Finance

How Much Does Insurance Pay For Braces

Published: November 22, 2023

Looking for financial assistance for braces? Discover how much insurance typically covers for orthodontic treatment and explore financing options.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Braces and Orthodontic Treatment

- Costs of Braces

- Insurance Coverage for Braces

- Types of Insurance Plans

- Determining Coverage for Braces

- Average Insurance Coverage for Braces

- Factors that Affect Insurance Coverage

- Out-of-Pocket Expenses for Braces

- Tips for Maximizing Insurance Coverage

- Conclusion

Introduction

Braces are a common orthodontic treatment used to correct misaligned teeth, improve bite alignment, and achieve a straighter smile. However, the cost of braces can be a significant financial burden for many individuals and families. This is where insurance coverage for braces can play a crucial role in easing the financial strain.

In this article, we will explore the topic of insurance coverage for braces, delving into the different types of insurance plans available and the factors that determine coverage. We will also discuss the average insurance coverage for braces and provide tips on how to maximize your insurance benefits, ultimately helping you make informed decisions about financing your orthodontic treatment.

Understanding the costs associated with braces is essential in planning for your orthodontic treatment. The cost of braces can vary depending on factors such as the complexity of the case, the type of braces selected, and even the geographical location of the dental practice. It is not uncommon for braces to cost several thousand dollars.

Insurance coverage for braces can assist in alleviating some of the financial burden. However, it’s important to note that not all insurance plans cover orthodontic treatment, and those that do may have specific limitations and requirements. That’s why it’s crucial to understand the different types of insurance plans and how they determine coverage for braces.

Determining the coverage for braces can be a complex process, as various factors come into play. Insurance plans typically consider the age of the patient, as orthodontic treatment is commonly covered for children and adolescents, but may have limited coverage for adults. The severity of the malocclusion or orthodontic issue may also be a determining factor in coverage.

In addition to insurance coverage, there are out-of-pocket expenses to consider when getting braces. These expenses can include initial consultations, X-rays, retainers, and adjustments. Understanding these costs and planning accordingly can help you manage your financial obligations effectively.

Maximizing your insurance coverage for braces is crucial in minimizing your out-of-pocket expenses. This can be achieved by researching different insurance plan options and understanding the specific coverage details. Furthermore, partnering with an experienced orthodontist who is familiar with insurance processes and can help navigate the claims can ensure you maximize your benefits.

By gaining a comprehensive understanding of insurance coverage for braces and implementing strategies to optimize your benefits, you can make orthodontic treatment more affordable and accessible. So, let’s delve deeper into the world of insurance coverage for braces and learn how you can make the most of your insurance benefits.

Understanding Braces and Orthodontic Treatment

Braces are a common orthodontic treatment used to correct dental misalignment and create a straighter smile. Orthodontic treatment goes beyond cosmetic improvements, as proper teeth alignment can also improve overall oral health and function.

Orthodontic treatment involves the use of dental devices, commonly known as braces, to gradually move the teeth into their desired positions. Braces consist of brackets that are bonded to the teeth and connected by archwires. Additional components, such as elastics and springs, may be used to apply pressure and guide tooth movement.

Orthodontic treatment typically begins with a consultation where the orthodontist assesses the patient’s dental alignment and discusses treatment options. Digital imaging and X-rays may be taken to create a personalized treatment plan that addresses the patient’s specific needs.

Depending on the severity of the dental misalignment, the duration of orthodontic treatment can vary. In most cases, braces need to be worn for an average of 1-3 years. Regular follow-up appointments are necessary to monitor progress and make any necessary adjustments to the braces.

Orthodontic treatment not only straightens teeth but also corrects bite issues. A misaligned bite can result in problems such as difficulty chewing, speech issues, and increased risk of dental problems like tooth decay and gum disease. Braces can help align the bite, improving oral function and reducing the risk of future dental issues.

There are different types of braces available, including traditional metal braces, ceramic braces, and clear aligners. Traditional metal braces consist of metal brackets and wires and are the most commonly used type of braces. Ceramic braces are similar to metal braces but feature tooth-colored or clear brackets, making them less noticeable. Clear aligners, such as Invisalign, are a popular alternative to braces as they are removable and virtually invisible.

Orthodontic treatment requires commitment and proper oral hygiene practices. Patients with braces need to brush and floss regularly, ensuring they clean around the brackets and wires. It is also important to avoid sticky and hard foods that can damage the braces. Regular dental visits are essential during orthodontic treatment to maintain good oral health and address any issues that may arise.

Understanding the basics of braces and orthodontic treatment is crucial as it lays the foundation for exploring insurance coverage. With this knowledge, you can make informed decisions about your orthodontic needs and better navigate the insurance landscape.

Costs of Braces

The cost of braces can vary depending on several factors, including the type of braces, the complexity of the case, and the location of the dental practice. It’s important to have a clear understanding of the potential costs associated with braces to properly plan and budget for your orthodontic treatment.

Traditional metal braces are typically the most affordable option, with prices ranging from $3,000 to $7,000 for a complete treatment. Ceramic braces, which are less noticeable, can cost slightly more, ranging from $4,000 to $8,000. Clear aligners, such as Invisalign, tend to be the most expensive option, with prices ranging from $4,000 to $8,000.

In addition to the upfront cost of braces, there may be additional expenses involved throughout the treatment process. Initial consultations, X-rays, and orthodontic records may incur separate charges. It’s important to inquire about these fees during your initial consultation to have a clear understanding of the total cost.

It’s also important to consider the cost of orthodontic appointments and adjustments. Regular visits to the orthodontist are required to monitor progress, make necessary adjustments to the braces, and ensure the treatment is on track. These appointments may involve additional charges, so it’s essential to factor in recurring expenses.

Furthermore, it’s worth noting that orthodontic treatment may require additional procedures or appliances in some cases. For instance, if a patient has impacted teeth or severe crowding, the orthodontist may need to extract teeth or use additional appliances, such as palatal expanders. These procedures and appliances can add to the overall cost of treatment.

It’s important to consult with an experienced orthodontist to get a comprehensive understanding of the costs associated with your specific case. They can provide you with a detailed treatment plan and a breakdown of the expenses involved.

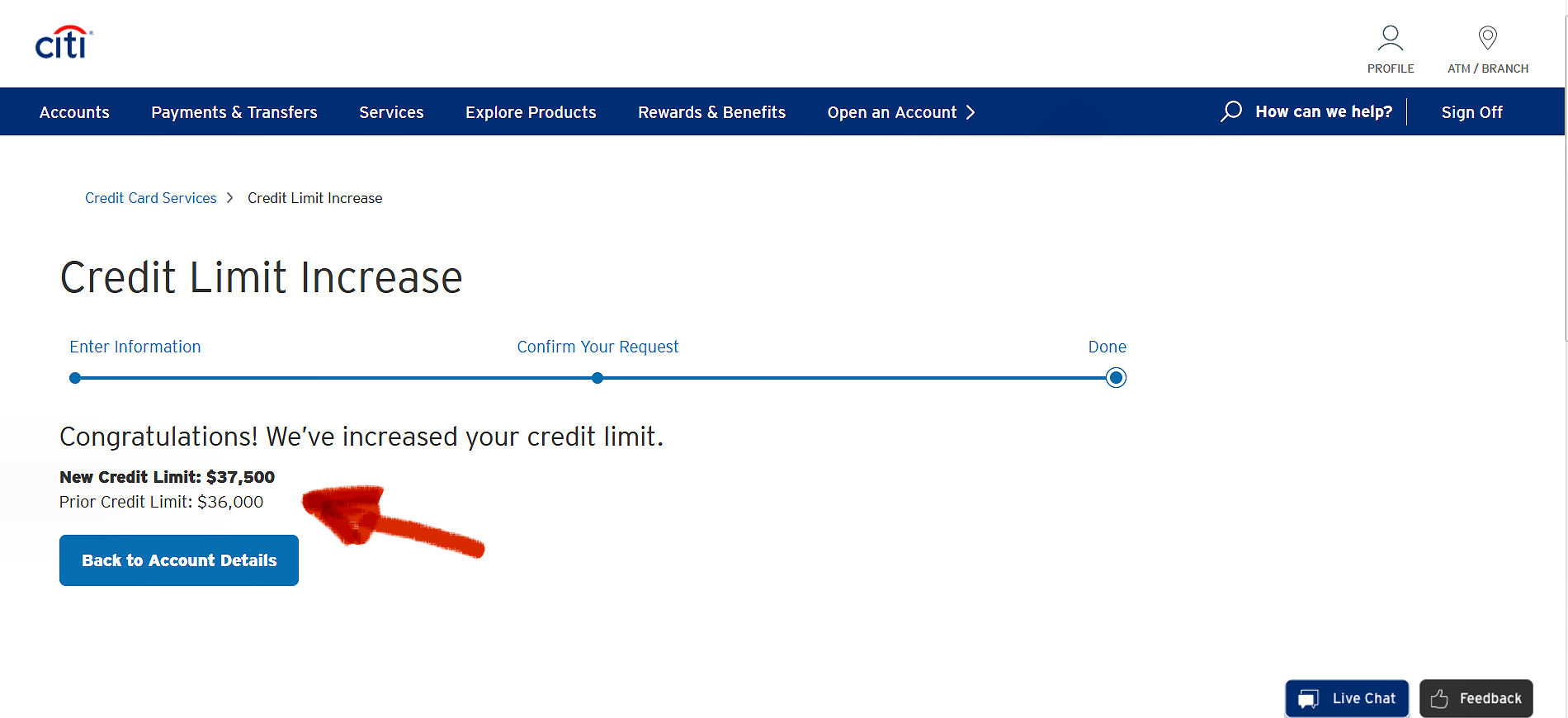

Some dental practices offer flexible payment plans or financing options to help make braces more affordable. These options allow you to spread out the cost of treatment over time, making it more manageable. It’s worth exploring these options with your orthodontist to find a solution that fits your budget.

Understanding the costs of braces is an essential step in planning for your orthodontic treatment. By having a clear idea of the potential expenses involved, you can make informed decisions about your treatment options and explore insurance coverage to help offset the cost.

Insurance Coverage for Braces

Insurance coverage for braces can provide much-needed financial assistance when it comes to orthodontic treatment. However, it’s important to understand that not all insurance plans offer coverage for braces, and those that do may have specific limitations and requirements.

The most common type of insurance plan that covers braces is dental insurance. Dental insurance plans typically provide coverage for orthodontic treatment, but the extent of coverage can vary significantly. Some plans may cover a portion of the total cost, while others may have a maximum coverage limit.

It’s important to carefully review your insurance policy and understand the terms and conditions regarding orthodontic coverage. Look for specific details, such as the age limits for coverage, whether pre-authorization is required, and any waiting periods that may apply.

Another type of insurance plan that may offer coverage for braces is medical insurance. In certain cases, orthodontic treatment may be considered medically necessary, such as when it is required to correct a structural issue that affects the patient’s ability to eat or speak properly. However, medical insurance coverage for braces is typically limited to severe cases.

Most insurance plans have a network of preferred providers. Before initiating orthodontic treatment, it’s important to check if your orthodontist is within the network of providers recognized by your insurance plan. If your orthodontist is out-of-network, coverage may be limited or not available at all.

Insurance plans usually require documentation and evidence to approve coverage for braces. This may include X-rays, photographs, and a detailed treatment plan from your orthodontist. It’s important to work closely with your orthodontist and provide the necessary documentation to ensure a smooth insurance claims process.

While insurance coverage can help offset the cost of braces, it’s essential to understand that there will still be out-of-pocket expenses. Deductibles, co-pays, and any remaining costs not covered by insurance will need to be paid by the patient. Understanding these potential expenses is crucial in budgeting for your orthodontic treatment.

It’s also important to note that insurance coverage for braces is typically limited to children and adolescents. Adult orthodontic treatment may have less coverage or no coverage at all under dental insurance plans. However, medical insurance plans may offer coverage for certain cases, such as severe jaw misalignment that affects overall health.

When considering orthodontic treatment, it is advisable to consult with an experienced orthodontist who can guide you through the insurance process and help you understand the specific coverage details of your plan.

By gaining a thorough understanding of your insurance coverage for braces, you can make informed decisions about your treatment options and effectively manage the financial aspects of orthodontic care.

Types of Insurance Plans

When it comes to insurance coverage for braces, it’s important to understand the different types of insurance plans available. Each type of plan has its own set of coverage options and limitations, so it’s crucial to explore your options to find the best fit for your orthodontic needs.

1. Dental Insurance: Dental insurance plans commonly provide coverage for orthodontic treatment, including braces. However, the extent of coverage can vary. Some plans have a waiting period before orthodontic coverage begins, while others may have age limits for coverage, typically covering children and adolescents. It’s important to review the specific details of your dental insurance plan to understand the coverage provided.

2. Medical Insurance: In some cases, orthodontic treatment may be considered medically necessary, such as when it is required to treat a structural issue that affects the patient’s ability to eat or speak properly. Medical insurance, rather than dental insurance, may provide coverage for orthodontic treatment in these situations. However, coverage for braces under medical insurance plans is typically limited to severe cases.

3. Employer-Sponsored Insurance: If you have dental or medical insurance through your employer, it’s essential to review the coverage options for orthodontic treatment. Some employer-sponsored insurance plans may provide coverage for braces, while others may have limited coverage or exclude orthodontic treatment altogether. It’s important to contact your HR department or insurance provider to understand the specifics of your plan.

4. Indemnity Plans: Indemnity plans, also known as fee-for-service plans, allow you to choose your orthodontist and receive reimbursement for a portion of the treatment cost. These plans typically have higher monthly premiums but give you more flexibility in choosing your orthodontic provider. The reimbursement percentage for orthodontic treatment may vary, so it’s important to review the specific terms of your indemnity plan.

5. Discount Plans: Discount plans are not insurance but provide discounted rates on dental services, including orthodontic treatment. With these plans, you pay a membership fee and receive discounted rates from participating orthodontists. Discount plans can be a cost-effective option for orthodontic treatment but may have limited provider options.

It’s important to thoroughly review the terms and coverage details of each type of insurance plan when considering orthodontic treatment. Understanding the coverage options, limitations, waiting periods, and age restrictions will help you make an informed decision about the best plan for your specific needs.

Consulting with an experienced orthodontist or insurance specialist can also be beneficial in understanding the nuances of insurance plans and determining the most suitable option for your orthodontic treatment.

Determining Coverage for Braces

When it comes to determining coverage for braces, there are several factors that insurance plans take into consideration. Understanding these factors can help you navigate the insurance landscape and have a clearer idea of what to expect in terms of your orthodontic treatment coverage.

1. Age Limitations: Many insurance plans have age limitations for orthodontic coverage. Orthodontic treatment is commonly covered for children and adolescents, as early intervention can lead to better outcomes. Adult orthodontic treatment may have more limited coverage or no coverage at all, depending on the insurance plan.

2. Severity of the Case: Insurance plans often consider the severity of the orthodontic case when determining coverage. Cases that involve significant dental misalignment or bite issues are more likely to receive coverage, as they are deemed more medically necessary. Mild cases may have reduced coverage or be excluded from coverage altogether.

3. Pre-Authorization Requirements: Some insurance plans require pre-authorization for orthodontic treatment. This means that a detailed treatment plan and supporting documentation, such as X-rays and photographs, need to be submitted and approved by the insurance company before the treatment starts. Failing to obtain pre-authorization may result in reduced or no coverage.

4. Network Providers: Insurance plans often have a network of preferred providers. These are orthodontists and dental practices that have a contractual agreement with the insurance company. If your orthodontist is within the network of providers, you are more likely to receive full or higher coverage. If your orthodontist is out-of-network, coverage may be limited or not available at all.

5. Waiting Periods: Some insurance plans have waiting periods before orthodontic coverage begins. This means that you need to be enrolled in the insurance plan for a specific period of time before being eligible for orthodontic benefits. It’s important to review your insurance policy to understand if a waiting period applies to your coverage.

6. Coverage Limits: Insurance plans may have specific limits on the coverage for orthodontic treatment. For example, they may cover a percentage of the total cost, typically ranging from 25% to 50%. Some plans may also have a maximum coverage amount, beyond which the patient is responsible for the remaining costs.

It’s important to review the terms and conditions of your insurance plan carefully to understand the specific factors that determine coverage for braces. Consulting with your orthodontist and insurance provider can also provide valuable insights and help you navigate the insurance claims process successfully.

By understanding the factors that determine coverage for braces, you can make informed decisions about your orthodontic treatment options and budget effectively for any potential out-of-pocket expenses.

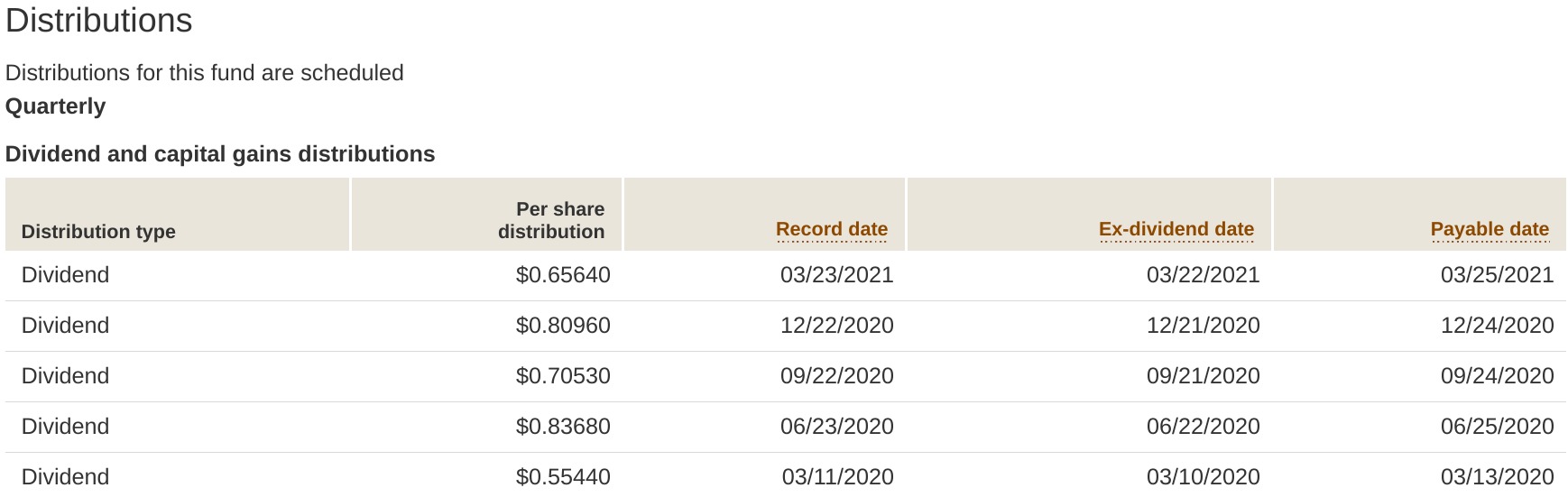

Average Insurance Coverage for Braces

The amount of insurance coverage for braces can vary depending on the specific insurance plan and its terms. On average, dental insurance plans typically cover a portion of the cost of orthodontic treatment, including braces. However, it’s important to understand that the level of coverage can differ significantly from one plan to another.

On average, dental insurance plans may cover around 25% to 50% of the total cost of braces. This means that the remaining amount, known as the patient’s out-of-pocket expense, will need to be covered by the individual receiving orthodontic treatment.

It’s important to note that some insurance plans may have a lifetime maximum limit for orthodontic coverage. This means there is a cap on the total amount the insurance will reimburse for orthodontic treatment. Once the lifetime maximum is reached, any additional orthodontic costs will be the responsibility of the patient.

It’s essential to review the specifics of your insurance plan to understand the average coverage percentage and any coverage limitations or maximums that may apply. Consulting with your insurance provider or an experienced orthodontist can help you better understand your specific insurance coverage and the financial responsibilities associated with orthodontic treatment.

Keep in mind that dental insurance plans with higher premiums may offer more extensive coverage for orthodontic treatment. Additionally, employer-sponsored insurance plans may provide more favorable coverage terms than individual dental insurance plans.

While insurance coverage for braces can help reduce the financial burden, it’s important to budget for the out-of-pocket expenses that are not covered by insurance. These expenses may include deductibles, co-pays, and any remaining costs after the insurance coverage has been applied.

Understanding the average insurance coverage for braces is essential in planning for your orthodontic treatment. By being aware of the coverage limitations and out-of-pocket expenses, you can make informed decisions about your treatment options and budget accordingly.

It’s recommended to consult with your orthodontist and insurance provider to gather accurate information about your specific insurance coverage for braces. They can provide you with the most up-to-date details about the average coverage percentages and any applicable coverage limits defined by your insurance plan.

Factors that Affect Insurance Coverage

Several factors can influence the extent of insurance coverage for orthodontic treatment, including braces. Understanding these factors can help you better navigate the insurance landscape and have a clearer understanding of what to expect in terms of coverage.

1. Type of Insurance Plan: Different types of insurance plans, such as dental insurance and medical insurance, have varying coverage options for orthodontic treatment. Dental insurance plans commonly provide coverage for braces, while medical insurance may have limited coverage for severe cases deemed medically necessary.

2. Age Limitations: Many insurance plans have age limitations for orthodontic coverage. Orthodontic treatment is typically covered for children and adolescents, as early intervention can have better outcomes. Adult orthodontic treatment may have more limited coverage or no coverage at all, depending on the insurance plan.

3. Severity of the Case: Insurance plans often consider the severity of the orthodontic case when determining coverage. Cases that involve significant dental misalignment or bite issues are more likely to receive coverage, as they are deemed more medically necessary. Mild cases may have reduced coverage or be excluded from coverage altogether.

4. Orthodontist Network: Insurance plans often have a network of preferred providers, including orthodontists. If your orthodontist is within the network of providers, you are more likely to receive full or higher coverage. If your orthodontist is out-of-network, coverage may be limited or not available at all.

5. Waiting Periods: Some insurance plans have waiting periods before orthodontic coverage begins. This means that you need to be enrolled in the insurance plan for a specific period of time before being eligible for orthodontic benefits. It’s important to review your insurance policy to understand if a waiting period applies to your coverage.

6. Pre-Authorization Requirements: Some insurance plans require pre-authorization for orthodontic treatment. This involves submitting a detailed treatment plan, X-rays, and other supporting documentation to the insurance company for approval before initiating treatment. Failing to obtain pre-authorization may result in reduced or no coverage.

7. Coverage Limits: Insurance plans may have specific limits on the coverage for braces, such as a percentage of the total cost or a maximum coverage amount. It’s important to review your insurance policy to understand the coverage limits and any associated costs that may not be covered.

8. Policy Exclusions: Insurance plans may have exclusions that specify certain types of orthodontic treatment or conditions that are not covered. It is crucial to carefully review your insurance policy to understand any exclusions that may affect orthodontic treatment coverage.

It’s important to thoroughly review the terms and conditions of your insurance plan and consult with your orthodontist and insurance provider to fully understand how these factors affect your specific coverage for braces.

Out-of-Pocket Expenses for Braces

While insurance coverage can help offset the cost of braces, it’s important to understand that there will still be out-of-pocket expenses that you will need to budget for. These additional costs can vary depending on your specific orthodontic treatment plan and insurance coverage. Understanding and planning for these expenses is crucial in managing the financial aspects of your orthodontic treatment.

1. Deductibles: Your insurance plan may have a deductible, which is the amount you must pay out-of-pocket before your insurance coverage kicks in. Deductibles vary between insurance plans, so it’s important to check your policy to determine how much you will need to pay before your insurance benefits begin.

2. Co-pays or Coinsurance: Co-pays or coinsurance are the portion of the total cost of treatment that you are responsible for paying. For example, if your insurance policy covers 50% of the cost of braces, you will be responsible for the remaining 50%, known as coinsurance or co-pay. It’s important to understand the percentage of your co-pay in order to plan for these expenses.

3. Orthodontic Records: Prior to initiating orthodontic treatment, orthodontic records such as X-rays, photographs, and impressions may be required. These records help create a personalized treatment plan and guide your orthodontic care. These additional diagnostic expenses are typically considered out-of-pocket and may not be covered by insurance.

4. Emergency Visits: While rare, emergencies can occasionally arise during orthodontic treatment. If an emergency visit is needed, there may be additional costs associated with any necessary repairs or adjustments. It’s important to inquire about emergency visit fees and whether they are covered by your insurance.

5. Retainers: After the braces are removed, retainers are often necessary to maintain the results of treatment. Retainers can be an additional expense and may not always be fully covered by insurance. It’s essential to understand the cost of retainers and whether they are included in your insurance coverage.

6. Additional Procedures or Treatments: Depending on your specific orthodontic needs, additional procedures or treatments may be required. For example, if you have impacted teeth or severe crowding, tooth extractions or additional appliances may be needed. These extra procedures typically incur additional costs that may not be fully covered by insurance.

It’s important to discuss the potential out-of-pocket expenses with your orthodontist and insurance provider to gain a clear understanding of what is covered by your insurance plan and what you will be responsible for financially. Planning ahead and budgeting for these out-of-pocket expenses will help you manage the financial aspects of your orthodontic treatment effectively.

Tips for Maximizing Insurance Coverage

Maximizing your insurance coverage for braces can help minimize your out-of-pocket expenses and make orthodontic treatment more affordable. Here are some tips to help you make the most of your insurance benefits:

1. Understand Your Insurance Policy: Read through your insurance policy thoroughly to understand the specific coverage details and any limitations or exclusions that may apply. Pay attention to factors such as age restrictions, waiting periods, and coverage limits.

2. Research In-Network Providers: In-network orthodontists have a contractual agreement with your insurance provider, which can result in higher coverage levels. Research and choose an orthodontist who is within the network of preferred providers recognized by your insurance plan.

3. Get Pre-Authorization: Before starting orthodontic treatment, make sure to obtain pre-authorization from your insurance company. This involves submitting a detailed treatment plan, X-rays, and any other required documentation. Pre-authorization ensures that you are aware of the coverage you can expect for your treatment.

4. Communicate with Your Orthodontist: Keep your orthodontist informed about your insurance coverage and share any pre-authorization information. They can work with you to develop a treatment plan that maximizes your insurance benefits while addressing your orthodontic needs.

5. Utilize Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs): If available, consider using an FSA or HSA to cover some of the expenses associated with orthodontic treatment. These accounts allow you to set aside pre-tax funds specifically for medical and dental expenses.

6. Keep Track of Your Treatment: Keep a record of all orthodontic visits, procedures, and expenses related to your braces. Maintain copies of invoices, statements, and receipts in case there is a need to refer back to them during insurance claims.

7. Communicate with Your Insurance Provider: If you have any questions or concerns regarding your insurance coverage, contact your insurance provider directly. They can provide valuable information about your plan and help clarify any ambiguities.

8. Consider Orthodontic Insurance Riders: Some dental insurance plans offer optional orthodontic insurance riders that provide additional coverage specifically for braces. Explore if this is available with your insurance plan and evaluate the benefits versus the cost of adding the rider.

9. Optimize Your Plan’s Coverage Period: If possible, time your orthodontic treatment to make the most of your insurance coverage. Begin treatment near the start of the coverage period to maximize the benefits before the policy renews or changes.

10. Seek Multiple Opinions: Consult with different orthodontists to understand their treatment plans and cost estimates. This can help you make an informed decision and potentially find a provider who offers affordable treatment options.

By following these tips, you can navigate the insurance process more effectively and maximize your coverage for braces. Remember to stay proactive, ask questions, and communicate openly with your orthodontist and insurance provider to ensure you are taking full advantage of your insurance benefits.

Conclusion

Insurance coverage for braces can significantly alleviate the financial burden of orthodontic treatment, making it more accessible for individuals and families. However, understanding the various factors that affect coverage and taking proactive steps to maximize insurance benefits are essential in navigating the insurance landscape effectively.

Throughout this article, we have explored the different types of insurance plans, including dental insurance and medical insurance, and how they provide coverage for braces. We have discussed the factors that can influence coverage, such as age limitations, severity of the case, network providers, waiting periods, and coverage limits.

It is important to have a clear understanding of the average insurance coverage for braces, which typically ranges from 25% to 50% of the total cost. However, it’s crucial to review the specific details of your insurance policy and consult with your orthodontist and insurance provider for accurate information about your coverage.

We have also discussed the out-of-pocket expenses associated with braces, including deductibles, co-pays, orthodontic records, emergency visits, retainers, and additional procedures. Planning for these expenses and budgeting accordingly will help you manage the financial aspects of your orthodontic treatment effectively.

Maximizing your insurance coverage for braces can be achieved through various strategies, such as understanding your insurance policy, researching in-network providers, obtaining pre-authorization, communicating with your orthodontist, utilizing flexible spending accounts, and keeping track of your treatment and expenses.

In conclusion, insurance coverage for braces can make a significant difference in the affordability of orthodontic treatment. By being well-informed, proactive, and in close communication with your orthodontist and insurance provider, you can navigate the insurance process more effectively and make the most of your insurance benefits.

Remember to review your insurance policy, explore all available options, and ask any questions you may have. With proper planning and utilization of insurance benefits, you can achieve a healthier, straighter smile without placing excessive financial strain on yourself or your family.