Finance

What Is Internet Banking ID

Modified: December 30, 2023

Learn everything you need to know about Internet Banking ID and how it is related to the world of finance. Discover the benefits and security features of this crucial tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

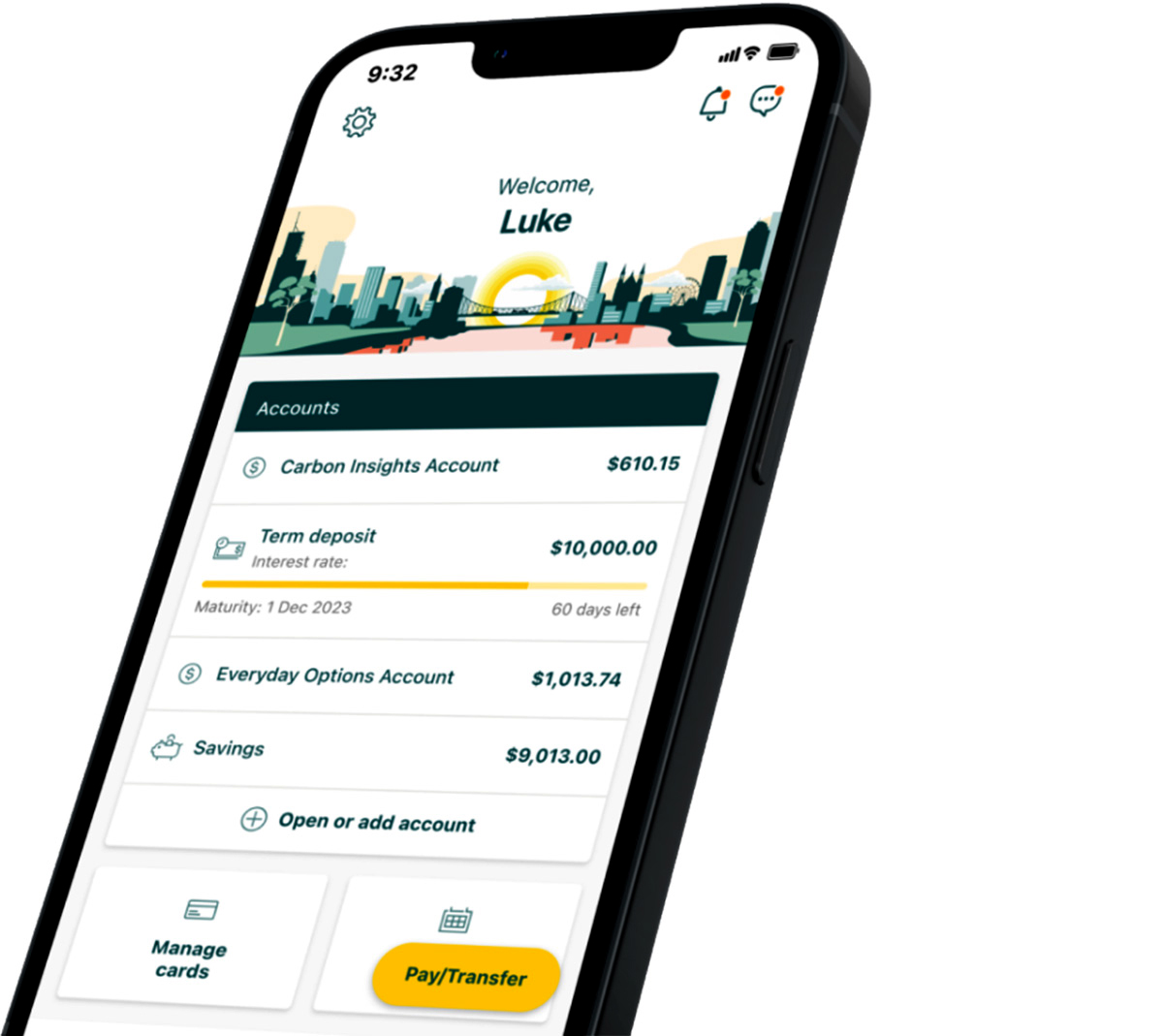

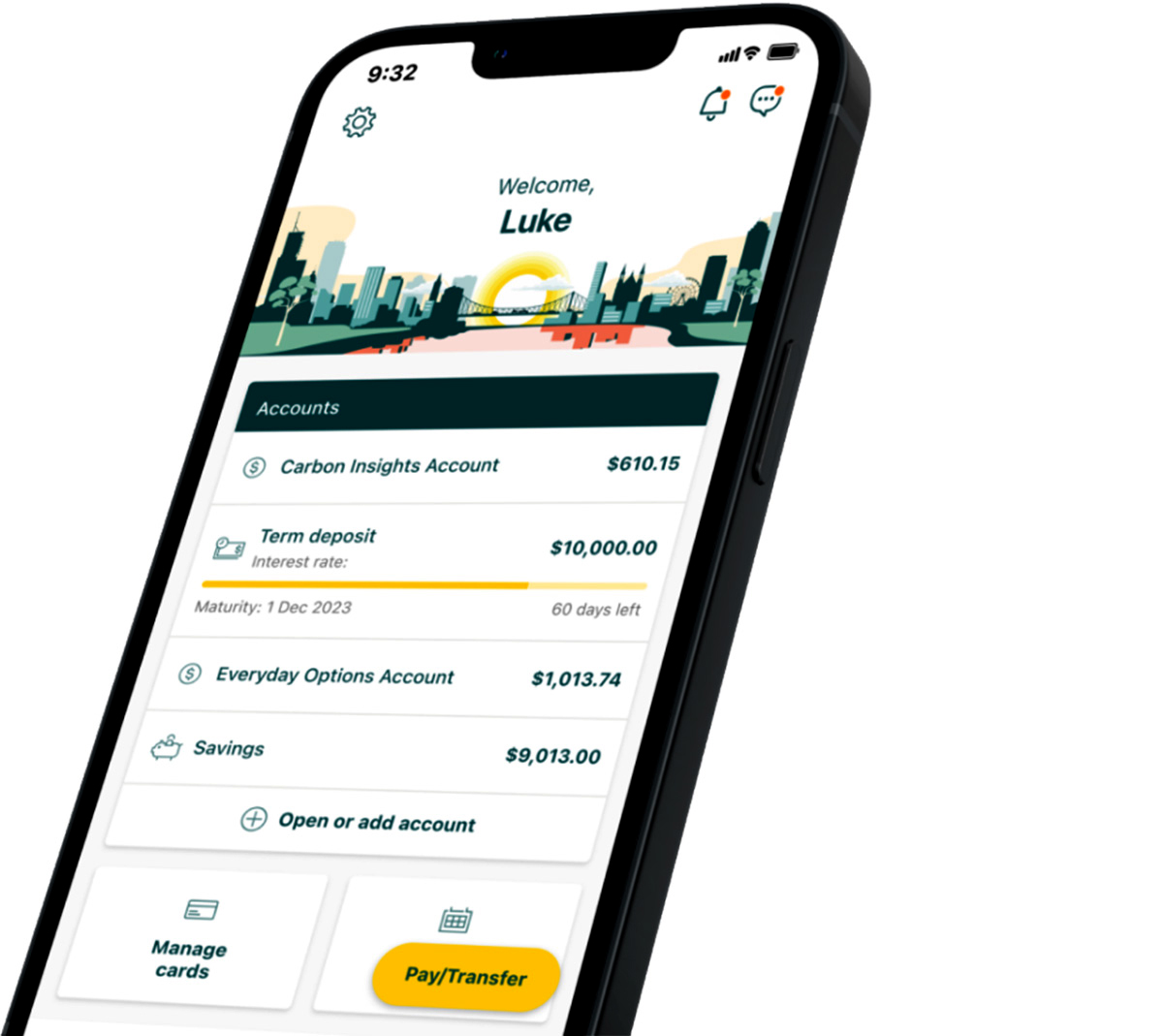

With the rapid advancement of technology, the way we handle our finances has undergone a significant transformation. No longer do we have to wait in long lines at the bank or worry about misplacing physical documents. Internet banking has revolutionized the way we manage our money, providing convenience, accessibility, and security right at our fingertips.

One crucial aspect of internet banking is the Internet Banking ID. In this article, we will delve into the details of what an Internet Banking ID is, how it works, its benefits, security measures, common issues, and best practices for using it.

An Internet Banking ID is a unique identifier that allows customers to access their online banking services securely. It serves as a personal key to authenticate and authorize users’ access to their financial accounts through the internet. This ID is typically assigned to customers when they open an account with a bank or financial institution that offers internet banking facilities.

When it comes to using Internet Banking ID, customers are required to log in to their online banking portals using their unique ID credentials. These credentials usually include a combination of a username and password or may involve additional security measures like biometric authentication or one-time passwords.

The primary purpose of an Internet Banking ID is to provide a secure and convenient way for customers to manage their finances online. It eliminates the need for physical visits to the bank, allowing users to check their account balances, transfer funds, pay bills, apply for loans, and perform various other financial transactions right from the comfort of their homes or on the go.

One of the significant benefits of using an Internet Banking ID is the convenience it offers. Customers can access their banking services 24/7, without being restricted by traditional banking hours. This flexibility allows individuals to take control of their finances at their preferred time and pace, which is especially beneficial for those with busy schedules.

Additionally, Internet Banking ID provides a high level of accessibility. It enables customers to manage multiple accounts, view transaction history, download statements, and track expenses without any hassle. This comprehensive access to financial information empowers individuals to make informed decisions and stay on top of their financial health.

Definition of Internet Banking ID

An Internet Banking ID, also known as an online banking ID or login credentials, is a unique identifier used by customers to access their online banking accounts. It serves as a security measure to authenticate and authorize users’ access to their financial information and perform various transactions through the internet.

The Internet Banking ID is typically provided by banks or financial institutions that offer internet banking services. It is created when a customer opens a bank account and opts for online banking facilities. The ID is used in combination with other authentication factors, such as a password or additional security measures, to establish a secure connection between the user and the online banking portal.

The Internet Banking ID acts as a personal key that unlocks access to a user’s financial accounts and services. It is unique to each individual and serves as a way to verify their identity when accessing their online banking portal. This helps protect customer information from unauthorized access and ensures that only authorized users can perform transactions and manage their finances online.

The Internet Banking ID is often a combination of a username and password. The username is typically chosen by the customer, while the password may be generated by the bank or chosen by the user. In some cases, additional security measures such as biometric authentication, one-time passwords (OTPs), or security questions may be required to enhance the security of the Internet Banking ID.

It is important for customers to keep their Internet Banking ID secure and confidential. This involves choosing a strong password, avoiding sharing the ID with others, and regularly updating the password to mitigate the risk of unauthorized access. Banks and financial institutions also implement various security measures to safeguard customer information and prevent fraudulent activities.

In summary, an Internet Banking ID is a unique identifier that allows customers to access their online banking services securely. It serves as a personal key to authenticate and authorize users’ access to their financial accounts through the internet. By using their Internet Banking ID, customers can conveniently manage their finances online and perform various transactions with confidence.

How Internet Banking ID Works

Internet Banking IDs work by establishing a secure connection between the user and the online banking platform. Here is a step-by-step breakdown of how Internet Banking IDs function:

- Registration: When a customer opens an account with a bank or financial institution that offers internet banking services, they are assigned an Internet Banking ID. This ID is typically provided along with instructions on how to activate and access the online banking portal.

- Authentication: To access their online banking account, customers must log in using their Internet Banking ID. This authentication process involves entering their unique username and password, and potentially answering security questions or inputting additional authentication factors.

- Secure connection: Once the login credentials are provided, the online banking platform verifies the information and establishes a secure connection between the user’s device and the banking servers. This is typically done through encryption protocols such as Secure Sockets Layer (SSL) or Transport Layer Security (TLS) to protect sensitive data transmitted over the internet.

- Access to account information: Once the secure connection is established, users gain access to their online banking account, where they can view their account balances, transaction history, and other relevant financial information. They can also perform various transactions, such as transferring funds between accounts, paying bills, or applying for loans.

- Logging out: To ensure the security of their account, users should always log out of their online banking session when they are finished. This helps prevent unauthorized access in case the device is lost or stolen.

It is important to note that Internet Banking IDs may have additional security measures in place to enhance the security of the online banking platform. These measures can include multi-factor authentication, where users may be required to provide additional verification, such as a one-time password (OTP) sent to their registered mobile number, or biometric authentication, using fingerprints or facial recognition.

Banks and financial institutions continually update and improve their online banking systems to stay ahead of evolving cybersecurity threats. They invest in robust security protocols to safeguard customer data and employ sophisticated encryption methods to protect sensitive information during transmission.

In summary, Internet Banking IDs work by providing a secure and personalized method for customers to access their online banking accounts. Through a series of authentication steps and secure connections, users can log in, view account information, perform transactions, and manage their finances with confidence.

Benefits of Internet Banking ID

Using an Internet Banking ID offers a range of benefits for customers. Let’s explore some of the key advantages of having an Internet Banking ID:

- Convenience: Internet Banking IDs provide unparalleled convenience by allowing customers to access their banking services anytime and anywhere. Whether it’s checking account balances, transferring funds, paying bills, or applying for loans, users can conveniently manage their finances from the comfort of their homes or while on the go. The 24/7 accessibility ensures that individuals can take control of their finances at their preferred time and pace.

- Accessibility: Internet Banking IDs provide easy access to comprehensive account information and financial services. Users can view their account balances, transaction history, and download statements, helping them keep track of their expenses and monitor their financial health. This accessibility empowers individuals to make informed decisions about their money and plan their finances effectively.

- Time-saving: With Internet Banking IDs, customers can eliminate the need for physical visits to banks or financial institutions. This saves valuable time that would have been spent waiting in long queues or traveling to and from the bank. Instead, users can perform various banking transactions with just a few clicks, enabling them to allocate their time to other priorities.

- Cost-effective: Internet Banking IDs reduce the need for physical paperwork and postage, resulting in cost savings for both customers and financial institutions. Additionally, users can avoid certain fees associated with traditional banking services, such as withdrawal fees or check-printing charges, by utilizing the online banking platform.

- Enhanced security: Internet Banking IDs incorporate various security measures to protect customer information and transactions. Banks and financial institutions employ advanced encryption technologies and multi-factor authentication methods to ensure the confidentiality and integrity of user data. Additionally, users can monitor their account activity regularly and report any suspicious transactions promptly, enhancing the overall security of their finances.

- Flexibility: Internet Banking IDs enable customers to manage multiple accounts from different financial institutions through a single platform. This flexibility allows users to consolidate their financial information, making it easier to track and manage their overall financial picture.

Overall, Internet Banking IDs offer convenience, accessibility, and security, resulting in a more efficient and streamlined banking experience for customers. By leveraging these IDs, individuals can take control of their finances, save time and money, and enjoy the benefits of 24/7 access to their accounts.

Security Measures for Internet Banking ID

Security is of utmost importance when it comes to Internet Banking IDs, as it involves the protection of sensitive financial information. Banks and financial institutions implement several security measures to ensure the safety and integrity of users’ Internet Banking IDs. Let’s explore some of the common security measures in place:

- Strong Encryption: Banks use strong encryption protocols, such as Secure Sockets Layer (SSL) or Transport Layer Security (TLS), to encrypt data transmitted between the user’s device and the banking servers. This encryption ensures that sensitive information, such as username, password, and transaction details, is securely transmitted and cannot be intercepted by unauthorized parties.

- Multi-Factor Authentication (MFA): Many banks employ the use of MFA as an additional layer of security. This requires users to provide multiple forms of identification before gaining access to their online banking accounts. Popular MFA methods include one-time passwords (OTPs) sent via SMS or email, biometric authentication (fingerprint or facial recognition), or the use of hardware tokens.

- Secure Login Credentials: Customers are encouraged to create strong and unique passwords for their Internet Banking IDs. These passwords should be a combination of letters, numbers, and special characters. Banks also enforce password complexity requirements and may ask users to change their password regularly to maintain security.

- Automatic Session Timeout: To prevent unauthorized access to an inactive user’s account, banks often set up an automatic session timeout feature. This means that if a user is inactive for a certain period of time, they will be automatically logged out of their online banking session.

- User-Friendly Security Alerts: Banks provide security alerts to notify users of any suspicious activities or transactions related to their accounts. These alerts are sent via email, SMS, or through the bank’s mobile banking application. Users are advised to keep their contact information up-to-date to ensure they receive these important alerts.

- Secure Network Infrastructure: Financial institutions invest heavily in secure network infrastructures to safeguard their online banking platforms. They employ firewalls, Intrusion Detection Systems (IDS), and other security measures to protect against unauthorized access, malware attacks, and other cybersecurity threats.

- Education and Awareness: Banks and financial institutions provide educational resources and guidelines to help users understand and practice safe online banking habits. This includes tips on creating strong passwords, avoiding phishing scams, and regularly updating security software on personal devices.

It is crucial for customers to be proactive in protecting their Internet Banking IDs. This includes regularly monitoring account activity, promptly reporting any suspicious transactions, and keeping login credentials confidential. By following best practices and staying informed about potential security risks, users can mitigate the chances of unauthorized access to their online banking accounts.

In summary, security measures for Internet Banking IDs encompass encryption protocols, multi-factor authentication, secure login credentials, session timeouts, security alerts, secure network infrastructure, and customer education. These measures work together to ensure the confidentiality, integrity, and availability of customer information, providing users with the peace of mind they need to conduct their online banking activities confidently.

Common Issues with Internet Banking ID

While Internet Banking IDs provide numerous benefits, they can sometimes be accompanied by certain challenges and issues. It’s important for users to be aware of these common issues to ensure a smooth online banking experience. Let’s explore some of the common issues that users may encounter with their Internet Banking IDs:

- Forgotten Passwords: One of the most common issues users face is forgetting their password. This can happen due to various reasons, such as not logging in for a prolonged period or using a complex password. To overcome this, most banks have password recovery options, such as security questions or links to reset the password via email or SMS.

- Locked Accounts: Accounts can sometimes be locked if multiple incorrect login attempts are made or due to suspicious activity. If an account is locked, users may need to contact their bank’s customer service to resolve the issue and regain access to their online banking account.

- Technical Glitches: Occasionally, users may experience technical glitches or system downtime with the online banking platform. This can disrupt access to Internet Banking IDs and prevent users from performing transactions or accessing account information. In such cases, it is advisable to contact the bank’s customer service to report the issue and seek assistance.

- Phishing and Online Scams: Phishing attacks and online scams are significant concerns in the realm of internet banking. Fraudsters may attempt to trick users into revealing their Internet Banking ID credentials and other personal information through fraudulent emails, websites, or phone calls. It is essential to exercise caution, never share sensitive information with unknown sources, and regularly update security software to prevent falling victim to such scams.

- Device Compatibility: Compatibility issues between different devices and browsers can sometimes affect the functionality of online banking platforms. Users may encounter difficulties accessing or using their Internet Banking ID due to these compatibility issues. Banks usually provide a list of recommended devices and browsers to ensure a seamless online banking experience.

- Security Risks: While banks implement robust security measures, there is always a potential risk of security breaches or data leaks. Cybercriminals are constantly evolving their tactics to exploit vulnerabilities in online banking systems. Banks work diligently to enhance security protocols and promptly address any detected threats, but users should also stay vigilant and report any unusual activities or suspicious transactions to their bank promptly.

It is important to note that many of these common issues can be mitigated by following best practices for online banking. Users should create strong and unique passwords, regularly update their security software, avoid clicking on suspicious links or downloading suspicious attachments, and stay informed about potential security risks and scams.

In summary, while Internet Banking IDs offer convenience and accessibility, users may encounter issues such as forgotten passwords, locked accounts, technical glitches, phishing scams, device compatibility, and security risks. By being aware of these common issues and taking necessary precautions, users can navigate online banking effectively and minimize any potential disruptions to their banking experience.

Best Practices for Using Internet Banking ID

To ensure a safe and secure online banking experience, it is essential to follow best practices when using your Internet Banking ID. By adopting these practices, you can protect your financial information and reduce the risk of unauthorized access. Here are some key best practices to consider:

- Create a Strong Password: Choose a unique and strong password for your Internet Banking ID. Use a combination of upper and lowercase letters, numbers, and special characters. Avoid using commonly used passwords or easily guessable information like birthdates or pet names.

- Keep Your Internet Banking ID Confidential: Never share your Internet Banking ID credentials with anyone. Be cautious of phishing attempts and only enter your login information on secure and trusted websites. Banks will never ask for your password or personal information through email or phone calls.

- Regularly Update Your Password: Change your Internet Banking ID password periodically. Set a reminder to update your password every few months to enhance security. Avoid using the same password for multiple accounts and refrain from saving your password on public or shared devices.

- Enable Multi-Factor Authentication: If available, opt for multi-factor authentication. This adds an extra layer of security by requiring additional verification, such as a one-time password (OTP) sent to your registered mobile number, or biometric authentication using fingerprints or facial recognition.

- Monitor Account Activity: Regularly check your account activity and transaction history to identify any suspicious or unauthorized transactions. Report any discrepancies to your bank immediately. Enable email or SMS alerts for notifications of significant account activities, such as large withdrawals or balance changes.

- Keep Software and Devices Updated: Ensure that your computer, smartphone, or any device used for online banking is equipped with updated security software, antivirus protection, and the latest operating system. Regularly install security updates and patches to protect against potential vulnerabilities.

- Use Secure Networks: When accessing your Internet Banking ID, avoid using public Wi-Fi networks or insecure connections. Stick to trusted and secure Wi-Fi networks or use your mobile network data for online banking transactions to minimize the risk of interception of your data.

- Regularly Review Bank Statements: Take the time to review your bank statements periodically to verify the accuracy of transactions. If you notice any fraudulent or unauthorized activity, contact your bank immediately.

- Securely Log Out: After completing your online banking tasks, always log out from your account. Simply closing the browser or app may not be sufficient. Logging out ensures that your account remains secure, especially if you are using a shared or public device.

- Stay Informed: Stay updated about the latest security practices and be aware of common online scams and threats. Banks often provide resources and educational materials to help users understand and navigate potential risks associated with online banking.

By adopting these best practices, you can better protect your Internet Banking ID and ensure the security of your online banking transactions. Remember, vigilance and proactive measures are vital for a safe and seamless online banking experience.

Conclusion

Internet Banking IDs have revolutionized the way we manage our finances, providing convenience, accessibility, and security in the digital age. With an Internet Banking ID, customers can access their online banking accounts anytime and anywhere, perform transactions, and stay on top of their financial health.

Throughout this article, we have explored the definition of Internet Banking ID, how it works, its benefits, security measures, common issues, and best practices for using it. Internet Banking IDs serve as personal keys that unlock access to online banking services securely. By using strong encryption, multi-factor authentication, and secure login credentials, banks and financial institutions strive to protect customer information and transactions.

Best practices such as creating strong passwords, regularly updating login credentials, enabling multi-factor authentication, monitoring account activity, and staying informed about potential security risks can further enhance the security of Internet Banking IDs.

While Internet Banking IDs offer convenience and accessibility, users may encounter common issues such as forgotten passwords, locked accounts, technical glitches, phishing scams, device compatibility, and security risks. By being aware of these challenges and taking necessary precautions, individuals can navigate online banking effectively and minimize any potential disruptions to their banking experience.

The adoption of Internet Banking IDs has transformed the way individuals manage their finances. With greater convenience, accessibility, and security, users can confidently conduct their financial transactions online, save time, and take control of their financial well-being.

In conclusion, Internet Banking IDs have become an integral part of the modern banking landscape, facilitating efficient and secure online banking experiences. By understanding the value of Internet Banking IDs and implementing the recommended best practices, users can enjoy the benefits of digital banking while safeguarding their financial information.