Finance

What Is Liquidity In Crypto?

Published: February 23, 2024

Learn about liquidity in crypto and its impact on finance. Understand the importance of liquidity in the world of cryptocurrency.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Cryptocurrencies have revolutionized the financial landscape, offering new and innovative ways to transact and invest. As the popularity of digital assets continues to soar, it's crucial to understand the concept of liquidity in the realm of crypto. Liquidity plays a pivotal role in the functioning of financial markets, and its significance is equally profound in the context of cryptocurrencies.

In the world of traditional finance, liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. When it comes to cryptocurrencies, liquidity encompasses the ability to swiftly convert digital assets into cash or other cryptocurrencies without substantially impacting their market prices. This fundamental aspect is instrumental in determining the efficiency and stability of crypto markets.

The liquidity of a cryptocurrency is influenced by various factors, such as trading volumes, order book depth, and market activity. Understanding these elements is essential for both seasoned investors and newcomers to the crypto space. Moreover, comprehending the nuances of liquidity in crypto can empower individuals to make informed decisions and navigate the market with confidence.

In this article, we will delve into the intricacies of liquidity in the realm of cryptocurrencies, exploring its significance, underlying factors, and measures. By gaining a comprehensive understanding of liquidity in crypto, readers will be better equipped to comprehend the dynamics of digital asset markets and harness this knowledge to optimize their investment strategies.

Understanding Liquidity in Crypto

Liquidity in the context of cryptocurrencies pertains to the ability to buy or sell digital assets in the market without causing a significant impact on their prices. This concept is crucial for market participants, as it directly influences the efficiency and stability of crypto trading. Understanding the dynamics of liquidity in the crypto space involves delving into various facets that collectively shape the tradability of digital assets.

One of the primary components of liquidity in crypto is trading volume, which represents the total quantity of a cryptocurrency traded within a specific timeframe, such as 24 hours. Higher trading volumes typically indicate greater liquidity, as there is a larger pool of buyers and sellers actively participating in the market. This abundance of market participants facilitates smoother and faster transactions, reducing the likelihood of substantial price fluctuations resulting from individual trades.

Another key factor influencing liquidity is the depth of the order book. The order book displays all outstanding buy and sell orders for a particular cryptocurrency, arranged by price. Deeper order books, characterized by a significant volume of buy and sell orders at various price levels, contribute to enhanced liquidity. A robust order book reflects a balanced market, where there is a sufficient number of buyers and sellers across different price points, fostering a more liquid trading environment.

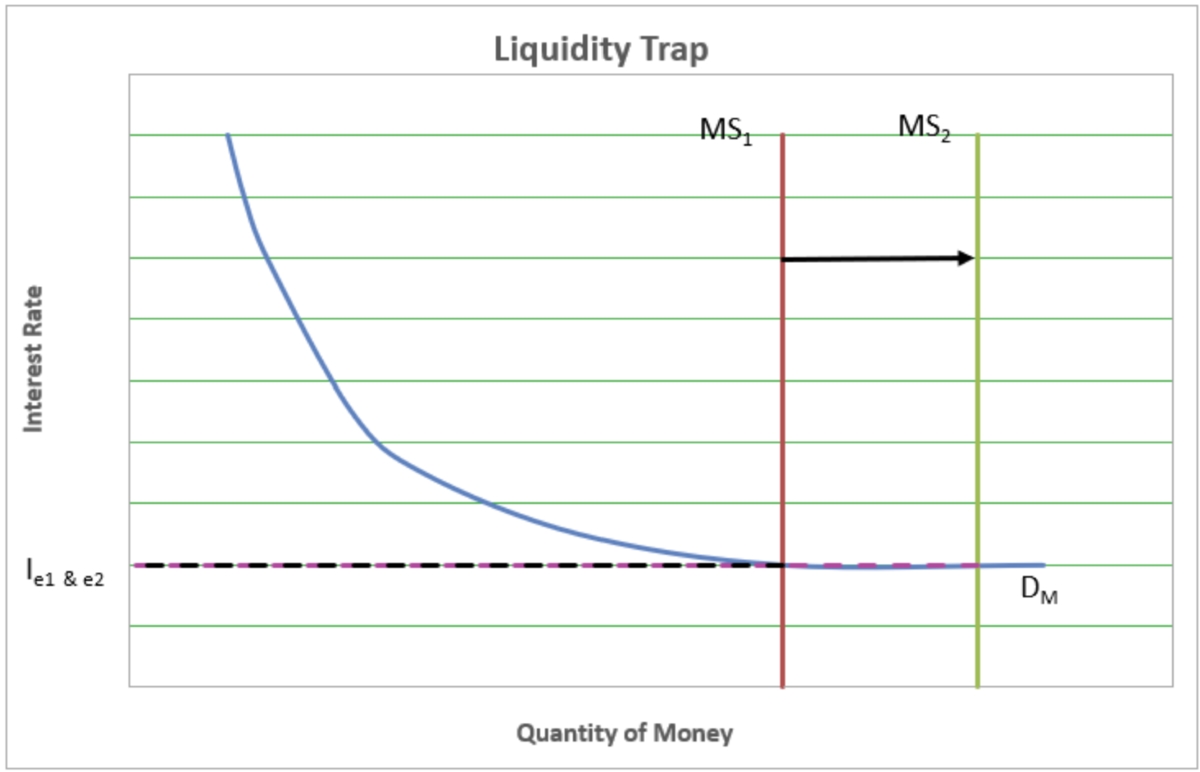

Market activity and volatility also play a pivotal role in determining liquidity in the crypto space. Highly volatile markets can experience rapid price movements, impacting the ease of executing trades without substantial price slippage. Moreover, periods of low trading activity may lead to decreased liquidity, as there are fewer market participants engaging in transactions, potentially resulting in wider bid-ask spreads and hindered trade execution.

Understanding the intricacies of liquidity in crypto empowers investors to make informed decisions regarding their trading and investment strategies. By gauging the liquidity of a cryptocurrency, market participants can assess the ease of entering and exiting positions, anticipate the potential impact of their trades on market prices, and effectively manage their risk exposure. As the crypto market continues to evolve, a nuanced understanding of liquidity is indispensable for navigating this dynamic and rapidly expanding financial landscape.

Factors Affecting Liquidity

The liquidity of cryptocurrencies is influenced by a multitude of factors that collectively shape the tradability and market dynamics of digital assets. Understanding these factors is essential for market participants seeking to comprehend the nuances of liquidity in the crypto space and make informed decisions regarding their trading activities and investment strategies.

1. Trading Volume: Trading volume is a primary determinant of liquidity in the crypto market. Higher trading volumes generally indicate greater liquidity, as there is a larger pool of buyers and sellers actively participating in the market. Cryptocurrencies with substantial trading volumes are often more liquid, allowing for smoother and faster trade executions.

2. Market Depth: The depth of the order book, which represents the cumulative volume of buy and sell orders at various price levels, significantly impacts liquidity. Deeper order books with a balanced distribution of buy and sell orders contribute to enhanced liquidity by facilitating seamless trade executions without substantial price slippage.

3. Volatility: Market volatility can affect the liquidity of cryptocurrencies. Highly volatile markets may experience rapid price fluctuations, potentially impacting the ease of executing trades without significant price impact. Traders and investors often consider the impact of volatility on liquidity when devising their trading strategies and risk management approaches.

4. Market Participants: The number and diversity of market participants, including retail traders, institutional investors, market makers, and liquidity providers, play a crucial role in shaping liquidity. A broad and diverse participant base can contribute to enhanced liquidity by fostering a more active and dynamic trading environment.

5. Regulatory Environment: Regulatory developments and the legal framework surrounding cryptocurrencies can influence liquidity. Clear and favorable regulatory conditions may attract more participants to the market, potentially bolstering liquidity. Conversely, regulatory uncertainty or restrictive measures may impact market sentiment and liquidity levels.

6. Market Sentiment: The overall sentiment and perception of market participants regarding specific cryptocurrencies can impact liquidity. Positive sentiment may attract more buyers and sellers, thereby enhancing liquidity, while negative sentiment could lead to reduced trading activity and liquidity levels.

7. Market Access and Infrastructure: The accessibility of trading platforms, liquidity pools, and market infrastructure can affect liquidity. Well-established and user-friendly trading platforms and infrastructure may contribute to higher liquidity by attracting a larger and more diverse participant base.

By comprehensively evaluating these factors, market participants can gain valuable insights into the liquidity of cryptocurrencies, enabling them to make well-informed decisions and navigate the dynamic landscape of digital asset trading with confidence.

Importance of Liquidity in Crypto

The significance of liquidity in the realm of cryptocurrencies cannot be overstated, as it plays a pivotal role in shaping the efficiency, stability, and overall functionality of digital asset markets. Understanding the importance of liquidity is essential for market participants, including traders, investors, and industry stakeholders, as it directly influences trading experiences, market dynamics, and investment strategies.

1. Efficient Trade Execution: Liquidity is crucial for facilitating efficient trade execution in the crypto market. Higher liquidity enables market participants to swiftly buy or sell cryptocurrencies without significantly impacting market prices, reducing the risk of price slippage and enhancing the overall trading experience. This efficiency is particularly valuable for active traders and institutional investors seeking to execute large orders with minimal market impact.

2. Price Stability: Liquidity contributes to price stability in cryptocurrency markets. A liquid market is less susceptible to extreme price fluctuations resulting from individual trades, as a robust pool of buyers and sellers helps absorb buying and selling pressure. This stability fosters a more predictable trading environment, enhancing risk management and investment decision-making processes.

3. Risk Management: Liquidity plays a crucial role in effective risk management for traders and investors. Assessing the liquidity of a cryptocurrency allows market participants to gauge the ease of entering and exiting positions, anticipate the potential impact of their trades on market prices, and manage their risk exposure more effectively. This understanding of liquidity is instrumental in devising prudent risk management strategies.

4. Market Accessibility: Enhanced liquidity promotes market accessibility by providing a seamless and efficient trading experience for participants. A liquid market attracts a diverse range of traders and investors, including retail participants and institutional entities, fostering a vibrant and inclusive trading ecosystem. This accessibility is vital for the widespread adoption and growth of the cryptocurrency market.

5. Market Confidence: Liquidity contributes to market confidence and investor sentiment. A liquid market instills confidence in market participants, as it signifies an active and robust trading environment with ample opportunities for trade execution and portfolio management. This confidence can attract new participants to the market and foster a positive perception of cryptocurrencies as viable investment assets.

6. Price Discovery: Liquidity facilitates efficient price discovery in cryptocurrency markets. A liquid market reflects the true supply and demand dynamics of digital assets, allowing prices to adjust more seamlessly to market conditions. This price discovery mechanism is essential for establishing fair market valuations and supporting informed investment decisions.

By recognizing the importance of liquidity in the crypto space, market participants can leverage this understanding to optimize their trading strategies, mitigate risks, and contribute to the overall resilience and growth of digital asset markets.

Measures of Liquidity in Crypto

Assessing the liquidity of cryptocurrencies involves employing various measures and metrics to gauge the tradability, market depth, and overall liquidity dynamics of digital assets. These measures provide valuable insights for traders, investors, and market analysts, enabling them to evaluate the liquidity of cryptocurrencies and make informed decisions based on their trading and investment objectives.

1. Trading Volume: Trading volume serves as a fundamental measure of liquidity in the crypto market. It represents the total quantity of a cryptocurrency traded within a specific timeframe, such as 24 hours. Higher trading volumes generally indicate greater liquidity, as there is a larger pool of buyers and sellers actively participating in the market. Analyzing trading volumes allows market participants to assess the level of market activity and the potential ease of executing trades without significant price impact.

2. Order Book Depth: The depth of the order book, which encompasses the cumulative volume of buy and sell orders at various price levels, is a critical measure of liquidity. Deeper order books with a balanced distribution of buy and sell orders indicate enhanced liquidity, as they facilitate seamless trade executions without substantial price slippage. Assessing the order book depth provides valuable insights into the availability of market liquidity at different price levels.

3. Spread and Slippage: The bid-ask spread and price slippage are indicative of liquidity conditions in the crypto market. Narrow spreads and minimal slippage suggest higher liquidity, as they reflect a smaller disparity between buying and selling prices and reduced price impact when executing trades. Monitoring spread and slippage metrics allows market participants to assess the cost and efficiency of trade execution in relation to liquidity.

4. Market Depth Charts: Visual representations of market depth, such as depth charts, provide valuable insights into the distribution of buy and sell orders across different price levels. Analyzing market depth charts enables traders and investors to assess the liquidity profile of a cryptocurrency, identify key support and resistance levels, and anticipate potential price movements based on order book dynamics.

5. Liquidity Ratios: Various liquidity ratios, such as the bid-ask ratio and the volume at price, offer quantitative measures of liquidity in the crypto market. These ratios provide insights into the relationship between buy and sell orders, the concentration of trading activity at specific price levels, and the overall liquidity distribution within the market. Utilizing liquidity ratios aids in evaluating the balance and tradability of cryptocurrencies.

6. Historical Liquidity Analysis: Conducting historical liquidity analysis involves examining past trading volumes, order book dynamics, and liquidity metrics to discern patterns and trends in liquidity levels for specific cryptocurrencies. This retrospective assessment enables market participants to identify liquidity trends, seasonal variations, and potential liquidity cycles, informing their trading strategies and market participation decisions.

By leveraging these measures of liquidity in the crypto market, market participants can gain comprehensive insights into the tradability and market dynamics of cryptocurrencies, empowering them to make well-informed decisions and navigate the evolving landscape of digital asset trading with confidence.

Conclusion

As the cryptocurrency market continues to expand and evolve, the concept of liquidity remains integral to the efficiency, stability, and accessibility of digital asset trading. Understanding the nuances of liquidity in the crypto space is paramount for market participants, as it directly influences trade execution, market dynamics, and investment strategies. By delving into the intricacies of liquidity and its measures, individuals can gain valuable insights to navigate the dynamic landscape of digital asset markets.

Assessing the factors affecting liquidity, such as trading volume, market depth, and market activity, provides a comprehensive understanding of the tradability and market dynamics of cryptocurrencies. These factors collectively shape the liquidity profile of digital assets, influencing the ease of executing trades, price stability, and risk management considerations for market participants.

Recognizing the importance of liquidity in the crypto space underscores its role in promoting efficient trade execution, fostering price stability, and instilling market confidence. Enhanced liquidity not only facilitates seamless market accessibility but also contributes to robust price discovery mechanisms, supporting informed investment decisions and market valuations.

Measures of liquidity, including trading volume, order book depth, spread and slippage metrics, market depth charts, liquidity ratios, and historical liquidity analysis, offer valuable tools for evaluating the liquidity profile of cryptocurrencies. These measures enable market participants to gauge market dynamics, anticipate potential price movements, and optimize their trading strategies based on liquidity considerations.

By comprehensively understanding and leveraging the concept of liquidity in the crypto market, individuals can navigate the complexities of digital asset trading with confidence, make informed investment decisions, and contribute to the resilience and growth of the cryptocurrency ecosystem. As the crypto market continues to mature, a nuanced understanding of liquidity will remain indispensable for market participants seeking to thrive in this dynamic and rapidly evolving financial landscape.