Finance

How To Find Liquidity In Forex

Published: February 23, 2024

Learn how to find liquidity in the forex market and improve your trading strategies. Discover essential tips and techniques to enhance your finance skills.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the exciting world of forex trading! If you are new to this dynamic market or looking to enhance your trading strategies, understanding liquidity in forex is crucial. Liquidity plays a pivotal role in the forex market, impacting the ease of executing trades and influencing price movements. In this article, we will delve into the concept of liquidity in forex, explore the factors that influence it, and provide valuable tips for finding liquidity in your forex trading endeavors.

The forex market is renowned for its unparalleled liquidity, offering traders the opportunity to enter and exit positions with ease. However, navigating this vast market requires a comprehensive understanding of liquidity and its implications. Whether you are a novice trader or a seasoned investor, mastering the art of identifying and leveraging liquidity can significantly improve your trading outcomes.

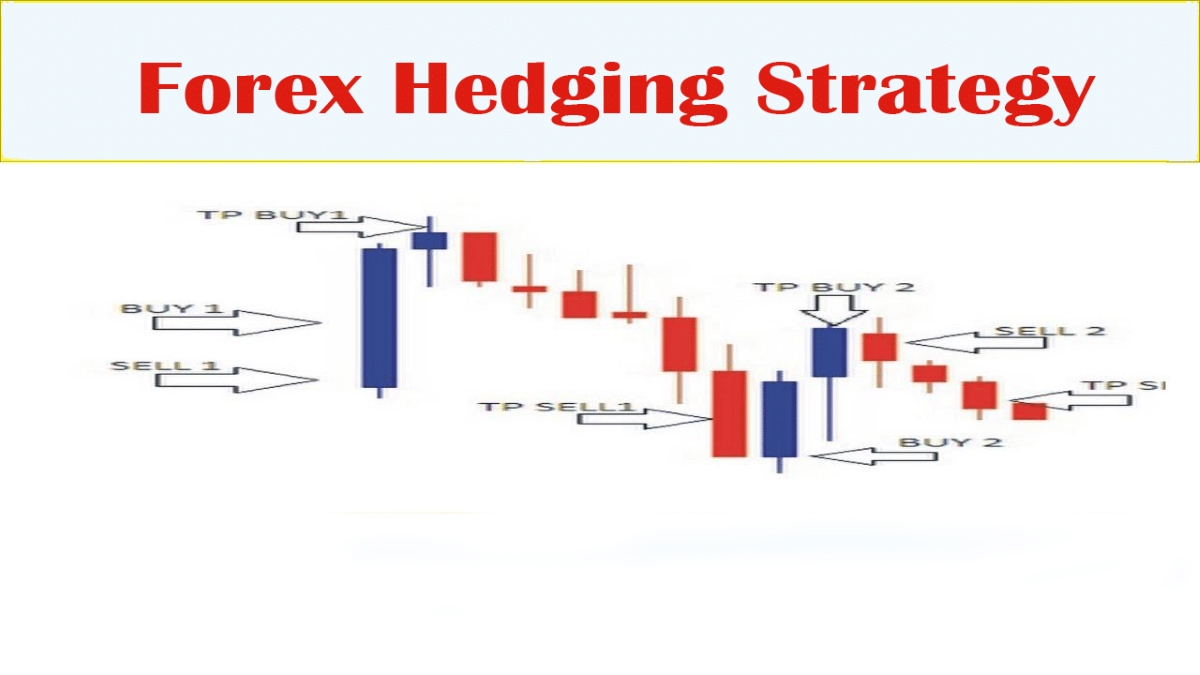

Liquidity, in the context of forex trading, refers to the market's ability to facilitate the swift and seamless execution of buy and sell orders without causing substantial price fluctuations. A highly liquid market allows traders to enter and exit positions at the desired price levels, minimizing the risk of slippage and enhancing overall trading efficiency. On the other hand, low liquidity can lead to wider spreads, increased price volatility, and challenges in executing trades, particularly in large volumes.

In the following sections, we will explore the intricacies of liquidity in forex, shedding light on the factors that influence it and providing actionable tips for identifying and capitalizing on liquidity in your trading activities. Whether you are aiming to capitalize on short-term price movements or seeking to execute large transactions with minimal market impact, understanding and harnessing liquidity is essential for achieving your trading objectives.

So, let's embark on this enlightening journey into the realm of liquidity in forex, equipping you with the knowledge and insights to navigate the market with confidence and precision. Whether you aspire to refine your trading skills or gain a deeper understanding of market dynamics, the exploration of liquidity in forex is sure to elevate your trading acumen and empower you to make informed, strategic decisions in the dynamic world of currency trading.

Understanding Liquidity in Forex

Liquidity is a cornerstone of the forex market, defining the ease with which currencies can be bought or sold without causing significant price fluctuations. In essence, it represents the depth and efficiency of the market, influencing the speed and cost of executing trades. Understanding liquidity in forex entails grasping the interplay of various market participants, the impact of trading volumes, and the dynamics of bid-ask spreads.

At the core of forex liquidity are the diverse participants engaging in currency transactions. These include central banks, financial institutions, corporations, hedge funds, individual traders, and other market makers. The collective actions of these participants contribute to the constant flow of buy and sell orders, thereby shaping the liquidity landscape. High participation levels generally lead to heightened liquidity, fostering an environment conducive to swift trade execution and competitive pricing.

Trading volumes play a pivotal role in determining liquidity levels in the forex market. Higher trading volumes typically indicate greater market activity and depth, resulting in improved liquidity. Major currency pairs such as EUR/USD, USD/JPY, and GBP/USD often exhibit the highest liquidity due to their widespread popularity and substantial trading volumes. Conversely, exotic currency pairs may experience lower liquidity, potentially leading to wider spreads and increased price volatility.

Bid-ask spreads, the difference between the buying (bid) and selling (ask) prices of a currency pair, offer valuable insights into market liquidity. In highly liquid markets, narrow spreads prevail, reflecting the abundance of buy and sell orders and the efficient matching of trades. Conversely, low liquidity scenarios may give rise to wider spreads, as market participants demand a premium for executing trades in a less liquid environment.

By comprehending the multifaceted nature of liquidity in forex, traders can make informed decisions regarding trade execution, risk management, and overall trading strategies. Whether gauging the optimal timing for entering the market, assessing the potential impact of news events on liquidity, or identifying currency pairs with favorable liquidity conditions, a nuanced understanding of liquidity empowers traders to navigate the forex market with confidence and acumen.

Factors Affecting Liquidity in Forex

Several key factors exert a profound influence on the liquidity dynamics of the forex market, shaping the accessibility and efficiency of trading activities. Understanding these factors is essential for traders seeking to navigate the market with precision and capitalize on favorable liquidity conditions.

- Market Hours: The forex market operates 24 hours a day, five days a week, across different time zones. Liquidity varies throughout the trading day, with peak activity occurring during overlapping trading sessions, such as the London-New York overlap. Traders should be mindful of these peak hours to capitalize on heightened liquidity and tighter spreads.

- Economic Indicators and News Releases: Major economic announcements, such as non-farm payroll data, GDP reports, and central bank decisions, can significantly impact market liquidity. Volatile market conditions often accompany the release of such indicators, influencing trading volumes and liquidity levels.

- Market Sentiment and Risk Appetite: Investor sentiment and risk preferences play a pivotal role in shaping forex market liquidity. During periods of heightened risk aversion, liquidity may diminish as market participants exhibit a tendency to avoid riskier assets, impacting trading volumes and price dynamics.

- Political Events and Geopolitical Risks: Political developments, geopolitical tensions, and unexpected events can trigger fluctuations in liquidity levels. Uncertainty stemming from geopolitical factors may lead to erratic market behavior and liquidity disruptions, warranting a cautious approach from traders.

- Market Depth and Participant Activity: The depth of the market, characterized by the volume and diversity of market participants, influences liquidity. Deeper markets, with a broad spectrum of active participants, tend to exhibit higher liquidity, fostering an environment conducive to efficient trade execution.

By recognizing and analyzing these influential factors, traders can adapt their trading strategies to align with prevailing liquidity conditions, optimize trade execution, and mitigate the impact of liquidity-related challenges. Moreover, staying attuned to the interplay of these factors enables traders to anticipate potential shifts in liquidity and make well-informed decisions in response to evolving market dynamics.

Tips for Finding Liquidity in Forex Trading

Efficiently navigating the forex market entails adeptly identifying and leveraging liquidity to optimize trade execution and minimize trading costs. Implementing the following tips can empower traders to harness favorable liquidity conditions and enhance their overall trading experience.

- Focus on Major Currency Pairs: Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, typically exhibit higher liquidity due to their widespread popularity and substantial trading volumes. Concentrating on these pairs can enhance trade execution efficiency and reduce the risk of encountering wide spreads and slippage.

- Stay Informed About Market Hours: Being cognizant of peak trading hours and overlapping sessions can enable traders to capitalize on heightened liquidity and tighter spreads. By aligning trading activities with periods of increased market activity, traders can optimize trade execution and potentially benefit from more favorable pricing.

- Monitor Economic Events: Major economic releases and central bank announcements can significantly impact market liquidity. Staying informed about scheduled economic events and their potential influence on liquidity levels empowers traders to adapt their strategies and risk management approaches accordingly.

- Utilize Limit Orders: Implementing limit orders allows traders to specify their desired entry and exit points in advance. By utilizing limit orders, traders can seek to execute trades at predefined price levels, potentially mitigating the impact of fluctuating liquidity and minimizing the risk of slippage.

- Assess Market Sentiment: Understanding prevailing market sentiment and risk appetite can aid traders in gauging potential shifts in liquidity. During periods of heightened risk aversion, liquidity may diminish, prompting traders to exercise caution and adjust their trading approach to align with evolving market conditions.

- Stay Attuned to Geopolitical Developments: Geopolitical events and unexpected political developments can influence market liquidity. By staying abreast of geopolitical risks and their potential impact on liquidity, traders can adapt their risk management strategies and trade execution tactics to navigate potential disruptions effectively.

By incorporating these tips into their trading approach, traders can proactively engage with liquidity dynamics, optimize trade execution efficiency, and mitigate the impact of liquidity-related challenges. Navigating the forex market with a keen awareness of liquidity empowers traders to make informed decisions, capitalize on favorable market conditions, and cultivate a more rewarding trading experience.

Conclusion

Embarking on a journey through the realm of liquidity in forex has unveiled the pivotal role of liquidity in shaping the dynamics of the currency market. From understanding the multifaceted nature of liquidity to recognizing the influential factors and leveraging actionable tips, traders are equipped with the knowledge and insights to navigate the forex market with acumen and precision.

Liquidity, as the lifeblood of the forex market, underpins the efficiency of trade execution, the cost of trading, and the overall market accessibility. By comprehending the interplay of market participants, trading volumes, and bid-ask spreads, traders can adeptly assess and capitalize on liquidity conditions, optimizing their trading strategies and decision-making processes.

As traders venture into the world of forex, the significance of liquidity becomes abundantly clear, guiding the timing of trades, risk management strategies, and the selection of currency pairs. By focusing on major currency pairs, staying attuned to market hours, monitoring economic events, and utilizing advanced order types, traders can harness liquidity to their advantage, enhancing trade execution efficiency and minimizing the impact of liquidity-related challenges.

Armed with a nuanced understanding of liquidity, traders are poised to navigate the ebb and flow of the forex market with confidence and astuteness. By integrating the insights gleaned from this exploration of liquidity in forex, traders can cultivate a more informed and strategic approach to their trading activities, positioning themselves to capitalize on favorable market conditions and achieve their trading objectives.

Ultimately, the journey into the realm of liquidity in forex serves as a cornerstone of traders’ quest for proficiency and success in the dynamic and ever-evolving currency market. By embracing the nuances of liquidity and leveraging its implications, traders embark on a transformative path, enriching their trading acumen and fostering a more rewarding and fulfilling trading experience in the vast and captivating world of forex.