Finance

Pension Funds Own What Share Of The S&P 500?

Published: January 23, 2024

Discover the percentage of the S&P 500 owned by pension funds. Explore the impact on finance and investment strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The Role of Pension Funds in S&P 500 Ownership

Pension funds play a pivotal role in the global financial landscape, channeling trillions of dollars into various investment avenues. Their influence extends to the stock market, where they are significant stakeholders in numerous companies. Understanding the extent of pension funds' ownership of the S&P 500, a leading stock market index, is crucial for comprehending the dynamics of institutional investing and its impact on the broader economy.

The ownership of the S&P 500 by pension funds is a topic of considerable interest and relevance. It sheds light on the allocation of retirement savings and the potential influence of these funds on corporate governance and market dynamics. As such, delving into the specifics of pension fund ownership within the S&P 500 provides valuable insights into the interplay between institutional investors and the equity market.

This article aims to explore the intricate relationship between pension funds and the S&P 500, offering a comprehensive analysis of the extent of pension fund ownership, the trends shaping their investment strategies, and the implications of their influence on the stock market. By examining these facets, readers will gain a deeper understanding of the role played by pension funds in shaping the dynamics of the S&P 500 and the broader financial ecosystem.

Overview of Pension Funds

Pension funds are instrumental in safeguarding the financial well-being of individuals during their retirement years. These funds are established by employers, government entities, or labor unions to provide a steady income stream to employees after they retire. Pension funds are typically funded through contributions from employers, employees, or both, and the accumulated assets are invested to generate returns that fund future pension obligations.

There are two primary types of pension funds: defined benefit (DB) and defined contribution (DC) plans. In a defined benefit plan, retirees receive a predetermined amount based on factors such as salary history and years of service. Meanwhile, defined contribution plans, such as 401(k) accounts, involve contributions from both employees and employers, with the retirement benefit contingent on the performance of the investment portfolio.

These funds are governed by fiduciary responsibilities, requiring them to act in the best interests of the plan participants and beneficiaries. As such, pension funds adhere to stringent investment guidelines and risk management practices to prudently manage the assets entrusted to them.

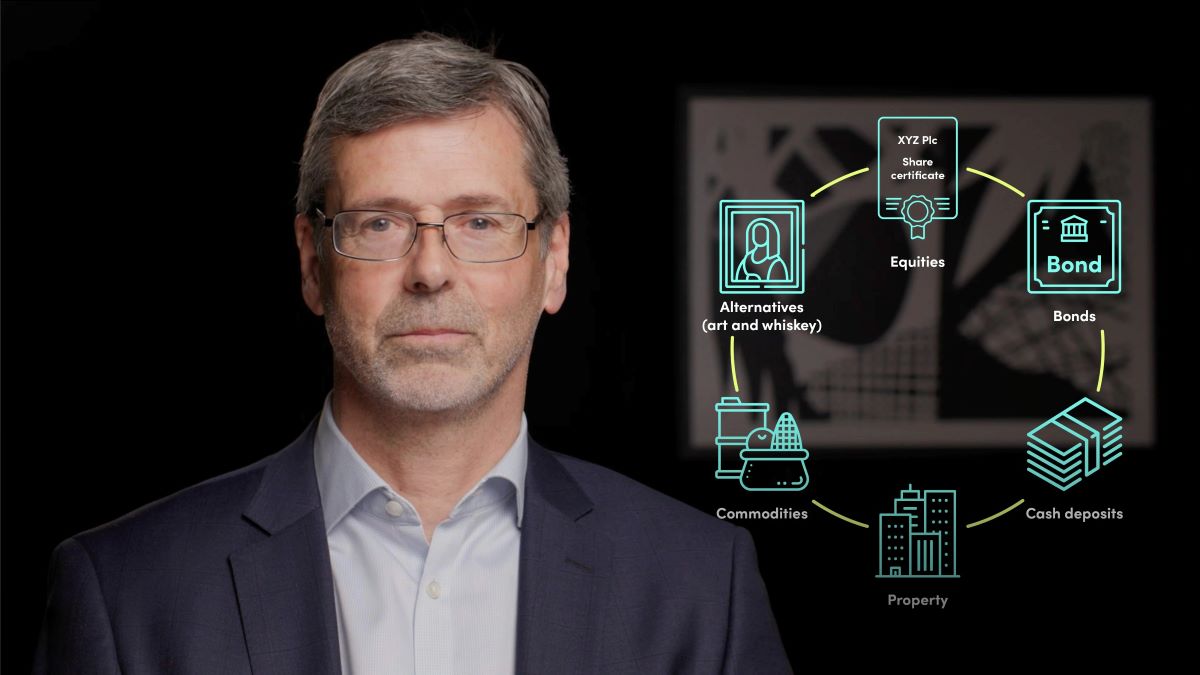

Given their long-term investment horizon and the need to meet future pension obligations, pension funds allocate their assets across various investment classes, including equities, fixed income securities, real estate, and alternative investments. The allocation decisions are guided by the fund’s investment objectives, risk tolerance, and market outlook, with the aim of achieving a balance between growth and income generation while mitigating risk.

Overall, pension funds play a crucial role in the financial ecosystem, serving as long-term investors with significant capital to deploy across diverse asset classes. Their investment decisions not only impact the financial markets but also have far-reaching implications for the retirement security of millions of individuals.

S&P 500 and Pension Fund Ownership

The S&P 500, often viewed as a barometer of the U.S. stock market, comprises 500 of the largest publicly traded companies. These companies collectively represent a substantial portion of the overall market capitalization, making the index a key benchmark for investors and financial professionals.

Pension funds are significant stakeholders in the S&P 500, with substantial investments in the constituent companies. Their ownership stakes in these companies afford them considerable influence in shaping corporate policies, governance practices, and strategic decisions. As long-term investors, pension funds prioritize sustainable growth and value creation, aligning their investment objectives with the long-term interests of the companies they invest in.

Given the size and scale of pension funds, their ownership of S&P 500 companies can have profound implications for the broader stock market. Their investment decisions, voting rights, and engagement with company management can impact shareholder value, corporate accountability, and the overall market sentiment.

Understanding the extent of pension fund ownership within the S&P 500 provides valuable insights into the distribution of institutional ownership, the concentration of voting power, and the potential for collaborative engagement among institutional investors. Moreover, it offers a glimpse into the alignment of pension fund investment strategies with the performance and governance practices of the companies comprising the index.

As such, the relationship between the S&P 500 and pension fund ownership underscores the interconnected nature of institutional investing and its impact on the equity market. Analyzing the ownership patterns and investment approaches of pension funds within the S&P 500 illuminates the dynamics of long-term investing, corporate stewardship, and the evolving landscape of institutional influence in the stock market.

Trends in Pension Fund Ownership

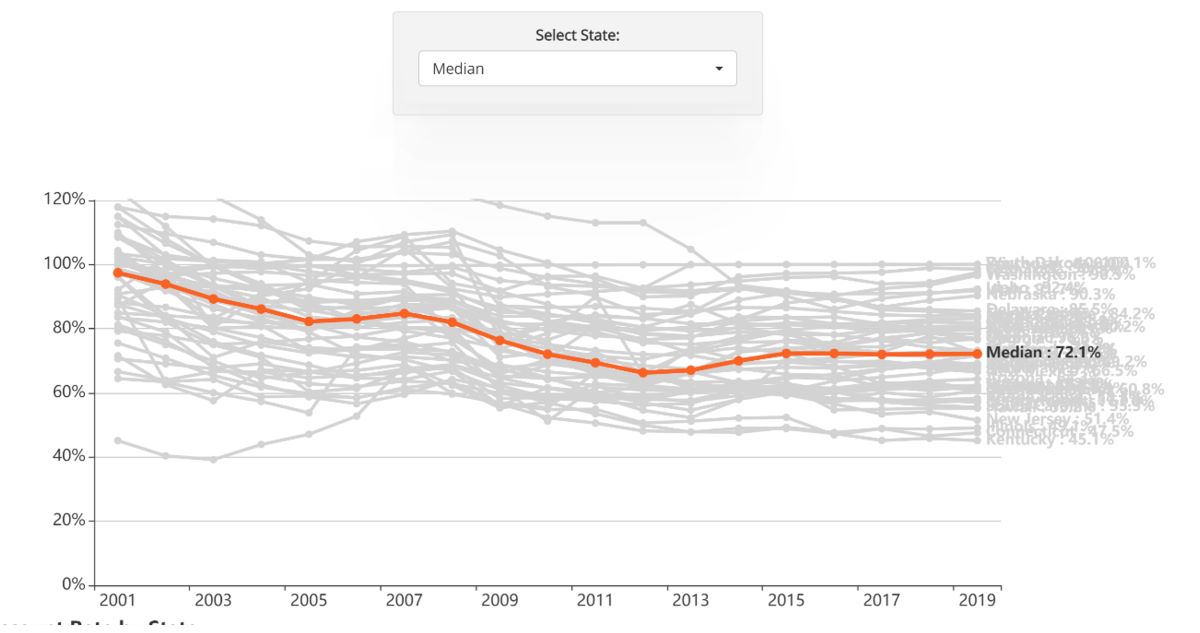

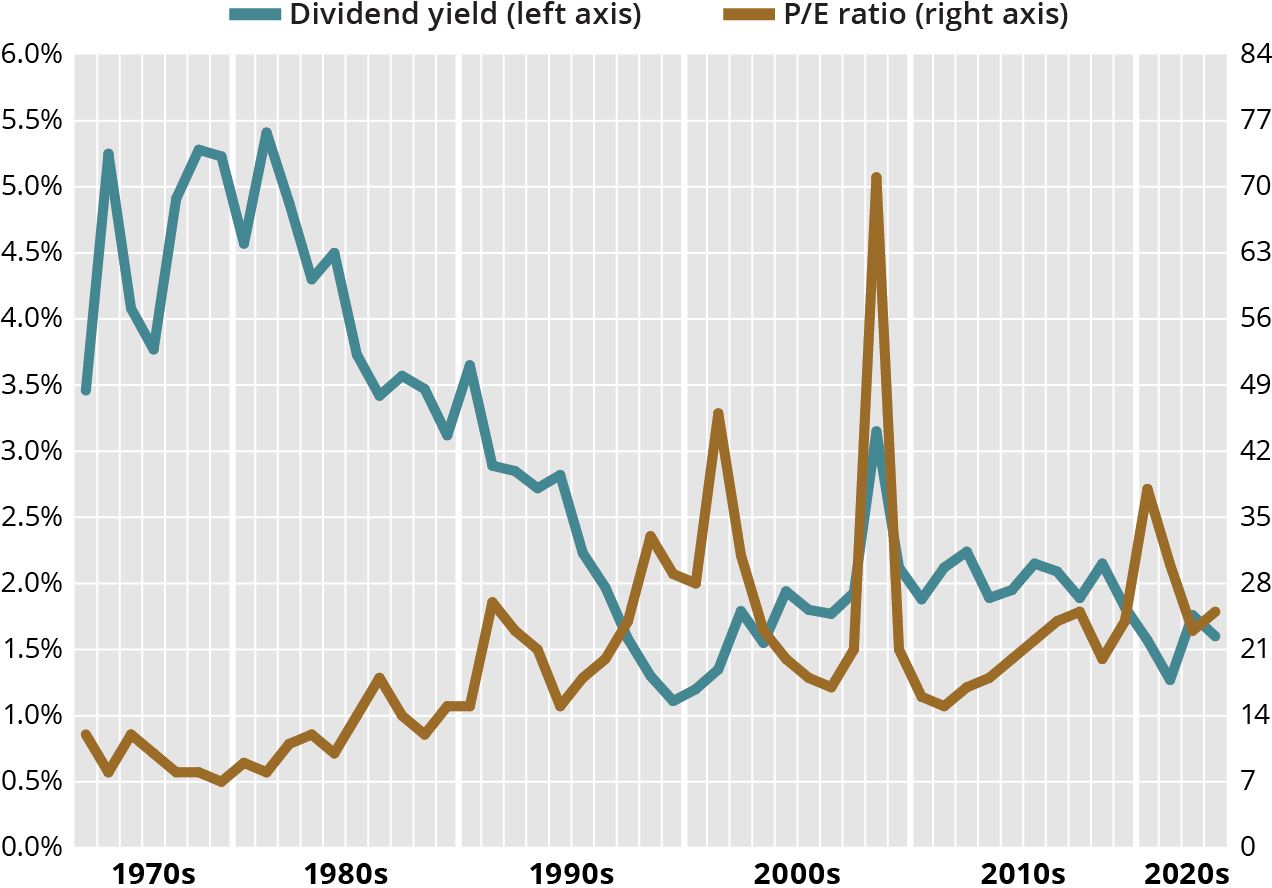

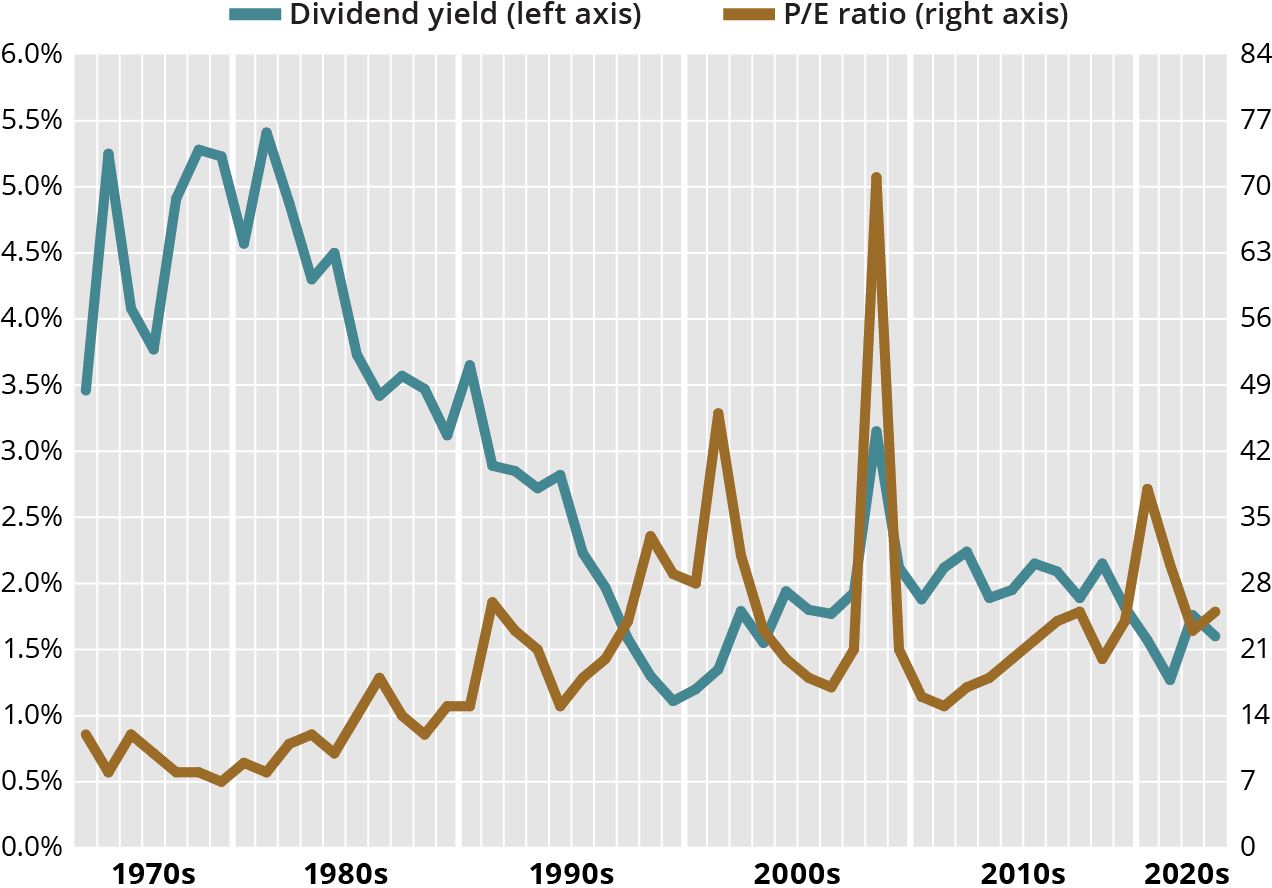

The landscape of pension fund ownership within the S&P 500 has witnessed notable trends and shifts in recent years, reflecting changing investment strategies, regulatory developments, and market dynamics.

One prominent trend is the increasing allocation of pension fund assets to passive investment strategies, such as index funds and exchange-traded funds (ETFs). These vehicles offer cost-effective exposure to the S&P 500 and other market benchmarks, allowing pension funds to gain broad market exposure while minimizing active management fees. The rise of passive investing has led to a significant uptick in the collective ownership of S&P 500 companies by pension funds utilizing these strategies.

Conversely, some pension funds have adopted more active ownership approaches, emphasizing shareholder engagement, proxy voting, and environmental, social, and governance (ESG) considerations. This trend reflects a growing emphasis on responsible investing and the integration of ESG factors into investment decision-making. Pension funds are increasingly leveraging their ownership positions to advocate for sustainable business practices, board diversity, and transparent corporate governance within the companies they invest in.

Another noteworthy trend is the evolution of pension fund diversification strategies, with a greater emphasis on alternative investments and private market opportunities. As pension funds seek to enhance portfolio diversification and generate uncorrelated returns, they are allocating capital to private equity, infrastructure, real assets, and other non-traditional investment avenues. This shift in asset allocation has implications for their ownership footprint within the S&P 500, as the relative weight of public equities in their portfolios undergoes adjustments.

Furthermore, regulatory developments and accounting standards have influenced the investment behavior of pension funds, impacting their ownership patterns within the S&P 500. Changes in pension fund funding requirements, reporting obligations, and risk management guidelines have prompted adjustments in asset allocation and investment strategies, thereby shaping their ownership dynamics within the index.

Overall, the trends in pension fund ownership within the S&P 500 underscore the dynamic nature of institutional investing, reflecting the interplay between passive and active strategies, the integration of ESG considerations, the pursuit of diversification, and the evolving regulatory landscape. These trends contribute to the evolving fabric of pension fund ownership and its impact on the broader equity market.

Implications of Pension Fund Ownership

The ownership of S&P 500 companies by pension funds carries significant implications for corporate governance, shareholder activism, and market dynamics. Understanding these implications is essential for comprehending the broader ramifications of pension fund ownership within the equity market.

Corporate Governance and Stewardship: Pension funds, as long-term investors, wield substantial influence over the governance practices of the companies in which they invest. Their ownership stakes afford them voting rights on corporate matters, enabling them to engage in proxy voting and influence board composition, executive compensation, and strategic decisions. By exercising their stewardship responsibilities, pension funds can advocate for sound governance practices, transparency, and accountability, thereby fostering sustainable value creation and mitigating governance-related risks.

Shareholder Activism and Engagement: Pension funds often engage in shareholder activism, leveraging their ownership positions to advocate for change and address issues related to corporate performance, social responsibility, and environmental impact. Through collaborative engagement with company management and other shareholders, pension funds can drive initiatives aimed at enhancing long-term shareholder value, promoting ethical business conduct, and addressing systemic risks that may impact the companies they invest in.

Market Stability and Long-Term Investing: The ownership of S&P 500 companies by pension funds contributes to market stability and liquidity, as these funds maintain long-term investment horizons and a commitment to the companies in their portfolios. Their patient capital and focus on sustainable growth align with the broader objectives of fostering stable, well-functioning markets that support economic growth and wealth creation over extended timeframes.

ESG Integration and Sustainable Investing: Pension funds’ ownership of S&P 500 companies reflects an increasing emphasis on environmental, social, and governance (ESG) considerations in investment decision-making. By integrating ESG factors into their ownership approach, pension funds can influence companies to adopt responsible business practices, address ESG risks, and contribute to positive societal and environmental outcomes, thereby aligning their investment strategies with broader sustainability objectives.

Market Performance and Investor Confidence: The ownership of S&P 500 companies by pension funds can impact market performance and investor confidence, as their investment decisions and engagement activities can influence the valuation, operational resilience, and long-term prospects of the companies comprising the index. As influential institutional investors, pension funds’ ownership behaviors and collaborative initiatives can shape market sentiment and contribute to the overall stability and efficiency of the equity market.

Overall, the implications of pension fund ownership within the S&P 500 underscore the multifaceted role played by these institutional investors in shaping corporate behavior, market dynamics, and the integration of sustainable investing principles into the equity market ecosystem.

Conclusion

The relationship between pension funds and the S&P 500 encapsulates the intricate interplay between institutional investing, corporate governance, and market dynamics. The ownership of S&P 500 companies by pension funds carries far-reaching implications that reverberate across the financial landscape, reflecting the evolving nature of institutional ownership and its impact on the equity market.

As pivotal stakeholders in the S&P 500, pension funds wield considerable influence over corporate governance, shareholder activism, and market stability. Their long-term investment horizons, fiduciary responsibilities, and emphasis on sustainable value creation position them as stewards of capital, driving responsible investing practices and shaping the behavior of the companies they invest in.

The trends in pension fund ownership within the S&P 500 underscore the dynamic nature of institutional investing, reflecting the interplay between passive and active strategies, the integration of ESG considerations, the pursuit of diversification, and the evolving regulatory landscape. These trends contribute to the evolving fabric of pension fund ownership and its impact on the broader equity market.

Understanding the implications of pension fund ownership within the S&P 500 is essential for appreciating the multifaceted role played by these institutional investors in shaping corporate behavior, market dynamics, and the integration of sustainable investing principles into the equity market ecosystem. Their ownership of S&P 500 companies underscores the commitment to long-term value creation, responsible stewardship, and the alignment of investment strategies with broader sustainability objectives.

In conclusion, the ownership of S&P 500 companies by pension funds epitomizes the convergence of financial prudence, governance stewardship, and sustainable investing, underscoring the profound impact of institutional ownership on the equity market and the broader economy. As pension funds continue to navigate evolving market trends and regulatory landscapes, their ownership dynamics within the S&P 500 will remain a focal point of interest, reflecting the enduring significance of institutional investors in shaping the contours of the modern financial landscape.