance Organization (HMO): HMO plans typically require you to select a primary care physician (PCP) within the network. You must obtain referrals from your PCP to see specialists, including cardiologists for an echocardiogram. HMO plans often have lower monthly premiums and require less paperwork, but they have stricter provider networks.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing healthcare providers. You can see specialists, including cardiologists, without requiring a referral. PPO plans generally have larger networks, but may come with higher monthly premiums compared to HMO plans.

- Point of Service (POS): POS plans combine features of HMO and PPO plans. Like an HMO, you choose a PCP within the network, but you have the flexibility to see out-of-network providers at a higher cost. POS plans typically require a referral to see specialists.

- Exclusive Provider Organization (EPO): EPO plans are similar to HMO plans but without requiring a PCP referral to see specialists. However, like an HMO, seeing out-of-network providers may not be covered, except for emergencies.

- High Deductible Health Plan (HDHP) with Health Savings Account (HSA): HDHPs have higher deductibles and lower premiums. They are often paired with an HSA, which allows you to save pre-tax dollars to cover healthcare expenses. The cost of an echocardiogram will go towards meeting your HDHP deductible before insurance coverage kicks in.

It’s important to review your insurance plan documents or contact your insurance provider to understand the specific details of your coverage. This includes understanding the copayments, coinsurance, and deductibles associated with an echocardiogram. Additionally, familiarize yourself with your plan’s network of healthcare providers to ensure you receive the maximum coverage and minimize out-of-pocket expenses.

By understanding the different types of health insurance plans and their coverage, you can better navigate the intricacies of insurance coverage for an echocardiogram and make informed decisions about your healthcare.

Deductibles, Copayments, and Coinsurance

When it comes to health insurance coverage, it’s important to understand the concepts of deductibles, copayments, and coinsurance. These factors can significantly influence the cost of an echocardiogram and how much you will be responsible for paying out of pocket. Let’s take a closer look at each of these terms:

- Deductibles: A deductible is the amount you must pay out of pocket before your insurance coverage begins. For example, if you have a $1,000 deductible, you will need to pay the first $1,000 of your healthcare expenses before your insurance company starts to contribute. It’s crucial to note that some insurance plans may have separate deductibles for different services or procedures, so it’s important to understand how your specific plan applies deductibles to an echocardiogram.

- Copayments: A copayment, or copay, is a fixed amount you are required to pay for a specific healthcare service. For example, your insurance plan might require a $20 copay for an echocardiogram. Copayments are typically due at the time of service and do not count toward meeting your deductible. It’s essential to review your insurance plan documents to understand the copayment amount for an echocardiogram.

- Coinsurance: Coinsurance is the percentage of the total cost of a healthcare service that you are responsible for paying. Unlike copayments, which are flat fees, coinsurance is a percentage-based payment. For example, if your insurance plan has a 20% coinsurance for an echocardiogram and the total cost is $1,000, you would be responsible for paying $200 (20% of $1,000), while your insurance would cover the remaining $800.

It’s important to note that deductibles, copayments, and coinsurance may all apply to the cost of an echocardiogram. The specific amounts will depend on your health insurance plan and the details of your coverage. It’s valuable to understand these terms and review your insurance policy documents or contact your insurance provider to gain clarity on how deductibles, copayments, and coinsurance will impact the cost of an echocardiogram.

By familiarizing yourself with these terms, you can better estimate your out-of-pocket expenses for an echocardiogram and plan your budget accordingly. Additionally, discussing these details with your healthcare provider and insurance company can help you make informed decisions about your healthcare while managing your costs effectively.

In-Network vs. Out-of-Network Providers

When considering the cost of an echocardiogram with insurance, it is important to understand the difference between in-network and out-of-network providers. The choice of provider can significantly impact the overall cost and coverage provided by your insurance plan.

In-Network Providers: In-network providers are healthcare professionals, facilities, and hospitals that have agreed to provide services at pre-negotiated rates with your insurance company. These providers have established contracts with your insurance plan, which often results in lower costs for insured individuals.

When you choose an in-network provider for your echocardiogram, you are more likely to receive the maximum coverage offered by your insurance plan. This typically means that your out-of-pocket expenses, such as deductibles, copayments, and coinsurance, would be lower compared to using an out-of-network provider.

Out-of-Network Providers: Out-of-network providers do not have contracts with your insurance company. Choosing an out-of-network provider for an echocardiogram can lead to higher costs and potentially limited coverage from your insurance plan. In some cases, your insurance company may not cover the cost of services provided by out-of-network providers at all.

It is crucial to consult your insurance provider and review your health insurance policy to understand the coverage and costs associated with using out-of-network providers. While out-of-network providers may offer certain advantages or specialized services, it is important to weigh those benefits against the potential financial burden.

Keep in mind that some insurance plans may have exceptions for out-of-network providers in emergency situations or if specific healthcare services are unavailable within the network. However, it is always advisable to contact your insurance provider before seeking services from an out-of-network provider to understand the coverage and potential additional costs.

By choosing in-network providers for your echocardiogram, you can ensure maximum coverage and minimize your out-of-pocket expenses. If you have a preferred healthcare provider in mind, it is recommended to verify their network status with your insurance company to ensure the best coverage and cost management for your echocardiogram.

Seeking Pre-authorization for an Echocardiogram

Pre-authorization is an important step to take when planning to undergo an echocardiogram, especially if you have health insurance coverage. Pre-authorization is the process of obtaining approval from your insurance company before receiving a specific healthcare service, such as an echocardiogram.

Many health insurance plans require pre-authorization for certain procedures to ensure that they are medically necessary and meet the criteria for coverage. Failing to obtain pre-authorization when required can result in reduced or denied coverage, leaving you responsible for the entire cost of the echocardiogram.

To seek pre-authorization for an echocardiogram, follow these steps:

- Contact Your Insurance Provider: Reach out to your insurance company, either by phone or through their online portal, to inquire about their pre-authorization process for an echocardiogram.

- Gather Necessary Information: Your insurance provider may require certain information when seeking pre-authorization. This might include the reason for the test, your healthcare provider’s name and contact information, and any relevant medical history and documentation.

- Healthcare Provider Assistance: Your healthcare provider, such as a cardiologist or primary care physician, can also assist you in obtaining pre-authorization. They can provide the necessary documentation and support your request by explaining the medical necessity of the echocardiogram.

- Submit the Request: Follow your insurance provider’s instructions for submitting the pre-authorization request. This can typically be done online, through a mobile app, or by faxing the necessary documents.

- Follow Up: After submitting the pre-authorization request, it is essential to follow up with your insurance company to ensure that it has been processed and approved. Keep track of any reference numbers or confirmation documents provided by your insurance company.

By seeking pre-authorization for an echocardiogram, you can ensure that the test is deemed medically necessary by your insurance company and that you will receive the maximum coverage available under your plan. It is important to note that each insurance company may have different pre-authorization requirements, so it is crucial to contact your specific insurance provider for guidance.

Remember that pre-authorization does not guarantee full coverage, and you may still be responsible for deductibles, copayments, or coinsurance. Review your insurance plan documents or contact your insurance provider to understand the out-of-pocket expenses you can expect even after pre-authorization.

By following the pre-authorization process and understanding your insurance coverage, you can navigate the financial aspect of your echocardiogram more efficiently and avoid potential coverage issues.

Tips for Reducing Echocardiogram Costs with Insurance

While health insurance coverage plays a crucial role in reducing echocardiogram costs, there are additional steps you can take to further minimize your out-of-pocket expenses. Here are some tips to help reduce echocardiogram costs with insurance:

- Choose In-Network Providers: Visit healthcare providers, including cardiologists and imaging centers, that are considered in-network by your insurance plan. In-network providers have negotiated rates with your insurance company, resulting in lower costs for you.

- Verify Coverage: Before scheduling an echocardiogram, contact your insurance provider to verify coverage for the procedure. Confirm that the specific echocardiogram type and any additional services or tests will be covered under your plan.

- Seek Pre-Authorization: As discussed, obtaining pre-authorization from your insurance company is crucial. Make sure to follow the pre-authorization process and provide all necessary information to ensure maximum coverage.

- Compare Prices: Shop around and compare prices for echocardiograms at different healthcare facilities. While quality of service should be a priority, comparing prices can help you find more affordable options within your insurance network.

- Utilize Preventive Care: Take advantage of preventive care benefits offered by your insurance plan. Some plans cover preventive screenings, including echocardiograms, at no or reduced cost. Ensure you are aware of any eligibility criteria or frequency limitations.

- Consider Diagnostic Centers: Look for diagnostic centers or imaging facilities that specialize in cardiac testing. These centers often offer echocardiograms at competitive prices, and their focus on cardiac diagnostics may result in more accurate and comprehensive results.

- Negotiate Billing: In some cases, healthcare providers may be willing to negotiate the cost of an echocardiogram, particularly if you are paying out-of-pocket or have a high deductible. It never hurts to ask if there is any flexibility in pricing or if the provider can offer a payment plan.

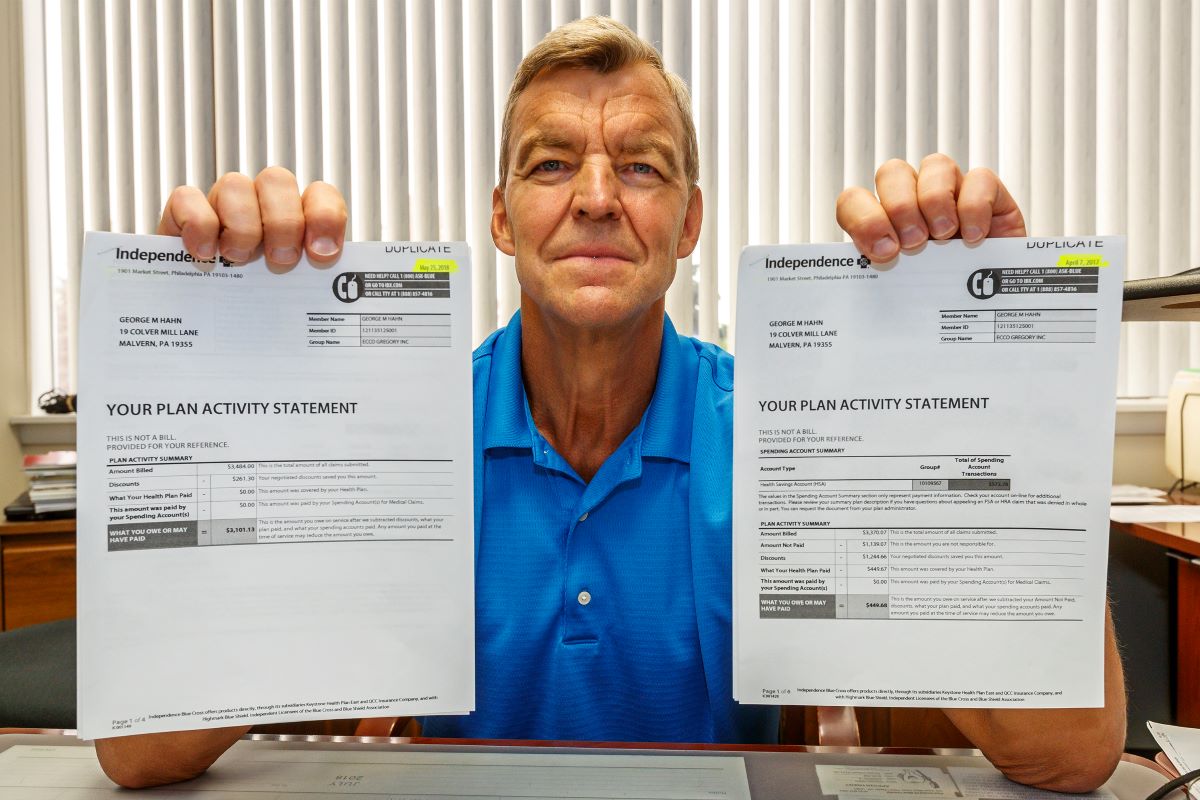

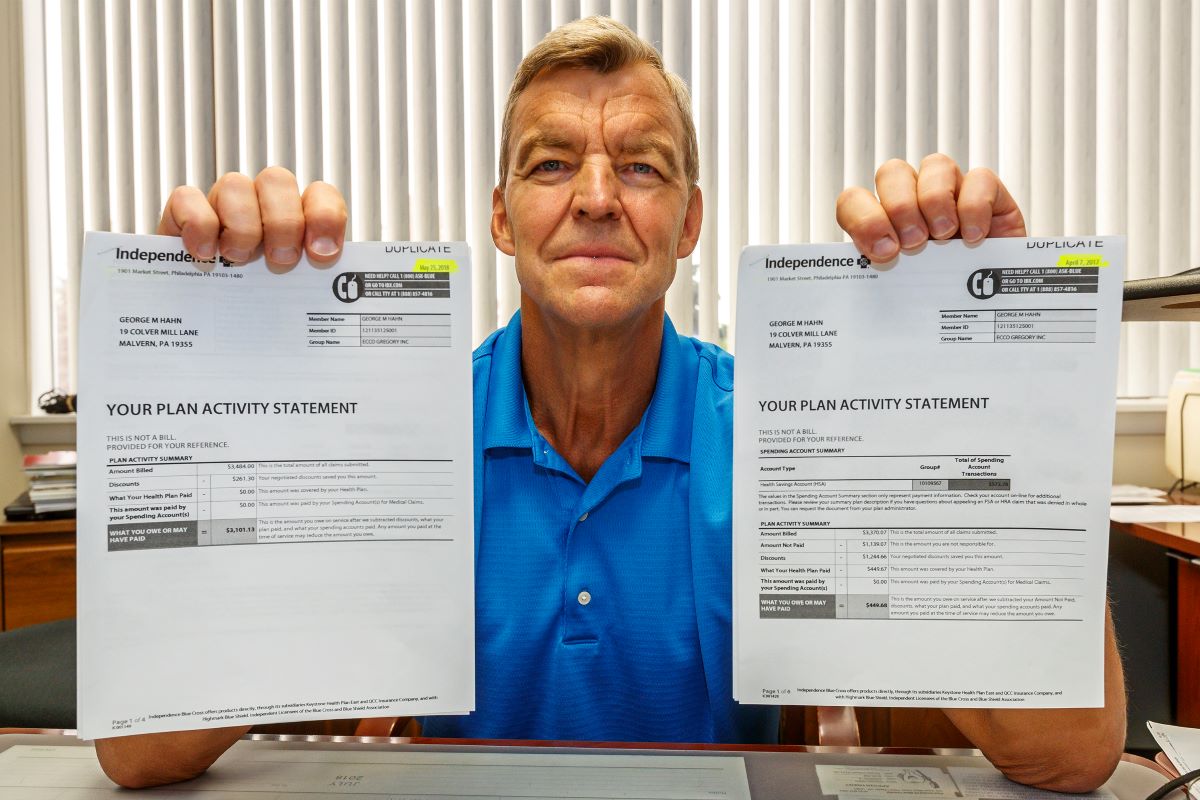

- Review Your Explanation of Benefits (EOB): Carefully review the EOB statements you receive from your insurance company after the echocardiogram. Ensure that the costs and coverage are accurately reflected. If you notice any discrepancies, contact your insurance company for clarification.

- Utilize Flexible Spending Accounts (FSA) or Health Savings Accounts (HSA): If available, contribute to an FSA or HSA to save pre-tax dollars for eligible medical expenses. Using these funds to pay for your echocardiogram can provide additional savings.

- Consult a Healthcare Advocate: If you find navigating the insurance process challenging, consider consulting a healthcare advocate who can help you understand your insurance coverage, negotiate bills, and guide you through the echocardiogram process.

By implementing these tips, you can proactively manage and reduce echocardiogram costs with your insurance coverage. It’s important to stay informed, ask questions, and take advantage of resources and strategies that can help mitigate the financial burden.

Remember to review your insurance plan documents, consult with your insurance provider, and stay in communication with your healthcare provider to ensure you are making the most cost-effective decisions regarding your echocardiogram.

Conclusion

Understanding the cost of an echocardiogram with insurance coverage is crucial for managing your healthcare expenses effectively. By familiarizing yourself with the factors that influence echocardiogram costs and how insurance coverage functions, you can make informed decisions and minimize out-of-pocket expenses.

Throughout this article, we explored various aspects of echocardiogram costs with insurance coverage, including the definition and importance of echocardiograms, understanding health insurance coverage, factors that influence costs, types of insurance plans, deductibles, copayments, and coinsurance. We also discussed the significance of seeking pre-authorization for an echocardiogram and provided tips for reducing costs.

Remember that each insurance plan is unique, and it is crucial to review your policy documents and consult with your insurance provider for accurate and up-to-date information regarding coverage for an echocardiogram. Keep in mind the distinction between in-network and out-of-network providers, and take advantage of preventive care benefits offered by your insurance plan whenever possible.

By comparing prices, negotiating billing, and utilizing flexible spending accounts or health savings accounts, you can further minimize the costs associated with an echocardiogram. It is essential to stay proactive, ask questions, and seek assistance from healthcare advocates or your insurance provider if needed.

Ultimately, understanding the financial aspects of an echocardiogram can help you plan and budget for this important cardiac diagnostic test. By making informed decisions and exploring cost-saving strategies, you can focus on maintaining your heart health without undue financial burdens.