Finance

What Is A Pension Trust Fund

Published: November 27, 2023

Explore the ins and outs of a pension trust fund and how it can positively impact your financial future. Learn about the benefits and strategies to effectively manage your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Pension Trust Fund?

- Purpose of a Pension Trust Fund

- Structure of a Pension Trust Fund

- Types of Investments in a Pension Trust Fund

- Management and Oversight of a Pension Trust Fund

- Benefits and Risks of Pension Trust Funds

- Role of Pension Trust Funds in Retirement Planning

- Importance of Funding and Solvency in Pension Trust Funds

- Recent Developments and Challenges in Pension Trust Funds

- Conclusion

Introduction

Retirement planning is a crucial aspect of financial management, and for many individuals, the primary source of retirement income is a pension. One of the most common vehicles for managing pension funds is a pension trust fund. Pension trust funds play a pivotal role in safeguarding and growing the assets that will provide retirees with a stable income during their post-working years.

In this article, we will delve into the world of pension trust funds, exploring their purpose, structure, management, and overall importance in retirement planning. We will also examine the types of investments typically found in pension trust funds, the benefits and risks associated with these funds, and the challenges they face in today’s ever-changing financial landscape.

Understanding the ins and outs of pension trust funds is crucial not only for individuals who depend on them for retirement income but also for anyone interested in the world of finance and investing. So, let’s begin by examining what exactly a pension trust fund is and why it is so essential in the realm of retirement planning.

What is a Pension Trust Fund?

A pension trust fund is a legal entity that holds and manages the assets of a pension plan. It acts as a custodian of the funds contributed by employers and employees to fund retirement benefits. The primary objective of a pension trust fund is to ensure that the pension plan remains financially stable and can fulfill its obligations to retirees.

Pension trust funds are typically established through a trust agreement, which outlines the terms and conditions governing the fund’s operations. This agreement is legally binding and provides a framework for how the fund is managed, the rights and responsibilities of the trustees, and the distribution of benefits.

The funds within a pension trust are invested in various financial instruments, such as stocks, bonds, and real estate, with the aim of generating returns and growing the assets over time. The income generated from these investments is used to pay retirement benefits to eligible plan participants.

Pension trust funds are separate legal entities from the employers or organizations that sponsor the pension plans. This separation ensures that the assets are held in trust for the exclusive benefit of the plan participants and are protected from the employer’s financial difficulties or bankruptcy.

Pension trust funds are subject to regulatory oversight and must comply with applicable laws and regulations, such as the Employee Retirement Income Security Act (ERISA) in the United States. These regulations provide safeguards to protect the rights and interests of plan participants and ensure the prudent management of the funds.

In summary, a pension trust fund is a dedicated entity that manages the assets of a pension plan, aiming to secure and grow those assets to provide retirement income for plan participants. It operates independently from the employer, protecting the funds from any potential financial challenges the employer may face.

Purpose of a Pension Trust Fund

The primary purpose of a pension trust fund is to ensure the long-term financial security and stability of a pension plan. Let’s explore the key objectives and functions that drive the existence and operation of these funds:

1. Asset Management:

A pension trust fund takes on the responsibility of managing the assets contributed to the pension plan. This involves making investment decisions to maximize returns while considering the risk tolerance and long-term objectives of the fund. Effective asset management aims to generate income and capital appreciation to support the payment of retirement benefits.

2. Benefit Distributions:

The pension trust fund plays a crucial role in distributing retirement benefits to eligible plan participants. It ensures that the benefits are paid out in accordance with the terms and conditions outlined in the pension plan. Timely and accurate benefit distributions are essential to support retirees in maintaining financial stability and enjoying their post-retirement years.

3. Risk Mitigation:

A pension trust fund implements risk management strategies to mitigate potential financial risks that could impact the sustainability of the pension plan. This involves diversifying investments, conducting thorough due diligence on investment opportunities, and monitoring market trends to make informed decisions. By effectively managing risks, the fund aims to protect the assets and preserve the long-term viability of the pension plan.

4. Fiduciary Responsibility:

As fiduciaries, pension trust fund trustees have a legal and ethical responsibility to act in the best interests of the plan participants. They must exercise prudence, diligence, and loyalty in the management of the funds, ensuring that they are allocated and invested wisely. This fiduciary duty helps to safeguard the assets and the rights of the individuals relying on the pension plan for their retirement income.

5. Financial Stability:

A pension trust fund strives to achieve financial stability by balancing income, expenses, and investment returns. Maintaining a financially healthy fund is crucial to meet the long-term obligations of the pension plan, providing retirees with a steady and reliable income stream throughout their retirement years.

In summary, the purpose of a pension trust fund is to manage and protect the assets of a pension plan, ensure the accurate distribution of retirement benefits, mitigate financial risks, fulfill fiduciary responsibilities, and maintain the long-term financial stability of the plan. By fulfilling these purposes, pension trust funds play a vital role in helping individuals achieve a secure and comfortable retirement.

Structure of a Pension Trust Fund

A pension trust fund operates within a well-defined structure that ensures effective management and oversight of the plan’s assets. Understanding the various components of this structure is crucial to comprehending how pension trust funds function. Let’s explore the key elements:

1. Trustees:

Trustees are individuals or entities responsible for overseeing the operations and management of the pension trust fund. They act in a fiduciary capacity and have a legal duty to act in the best interests of the plan participants. Trustees are typically appointed by the plan sponsor or designated in the trust agreement. They make investment decisions, monitor the fund’s performance, and ensure compliance with relevant regulations.

2. Investment Committee:

The investment committee is a subset of the trustees or an independent body responsible for making investment decisions on behalf of the pension trust fund. This committee conducts research, analyzes investment opportunities, and formulates investment strategies aligned with the fund’s objectives. Its primary goal is to generate optimal returns while managing risk within the fund.

3. Custodian:

A custodian is a financial institution or entity responsible for holding and safeguarding the assets of the pension trust fund. The custodian ensures the proper settlement of transactions, safekeeping of securities, and accurate record-keeping of the fund’s holdings. They play a crucial role in ensuring the transparency and security of the fund’s assets.

4. Actuary:

An actuary is a qualified professional who specializes in assessing and managing the financial risks associated with pension plans. They analyze demographic data, investment returns, and other relevant factors to determine the funding levels, contribution rates, and the long-term viability of the pension trust fund. Actuaries provide valuable insights to ensure the sustainability of the pension plan.

5. Plan Administrator:

The plan administrator is responsible for the day-to-day administration of the pension trust fund. They handle tasks such as record-keeping, participant communications, benefit calculations, and regulatory compliance. The plan administrator plays a pivotal role in ensuring the smooth and efficient management of the pension plan.

6. Professional Service Providers:

Pension trust funds often engage external professionals to provide specialized services. This may include investment managers, asset consultants, auditors, legal advisors, and compliance experts. These experts bring their expertise and knowledge to support the trustees and ensure the proper functioning of the pension trust fund.

In summary, the structure of a pension trust fund consists of trustees who oversee the fund’s operations, an investment committee responsible for investment decisions, a custodian to safeguard the assets, an actuary to assess financial risks, a plan administrator to manage day-to-day operations, and professional service providers to offer specialized expertise. This well-organized structure ensures that the pension trust fund operates efficiently and effectively for the benefit of the plan participants.

Types of Investments in a Pension Trust Fund

A pension trust fund typically invests in a diverse range of financial instruments to generate returns and grow the assets over time. The specific types of investments can vary based on factors such as the fund’s risk tolerance, investment goals, and regulatory guidelines. Here are some common types of investments found in pension trust funds:

1. Stocks:

Stocks, or equities, represent ownership in a company. Pension trust funds may invest in individual stocks or stock-based mutual funds to participate in the potential long-term growth of companies. Stocks offer the potential for capital appreciation and the possibility of receiving dividends.

2. Bonds:

Bonds are debt securities issued by governments, municipalities, or corporations. Pension trust funds may invest in various types of bonds, such as government bonds, corporate bonds, or municipal bonds. Bonds provide a fixed income stream through periodic interest payments and the return of principal at maturity.

3. Real Estate:

Pension trust funds may invest in real estate properties directly or through real estate investment trusts (REITs). Real estate investments can offer potential income through rental payments and the potential for property value appreciation over time.

4. Alternative Investments:

Pension trust funds may allocate a portion of their assets to alternative investments, such as private equity, hedge funds, commodities, infrastructure, or venture capital. These investments offer diversification and potential higher returns but often come with increased risk and longer investment horizons.

5. Fixed Income Securities:

In addition to bonds, pension trust funds may invest in other fixed income securities, such as Treasury bills, certificates of deposit (CDs), or money market instruments. These investments provide a stable source of income and help to preserve capital.

6. Mutual Funds and Exchange-Traded Funds (ETFs):

Pension trust funds often invest in mutual funds or ETFs, which allow for diversification across a range of assets. These funds pool together investments from multiple investors and are managed by professional portfolio managers, providing instant access to a diversified portfolio.

7. International Investments:

Pension trust funds may invest in international stocks, bonds, or other securities to diversify their portfolios and capture potential growth opportunities in global markets. This allows for exposure to different economies, industries, and currencies.

It’s important to note that the specific allocation and selection of investments within a pension trust fund will depend on factors such as the fund’s investment policy, risk tolerance, and the expertise of the fund managers and trustees. The goal is to create a well-diversified portfolio that balances risk and potential returns while aligning with the fund’s long-term investment objectives.

Management and Oversight of a Pension Trust Fund

The management and oversight of a pension trust fund are critical for ensuring the fund’s stability, growth, and adherence to regulatory requirements. Effective management and oversight involve various activities and processes that collectively support the fund’s long-term objectives. Here are key aspects involved in the management and oversight of a pension trust fund:

1. Investment Strategy:

The pension trust fund’s investment strategy is a crucial component of its management. This strategy determines the asset allocation, risk tolerance, and investment objectives of the fund. The investment strategy is typically established by the fund’s trustees or investment committee and should align with the fund’s long-term goals and the risk appetite of the plan participants.

2. Risk Management:

Risk management is integral to the management and oversight of a pension trust fund. Trustees and investment professionals closely monitor and assess various risks associated with the fund’s investments. This includes market risks, credit risks, liquidity risks, and operational risks. Risk management strategies are implemented to mitigate potential risks and protect the assets of the fund.

3. Investment Selection and Monitoring:

The management of a pension trust fund involves the selection and ongoing monitoring of investments. Trustees or the investment committee review and analyze potential investment opportunities based on their alignment with the fund’s investment strategy and risk profile. Once investments are made, regular monitoring is essential to ensure they continue to meet the fund’s objectives and comply with regulatory guidelines.

4. Performance Evaluation:

Pension trust fund management includes evaluating the performance of the fund’s investments. Performance evaluation involves measuring the returns generated by the investments against predefined benchmarks and comparing them to industry standards. This evaluation helps identify areas for improvement, assess the effectiveness of the investment strategy, and inform future investment decisions.

5. Regulatory Compliance:

A pension trust fund must comply with applicable laws, regulations, and reporting requirements. This includes adhering to legislation such as the Employee Retirement Income Security Act (ERISA) in the United States or other local pension regulations. Trustees and other fiduciaries of the fund ensure proper compliance to protect the interests of the plan participants and maintain the fund’s integrity.

6. Communication and Reporting:

Effective communication and reporting are essential for the management and oversight of a pension trust fund. Trustees and plan administrators are responsible for communicating with plan participants, providing regular updates on the fund’s performance, investment decisions, and benefit distributions. Clear and transparent communication fosters trust and ensures that participants are well-informed about the status of their retirement accounts.

Overall, the management and oversight of a pension trust fund involve strategic investment decisions, risk management, performance evaluation, regulatory compliance, and clear communication with all stakeholders. By diligently carrying out these responsibilities, trustees and other fiduciaries can safeguard the assets of the fund and fulfill their duty to plan participants.

Benefits and Risks of Pension Trust Funds

Pension trust funds offer numerous benefits to both employers and employees, but they also come with inherent risks. Understanding these benefits and risks is crucial for individuals relying on pension trust funds for their retirement income. Let’s explore them in more detail:

Benefits of Pension Trust Funds:

1. Retirement Income Security:

Pension trust funds provide a reliable source of income during retirement, ensuring individuals have financial security and stability in their post-working years. These funds enable retirees to maintain their standard of living and meet their ongoing expenses without worrying about outliving their savings.

2. Professional Management:

Pension trust funds are managed by professionals who have expertise in investments and financial management. This ensures that the fund’s assets are diligently managed, aiming to generate returns and grow the fund over time. Professional management allows for efficient decision-making and adherence to investment strategies.

3. Diversification:

Pension trust funds invest in a diversified portfolio of assets, which helps to spread risk and potentially increase returns. Diversification allows for exposure to different asset classes, industries, and geographical regions, reducing the impact of any single investment’s performance on the overall portfolio.

4. Tax Advantages:

Contributions made to pension trust funds often enjoy tax advantages. In many jurisdictions, employers can deduct their contributions from corporate income taxes, and employees can contribute on a pre-tax basis, deferring taxes until retirement when their withdrawals are typically taxed. These tax advantages can enhance the growth of retirement savings.

Risks of Pension Trust Funds:

1. Investment Risk:

Pension trust funds are exposed to investment risks, such as market volatility and fluctuations in asset prices. Poor investment decisions or underperforming investments can lead to lower returns and potential fund losses. It is essential to carefully manage investment risks and regularly assess the performance of the fund’s investments.

2. Longevity Risk:

Longevity risk refers to the potential for retirees to live longer than expected, exhausting their pension benefits. As life expectancies increase, pension trust funds may face challenges in ensuring that retirees have sufficient income for the entirety of their retirement. Managing longevity risk requires accurate estimation of life expectancies and appropriate funding levels.

3. Legal and Regulatory Risks:

Pension trust funds are subject to legal and regulatory requirements, which can pose risks if not properly managed. Compliance with laws and regulations, such as reporting, disclosure, and fiduciary responsibilities, is crucial to avoid penalties and protect plan participants’ interests.

4. Funding Risk:

Pension trust funds depend on contributions from employers and employees to fund retirement benefits. Insufficient contributions or an economic downturn can result in funding shortfalls, jeopardizing the fund’s ability to meet its obligations. Proper funding and regular monitoring of the fund’s financial health are essential to mitigate funding risks.

While pension trust funds offer valuable benefits in terms of retirement income security, professional management, diversification, and tax advantages, they also carry risks associated with investments, longevity, legal and regulatory compliance, and funding. It is important for individuals and stakeholders to be aware of these risks and work towards effectively managing them to ensure the long-term stability and success of the pension trust fund.

Role of Pension Trust Funds in Retirement Planning

Pension trust funds play a vital role in the realm of retirement planning, offering a reliable and structured approach to building and managing retirement savings. The following highlights the key roles pension trust funds play in retirement planning:

1. Retirement Income Source:

Pension trust funds serve as a primary source of retirement income for many individuals. Through regular contributions made by both employers and employees, the funds accumulate and grow over time, ultimately providing a steady income stream during retirement. This income can supplement other sources of retirement income, such as social security benefits or personal savings.

2. Asset Accumulation:

One of the main functions of a pension trust fund is to accumulate assets that will generate income in retirement. By contributing a portion of their salary to the fund throughout their working years, individuals can build a significant retirement nest egg. Pension trust funds offer the advantage of consistent and automatic contributions over an extended period, facilitating the accumulation of a substantial retirement fund.

3. Professional Investment Management:

Pension trust funds are typically managed by investment professionals who are responsible for making sound investment decisions on behalf of the fund. These professionals leverage their expertise to diversify the fund’s investments, maximize returns, and manage risks. The involvement of professional investment managers enhances the potential for long-term growth and optimal performance of the pension trust fund.

4. Risk Mitigation:

Pension trust funds play a crucial role in mitigating key retirement risks. By diversifying investments, managing asset allocations, and regularly monitoring funds, pension trust funds aim to reduce investment risks for plan participants. Furthermore, they provide protections against employer bankruptcies or financial difficulties, ensuring that individuals can rely on their accrued retirement benefits even in challenging economic times.

5. Retirement Income Distribution:

Upon retirement, pension trust funds are responsible for distributing retirement income to eligible plan participants. The funds are structured to provide a regular stream of income throughout the retirement years, offering financial stability and a reliable source of cash flow to cover living expenses and enjoy a comfortable retirement lifestyle.

6. Facilitating Retirement Planning:

Pension trust funds facilitate retirement planning by offering individuals a structured and disciplined approach to saving for retirement. By participating in a pension trust fund, individuals are encouraged to save consistently and benefit from the potential growth of their retirement savings over time. The funds provide individuals with a roadmap for retirement goals and help them navigate the complexities of retirement planning.

In summary, pension trust funds serve as a crucial component of retirement planning by providing a reliable source of retirement income, facilitating asset accumulation, offering professional investment management, mitigating risks, ensuring the distribution of retirement income, and guiding individuals in their retirement planning journey. By leveraging the benefits of pension trust funds, individuals can be better equipped to achieve their desired retirement lifestyle and financial security.

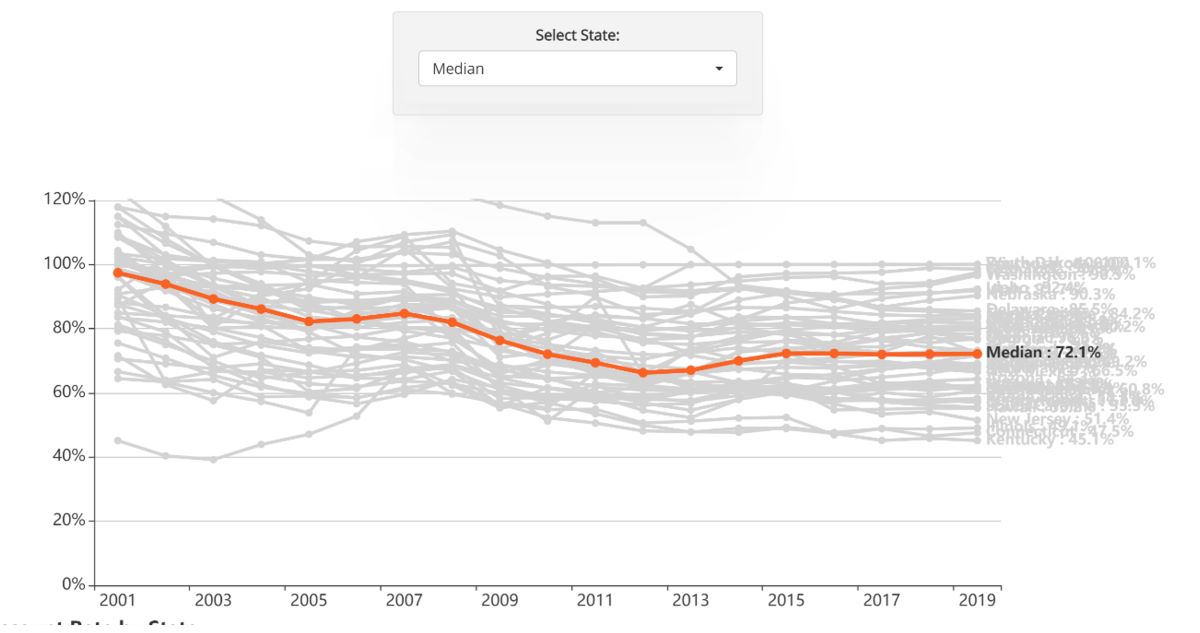

Importance of Funding and Solvency in Pension Trust Funds

Funding and solvency are critical factors in the sustainability and long-term viability of pension trust funds. Adequate funding and solvency levels ensure that pension trust funds can meet their obligations and provide retirement income to plan participants. Here’s why funding and solvency are so important:

1. Meeting Retirement Obligations:

Pension trust funds are responsible for fulfilling retirement benefit obligations to plan participants. Adequate funding is necessary to ensure that the fund has sufficient assets to pay out these benefits as retirees become eligible. Without proper funding, pension trust funds may face challenges in meeting their obligations, potentially resulting in a reduction in retirement benefits or an inability to provide benefits altogether.

2. Financial Stability:

Funding and solvency are key indicators of the financial stability of a pension trust fund. A well-funded and solvent fund has the resources to weather economic downturns, market fluctuations, and unexpected events. It allows the fund to continue generating income, covering expenses, and maintaining the fund’s operability over the long term.

3. Mitigating Investment Risks:

Funding levels in a pension trust fund are closely linked to investment risks. Adequate funding can mitigate the impact of investment losses and fluctuations on the overall financial health of the fund. It provides a buffer to absorb potential negative returns and allows for a longer investment horizon to recover from short-term market volatility.

4. Plan Sustainability:

Funding and solvency are crucial for the sustainability of a pension trust fund. A well-funded fund can sustain itself over time, delivering retirement benefits to plan participants not just in the near term but also for future generations. Proper funding ensures that the fund can maintain its operations, cover administrative expenses, and adjust for potential changes in the demographic composition of the plan’s beneficiaries.

5. Regulator Compliance:

Funding and solvency requirements are often regulated by government authorities or pension oversight bodies. Pension trust funds must adhere to these regulations and demonstrate sound funding levels and solvency ratios. Compliance with these requirements is essential to ensure the protection of plan participants’ interests, maintain the fund’s integrity, and avoid any potential legal or regulatory consequences.

6. Participant Confidence:

Proper funding and solvency levels inspire confidence and trust among plan participants. It assures them that their retirement savings are being managed responsibly and that the fund has the financial capacity to deliver on its promises. Participant confidence is crucial for the success and continued participation in pension trust funds, fostering a sense of security and peace of mind.

In summary, funding and solvency are critical components of pension trust funds. Adequate funding ensures the fund’s capacity to meet retirement obligations, maintain financial stability, mitigate investment risks, sustain plan operations, comply with regulatory requirements, and instill participant confidence. By prioritizing funding and solvency, pension trust funds can enhance their ability to provide reliable and secure retirement benefits to plan participants over the long term.

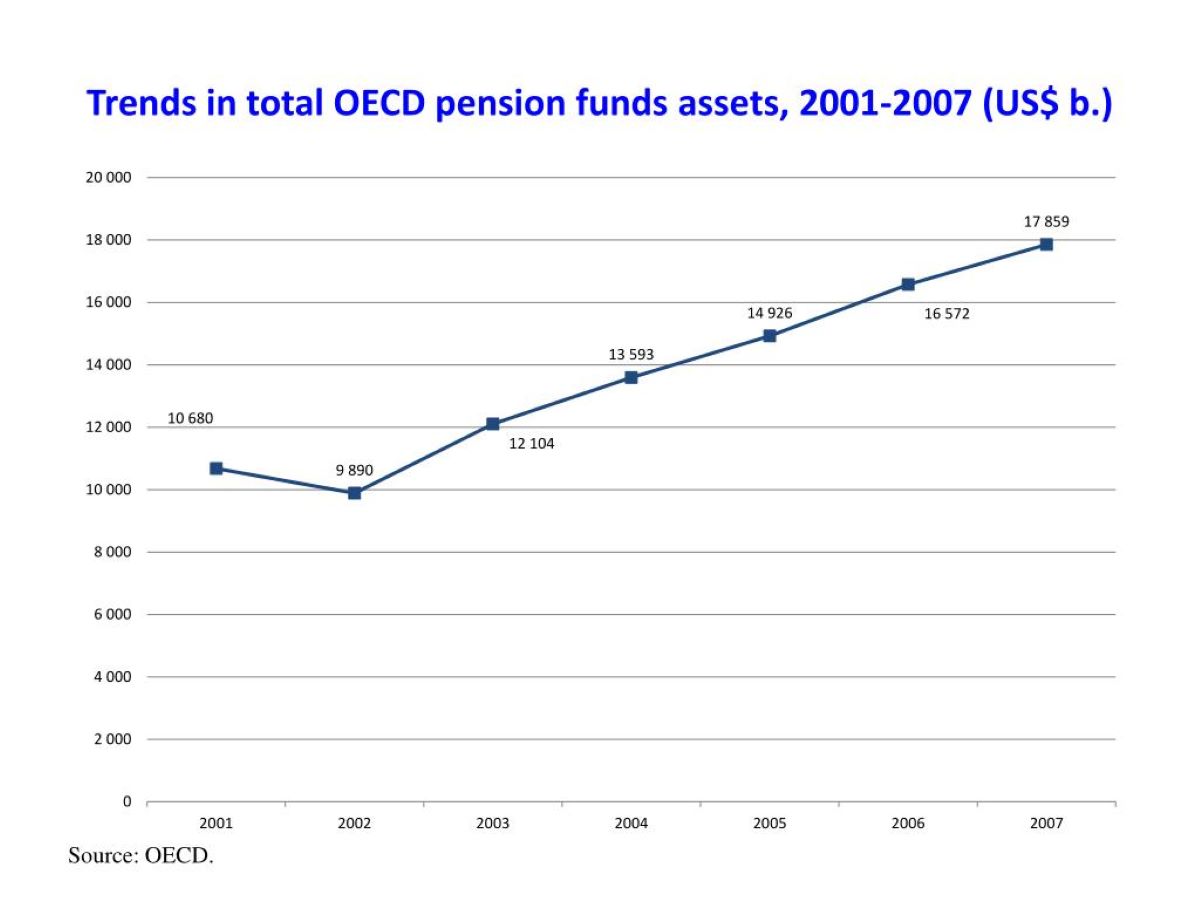

Recent Developments and Challenges in Pension Trust Funds

Pension trust funds face ongoing developments and challenges that impact their operation, funding, and sustainability. Keeping abreast of these developments is essential for trustees, plan sponsors, and participants. Let’s explore some recent developments and challenges in pension trust funds:

1. Increasing Life Expectancies:

One of the significant challenges facing pension trust funds is the increasing life expectancies of retirees. People are living longer, which means pension funds must provide retirement benefits for a more extended period. This places additional strain on the funds’ resources, necessitating adjustments in funding strategies, investment approaches, and retirement age eligibility.

2. Shifting Demographics:

Changing demographics, such as declining birth rates and an aging population, present challenges for pension trust funds. With fewer active workers contributing to the fund compared to retirees, maintaining funding levels becomes more challenging. This requires careful planning, adjustments to contribution rates, and potential modifications to benefit structures to ensure the sustainability of the fund.

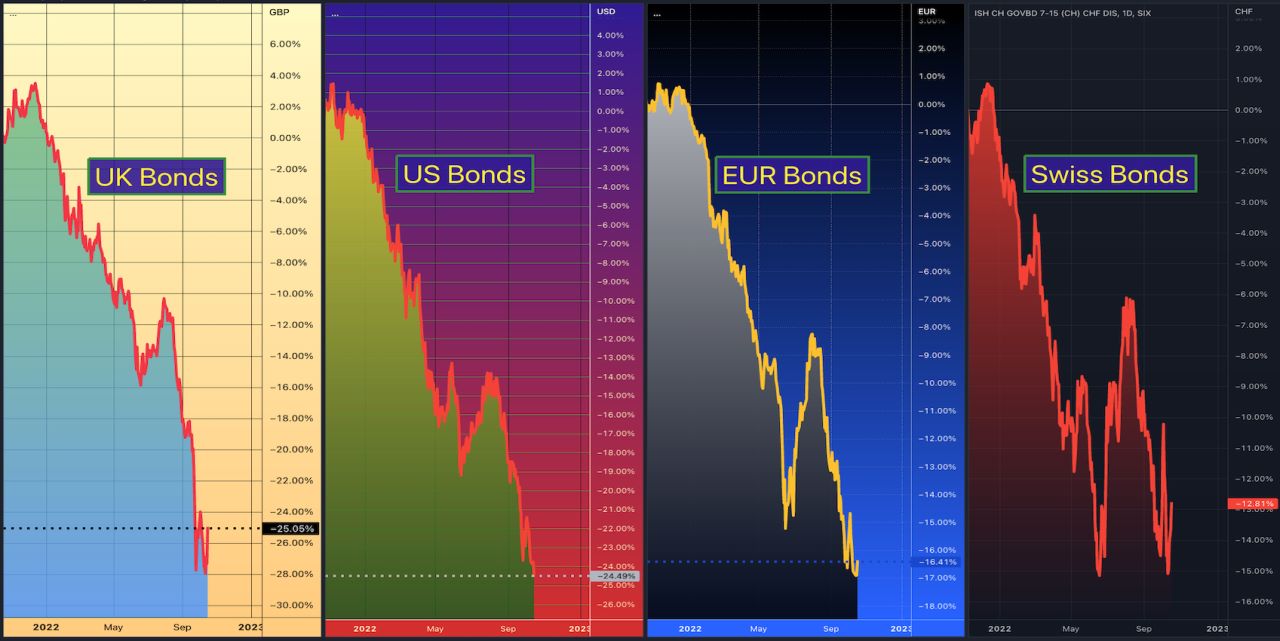

3. Pension Fund Deficits:

Many pension trust funds globally are facing funding deficits, meaning their assets are insufficient to cover their long-term liabilities. Factors such as low interest rates, market volatility, and changes in actuarial assumptions contribute to these deficits. Addressing deficits requires active management, enhanced funding contributions, and potential adjustments to benefit calculations or plan designs to restore financial sustainability.

4. Investment Volatility:

Pension trust funds are exposed to investment risks, including volatility in financial markets. Recent economic uncertainty, geopolitical tensions, and global events have amplified market volatility, impacting pension fund returns. Managing and mitigating investment volatility is crucial for protecting pension fund assets and achieving long-term financial stability.

5. Regulatory Changes:

Pension trust funds operate within a complex regulatory framework that is subject to changes and updates. Legislative and regulatory changes, such as pension reform laws and reporting requirements, can impact fund operations, funding obligations, investment options, and plan administration. Staying informed about these regulatory developments is vital to ensure compliance and adapt to evolving pension landscape.

6. Social and Environmental Considerations:

There is a growing awareness and emphasis on incorporating social and environmental considerations into investment strategies, known as Environmental, Social, and Governance (ESG) factors. Pension trust funds face increasing pressure to align their investments with sustainable and responsible practices. Integrating ESG considerations presents both opportunities and challenges, requiring careful analysis to balance financial returns with social and environmental outcomes.

In summary, pension trust funds are navigating through various recent developments and challenges, including increasing life expectancies, shifting demographics, funding deficits, investment volatility, regulatory changes, and the inclusion of social and environmental considerations. Addressing these challenges requires adaptability, strategic planning, enhanced governance, and effective risk management to ensure the long-term viability and sustainability of pension trust funds.

Conclusion

Pension trust funds are integral to retirement planning, providing a structured and reliable approach to accumulating and managing retirement savings. These funds offer numerous benefits, such as retirement income security, professional investment management, asset diversification, and tax advantages. They play a crucial role in ensuring that individuals have a stable and sustainable source of income during their post-working years.

However, pension trust funds also face various challenges and must navigate through changing landscapes. Factors such as increasing life expectancies, shifting demographics, funding deficits, investment volatility, regulatory changes, and social and environmental considerations pose ongoing challenges for these funds. Trustees, plan sponsors, and participants must remain vigilant and adapt to these developments to ensure the long-term viability and success of pension trust funds.

Efficient management and oversight of pension trust funds are crucial. Trustees, investment committees, and plan administrators must make informed investment decisions, monitor fund performance, comply with regulations, and communicate effectively with plan participants. Adequate funding, prudent investment strategies, and sound risk management are essential components of successful pension trust fund management.

In conclusion, pension trust funds have a critical role in retirement planning, providing individuals with a reliable income source, professional management, and diversified investments. They require diligent management and adaptability to navigate challenges and ensure the financial stability and long-term sustainability of the funds. By addressing these challenges and maximizing the benefits, pension trust funds can play an instrumental role in helping individuals achieve a secure and comfortable retirement.