Finance

How Much Does QYLD Pay In Dividends?

Published: January 3, 2024

Find out how much QYLD pays in dividends and improve your finance with this detailed guide. Learn more about dividend payments and investment strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on the dividends paid by QYLD, a popular exchange-traded fund (ETF) that focuses on generating income through covered call options. If you’re an investor seeking steady cash flow, understanding how much QYLD pays in dividends is crucial.

QYLD, also known as the Global X NASDAQ 100 Covered Call ETF, is designed to track the performance of the NASDAQ-100 Index while generating income from writing covered call options on the underlying index. The ETF is managed by Global X Funds and has gained significant attention for its unique approach.

Dividends are a critical consideration for many investors, as they provide ongoing income and play an important role in total return. By uncovering the details of QYLD’s dividend payments, we can gain insights into the potential returns and cash flow it may offer.

In this article, we will explore how QYLD determines its dividend payments, examine its historical dividend track record, and shed light on the factors that can influence future dividend payouts. Additionally, we will discuss QYLD’s dividend yield, a key metric for evaluating income-generating investments. With this information, you’ll be better equipped to assess QYLD as a potential addition to your investment portfolio.

It’s worth noting that while information on dividend payments is vital, it’s crucial to consider other factors such as risk, overall performance, and investment objectives when making investment decisions. A comprehensive analysis that includes these factors is essential for making informed investment choices.

Now, let’s dive into the world of QYLD dividends and explore all the important details you need to know about the income potential of this unique ETF.

Understanding QYLD

Before delving into the specifics of dividend payments, it’s essential to have a solid understanding of QYLD and its investment strategy. QYLD, the Global X NASDAQ 100 Covered Call ETF, is an ETF that aims to provide investors with exposure to the performance of the NASDAQ-100 Index while generating income through covered call options.

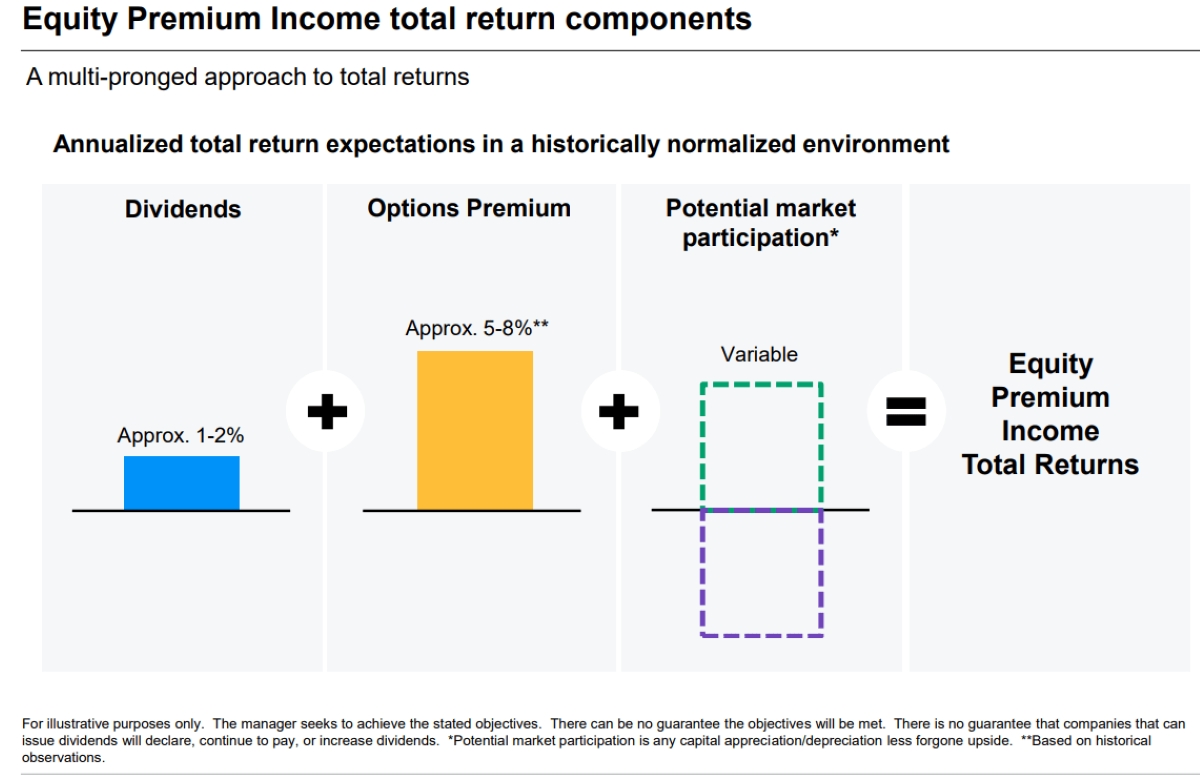

What are covered call options, you may ask? In simple terms, covered call options are a strategy in which an investor sells call options on a security they already own. By doing so, the investor earns a premium from the buyer of the call option in exchange for the potential obligation to sell the security at a predetermined price (strike price) in the future.

QYLD utilizes this covered call strategy on the NASDAQ-100 Index, which consists of 100 of the largest non-financial companies listed on the NASDAQ stock exchange. By writing covered call options on the underlying index, QYLD collects premiums, which help generate income for the ETF and its investors.

While this covered call strategy provides income potential for QYLD, it also comes with a trade-off. When a call option is sold, it limits the potential upside of the underlying security if its price rises above the strike price. Consequently, QYLD’s performance may lag behind the full upside potential of the NASDAQ-100 Index.

However, in exchange for accepting this limitation in potential gains, QYLD aims to provide investors with regular dividend payments, making it an attractive option for income-focused investors. By employing a disciplined approach to writing covered calls, QYLD seeks to strike a balance between income generation and participation in the rise of the underlying index.

With a deeper understanding of QYLD’s investment strategy, we can now delve into the specifics of its dividend payments. In the next section, we will explore how QYLD determines its dividend payments and the factors that influence those payments.

Dividend Overview of QYLD

When it comes to investing in dividend-oriented funds like QYLD, understanding the dividend overview is vital. Dividends play a critical role in generating income for investors and can significantly impact the total return of an investment.

QYLD is structured as a grantor trust, which allows it to pass through most of its income to investors in the form of dividends. As a result, QYLD aims to distribute a substantial portion of its net investment income to shareholders on a monthly basis.

As an ETF, QYLD is required to distribute at least 90% of its taxable income to shareholders annually in order to maintain its favorable tax treatment. This means that QYLD is designed to provide a reliable income stream to its investors.

It’s important to note that QYLD’s dividend payments may vary from month to month, as they are influenced by various factors. These factors include the options premiums collected, the performance of the underlying index, and the number of outstanding shares.

QYLD’s dividend payments are typically made in cash, directly deposited into the brokerage accounts of shareholders. This ease of distribution makes it convenient for investors to access their dividend income and either reinvest it or use it for other financial needs.

It’s also worth mentioning that QYLD’s dividend payments are subject to taxes. The specific tax treatment will depend on the investor’s individual circumstances and tax jurisdiction. It’s always recommended to consult with a tax professional for personalized advice related to taxes on QYLD dividends.

In the next section, we will explore how QYLD determines its dividend payments, providing insights into the factors that influence the amount and frequency of these distributions.

How QYLD Determines Dividend Payments

QYLD determines its dividend payments based on several key factors that reflect its underlying investment strategy and income generation process. Understanding how QYLD calculates its dividend payments can provide insights into the potential income stream investors can expect.

First and foremost, QYLD’s dividend payments are primarily derived from the premiums collected through writing covered call options on the NASDAQ-100 Index. When investors buy call options from QYLD, they pay a premium, which becomes part of the fund’s income. This income is then distributed to shareholders as dividends.

The amount of premiums collected by QYLD can vary based on various factors, including market conditions, volatility, and the strike prices of the covered call options. Higher levels of market volatility and wider strike price ranges generally lead to higher premiums collected and, potentially, higher dividend payments.

Another crucial factor that influences QYLD’s dividend payments is the performance of the underlying NASDAQ-100 Index. If the index experiences significant price appreciation, it may result in higher capital gains from the covered call options, thereby increasing the income available for distribution.

However, it’s important to note that QYLD’s dividend payments are affected by various external factors, including interest rates and market conditions. For example, in times of low interest rates or stagnant market conditions, the premiums collected could be lower, potentially leading to lower dividend payments.

Furthermore, the number of outstanding shares can also impact QYLD’s dividend payments. As the number of shares fluctuates over time due to inflows or outflows from the fund, the total dividend payment is spread over a varying number of shares, which can affect the per-share dividend amount.

QYLD aims to strike a balance between generating income through covered call options and participating in the price appreciation of the underlying index. By employing its unique investment strategy, QYLD seeks to provide regular dividend payments to its shareholders.

Now that we understand how QYLD determines its dividend payments, let’s explore its historical dividend track record and gain insights into the consistency and growth potential of its income distributions.

Historical Dividend Payments by QYLD

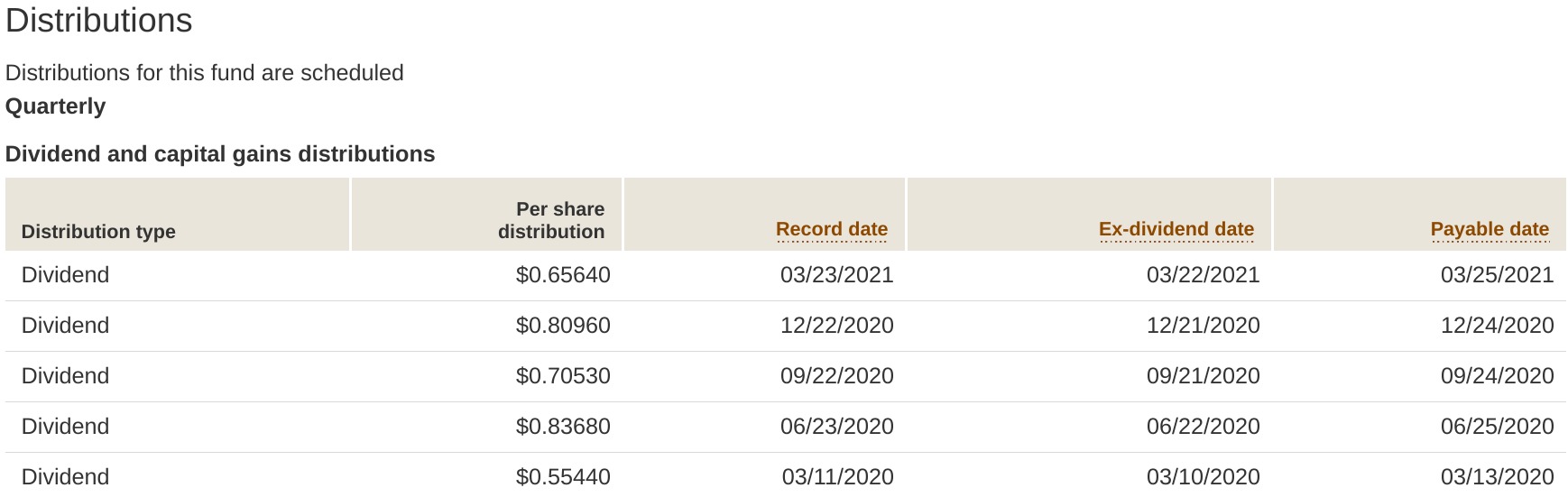

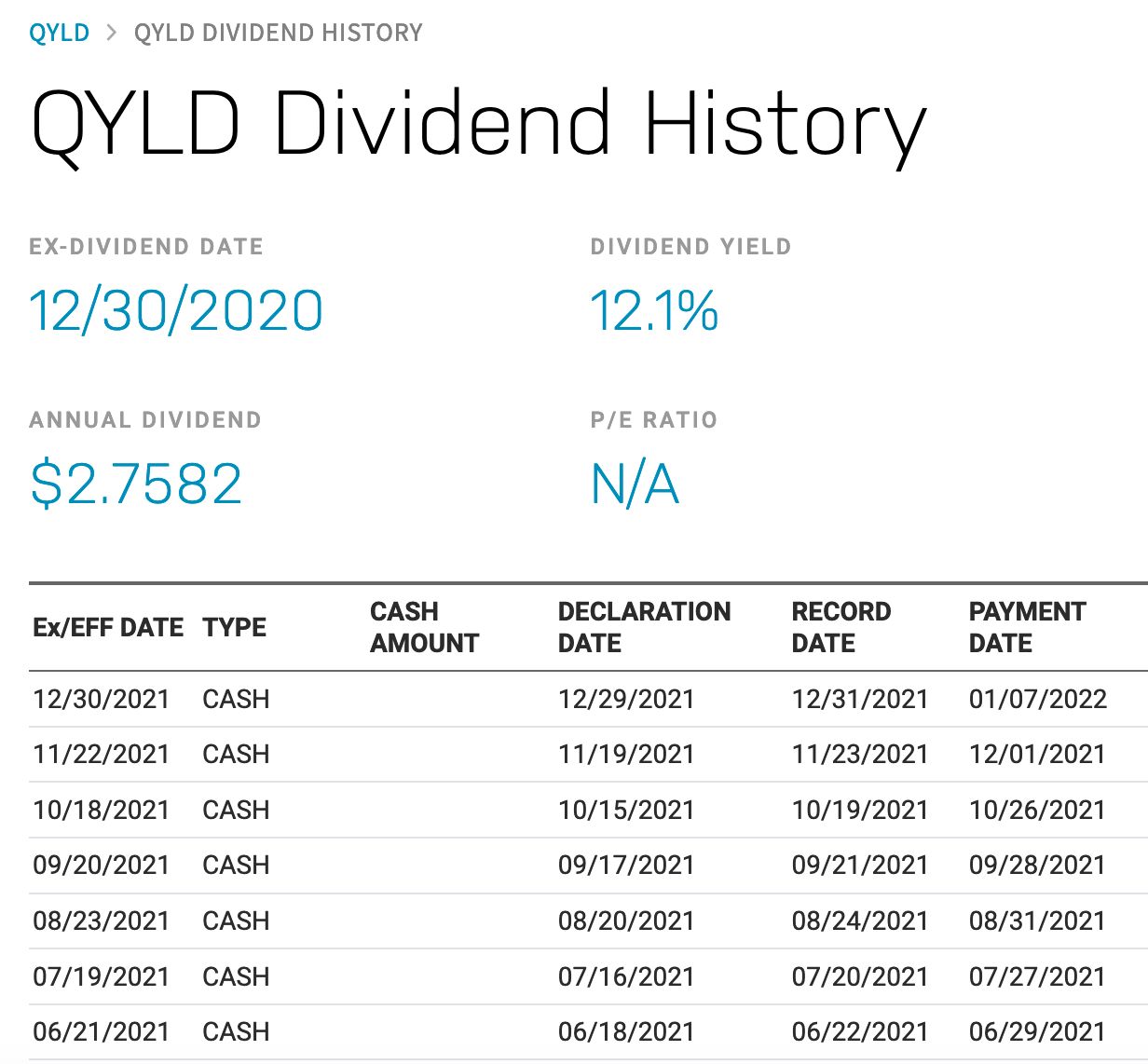

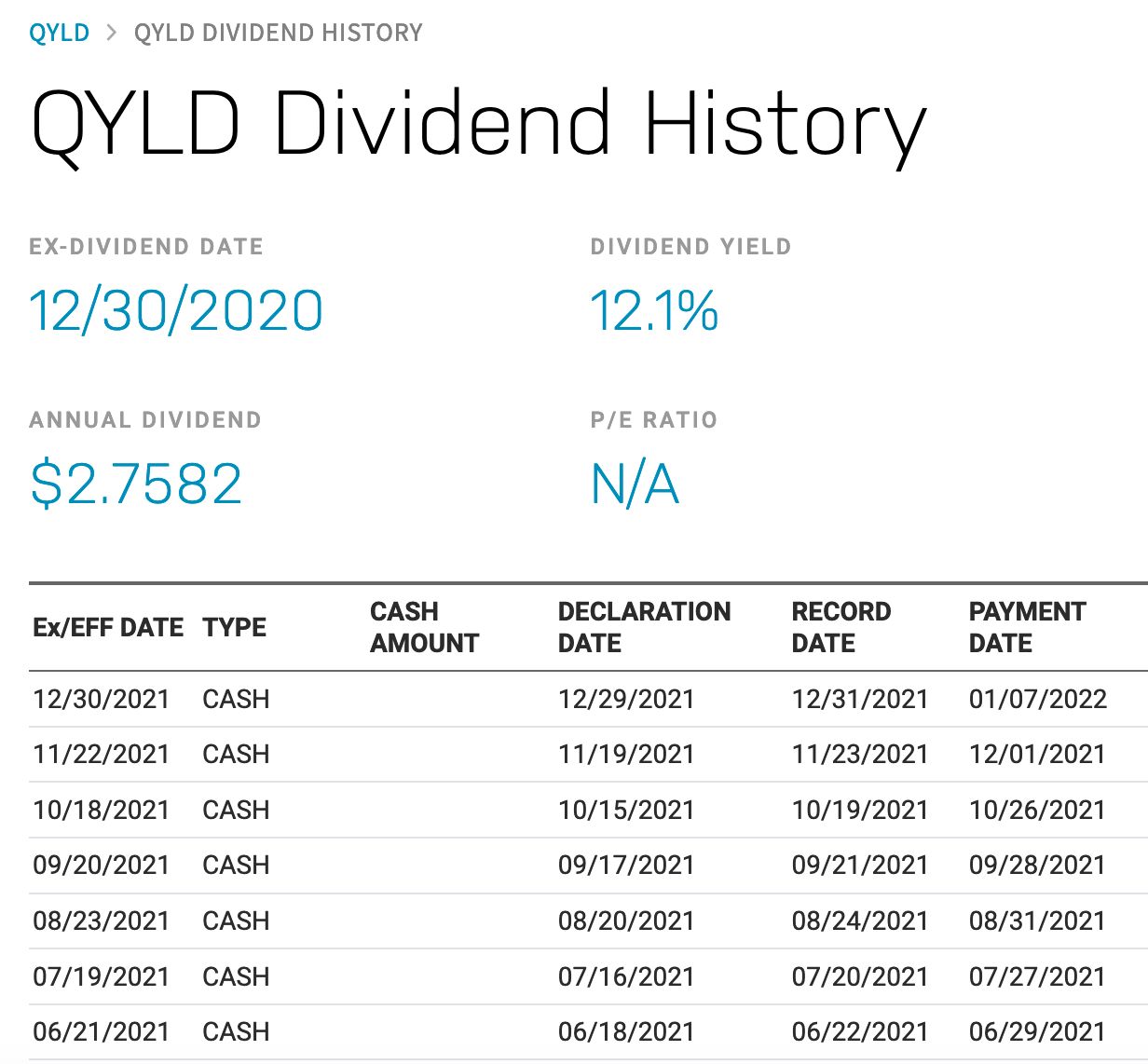

Examining the historical dividend track record of QYLD can give investors valuable insights into the consistency and potential growth of its dividend payments. By assessing past distributions, investors can make informed decisions and better understand the income potential of the ETF.

QYLD has a history of consistently paying monthly dividends since its inception. It has become a popular choice among income-focused investors due to its regular income stream. Tracking the historical dividend payments of QYLD can provide a clear picture of its income generation capabilities.

It’s important to note that the amount of QYLD’s dividends can fluctuate from month to month due to various factors, as mentioned earlier. Market conditions, volatility, and options premiums collected are some of the variables that can influence the dividend amount in any given month.

Over the years, QYLD has demonstrated relatively stable and competitive dividend payments, often outperforming other income-generating investment options. However, it’s important to remember that past performance is not indicative of future results, and dividend payments can be impacted by changing market conditions.

Investors can track QYLD’s historical dividend payments through various financial websites, brokerage platforms, or by reviewing the dividend history provided by the fund itself. By analyzing the patterns and trends in dividend payments, investors can assess the consistency and potential growth of QYLD’s income distributions.

It’s also worth noting that QYLD’s historical dividend yield, which is the dividend payment as a percentage of the ETF’s share price, can provide additional insights for investors. The dividend yield can help compare QYLD’s income potential with other investments and evaluate the attractiveness of its dividend payments.

However, it’s important to remember that dividend payments can be influenced by various factors, and they should not be the sole metric for determining the overall performance and suitability of an investment. A comprehensive analysis that includes factors beyond dividends, such as risk, total return, and investment objectives, is vital for making informed investment decisions.

In the next section, we will discuss the factors that can impact QYLD’s dividend payments and help investors understand what to consider when evaluating the income potential of the ETF.

Factors Affecting QYLD Dividends

Several factors can influence the dividend payments of QYLD, shaping the amount and frequency of its distributions. Understanding these factors is crucial for investors seeking to evaluate the income potential of the ETF and make informed investment decisions.

1. Options Premiums: QYLD generates income through writing covered call options on the NASDAQ-100 Index. The premiums collected from selling these options play a significant role in determining the dividend payments. Higher premiums collected can lead to higher dividend distributions.

2. Market Volatility: The level of market volatility can impact QYLD’s dividend payments. During periods of high volatility, options premiums tend to increase, potentially resulting in higher income and larger dividend payments. Conversely, low levels of volatility may lead to lower premiums and subsequently lower dividend distributions.

3. Performance of the Underlying Index: QYLD’s dividend payments can be influenced by the performance of the NASDAQ-100 Index. If the index experiences substantial price appreciation, it can lead to higher capital gains from the covered call options, potentially increasing the income available for distribution.

4. Number of Outstanding Shares: Fluctuations in the number of outstanding shares can impact QYLD’s dividend payments. If the number of shares increases due to inflows into the ETF, the total dividend payment is spread over a larger number of shares, potentially reducing the per-share dividend amount.

5. Interest Rates: Interest rates can also affect QYLD’s dividend payments. When interest rates are low, options premiums tend to be lower, resulting in potentially reduced income and smaller dividend distributions. Conversely, higher interest rates can lead to higher premiums and potentially larger dividends.

It’s important to bear in mind that dividend payments can vary from month to month based on the combination of these factors. QYLD aims to strike a balance between generating income through covered call options and providing investors with regular, competitive dividend payments.

Investors should also consider that the market conditions and factors affecting dividend payments can change over time. It’s crucial to stay informed and regularly assess these factors when evaluating the income potential of QYLD.

Overall, by understanding the factors that can impact QYLD’s dividend payments, investors can make informed decisions about whether the ETF aligns with their income objectives and risk tolerance. In the next section, we will explore QYLD’s dividend yield, a key metric for evaluating the income potential of the ETF in comparison to other investments.

QYLD’s Dividend Yield

One essential metric for evaluating the income potential of QYLD and comparing it to other investments is its dividend yield. Dividend yield measures the annual dividend payment as a percentage of the ETF’s share price, providing insight into the return on investment in terms of income generation.

The dividend yield can help investors assess the attractiveness of QYLD’s dividend payments relative to the price they are paying for the ETF’s shares. It allows for comparisons with other income-generating investments, such as bonds, other ETFs, or dividend-paying stocks.

QYLD’s dividend yield is influenced by two main factors: the amount of its dividend payments and its share price. When the dividend payments remain consistent, a decrease in QYLD’s share price can result in a higher dividend yield, making it potentially more appealing for income-focused investors.

It’s important to note that dividend yield is a dynamic metric and can change over time as the share price and dividend payments fluctuate. Comparing the dividend yield of QYLD to its historical average or benchmark indices can provide a context for evaluating the current income potential.

However, while dividend yield is a valuable metric, it should not be the sole factor in investment decision-making. Investors must consider other factors such as the sustainability of dividend payments, overall performance, risk factors, and the alignment of QYLD’s investment strategy with their financial goals.

Additionally, dividend yield should be analyzed within the larger framework of an investor’s portfolio diversification strategy. It’s crucial to assess the risk and return characteristics of QYLD in relation to other asset classes to ensure a well-balanced investment approach.

To calculate QYLD’s dividend yield, divide the annual dividend payment by the ETF’s share price and multiply by 100 to express it as a percentage. This can be a useful tool for comparing QYLD’s income potential with other investment opportunities.

Remember, while dividend yield provides insights into QYLD’s income generation capabilities, it is just one of many factors to consider in evaluating the investment’s suitability for individual financial objectives and risk tolerance.

In the concluding section, we will summarize the key points discussed in this comprehensive guide to QYLD’s dividend payments and their significance for investors.

Conclusion

Understanding the dividend payments of QYLD, the Global X NASDAQ 100 Covered Call ETF, is essential for investors seeking income-focused investment opportunities. Throughout this guide, we have explored various aspects of QYLD’s dividends, providing insights into its dividend overview, how dividend payments are determined, historical dividend payments, factors influencing dividend payments, and the significance of QYLD’s dividend yield.

QYLD’s focus on generating income through writing covered call options on the NASDAQ-100 Index offers unique potential for steady cash flow. By collecting premiums from these options, QYLD aims to provide reliable income to investors on a monthly basis.

The amount and frequency of QYLD’s dividend payments are influenced by factors such as options premiums, market volatility, the performance of the underlying index, the number of outstanding shares, and interest rates. Understanding these factors can help investors assess the consistency and potential growth of QYLD’s dividend distributions.

Examining the historical dividend track record of QYLD showcases its commitment to regular dividend payments. However, it’s important to remember that past performance is not indicative of future results, and various external factors can impact dividend payments.

The dividend yield of QYLD, which measures the annual dividend payment as a percentage of the ETF’s share price, provides a useful metric for evaluating its income potential and comparing it to other investment options. However, investors should consider dividend yield in conjunction with other factors and ensure it aligns with their overall investment objectives and risk tolerance.

When considering QYLD or any investment opportunity, it’s crucial to conduct thorough research, assess the risks involved, and evaluate the investment’s fit within a well-diversified portfolio strategy.

In conclusion, understanding the dividend payments of QYLD is paramount for income-focused investors. By comprehending the fundamentals of QYLD’s dividends, assessing its historical track record, and evaluating its dividend yield, investors can make informed decisions about the income potential and suitability of this unique ETF.

Remember, consulting with a financial advisor or investment professional is always recommended to gain personalized insights and guidance specific to your individual financial goals and circumstances.