Finance

What Does Pending Credit Mean Bank Of America

Modified: February 21, 2024

Learn what "pending credit" means at Bank of America and how it impacts your finances. Get the answers you need to manage your money effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of banking, where financial transactions are made easy and convenient. One such feature that comes into play when dealing with finances is the concept of pending credit. In this article, we will explore what pending credit means specifically in the context of Bank of America, one of the leading banking institutions worldwide.

Pending credit is an important aspect of banking that impacts both consumers and businesses. Whether you’re awaiting a deposit, a transfer, or a refund, understanding the process and implications of pending credit can help you manage your finances more effectively.

Bank of America, with its wide range of services and a strong presence, is known for prioritizing the needs of its customers. This includes providing clear and transparent information about pending credit and offering efficient processes to facilitate financial transactions. Whether you’re a Bank of America customer or simply interested in learning more about the financial industry, this article will provide you with valuable insights.

By delving into the depths of pending credit, we’ll explore its definition, the process involved, as well as the benefits and limitations that come with it. Additionally, we’ll provide you with tips on how to monitor and manage pending credit effectively. So, let’s dive in and unravel the mysteries surrounding pending credit with Bank of America!

Definition of Pending Credit

Before we dive into the nitty-gritty details of pending credit, let’s start by understanding what it actually means. Pending credit refers to a temporary hold or delay placed on funds that are being deposited into your Bank of America account.

When you engage in a transaction that involves receiving money, such as receiving a direct deposit from your employer, a refund from a retailer, or a transfer from another bank, the funds may not immediately appear in your account. Instead, they go through a process called pending credit.

During this period, the funds are considered pending and are not yet available for withdrawal or use. The pending credit status is not limited to Bank of America; other financial institutions use a similar concept as well.

The aim of pending credit is to ensure that the funds being deposited are legitimate and that there are no issues or discrepancies with the transaction. It acts as a security measure to protect both the bank and the account holder, preventing fraudulent activity and potential losses.

Typically, pending credit lasts for a short period of time, usually a few days, before the funds become fully available for use. However, the exact duration may vary depending on various factors, such as the type of transaction, the source of the funds, and the policies of Bank of America.

It’s important to note that pending credit is different from actual credit. It does not mean that you have received additional funds or that your account balance has increased. Rather, it indicates that the funds are in the process of being verified and will be credited to your account shortly.

Now that we have a clear understanding of what pending credit means, let’s explore the process involved in pending credit at Bank of America.

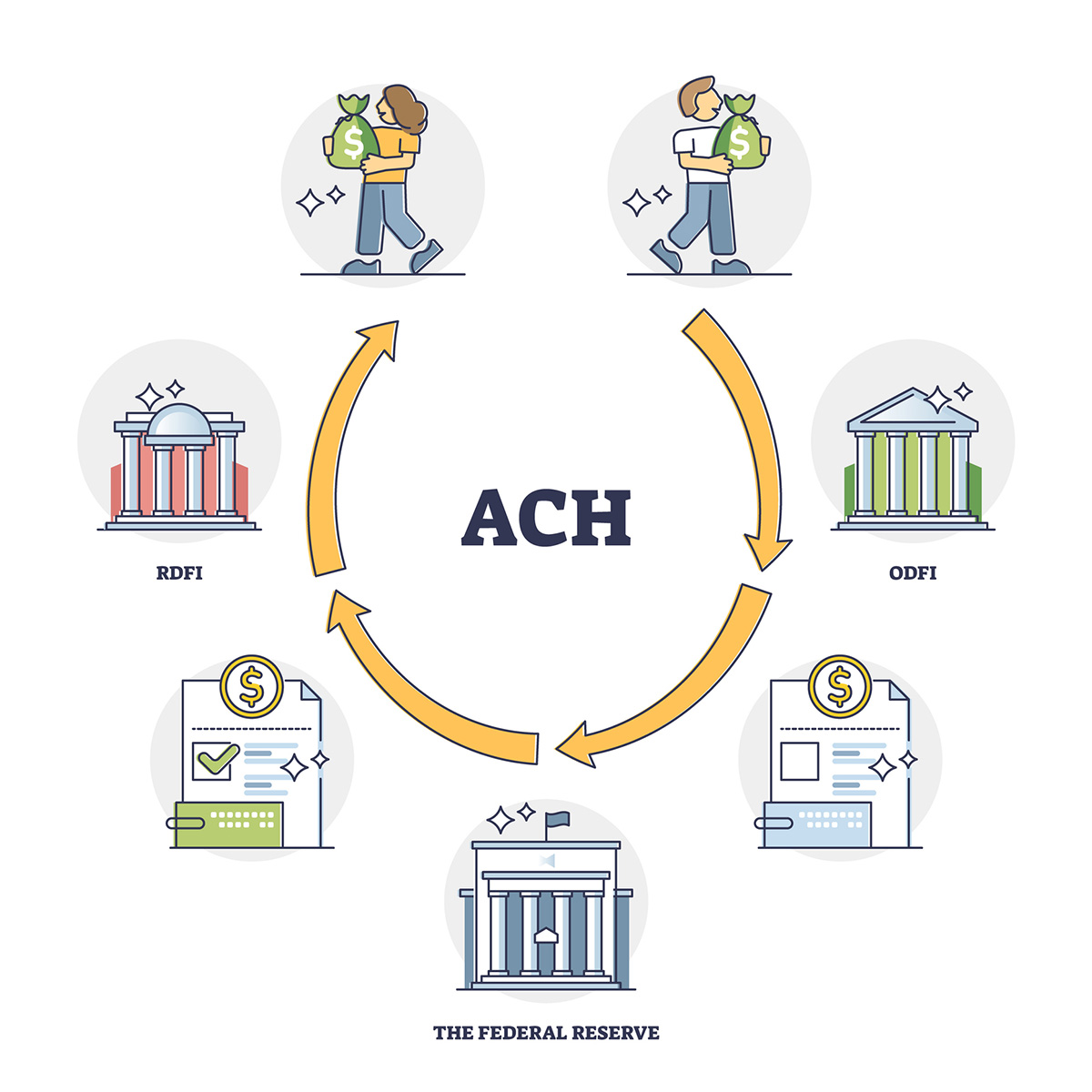

Process of Pending Credit in Bank of America

Understanding the process of pending credit in Bank of America can help demystify the inner workings of financial transactions. When a deposit or transfer is made to your Bank of America account, it goes through several stages before the funds become fully available for use. Let’s take a closer look at the typical process involved:

- Initiation: The pending credit process begins when a deposit or transfer is initiated. This can be done through various channels, such as electronic transfers, direct deposits, or mobile check deposits.

- Verification: Once the funds are initiated, Bank of America verifies the transaction to ensure its authenticity. This involves checking for any potential issues or discrepancies, such as insufficient funds or suspicious activity.

- Pending Status: During the verification process, the funds are marked as pending credit. This means that they are temporarily held and not yet available for withdrawal or use. The pending status allows Bank of America to thoroughly review the transaction and mitigate any risks.

- Clearing Period: The duration of the pending credit period varies depending on several factors. In some cases, it may be a few hours, while in others, it could last up to several business days. Bank of America uses this time to complete the necessary checks and ensure the transaction meets all requirements.

- Final Credit: Once the pending credit period is over and the transaction has passed all necessary verifications, the funds are credited to your account. At this point, they become fully available for withdrawal or use.

It’s essential to note that pending credit is not limited to incoming transactions. Outgoing transactions, such as bill payments and outgoing transfers, can also go through a pending status. This helps ensure that the funds are properly allocated and the transaction meets all necessary requirements.

The overall process of pending credit is designed to provide security and peace of mind to both Bank of America and its customers. By carefully reviewing each transaction, Bank of America can mitigate risks and protect against fraudulent activity.

Now that we’ve explored the process of pending credit, let’s move on to discuss the benefits that come with it.

Benefits of Pending Credit

Pending credit offers several benefits for both Bank of America and its customers. Let’s explore some of the key advantages:

- Fraud Protection: Pending credit acts as a security measure, safeguarding against fraudulent transactions. By placing a temporary hold on funds, Bank of America can thoroughly review each transaction and ensure its legitimacy, protecting both the bank and the account holder from potential losses.

- Verification Process: The pending credit period allows Bank of America to verify the accuracy of the transaction. This includes checking if the funds are sufficient and ensuring that all necessary documentation and requirements are met. This verification process helps maintain the integrity of the financial system and reduces the risk of errors or unauthorized activity.

- Error Correction: In case of any discrepancies or errors in the transaction, pending credit gives Bank of America the opportunity to rectify the issue before the funds are fully credited. This ensures that any mistakes or issues are resolved promptly, minimizing potential inconveniences for the account holder.

- Transparent Process: Pending credit provides transparency in the banking system. When funds are held in pending status, account holders can easily track and monitor the progress of their transactions. This transparency helps build trust between the bank and its customers, enhancing satisfaction and peace of mind.

- Effective Fund Management: By providing a temporary hold on funds, pending credit allows account holders to have a clearer picture of their available balance. This is particularly beneficial for managing finances and avoiding overdrafts. Account holders can make informed decisions on their spending and ensure they have sufficient funds to cover their expenses.

The benefits of pending credit extend beyond individual transactions. They contribute to the overall stability and security of the banking system, establishing trust between financial institutions and their customers. By implementing pending credit, Bank of America demonstrates its commitment to providing a safe and reliable platform for financial transactions.

Now that we’ve explored the benefits of pending credit, let’s discuss its limitations and the possible risks associated with it.

Limitations and Risks of Pending Credit

While pending credit serves as a valuable security mechanism, it is important to be aware of its limitations and potential risks. Let’s delve into some of the key considerations:

- Delayed Access to Funds: One of the main limitations of pending credit is that it temporarily restricts access to the deposited funds. During the pending credit period, the money is on hold and cannot be freely used or withdrawn. This may cause inconvenience for individuals who need immediate access to their funds.

- Uncertain Duration: The duration of the pending credit period can vary, making it challenging to accurately predict when the funds will be fully available. This can be particularly frustrating when trying to plan and manage financial obligations.

- Inconvenience for Time-Sensitive Transactions: Pending credit can present difficulties for time-sensitive transactions, such as bill payments or urgent fund transfers. If the funds do not clear within the required timeframe, it may result in late payments or missed opportunities.

- Financial Planning Challenges: The temporary hold on funds due to pending credit can disrupt financial planning. Individuals may need to account for the pending status when assessing their available funds, potentially leading to confusion or miscalculations.

- Potential for Disputes: In certain cases, especially for disputed transactions or when additional documentation is required, the pending credit period can be prolonged. This can lead to frustration and disputes between account holders and the bank, creating an inconvenience for both parties involved.

It’s important to note that while pending credit aims to protect against fraud and ensure the accuracy of transactions, it is not foolproof. There is still a possibility of unauthorized or fraudulent activity occurring despite the pending credit process.

To mitigate the risks associated with pending credit, it is crucial to monitor your accounts regularly, review transaction details, and promptly report any suspicious activities to Bank of America. By remaining vigilant and proactive, you can minimize potential risks and disruptions.

Now that we’ve explored the limitations and risks of pending credit, let’s discuss how to effectively monitor and manage pending credit in Bank of America.

How to Monitor and Manage Pending Credit

Effectively monitoring and managing pending credit in your Bank of America account can help you stay on top of your finances and ensure a smooth banking experience. Here are some key tips to help you navigate the process:

- Regular Account Monitoring: Make it a habit to review your account regularly. This includes checking your transaction history and keeping an eye out for any pending credits or debits. By staying informed, you can track the progress of your transactions and address any issues promptly.

- Utilize Online Banking and Mobile Apps: Bank of America offers convenient online banking platforms and mobile apps that allow you to access your account information anytime, anywhere. Take advantage of these tools to monitor your pending credits and stay updated on the status of your transactions.

- Set up Account Alerts: Bank of America allows you to set up customizable account alerts that notify you of important updates and changes in your account. Consider enabling alerts for pending credits, which will keep you informed when funds are being held in the pending status.

- Understand Transaction Timeframes: Different types of transactions may have varying timeframes for pending credit. Familiarize yourself with the typical processing times for common transactions like direct deposits or electronic transfers. This will help you anticipate when funds will be available in your account.

- Communicate with Bank of America: If you encounter any issues or have questions regarding pending credit, don’t hesitate to reach out to Bank of America’s customer service. They can provide guidance and clarification on transaction statuses, processing times, and any specific concerns you may have.

- Plan Ahead: Given the potential for a delay in accessing your funds, it’s important to plan your finances accordingly. Avoid relying on pending credits for time-sensitive payments or immediate cash needs. Plan in advance to ensure you have enough available funds to cover your expenses.

By following these strategies, you can effectively monitor and manage pending credit in your Bank of America account. Stay proactive, stay informed, and communicate with your bank whenever necessary to ensure a seamless banking experience.

As we conclude, let’s recap what we’ve covered so far.

Conclusion

Pending credit is an integral part of the banking process, especially when it comes to managing funds in your Bank of America account. Understanding the concept of pending credit, its benefits, limitations, and the ways to effectively monitor and manage it can greatly enhance your financial experience.

In this article, we explored the definition of pending credit and how it works in the context of Bank of America. We learned that pending credit refers to a temporary hold placed on funds during the verification process, ensuring the legitimacy of transactions and protecting against fraudulent activity.

We discussed the process of pending credit in Bank of America, involving initiation, verification, pending status, clearing period, and final credit. We also explored the benefits of pending credit, such as fraud protection, transparent processes, and effective fund management.

However, we also highlighted some limitations and risks associated with pending credit, such as delayed access to funds and potential inconveniences for time-sensitive transactions. It’s essential to stay vigilant and proactive in monitoring your accounts and promptly reporting any issues or suspicious activities.

To effectively manage pending credit, we provided valuable tips, such as regular account monitoring, utilizing online banking and mobile apps, setting up account alerts, understanding transaction timeframes, and planning ahead.

In conclusion, pending credit plays a crucial role in the banking system, providing security and transparency for both financial institutions and account holders. By understanding and managing pending credit effectively, you can navigate your financial transactions with confidence and peace of mind.

Remember, if you have any specific concerns or questions about pending credit in your Bank of America account, reach out to their customer service for assistance. Stay informed, stay proactive, and enjoy a seamless banking experience!