Finance

What Does Capital Markets Analyst Do

Modified: December 30, 2023

Discover the role of a Capital Markets Analyst in the finance industry. Gain insights into their responsibilities, skills, and the impact they have on the global market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

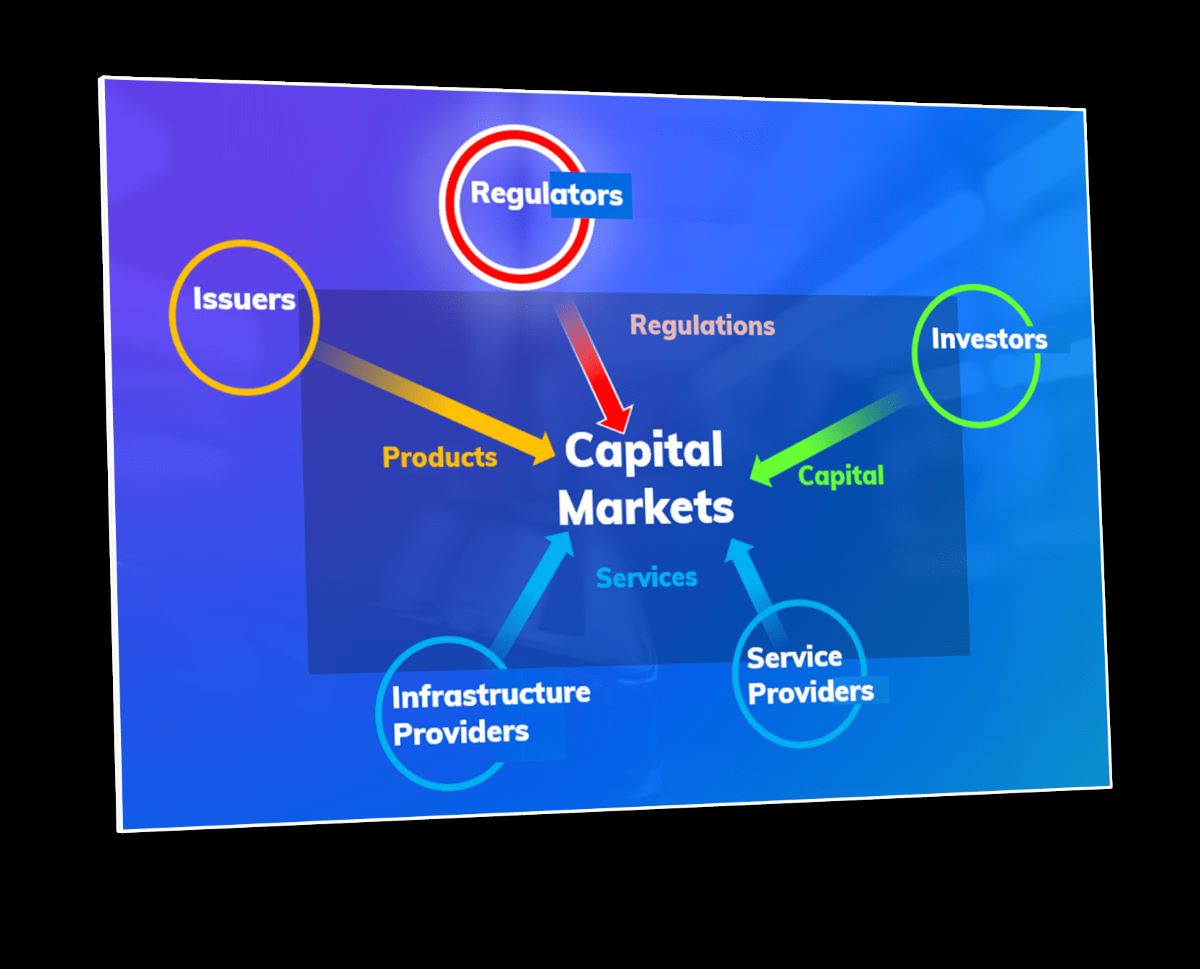

A capital markets analyst is a financial professional who specializes in analyzing and evaluating the performance of capital markets, such as stocks, bonds, and commodities. They are responsible for conducting extensive research, monitoring market trends, and providing recommendations to investors and financial institutions.

Capital markets analysts play a critical role in helping investors make informed investment decisions by providing insights and analysis into the performance and potential risks associated with various financial instruments. Their expertise and knowledge of market dynamics are essential in understanding and predicting market trends and assisting clients in optimizing their investment strategies.

As financial markets become increasingly complex and interconnected, the role of a capital markets analyst has become more vital than ever. In an ever-evolving landscape, these professionals serve as the bridge between investors and the financial markets, providing valuable information that influences investment decisions.

In this article, we will delve into the details of what a capital markets analyst does, from their responsibilities and skills required to their educational background and career outlook. Whether you are considering a career as a capital markets analyst or simply want to gain a better understanding of their role, this article will provide you with a comprehensive overview.

Definition of Capital Markets Analyst

A capital markets analyst is a financial professional who specializes in analyzing and evaluating the performance of various capital markets, including stocks, bonds, derivatives, and commodities. They are responsible for conducting thorough research, collecting and analyzing data, and providing insights and recommendations to investors and financial institutions.

Capital markets analysts work closely with investment bankers, portfolio managers, and other financial professionals to help inform investment decisions. They use their expertise and knowledge of market dynamics to assess the value and risk of different financial instruments and provide guidance on investment strategies.

The role of a capital markets analyst involves monitoring market trends, analyzing economic indicators, and assessing the financial health of companies. They use financial models and statistical techniques to analyze data and make predictions about market conditions and investment opportunities.

Capital markets analysts also stay updated on regulatory changes and industry news that could impact capital markets. They need to have a solid understanding of financial instruments, valuation techniques, and risk management principles.

In addition to analyzing financial data, capital markets analysts often communicate their findings and recommendations to clients and internal stakeholders through reports, presentations, and meetings. Effective communication skills are crucial in this role to ensure that complex financial information can be clearly understood by others.

Overall, the primary goal of a capital markets analyst is to provide accurate and actionable insights that help clients make informed investment decisions. By analyzing market trends, assessing risks, and evaluating financial data, they play a crucial role in helping investors navigate the complex world of capital markets.

Responsibilities of a Capital Markets Analyst

A capital markets analyst has a wide range of responsibilities that revolve around analyzing and evaluating the performance of capital markets. Their role involves conducting extensive research, monitoring market trends, and providing recommendations to investors and financial institutions. Here are some of the key responsibilities of a capital markets analyst:

- Analyzing Financial Data: Capital markets analysts are responsible for collecting and analyzing financial data related to various investment instruments, such as stocks, bonds, derivatives, and commodities. They use financial models, statistical techniques, and other analytical tools to evaluate the performance, risks, and potential returns of these instruments.

- Monitoring Market Trends: It is the duty of capital markets analysts to stay updated on the latest market trends, economic indicators, and regulatory changes that impact capital markets. They closely monitor factors such as interest rates, inflation, political developments, and industry news to identify potential investment opportunities and risks.

- Conducting Market Research: Capital markets analysts conduct extensive research on companies, industries, and market sectors to identify promising investment opportunities. This involves analyzing financial statements, industry reports, and company news to assess the financial health, growth potential, and competitive position of different companies.

- Preparing Reports and Recommendations: Capital markets analysts prepare detailed reports and recommendations based on their analysis and research findings. These reports provide insights into investment opportunities, risks, and potential returns. They also communicate their recommendations to clients and internal stakeholders through presentations, meetings, and written reports.

- Assessing Risk: Managing risk is a critical aspect of the capital markets analyst’s role. They evaluate the risk factors associated with different investment instruments and provide recommendations on risk mitigation strategies. This involves assessing the creditworthiness of issuers, evaluating market volatility, and considering macroeconomic factors that may impact investments.

- Collaborating with Stakeholders: Capital markets analysts work closely with investment bankers, portfolio managers, and other financial professionals to inform investment decisions. They collaborate with these stakeholders to gather insights, share research findings, and develop investment strategies that align with clients’ goals and risk tolerance.

- Continuous Learning: The capital markets landscape is constantly evolving, and analysts need to stay updated on industry trends, regulations, and new investment products. They engage in continuous learning, attend industry conferences, and pursue professional certifications to enhance their knowledge and skills.

Overall, the responsibilities of a capital markets analyst comprise analyzing financial data, monitoring market trends, conducting research, preparing reports and recommendations, assessing risk, collaborating with stakeholders, and engaging in continuous learning. By fulfilling these responsibilities, they play a crucial role in guiding investment decisions and helping clients achieve their financial objectives.

Skills and Qualifications required for a Capital Markets Analyst

A capital markets analyst must possess a combination of technical skills, analytical abilities, and personal qualities to excel in their role. Here are some of the key skills and qualifications required for a capital markets analyst:

- Financial Analysis: A strong foundation in financial analysis is essential for a capital markets analyst. They should have a deep understanding of financial statements, valuation techniques, and investment analysis. Proficiency in financial modeling, statistical analysis, and the ability to interpret complex data are crucial skills.

- Market Knowledge: Capital markets analysts need a comprehensive understanding of various financial markets, including stocks, bonds, derivatives, and commodities. They should be well-versed in market trends, economic indicators, and regulatory changes that impact capital markets. Keeping up to date with industry news and following market developments is essential.

- Research Skills: Strong research skills are vital for capital markets analysts, as they need to collect and analyze vast amounts of data to make informed investment recommendations. They should be proficient in gathering information from a variety of sources, such as financial statements, industry reports, and market research, and have the ability to critically evaluate the validity and reliability of the data.

- Quantitative and Analytical Skills: Capital markets analysts must possess excellent quantitative and analytical skills. They should have a solid understanding of statistics, mathematical concepts, and financial modeling techniques. The ability to interpret complex data, identify trends, and draw meaningful insights is crucial for their analysis and recommendations.

- Communication Skills: Effective communication skills are vital for capital markets analysts. They need to be able to present their findings and recommendations clearly and concisely to clients and internal stakeholders. Strong written and verbal communication skills, including the ability to explain complex financial concepts in simple terms, are necessary to effectively convey information and influence decision-making.

- Critical Thinking and Problem-Solving: Capital markets analysts should possess strong critical thinking and problem-solving abilities. They need to be able to analyze complex financial situations, identify potential risks and opportunities, and develop innovative strategies. The ability to think critically, make logical decisions, and solve problems efficiently is crucial in this role.

- Time Management: The role of a capital markets analyst requires managing multiple tasks and adhering to strict deadlines. Strong time management and organizational skills are necessary to prioritize work effectively, meet deadlines, and handle the pressure of a fast-paced environment.

- Teamwork and Collaboration: Capital markets analysts often work as part of a team and collaborate with various stakeholders, such as portfolio managers, investment bankers, and research analysts. They should possess strong teamwork and collaboration skills to effectively communicate, share ideas, and work towards common goals.

While a bachelor’s degree in finance, economics, or a related field is typically required for a career as a capital markets analyst, additional certifications such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM) can enhance career prospects and demonstrate expertise and commitment to the field.

In summary, a capital markets analyst should possess financial analysis skills, market knowledge, research skills, quantitative and analytical skills, communication skills, critical thinking and problem-solving abilities, time management skills, and teamwork and collaboration skills. These qualifications, combined with a solid educational background and relevant certifications, can pave the way for a successful career in capital markets analysis.

Educational Requirements for a Capital Markets Analyst

To become a capital markets analyst, a solid educational foundation in finance, economics, or a related field is typically required. While specific educational requirements may vary depending on the employer and the complexity of the role, here are the general educational requirements for a capital markets analyst:

Bachelor’s Degree: Most employers in the finance industry require a bachelor’s degree as a minimum educational qualification. A degree in finance, economics, business administration, or a related field provides students with a solid understanding of financial principles, markets, and investment strategies. Courses in accounting, statistics, financial analysis, and economics are particularly beneficial for aspiring capital markets analysts.

Master’s Degree: While not always mandatory, some employers may prefer candidates with a master’s degree in finance, economics, or a relevant discipline. A master’s degree offers a more in-depth understanding of financial markets, advanced quantitative analysis techniques, and specialized knowledge in areas such as portfolio management or financial risk management. Pursuing a master’s degree can enhance job prospects and provide a competitive edge in the field.

Professional Certifications: While not strictly educational requirements, earning professional certifications can greatly enhance the qualifications of a capital markets analyst. The most widely recognized certification for finance professionals is the Chartered Financial Analyst (CFA) designation, offered by the CFA Institute. Becoming a CFA charterholder involves passing a series of rigorous exams covering topics such as ethics, financial analysis, investment management, and portfolio management. Other certifications such as the Financial Risk Manager (FRM) or Certified Investment Management Analyst (CIMA) can also be valuable for specializing in specific areas within capital markets analysis.

Continuing Education: The finance industry is ever-evolving, and capital markets analysts need to stay updated on the latest trends, regulations, and investment strategies. Continuing education through workshops, seminars, webinars, and industry conferences is crucial for professionals to enhance their knowledge, gain new insights, and develop their skills. Many financial institutions and professional organizations offer professional development programs and educational resources specifically tailored to capital markets analysts.

Internships and Work Experience: While not a formal educational requirement, gaining relevant work experience through internships or entry-level positions is highly recommended for aspiring capital markets analysts. Internships provide valuable hands-on experience in analyzing financial markets, conducting research, and working with industry professionals. This practical experience can significantly enhance a candidate’s resume and improve their chances of securing a full-time position in the field.

While a strong educational background is essential, it is important to note that educational requirements alone may not be sufficient for success as a capital markets analyst. Developing practical skills, such as financial analysis, research, and communication skills, through internships, extracurricular activities, or personal projects is equally important in preparing for a career in capital markets analysis.

In summary, the educational requirements for a capital markets analyst typically include a bachelor’s degree in finance, economics, or a related field, with the option of pursuing a master’s degree for advanced knowledge and specialization. Professional certifications and continuing education also play a significant role in enhancing qualifications and staying competitive in the field.

Career Outlook for Capital Markets Analysts

The career outlook for capital markets analysts is generally positive, driven by the continuous growth and complexity of global financial markets. As the demand for investment advice and analysis remains strong, qualified professionals in this field can expect to find promising career opportunities. Here are some key factors influencing the career outlook for capital markets analysts:

Increasing Demand: With the expansion of global financial markets, there is a growing need for professionals who can provide in-depth analysis and insights into capital market trends. As investors seek to optimize their investment strategies and manage risks effectively, the role of capital markets analysts becomes increasingly vital.

Globalization and Diversification: The globalization of financial markets has opened up new investment avenues and created complex interdependencies. Capital markets analysts play a crucial role in understanding and analyzing these market dynamics, allowing investors to make informed decisions across a wide range of geographic regions and asset classes.

Advancements in Technology: Technological advancements, such as big data analytics, artificial intelligence, and machine learning, are transforming the finance industry, including capital markets analysis. Capital markets analysts who can leverage these technologies to extract actionable insights from vast amounts of data have a competitive advantage in the job market.

Risk Management Emphasis: In the aftermath of the global financial crisis, risk management has gained significant importance. Capital markets analysts with expertise in assessing and managing risks in investment portfolios are highly sought after by financial institutions and investors seeking to mitigate potential losses.

Regulatory Changes: Increased scrutiny and regulatory reforms in the financial industry have placed a greater emphasis on transparency and accountability. Capital markets analysts who can navigate complex regulatory frameworks and effectively communicate compliance measures to clients are in high demand.

Career Progression: Career progression for capital markets analysts often involves advancing to managerial or senior analyst positions. As they gain experience and develop a strong track record of successful investment recommendations, opportunities for leadership roles and higher compensation increase.

Industry Specialization: Capital markets analysts may choose to specialize in specific sectors or asset classes, such as equities, fixed income, commodities, or alternative investments. Specialization can lead to niche career opportunities and potentially higher earning potential.

Continuing Professional Development: The finance industry is continuously evolving, with new investment strategies, products, and regulatory requirements. Capital markets analysts who actively engage in continuing professional development, such as pursuing advanced certifications or attending industry conferences, are better positioned to adapt to changes and remain competitive.

In summary, the career outlook for capital markets analysts is favorable, driven by the increasing demand for their expertise, the globalization of financial markets, technological advancements, emphasis on risk management, regulatory changes, and opportunities for career progression and specialization. While competition in this field is strong, individuals with strong analytical skills, industry knowledge, and a commitment to ongoing learning and professional development can find rewarding and fulfilling career opportunities in capital markets analysis.

Conclusion

A career as a capital markets analyst offers an exciting and rewarding path for individuals with a strong interest in finance, a knack for quantitative analysis, and a passion for understanding and navigating the complexities of the financial markets.

Throughout this article, we have explored the role of a capital markets analyst, including their responsibilities, required skills and qualifications, educational requirements, and the career outlook in this field. It is evident that capital markets analysts play a critical role in providing valuable insights and recommendations to investors and financial institutions, helping them make informed investment decisions.

To excel in this profession, capital markets analysts need a combination of technical skills, such as financial analysis and market knowledge, as well as personal qualities like critical thinking, communication, and teamwork. Continuous learning and staying updated with industry trends and regulatory changes are also crucial in this ever-evolving field.

The career outlook for capital markets analysts appears positive, driven by the increasing demand for investment analysis expertise in a globalized and diversified financial landscape. Advancements in technology and the focus on risk management and regulatory compliance further contribute to the significance of this role.

Aspiring capital markets analysts should consider pursuing a bachelor’s degree in finance, economics, or a related field, followed by specialized certifications like the Chartered Financial Analyst (CFA) designation. Additionally, gaining practical work experience through internships or entry-level positions can provide a competitive edge when entering the job market.

In conclusion, a career as a capital markets analyst offers opportunities for personal and professional growth, as well as the chance to contribute to the success of investors and financial institutions. By leveraging their expertise in financial analysis, market knowledge, and risk management, capital markets analysts play a crucial role in guiding investment decisions and navigating the complexities of the financial markets.