Home>Finance>What Is Involved When A Life Insurance Policy Is Backdated?

Finance

What Is Involved When A Life Insurance Policy Is Backdated?

Modified: February 21, 2024

Learn about the process and implications of backdating a life insurance policy in the field of finance. Understand the intricacies and considerations involved.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Backdated Life Insurance Policy

- Reasons for Backdating a Life Insurance Policy

- Process of Backdating a Life Insurance Policy

- Implications of Backdating a Life Insurance Policy

- Benefits and Risks of Backdating a Life Insurance Policy

- Considerations Before Backdating a Life Insurance Policy

- Conclusion

Introduction

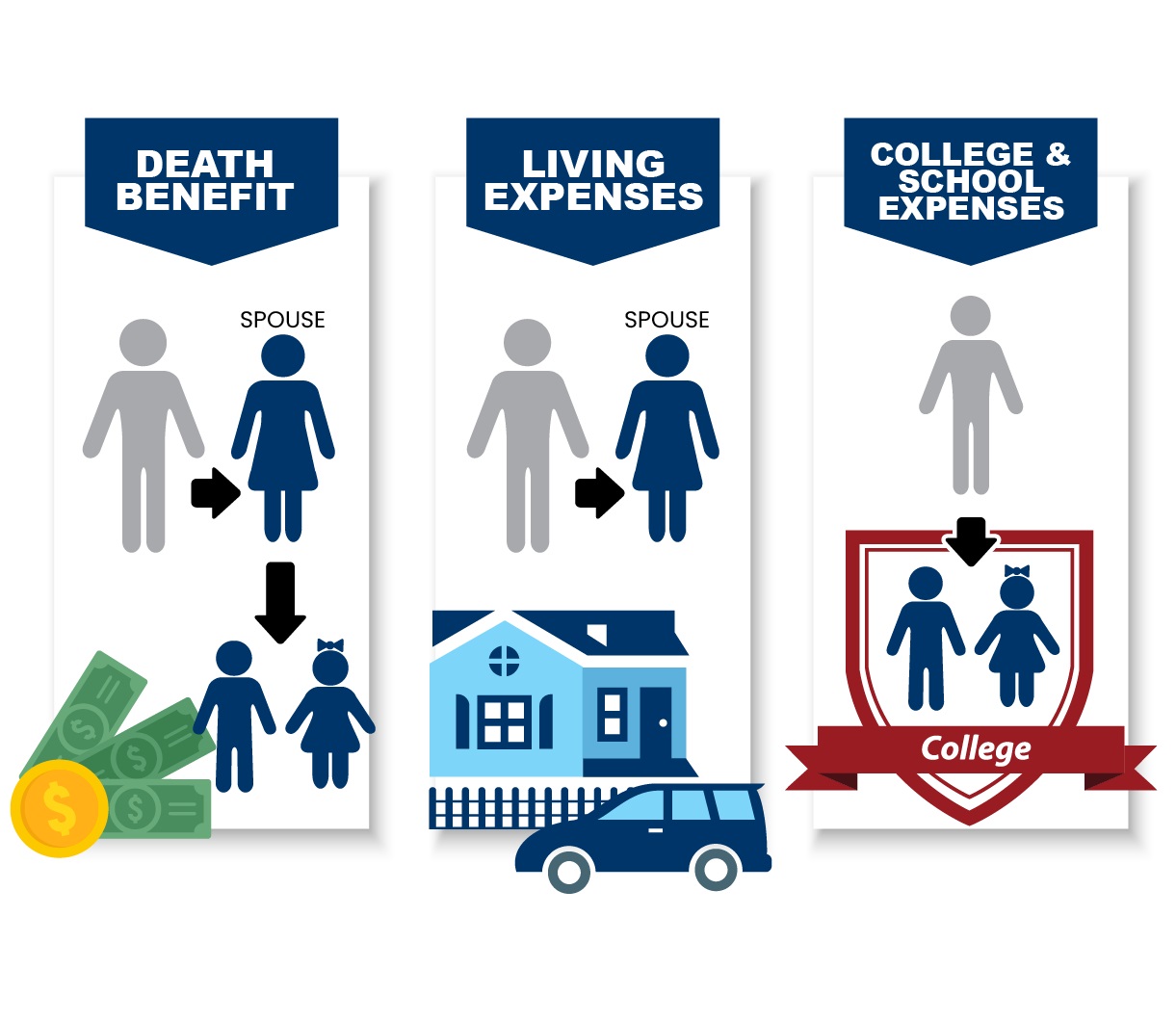

Life insurance is a crucial financial tool that provides protection and financial security for you and your loved ones. It ensures that your family’s financial needs are met in the event of your untimely demise. Typically, a life insurance policy is issued with a start date that coincides with the date of application and payment. However, in some cases, individuals may choose to backdate their policy for various reasons.

A backdated life insurance policy is one that has an effective start date that precedes the date of application and payment. This means that the coverage begins on a date earlier than when the policyholder actually applied for it. While this practice may seem unusual, it is legally permissible and can offer certain advantages, though with potential risks.

In this article, we will explore the concept of backdating a life insurance policy, the reasons why individuals may choose to do so, and the process involved. We will also delve into the implications, benefits, and risks associated with backdating, as well as important considerations to keep in mind before deciding to backdate a life insurance policy.

It is important to note that backdating a life insurance policy should be done with careful consideration, consultation with an insurance professional, and an understanding of the potential implications. Let’s dive in and learn more about this practice and its impact on life insurance coverage.

Definition of a Backdated Life Insurance Policy

A backdated life insurance policy refers to a policy that has its effective start date set to a date that precedes the actual date of application and payment. In other words, it allows individuals to secure coverage that begins in the past, providing the policyholder with the advantage of retroactive coverage.

This practice is typically used when individuals want to secure life insurance coverage based on their health and age at a previous point in time. By backdating the policy, they can potentially obtain lower premium rates based on a younger age and better health status, which can result in significant cost savings over the life of the policy.

For example, suppose a person wants to purchase a life insurance policy but has recently been diagnosed with a medical condition. By backdating the policy to a date before the diagnosis, the insurance company assesses the premium based on the person’s health status at that earlier point in time, potentially resulting in a more favorable rate.

It is important to note that backdating a life insurance policy should not be confused with changing the premium payment date. Backdating specifically refers to altering the policy’s start date, while changing the premium payment date simply adjusts the timing of when the premiums are due.

Backdating a life insurance policy requires the consent of both the policyholder and the insurance company. It is crucial to follow the guidelines and regulations set by the insurance provider and state laws to ensure compliance and legitimacy.

Now that we understand what a backdated life insurance policy entails, let’s explore the reasons why individuals might choose to backdate their policies.

Reasons for Backdating a Life Insurance Policy

There are several reasons why individuals may choose to backdate a life insurance policy. These reasons can vary based on personal circumstances and financial goals. Here are some common motivations for backdating a policy:

- Health considerations: Backdating allows individuals to secure coverage based on their health status at a previous point in time. If an individual’s health has deteriorated since the desired effective date, backdating can help them obtain coverage at a more favorable premium rate.

- Age advantages: Age is a key factor in determining life insurance premiums. By backdating a policy, individuals can secure coverage based on their age at a younger point in time, potentially resulting in lower premium rates.

- Financial planning: Backdating a policy can align with an individual’s financial planning goals. For example, if someone wants to establish coverage for estate planning purposes or to protect business interests, backdating can help ensure that the policy covers a specific period of time.

- Retroactive coverage: Backdating can provide retroactive coverage, which means that the policyholder is protected from the chosen effective date. This can be especially beneficial if the individual had a specific event or circumstance in mind when selecting the backdated start date.

- Cost savings: One of the main incentives for backdating a policy is the potential cost savings. By securing coverage at a lower premium rate, policyholders can save money over the duration of the policy.

It is important to note that while backdating may offer advantages, it is essential for individuals to consider the potential risks and implications associated with this practice. The process of backdating a life insurance policy will be discussed in the next section.

Now that we have explored the reasons why individuals may choose to backdate a life insurance policy, let’s delve into the process involved in backdating a policy.

Process of Backdating a Life Insurance Policy

The process of backdating a life insurance policy involves several steps and requires the cooperation and agreement of both the policyholder and the insurance company. Here is an overview of the typical process:

- Consultation: The policyholder initiates a discussion with their insurance agent or company to express their interest in backdating the policy. During this consultation, they will determine whether backdating is a viable option based on their specific circumstances.

- Underwriting: Once the decision to backdate the policy is made, the insurance company will assess the individual’s insurability based on their health, lifestyle, and other relevant factors. This may involve a medical examination, as well as a review of the individual’s medical records and personal history.

- Approval and documentation: If the insurance company determines that the individual meets the underwriting criteria, they will provide approval for the backdating. The policyholder will then need to sign the necessary paperwork, which includes a written agreement specifying the backdated start date and any associated terms and conditions.

- Premium calculation: The insurance company will calculate the premiums based on the backdated start date, taking into account the individual’s age and health status at that time. The premiums may be adjusted to reflect the retroactive coverage period.

- Premium payment: The policyholder will be required to pay the initial premium amount, as well as any outstanding premiums for the retroactive coverage period. The payment can usually be made in a lump sum or through a payment plan, depending on the insurance company’s policies.

- Effective coverage: Once the required premium payment is received and processed, the policy will become effective with the selected backdated start date. The policyholder will be covered from that date onwards, and their beneficiaries will be eligible to receive the death benefit in the event of their passing.

It is important to note that the specific process may vary depending on the insurance company and the individual’s circumstances. Consulting with an experienced insurance professional is crucial to navigate the backdating process effectively and ensure compliance with all legal and regulatory requirements.

Now that we understand the process of backdating a life insurance policy, let’s explore the implications of this practice.

Implications of Backdating a Life Insurance Policy

Backdating a life insurance policy can have several implications for both the policyholder and the insurance company. It is important to understand these implications before deciding to backdate a policy. Here are some key considerations:

- Cost of coverage: Backdating a policy can result in lower premium rates based on a younger age and better health status. This can lead to cost savings over the life of the policy. However, it is crucial to carefully calculate the overall cost of the coverage, taking into account any additional premiums for the retroactive period.

- Underwriting assessment: When backdating a policy, the insurance company will assess the individual’s insurability based on their health and other factors at the selected backdated start date. This means that any changes in health, lifestyle, or other relevant factors since that date may not be taken into consideration.

- Limitations on coverage: Backdating a policy may impose certain limitations on the coverage. For example, the policy may have exclusions for specific pre-existing conditions that were present at the selected backdated start date. It is crucial to carefully review the policy terms and conditions to understand any limitations or restrictions that may apply.

- Policy term duration: Backdating a policy affects the duration of coverage. The policyholder must consider how the selected backdated start date aligns with their financial goals and the desired duration of coverage. It may be necessary to adjust the backdated start date to ensure that the policy provides the desired protection for the intended period of time.

- Legal and regulatory compliance: Backdating a life insurance policy must be done in accordance with the guidelines and regulations set by the insurance company and state laws. Failure to comply with legal and regulatory requirements may lead to the policy being deemed invalid or the denial of claims.

Understanding the implications of backdating a life insurance policy is crucial to make an informed decision. It is recommended to consult with an insurance professional who can provide guidance based on your specific circumstances and financial goals.

Now, let’s explore the potential benefits and risks associated with backdating a life insurance policy.

Benefits and Risks of Backdating a Life Insurance Policy

Backdating a life insurance policy can offer both benefits and risks. It is important to carefully consider these factors before deciding whether to backdate your policy. Here are some potential benefits and risks associated with backdating:

Benefits:

- Cost savings: By backdating the policy, individuals may secure coverage at a younger age and better health status, potentially resulting in lower premium rates. This can lead to significant cost savings over the duration of the policy.

- Obtaining coverage based on past health: Backdating allows individuals to secure coverage based on their health status at a previous point in time. This can be advantageous if their health has deteriorated since the desired effective date, as the policy will be issued based on their better health at that earlier period.

- Retrospective coverage: Backdating a policy provides retroactive coverage, meaning the policyholder is protected from the selected backdated start date. This can be beneficial if there was a specific event or circumstance in mind when choosing the backdated date.

- Estate planning: Backdating can align with estate planning goals by ensuring coverage for a specific period of time. It can be useful for individuals who want their life insurance policy to provide financial protection for their beneficiaries during key stages of their estate plan.

Risks:

- Underwriting limitations: Backdating a policy means that the insurance company assesses the individual’s insurability based on their health and other factors at the selected backdated start date. This means any changes in health since that date may not be taken into account, potentially resulting in limitations on coverage.

- Exclusions for pre-existing conditions: Backdating may lead to exclusions for pre-existing conditions that were present at the selected backdated start date. It is important to carefully review the policy terms to understand any limitations or restrictions that may apply.

- Potential for higher premiums: While backdating can result in cost savings, it is important to consider any additional premiums for the retroactive coverage period. These premiums can increase the overall cost of the policy.

- Compliance and legality: Backdating a life insurance policy must be done in compliance with the guidelines and regulations set by the insurance company and state laws. Failure to comply may lead to the policy being considered invalid or claims being denied.

It is crucial to weigh the potential benefits against the risks when considering whether to backdate a life insurance policy. Consulting with an insurance professional who specializes in life insurance can provide valuable guidance based on your specific circumstances and financial goals.

Now, let’s explore the important considerations to keep in mind before deciding to backdate a life insurance policy.

Considerations Before Backdating a Life Insurance Policy

Backdating a life insurance policy is a decision that requires careful consideration and evaluation of various factors. Before proceeding with backdating, it’s important to keep the following considerations in mind:

- Cost-benefit analysis: Evaluate the potential cost savings versus any additional premiums for the retroactive coverage period. Consider whether the overall financial benefits outweigh the costs and fit within your budget.

- Health status: Assess your current health status and any changes that have occurred since the selected backdated start date. If your health has significantly deteriorated, backdating may not provide the desired advantages in terms of lower premium rates.

- Policy duration: Determine the desired duration of coverage and ensure that the selected backdated start date aligns with your financial goals. Adjust the start date if necessary to ensure that the policy provides the intended protection for the desired period of time.

- Policy terms and restrictions: Carefully review the policy terms and conditions, especially regarding exclusions for pre-existing conditions and any limitations on coverage based on the backdated start date. It’s crucial to fully understand the implications of these terms before proceeding.

- Compliance: Ensure that the process of backdating a policy is conducted in compliance with the guidelines and regulations set by the insurance company and state laws. Non-compliance can lead to complications, including the policy being considered invalid or denial of claims.

- Consultation with an insurance professional: Seek the advice of an experienced insurance professional who specializes in life insurance. They can provide personalized guidance based on your specific circumstances and help you navigate the backdating process effectively.

Taking these considerations into account will help you make an informed decision about whether to backdate your life insurance policy. Remember that backdating should only be pursued after carefully evaluating the potential benefits and risks, and consulting with a trusted insurance professional.

Now, let’s summarize the key points discussed in this article.

Conclusion

Backdating a life insurance policy can be a strategic option for individuals looking to secure coverage based on their health and age at a previous point in time. It offers the potential for cost savings, retroactive coverage, and alignment with specific financial planning goals. However, it is essential to carefully consider the implications, benefits, and risks associated with backdating before making a decision.

When contemplating backdating, it is important to evaluate the potential cost savings versus any additional premiums for the retroactive coverage period. This analysis should take into account your current health status and any changes that have occurred since the selected backdated start date. Additionally, consider the desired duration of coverage, reviewing policy terms and restrictions, and ensuring compliance with legal and regulatory requirements.

Consulting with an insurance professional who specializes in life insurance is highly recommended. They can assess your unique circumstances, provide personalized guidance, and navigate the backdating process effectively.

Ultimately, the decision to backdate a life insurance policy should be based on thoughtful consideration and understanding of the potential benefits and risks. By making an informed choice and working with professionals, individuals can ensure that their life insurance coverage aligns with their needs and financial goals.

Remember, life insurance is a crucial financial tool that provides peace of mind and financial security for you and your loved ones. Whether you choose to backdate your policy or not, the most important thing is to have adequate coverage in place to protect your family’s future.