Finance

What Does ACH Credit Mean In Banking

Modified: January 15, 2024

Learn what ACH credit means in banking and how it is related to finance. Explore the key concepts and benefits of this financial transaction method.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of banking and finance, where a multitude of terms and acronyms can sometimes make your head spin. One such term that you may have come across is “ACH credit,” but what exactly does it mean?

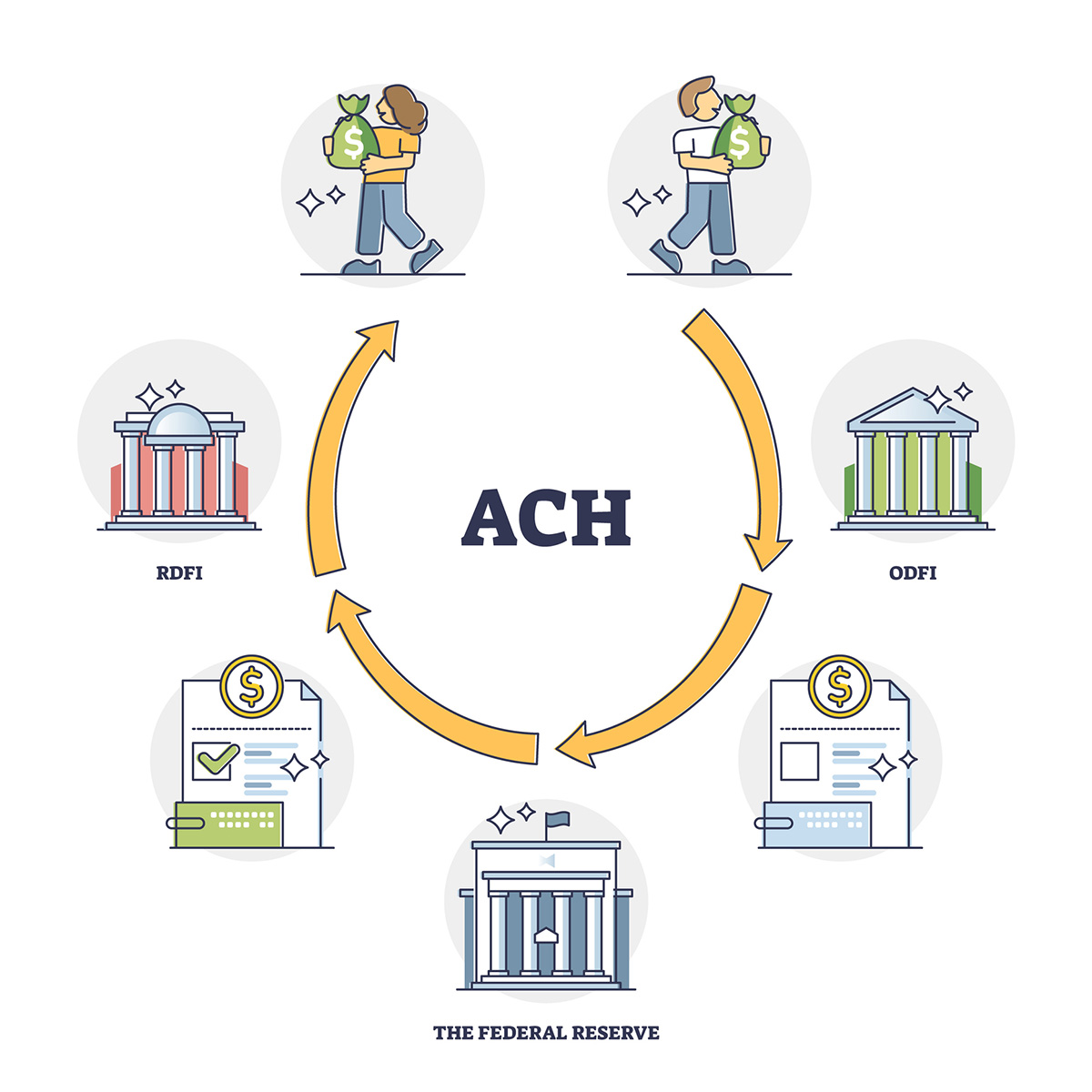

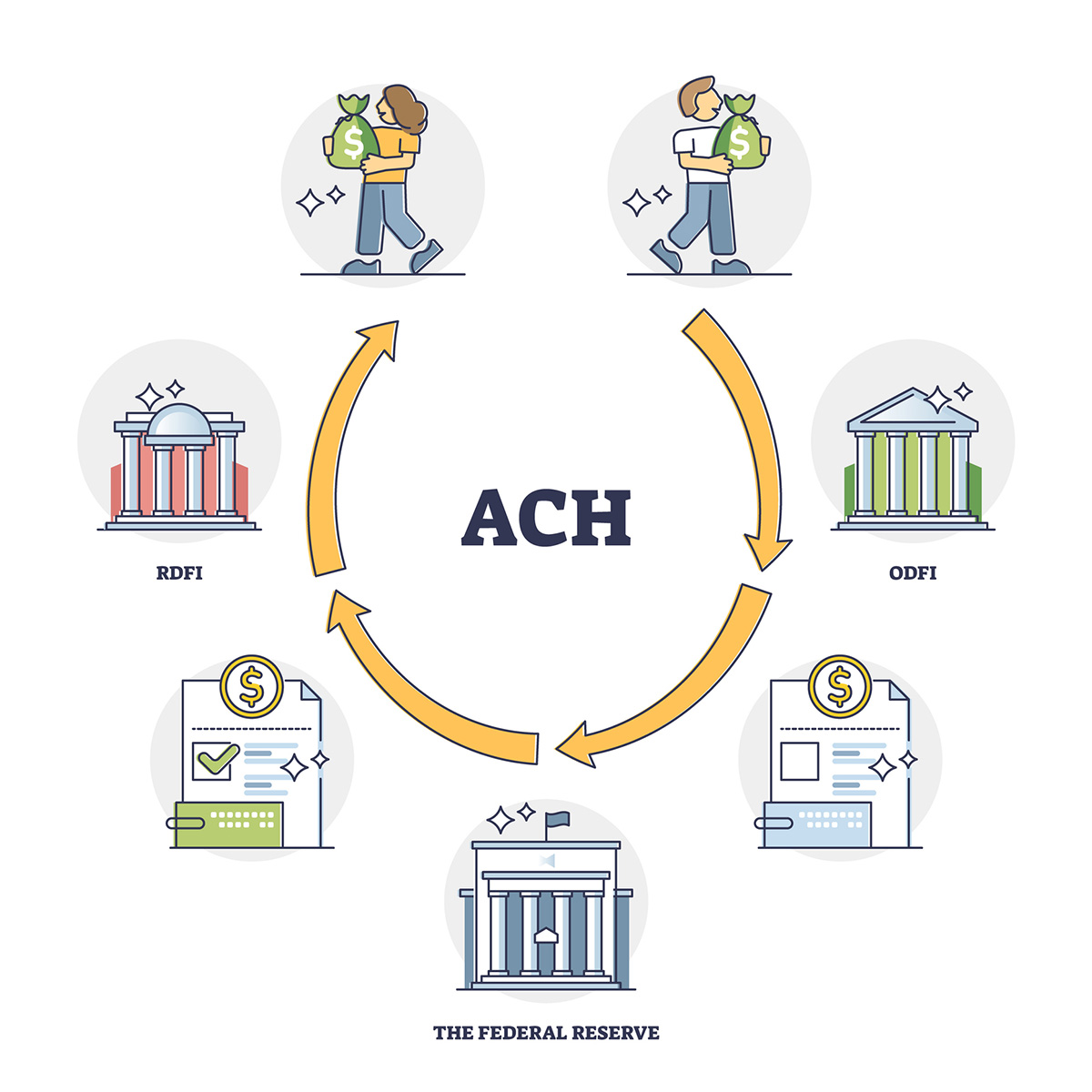

ACH, which stands for Automated Clearing House, is a widely-used electronic payment system in the United States. It allows individuals and businesses to send and receive funds securely and efficiently. Within this system, an ACH credit is a type of transaction where funds are transferred from one account to another, typically for the purpose of making a payment.

In simpler terms, when you receive an ACH credit, it means that someone has deposited money into your account electronically, without the need for physical checks or cash. This can be done for various reasons, such as receiving a salary, receiving a refund, or receiving a payment from a client or customer.

ACH credits offer a convenient and cost-effective alternative to paper checks and cash transactions. They provide a faster way to transfer funds compared to traditional methods, allowing for quicker access to money and streamlined payment processes. Whether you’re an individual or a business, understanding how ACH credits work can be beneficial in managing your finances effectively.

Now that you have a basic understanding of what ACH credits are, let’s dive deeper into how they work, their advantages and disadvantages, and some real-life examples to help you grasp the concept even better.

Definition of ACH Credit

An ACH credit, as mentioned earlier, refers to a specific type of electronic funds transfer within the Automated Clearing House (ACH) system. It involves the movement of funds from one bank account to another, initiated by the sender who authorizes the transfer.

When someone sends you an ACH credit, they provide their bank with your account number and the necessary information to complete the transaction. The sender’s bank then withdraws the funds from their account and transfers them to your bank account via the ACH network.

It’s important to note that ACH credits can be used for both one-time and recurring payments. For example, if you’re receiving your monthly salary, it would likely be set up as a recurring ACH credit. On the other hand, if a client is paying a one-time invoice, it would be a single ACH credit transaction.

ACH credits are regulated by the National Automated Clearing House Association (NACHA), which sets the rules and guidelines for ACH transactions in the United States. These guidelines ensure the security, reliability, and efficiency of ACH transfers, providing protection for both the sender and the recipient.

Overall, ACH credits have revolutionized the way money is moved between accounts, eliminating the need for physical checks, reducing the risk of errors and fraud, and streamlining the payment process for individuals and businesses alike.

How ACH Credits Work

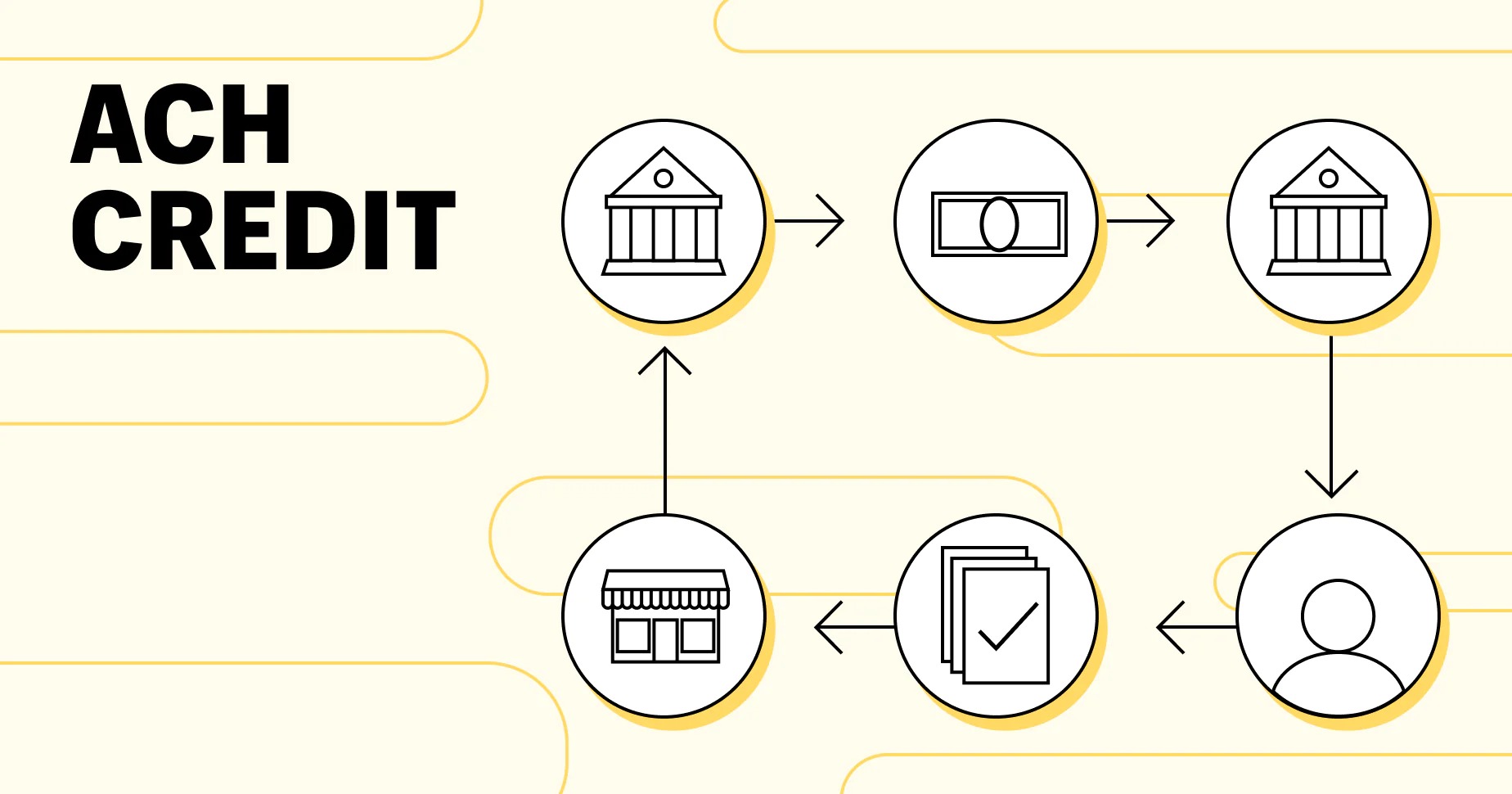

Now that we have a grasp of what ACH credits are, let’s delve deeper into how they work. The process of an ACH credit transaction can be broken down into several steps:

- Initiation: The sender, whether an individual or a business, initiates the ACH credit transaction. They provide their bank with your account information, including the routing number and account number, along with the amount to be transferred.

- Authorization: The sender’s bank verifies the account information and the availability of funds. Once validated, the sender authorizes the transfer by providing their consent.

- Fund withdrawal: The sender’s bank withdraws the specified funds from their account, reducing their balance accordingly. This typically happens on the same day or within a couple of days after initiating the transaction.

- Transfer through ACH network: The sender’s bank transmits the payment details and the requested transfer to the ACH network. The ACH network acts as a central hub, routing the information to the recipient’s bank.

- Recipient bank processing: The recipient’s bank receives the ACH credit request and processes it. This involves validating the recipient’s account information and ensuring the funds are credited to the correct account.

- Fund deposit: Once the recipient’s bank verifies the information and approves the transaction, the funds are credited to the recipient’s account. The recipient can then access the funds and use them as needed.

It’s worth noting that the timeframe for ACH credit transactions can vary. While many transfers are completed within one to two business days, it’s possible for some transfers to take longer. This can depend on various factors, such as the banks involved, the volume of transfers being processed, and any specific timing requirements specified by the sender or recipient.

Overall, the ACH system provides a convenient and secure method for transferring funds between accounts electronically. It eliminates the need for paper checks, reduces processing times, and allows for seamless financial transactions.

Advantages of ACH Credits

ACH credits offer several advantages for both individuals and businesses. Let’s explore some of the key benefits:

- Efficiency and speed: With ACH credits, funds can be transferred electronically, eliminating the need for physical checks or cash. This results in quicker and more efficient transactions, as there is no need to wait for checks to be processed or physically deposited.

- Convenience: ACH credits provide a convenient way to send and receive payments. Recurring payments, such as monthly salaries or mortgage payments, can be set up as automatic transfers, saving time and effort for both the sender and recipient.

- Cost-effective: ACH credits are generally more cost-effective compared to other payment methods, such as wire transfers or paper checks. Banks typically charge lower fees for ACH transactions, making it a cost-efficient option for businesses and individuals.

- Enhanced security: ACH credits offer a high level of security. The transaction process is electronic, reducing the risk of lost or stolen checks. Additionally, all ACH transactions are subject to stringent regulations and security measures set by NACHA and the banks involved.

- Improved cash flow management: ACH credits allow for quicker access to funds, enhancing cash flow management for businesses. With expedited transfers, businesses can have a better handle on their finances, enabling timely payments to suppliers or employees.

- Eco-friendly: By eliminating the need for paper checks and reducing reliance on physical documentation, ACH credits contribute to a more sustainable and eco-friendly payment system. This reduces paper waste and the carbon footprint associated with traditional check-based transactions.

Overall, the advantages of ACH credits make it a preferred payment method for many individuals and businesses. It offers speed, convenience, cost-effectiveness, and improved security, all while promoting efficient financial management and sustainable practices.

Disadvantages of ACH Credits

While ACH credits have numerous advantages, it’s important to recognize that there are also a few potential disadvantages to consider:

- Processing Time: Although ACH credits are generally faster than traditional check-based transactions, they may not be as instantaneous as other electronic payment methods, such as wire transfers. It can take one to two business days for the funds to be deposited into the recipient’s account.

- Transaction Limits: Some financial institutions may impose transaction limits on ACH credits. These limits can restrict the amount of money that can be transferred at one time, which may not be suitable for high-value transactions.

- Funds Availability: While the sender’s account is debited immediately after initiating an ACH credit, the recipient may not have immediate access to the funds. This can be problematic if the recipient needs immediate access to the money for time-sensitive payments.

- Reversal Challenges: Once an ACH credit transaction is initiated, it can be challenging to reverse or cancel the transfer. This can pose issues if there is an error in the transaction or if the sender needs to stop the payment.

- Potential for Fraud: Although ACH credits are generally secure, there is still a risk of fraud. Hackers and scammers may attempt to gain unauthorized access to account information or manipulate the transaction process, so it’s important to exercise caution and protect personal and banking information.

- Dependency on Technology: ACH credits rely heavily on electronic systems and technology. Any disruptions or issues with the banking systems or the ACH network can result in delays or complications with transactions.

It’s important to weigh the advantages and disadvantages of ACH credits based on your specific needs and requirements. While the disadvantages exist, they are typically outweighed by the benefits and widespread use of ACH credit transactions in today’s digital banking landscape.

Examples of ACH Credit Transactions

ACH credit transactions are widely used in various scenarios, both for personal and business purposes. Let’s explore a few examples to understand how ACH credits are utilized in real-life situations:

- Direct Deposits: Many employees receive their salaries via ACH credits. Instead of receiving physical checks, their employers deposit their pay directly into their bank accounts on a regular basis. This provides convenience and efficiency for both employers and employees.

- Vendor Payments: Businesses often use ACH credits to make payments to their vendors and suppliers. Rather than writing and mailing checks, they can initiate ACH credit transfers to pay for goods and services. This streamlines the payment process, reduces paperwork, and allows for faster transactions.

- Online Bill Payments: ACH credits are also commonly used for online bill payments. Individuals can set up recurring ACH credits with utility companies, credit card providers, mortgage lenders, and other service providers to automate their monthly payments. This ensures that their bills are paid on time without the hassle of writing and mailing checks.

- Tax Refunds: When taxpayers are eligible for a refund from the government, the funds can be disbursed through ACH credits. Instead of receiving a paper check, the refund is directly deposited into the taxpayer’s bank account, providing quicker access to the funds.

- Insurance Claims: Insurance companies often use ACH credits to settle claims. Once a claim has been approved and processed, the insurance company can send the funds directly to the policyholder’s bank account, minimizing delays and simplifying the reimbursement process.

These examples illustrate how ACH credits are utilized in various financial transactions. Whether it’s receiving salaries, paying bills, or settling insurance claims, ACH credits offer a secure, efficient, and convenient method for transferring funds electronically.

ACH Credit vs. ACH Debit

When it comes to electronic funds transfer through the Automated Clearing House (ACH) system, it’s important to understand the distinction between ACH credits and ACH debits. While similar in many ways, they have some fundamental differences:

ACH Credit:

- An ACH credit involves the transfer of funds from the sender’s account to the recipient’s account.

- The sender initiates the transaction and authorizes the transfer, typically for the purpose of making a payment to the recipient.

- ACH credits are used when funds need to be deposited into a recipient’s account, such as receiving salaries, refunds, or payments from clients or customers.

- The recipient’s account is credited with the transferred funds, increasing their available balance.

ACH Debit:

- An ACH debit, on the other hand, involves the transfer of funds from the recipient’s account to the sender’s account.

- The recipient authorizes the debit transaction, granting permission for the funds to be withdrawn from their account.

- ACH debits are used when funds need to be withdrawn from a recipient’s account, such as paying bills, making loan payments, or purchasing goods and services.

- The recipient’s account is debited with the transferred funds, reducing their available balance.

In summary, ACH credits are used to deposit funds into a recipient’s account, while ACH debits are used to withdraw funds from a recipient’s account. ACH credits increase the recipient’s available balance, while ACH debits decrease it.

Both ACH credits and ACH debits offer advantages and convenience in the electronic payment system. They eliminate the need for physical checks, enable faster transactions, and streamline financial processes for individuals and businesses.

Note that the ability to send or receive ACH credits and debits may vary depending on your bank and the specific services they offer. It’s advisable to check with your financial institution to understand their ACH capabilities and any associated fees or limitations.

Conclusion

ACH credits have become an integral part of the modern banking system, revolutionizing the way funds are transferred electronically. By providing a secure, efficient, and convenient method of payment, ACH credits offer numerous benefits for individuals and businesses alike.

With ACH credits, individuals can receive direct deposits, automate bill payments, and access their funds faster. For businesses, ACH credits streamline payment processes, improve cash flow management, and reduce costs associated with traditional payment methods.

Despite the advantages, it’s important to consider the limitations of ACH credits, including potential processing delays, transaction limits, and the need to protect against fraud. However, these disadvantages are generally outweighed by the convenience, cost-effectiveness, and enhanced security that ACH credits provide.

As the financial landscape continues to evolve, ACH credits remain a crucial component of the electronic payment system. They offer a reliable and efficient alternative to traditional methods, promoting faster transactions, reducing paperwork, and contributing to a more sustainable and eco-friendly banking system.

Understanding how ACH credits work and their benefits can empower individuals and businesses to make informed financial decisions, manage their funds effectively, and embrace the digital transformation in banking.

Whether you’re receiving your salary, paying bills, or settling business transactions, ACH credits can simplify and expedite your financial interactions, making them an essential tool in the modern era of finance.