Finance

What Does Pending Mean In Banking

Published: October 11, 2023

Learn what the term "pending" means in the banking industry and how it affects your finances. Get insights and tips on managing your pending transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of banking, where transactions happen at the click of a button or the swipe of a card. While the speed and convenience of modern banking are undeniable, there is a process that takes place behind the scenes that you may not always be aware of – the pending status.

When you see the term “pending” associated with a transaction in your banking statement or online portal, it means that the transaction has been initiated but has not been fully processed and completed. In simpler terms, it is in a temporary state of limbo, awaiting final authorization or approval.

Pending transactions are an integral part of the banking process, ensuring that funds are checked, verified, and allocated properly before they are credited or debited from an account. Understanding what pending means in banking is essential for managing your finances effectively and avoiding any unexpected surprises.

In this article, we will delve deeper into the concept of pending transactions in banking, how they can affect your account, and provide some practical tips for managing them. So, let’s dive in and unravel the mysteries behind those pending transactions!

Definition of Pending

The term “pending” refers to a transaction that is in progress but has not yet been finalized. It represents the interim stage between when a transaction is initiated and when it is fully completed or settled. During this period, the transaction is considered pending and may not be reflected in your account balance.

Pending transactions can apply to various types of banking activities, including deposits, withdrawals, transfers, bill payments, and even card transactions. Regardless of the transaction type, the pending status indicates that the processing of the transaction is still ongoing and has not been fully authorized or settled by the relevant financial institution.

When a transaction is marked as pending, it means that the necessary verification and authorization processes are being carried out. This can involve validating available funds, confirming the accuracy of the transaction details, and ensuring compliance with regulatory requirements, among other checks.

It is important to note that the duration for which a transaction remains pending may vary depending on the specific circumstances and the policies of the involved financial institution. Some transactions may only be pending for a few hours, while others could be pending for several days. The pending period allows the necessary due diligence to be performed and provides an opportunity for any discrepancies or issues to be resolved before the transaction is fully processed.

During the pending stage, the transaction may not have a direct impact on your available balance or account statement. This means that the pending transaction will not be included in your current balance or reflected in any recent transaction history. However, it is essential to keep in mind that these pending transactions can still affect your account in other ways, which we will explore further in the next section.

Pending Transactions in Banking

Pending transactions are a common occurrence in the world of banking and can be seen across various types of financial activities. Whether you’re making a purchase with your debit card, transferring funds between accounts, or depositing a check, the pending status is a temporary phase that signifies the transaction is in progress.

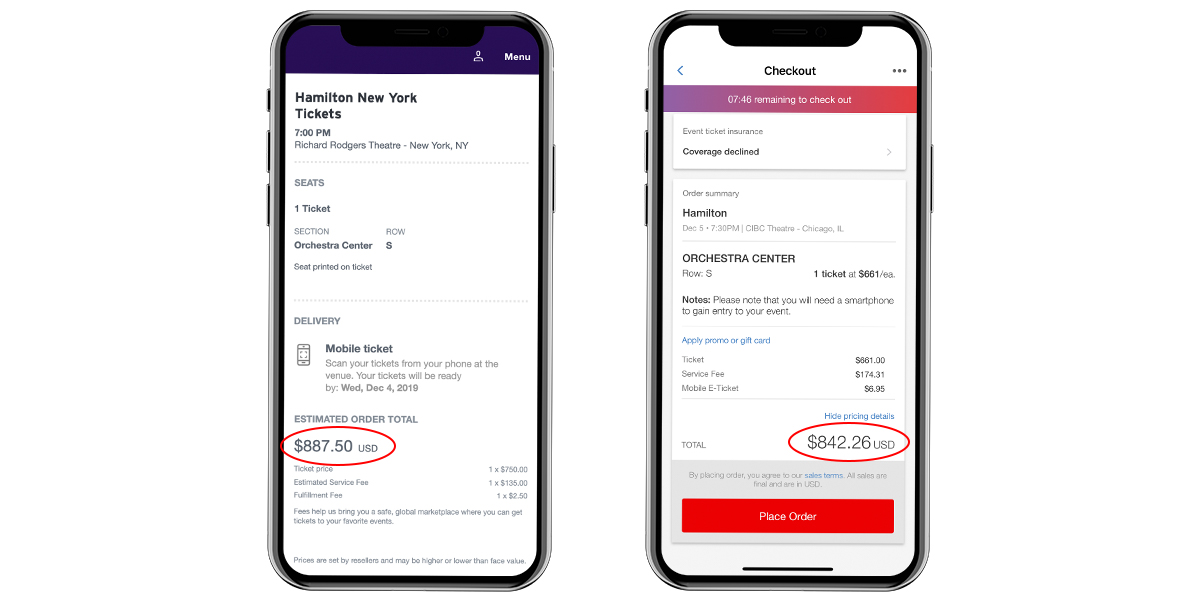

One of the most common instances of pending transactions is when you use your debit or credit card to make a purchase. When you swipe your card or enter your card details online, the transaction is immediately sent to the merchant for authorization. At this stage, the transaction is marked as pending, indicating that the funds have been allocated but not yet debited from your account. The pending status allows the merchant to verify the availability of funds and confirm the transaction before it is completed and reflected in your account statement.

In addition to card transactions, pending status can also be seen with other banking activities. For example, when you initiate a transfer between accounts or make a bill payment, the transaction will typically go through a pending phase. During this time, the financial institution processes the transaction details, verifying that the necessary funds are available and that all information is accurate. Once everything is confirmed, the transaction will be completed and the funds will be moved or debited from your account.

Another common scenario for pending transactions is when you deposit a check. Depending on the bank’s policies, the funds from the check may initially be shown as pending until they are fully processed and cleared. This ensures that the check is legitimate and that sufficient funds are available in the payer’s account. Once the check clears, the funds will no longer be listed as pending and will be available for use.

It’s important to note that while pending transactions are in progress, they may have an impact on your available balance. Although the funds may not be immediately debited from your account, they are set aside to cover the pending transaction. This means that the available balance shown in your account may be lower than your actual balance due to the pending transactions.

Understanding why transactions are marked as pending in banking is crucial for managing your finances effectively. It allows you to have a clearer picture of your true available balance and helps you avoid overdrawing your account or encountering unexpected fees or charges.

How Pending Transactions Affect Your Account

Pending transactions can have various impacts on your bank account, and it’s important to understand how they can affect your overall financial situation. While these transactions may not immediately impact your available balance, they can still have repercussions that you need to be aware of.

One of the primary ways that pending transactions affect your account is through the temporary reduction of your available balance. When a transaction is marked as pending, the funds required to cover that transaction are set aside and may not be available for other purposes. This means that even though the transaction has not yet been completed, those funds are essentially “held” until the transaction is finalized.

For example, if you make a purchase with your debit card at a store, the transaction will be pending until the merchant completes the transaction and it is fully processed by your bank. During this time, the funds needed to cover the purchase will be deducted from your available balance, reducing the amount you have for other transactions or withdrawals.

It’s important to keep track of your pending transactions, especially if you have upcoming bills or expenses. Failing to account for pending transactions in your available balance could lead to overdrawing your account or incurring overdraft fees. By understanding how pending transactions affect your account, you can avoid these unnecessary fees and stay in control of your finances.

Additionally, pending transactions can also impact your statement accuracy. Since pending transactions are not fully processed, they may not be reflected in your account statement immediately. This can make it challenging to reconcile your account or track your spending accurately.

Another way that pending transactions can affect your account is through transaction priority. In some cases, pending transactions may take precedence over other transactions, leading to a delay in the processing of subsequent transactions. This can impact the timing of bill payments, transfers, or other financial activities that rely on the availability of funds.

It’s essential to actively monitor your account for pending transactions and ensure that you have a clear understanding of your true available balance. This will help you avoid any potential overdrafts, inaccuracies in your financial records, or delays in important transactions.

Examples of Pending Transactions

Pending transactions can occur in various scenarios within the realm of banking. Here are a few examples of common pending transactions that you may encounter:

- Card Transactions: When you use your debit or credit card to make a purchase, the transaction is typically marked as pending until it is fully processed. This allows the merchant to verify the payment and ensure the availability of funds.

- Online Bill Payments: When you schedule a bill payment through your online banking portal, the payment may initially appear as pending. This is because the financial institution needs time to process and send the payment to the payee.

- Transfers Between Accounts: If you transfer funds from one bank account to another, the transaction will often go through a pending stage. This allows the banks involved to verify the account details and ensure that the transaction is valid.

- Check Deposits: When you deposit a check, especially through mobile banking, the funds from the check may be listed as pending until the check is fully processed and cleared by the issuing bank.

- Pre-Authorized Payments: If you have set up pre-authorized payments, such as subscription fees or automatic loan repayments, these transactions may appear as pending before they are officially processed on the scheduled payment date.

These are just a few examples of pending transactions in banking. It’s important to note that the duration for which a transaction remains pending can vary. Some transactions may be pending for only a few hours, while others may take several days to complete. It ultimately depends on the specific circumstances and the policies of the financial institution.

During the pending stage, it’s crucial to keep an eye on your transactions and ensure that you have sufficient funds available to cover them. This will help you avoid any potential overdrafts or delays in payments, ensuring smooth financial management.

How Long Do Transactions Stay Pending?

The duration for which transactions stay pending can vary depending on several factors, including the type of transaction and the policies of the financial institution involved. While some transactions may only be pending for a few hours, others can remain in this status for several days. Here are some factors that influence how long transactions stay pending:

- Merchant Processing Time: For card transactions, the pending status will typically last until the merchant completes the transaction and sends it for processing. This can range from a few minutes to a couple of days, depending on the merchant’s processes.

- Weekends and Holidays: Transactions initiated on weekends or holidays may experience longer pending periods. This is because many financial institutions have limited or no processing capabilities on such days, causing transactions to be delayed until the next business day.

- Transfer Types: Transfers between accounts within the same financial institution may have shorter pending periods compared to transfers between different institutions. Internal transfers are often processed more quickly due to the centralized nature of the financial institution’s systems.

- Check Clearing Time: If you deposit a check, the pending status may last until the check is cleared by the issuing bank. The clearing process can take several business days, particularly for out-of-town checks or larger amounts.

- Payment Processing: Online bill payments or pre-authorized payments can have varying pending periods based on the financial institution’s policies and the time required to send the payment to the respective payee.

It’s important to remember that even though a transaction is in pending status, the funds allocated for it are not available for other purposes. The pending amount is typically put on hold until the transaction is fully processed and settled.

If you have concerns or questions about a particular pending transaction, it is advisable to contact your financial institution. They can provide more specific information about their processing times and help address any issues or inquiries you may have.

Overall, the duration of pending transactions can vary depending on several factors. It’s important to stay vigilant and keep track of your pending transactions to ensure that you have an accurate understanding of your available funds and can effectively manage your finances.

Tips for Managing Pending Transactions

Managing pending transactions effectively is crucial for maintaining control over your finances and avoiding any potential issues or surprises. Here are some tips to help you navigate and manage pending transactions:

- Keep Track of Pending Transactions: Regularly monitor your account activity and make note of any pending transactions. This will help you have an accurate understanding of your available balance and ensure that you are aware of any upcoming debits or credits.

- Account for Pending Transactions in Your Budget: Take into account the pending transactions when planning your budget. Be mindful of the funds that are on hold and ensure that you have enough available for your essential expenses and upcoming obligations.

- Anticipate Delays During Weekends and Holidays: Keep in mind that transactions initiated on weekends or public holidays may experience delays in processing. Plan ahead and ensure that you have enough funds available to cover your expenses during these periods.

- Communicate with Billers and Payees: If you have upcoming payments or transactions that are pending, it may be helpful to inform the relevant billers or payees. This can help avoid any potential issues or late payment charges if the pending status causes a delay in the funds reaching their intended destination.

- Set Up Alerts and Notifications: Take advantage of the alerts and notifications provided by your financial institution. Set up alerts for when a transaction moves from pending to completed status or if your account balance falls below a certain threshold. This can help you stay informed and make timely financial decisions.

- Be Mindful of Overdrafts and Fees: Keep a close eye on your account balance, especially when you have pending transactions. Be cautious not to exceed your available balance and trigger overdraft fees. Having a buffer in your account can provide some peace of mind and prevent any potential financial stress.

- Stay in Contact with Your Financial Institution: If you have any questions or concerns about pending transactions, don’t hesitate to reach out to your financial institution. They can provide clarification, updates, and assistance in managing and resolving any issues that may arise.

By following these tips, you can effectively manage pending transactions and ensure that your financial matters run smoothly. Remember, staying proactive and informed is key to maintaining control over your banking activities and achieving your financial goals.

Conclusion

Understanding what “pending” means in the context of banking is crucial for managing your finances effectively. Pending transactions serve as temporary placeholders during the verification and processing stage, ensuring that funds are properly allocated and transactions are authorized before they are finalized.

Throughout this article, we have explored the definition of pending transactions, how they can affect your account, and provided several examples of common pending transactions you may encounter. We also discussed the varying durations for which transactions can stay pending and offered tips for managing them.

It’s important to remember that while pending transactions may not immediately impact your available balance or be reflected in your account statement, they can still affect your finances in terms of allocating funds and potential delays. Staying vigilant, keeping track of pending transactions, and factoring them into your budget are essential steps toward maintaining control over your finances.

By following the tips provided, such as anticipating delays during weekends and holidays, communicating with billers and payees, setting up alerts, and staying in contact with your financial institution, you can effectively manage pending transactions and mitigate any potential issues or fees.

Managing your finances requires attention to detail, organization, and proactive decision-making. With a solid understanding of pending transactions and the necessary strategies in place, you can navigate the banking world with confidence and ensure that your financial goals are met.

So, the next time you come across a pending transaction in your banking statement or online portal, embrace it as a temporary state in the transaction process. By staying informed and managing pending transactions effectively, you can maintain control over your finances and forge a path toward financial success.