Finance

What Is A Banking ID

Published: October 12, 2023

Discover the importance of a Banking ID and how it enhances your financial security. Stay protected and manage your finance seamlessly with a unique Banking ID.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of modern banking, where convenience and security go hand in hand. In today’s digital age, managing your finances has become easier than ever before, thanks to the advancements in technology. One essential tool that plays a crucial role in accessing and safeguarding your financial information is a banking ID. Whether you’re a seasoned account holder or a newbie to the financial world, understanding what a banking ID is and how it can benefit you is vital.

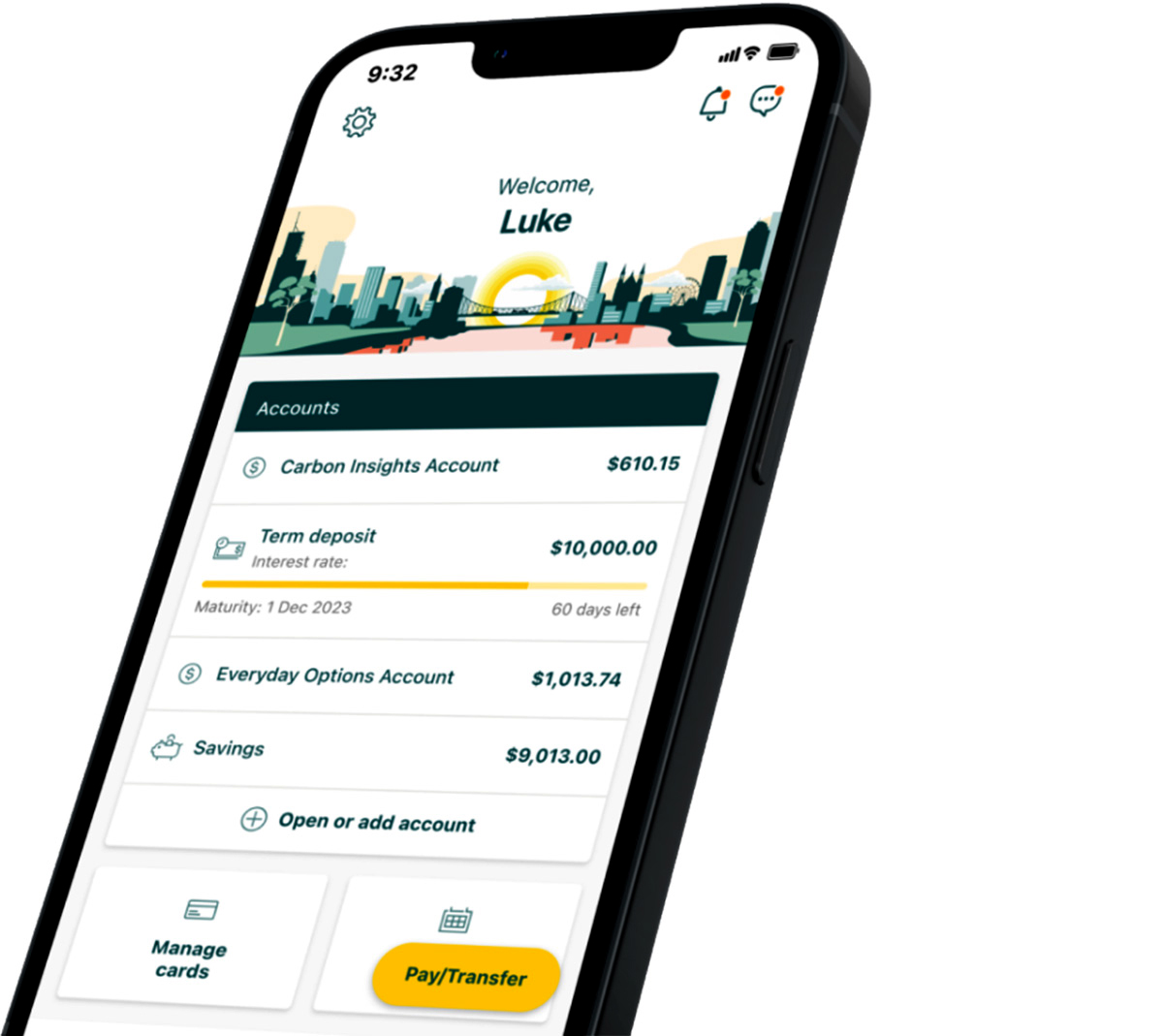

A banking ID, also known as an online banking ID or user ID, is a unique alphanumeric code that allows you to securely access your financial accounts online. It serves as your digital signature or virtual key, granting you permission to log in to your bank’s website or mobile app and perform a range of banking tasks from the comfort of your home or on the go.

Gone are the days when one had to physically visit a bank branch to check account balances, transfer funds, or make payments. With a banking ID, you have the power to manage your finances at your fingertips, 24/7. This convenient and secure mode of banking has revolutionized the way people handle their money and has become an integral part of modern banking services.

Now that we have a basic understanding of what a banking ID is, let’s explore why it’s essential to have one and how to obtain it.

Definition of Banking ID

A banking ID, also known as an online banking ID or user ID, is a unique identifier provided by a financial institution that allows customers to access their banking services online. It is a combination of letters, numbers, or a combination of both, created to ensure the security and privacy of the user’s financial information.

When a customer registers for online banking, they are typically required to create a banking ID along with a strong password. This ID serves as a login credential to access their account securely and perform various banking transactions remotely. It acts as a virtual key, granting the customer the ability to view account balances, transfer funds, pay bills, and more.

The banking ID is encrypted and stored in the financial institution’s database, ensuring that only the user and authorized personnel can access it. It is important to keep the banking ID confidential and not share it with anyone to prevent unauthorized access to your account.

Moreover, some financial institutions may offer additional security measures, such as two-factor authentication, where users are required to provide an additional verification code or answer security questions to further protect their accounts.

Overall, a banking ID is a secure and convenient way for individuals to access their financial accounts and conduct transactions online. It provides a layer of protection against unauthorized access and helps ensure the safety and privacy of the user’s financial information.

Importance of Banking ID

The importance of a banking ID cannot be overstated in today’s digital banking landscape. Here are several key reasons why having a banking ID is essential:

- Secure Access: A banking ID provides a secure and private way for individuals to access their financial accounts. It acts as a digital key, ensuring that only authorized users can log in and perform transactions.

- Convenience: With a banking ID, individuals can access their accounts anytime, anywhere, without the need to physically visit a bank branch. This convenience allows for efficient management of finances, even outside of banking hours.

- Account Management: A banking ID enables users to view their account balances, monitor transactions, transfer funds, and pay bills seamlessly. It provides full control over one’s financial activities, giving users the ability to track their spending and make timely payments.

- Enhanced Security Features: Financial institutions implement various security measures to protect users’ accounts, and a banking ID is a part of that security framework. It may be coupled with features such as two-factor authentication, biometric login, or unique security questions to ensure the highest level of protection.

- Reduced Paperwork: By utilizing a banking ID, individuals can reduce the need for paper statements, receipts, and physical documents. Most transactions and communication can be carried out electronically, reducing clutter and promoting sustainability.

- Efficient Bill Payments: With a banking ID, users can set up automatic bill payments, eliminating the need for manual checks and postage. This streamlines the bill payment process and helps avoid late fees or missed payments.

- Access to Additional Services: Many financial institutions offer additional services and features exclusively to online banking users. This can include personalized financial insights, budgeting tools, and access to exclusive promotions or offers.

In summary, a banking ID offers a secure and convenient gateway to one’s financial accounts. It empowers users with control over their finances, enhances security, and provides access to a range of online banking services and features.

How to Obtain a Banking ID

To obtain a banking ID, follow these steps:

- Choose a Financial Institution: Research and select a reputable financial institution that offers online banking services. Consider factors such as customer reviews, security measures implemented, and the range of services provided.

- Visit the Institution’s Website: Go to the official website of the chosen financial institution and navigate to the online banking section. Look for the “Register” or “Sign Up” option.

- Provide Your Information: Fill out the required information on the registration form. This typically includes personal details such as your full name, date of birth, address, and social security number. Be sure to provide accurate information to avoid any issues in the future.

- Create a Strong Password: Choose a strong password that includes a combination of letters, numbers, and special characters. Avoid using easily guessable information such as your birthdate or name. The password serves as an additional layer of security for your banking ID.

- Set Security Questions: Some financial institutions may require you to set up security questions and provide answers. These questions act as an extra layer of protection to verify your identity in case you need to recover your account or perform certain sensitive transactions.

- Read and Accept Terms and Conditions: Familiarize yourself with the terms and conditions presented by the financial institution. Make sure you understand the rights and responsibilities associated with the online banking service, and accept the terms to proceed.

- Verify Your Identity: Depending on the financial institution, you may need to verify your identity through additional steps. This can involve providing a copy of your identification documents, such as a driver’s license or passport, or answering security questions based on your previous financial history.

- Receive Your Banking ID: Once your registration is complete and your identity has been verified, you will receive your banking ID. This is usually provided in the form of an email or displayed on the screen. Make sure to keep this information secure and avoid sharing it with anyone.

Remember, the specific steps and requirements may vary among financial institutions. It is always advisable to refer to the provided instructions and guidance on the official website of your chosen institution to ensure a smooth and secure process.

Features and Benefits of Banking ID

A banking ID offers a range of features and benefits that enhance the overall banking experience. Let’s explore some of the key features and benefits:

- Secure Authentication: A banking ID ensures secure authentication by acting as a unique identifier. This prevents unauthorized individuals from accessing your financial information and provides an additional layer of protection for your accounts.

- 24/7 Account Access: With a banking ID, you have around-the-clock access to your accounts. You can check balances, view transaction history, and manage your finances at any time, from anywhere, as long as you have an internet connection.

- Convenient Account Management: Banking IDs allow you to perform a wide range of financial tasks conveniently, such as transferring funds between accounts, paying bills, setting up automatic payments, and managing standing orders. These functionalities streamline your financial management and save you time and effort.

- Mobile Banking Capabilities: Many financial institutions offer mobile apps that allow you to access your accounts using your banking ID. This enables you to manage your money on the go, from your smartphone or tablet, providing flexibility and convenience.

- Enhanced Security Features: Banking IDs often come with enhanced security features to protect your financial information. This can include two-factor authentication, biometric login (such as fingerprint or face recognition), and real-time fraud monitoring to ensure the utmost security for your accounts.

- E-Statements and Notifications: By using a banking ID, you can opt for electronic statements (e-statements) instead of traditional paper statements. These e-statements are secure, easily accessible, and help reduce paper waste. Additionally, you can receive notifications and alerts related to account activities and important updates.

- Financial Insights and Budgeting Tools: Some banking platforms provide financial insights and tools to help you manage your money effectively. These may include spending categorization, budgeting tools, and personalized recommendations to help you make informed financial decisions.

- Customer Support: Most financial institutions offer dedicated customer support for online banking customers. You can get assistance with any issues or queries related to your accounts, transactions, or technical difficulties via phone, email, or live chat.

These features and benefits make a banking ID an invaluable tool for managing your finances efficiently, securely, and conveniently. By utilizing your banking ID, you can take control of your financial well-being and enjoy a seamless banking experience.

Frequently Asked Questions about Banking ID

Here are some commonly asked questions regarding banking IDs:

-

What is the difference between a banking ID and a password?

A banking ID is a unique identifier provided by the financial institution, while a password is a secret code created by the user as a security measure. The banking ID is used in combination with the password to authenticate the user’s identity and grant access to their online banking account. -

Can I change my banking ID?

Typically, banking IDs are not editable once created. It is a permanent identifier associated with your online banking account. However, you may have the option to change your password if needed. -

What should I do if I forget my banking ID?

If you forget your banking ID, contact your financial institution’s customer support. They will guide you through the process of recovering or resetting your banking ID. Be prepared to provide necessary information to verify your identity. -

Can I use the same banking ID for multiple accounts?

It depends on your financial institution’s policies. Some institutions allow you to link multiple accounts to a single banking ID, while others may require a separate banking ID for each account. -

Is a banking ID secure?

Financial institutions take several measures to ensure the security of banking IDs. These measures may include encryption, two-factor authentication, and other security protocols. However, it is essential to keep your banking ID and password confidential and avoid sharing them with anyone. -

Can I access my banking ID from different devices?

Yes, you can usually access your online banking account using your banking ID from various devices, including desktops, laptops, smartphones, and tablets. Ensure that the device and network you use are secure and trusted. -

Is it possible to have multiple banking IDs for the same financial institution?

Generally, financial institutions allow customers to have only one banking ID per account. However, you can have multiple accounts linked to a single banking ID in some cases. -

What should I do if I suspect unauthorized access to my account?

If you notice any suspicious activity or suspect unauthorized access to your account, contact your financial institution immediately. They will guide you on the steps to take, such as changing your password, reviewing transactions, and reporting any fraudulent activity.

These are just a few common questions about banking IDs. It is important to familiarize yourself with your financial institution’s specific guidelines and policies regarding online banking and the use of banking IDs.

Conclusion

A banking ID is more than just a unique identifier; it is the key that unlocks a world of secure, convenient, and efficient online banking. It provides individuals with the ability to manage their finances on their own terms, anytime, anywhere. With features such as secure authentication, 24/7 account access, and enhanced security measures, banking IDs offer a wide range of benefits.

By obtaining a banking ID, you gain access to a host of online banking services, including balance inquiries, fund transfers, bill payments, and more. These features streamline your financial management, save time, reduce paperwork, and provide valuable insights into your spending habits.

One of the greatest advantages of a banking ID is the peace of mind it offers. With robust security measures and real-time fraud monitoring, financial institutions strive to ensure the safety and privacy of your financial information. However, it is important to take responsibility for keeping your banking ID and password confidential to further protect your accounts.

Whether you’re a tech-savvy user or new to online banking, a banking ID is essential in today’s digital age. It empowers you to have control over your finances with just a few clicks or taps on your preferred device.

Remember to choose a reputable financial institution, follow their registration process, and keep your banking ID information secure. With a banking ID in hand, you can enjoy the convenience and security of online banking, making your financial journey smoother and more efficient.

So, don’t wait any longer. Take the first step towards effortless banking and obtain your banking ID today!