Home>Finance>Why Would A Lender Want To Sell Their Loans On The Secondary Mortgage Market?

Finance

Why Would A Lender Want To Sell Their Loans On The Secondary Mortgage Market?

Modified: February 21, 2024

Discover the benefits of lenders selling their loans on the secondary mortgage market to maximize profits and manage risk in the finance industry. Learn why this strategic move can be advantageous.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

The world of finance is complex and ever-evolving, with intricate systems and markets that play a crucial role in the global economy. One such market that significantly impacts the real estate and lending industries is the secondary mortgage market. Understanding the dynamics of this market is essential for both industry professionals and consumers, as it directly influences the availability and terms of mortgage loans.

The secondary mortgage market serves as a platform where mortgage loans are bought and sold by various entities, including government-sponsored enterprises, institutional investors, and private individuals. This market plays a pivotal role in providing liquidity to lenders, thereby enabling them to issue more loans to prospective homebuyers. Moreover, it facilitates the redistribution of risk and capital within the financial system, contributing to overall market stability.

As we delve into the intricacies of the secondary mortgage market, it becomes evident that the decision of lenders to sell their loans on this market is influenced by a myriad of factors, each with its own set of benefits and risks. By exploring these factors, we can gain valuable insights into the motivations behind this strategic financial maneuver and its implications for all stakeholders involved.

Understanding the Secondary Mortgage Market

Before delving into the reasons why lenders opt to sell their loans on the secondary mortgage market, it is essential to grasp the fundamental workings of this intricate financial arena. The secondary mortgage market provides a platform for the buying and selling of existing mortgage loans, thereby facilitating the flow of funds between lenders and investors. This market is not to be confused with the primary mortgage market, where borrowers obtain mortgage loans directly from lenders, such as banks or credit unions.

One of the primary entities involved in the secondary mortgage market is the government-sponsored enterprises (GSEs), including Fannie Mae and Freddie Mac. These entities play a pivotal role in purchasing mortgage loans from primary lenders, thereby injecting liquidity into the market and allowing lenders to free up capital for issuing new loans. Additionally, private investors, such as pension funds and hedge funds, actively participate in this market, seeking investment opportunities in mortgage-backed securities (MBS).

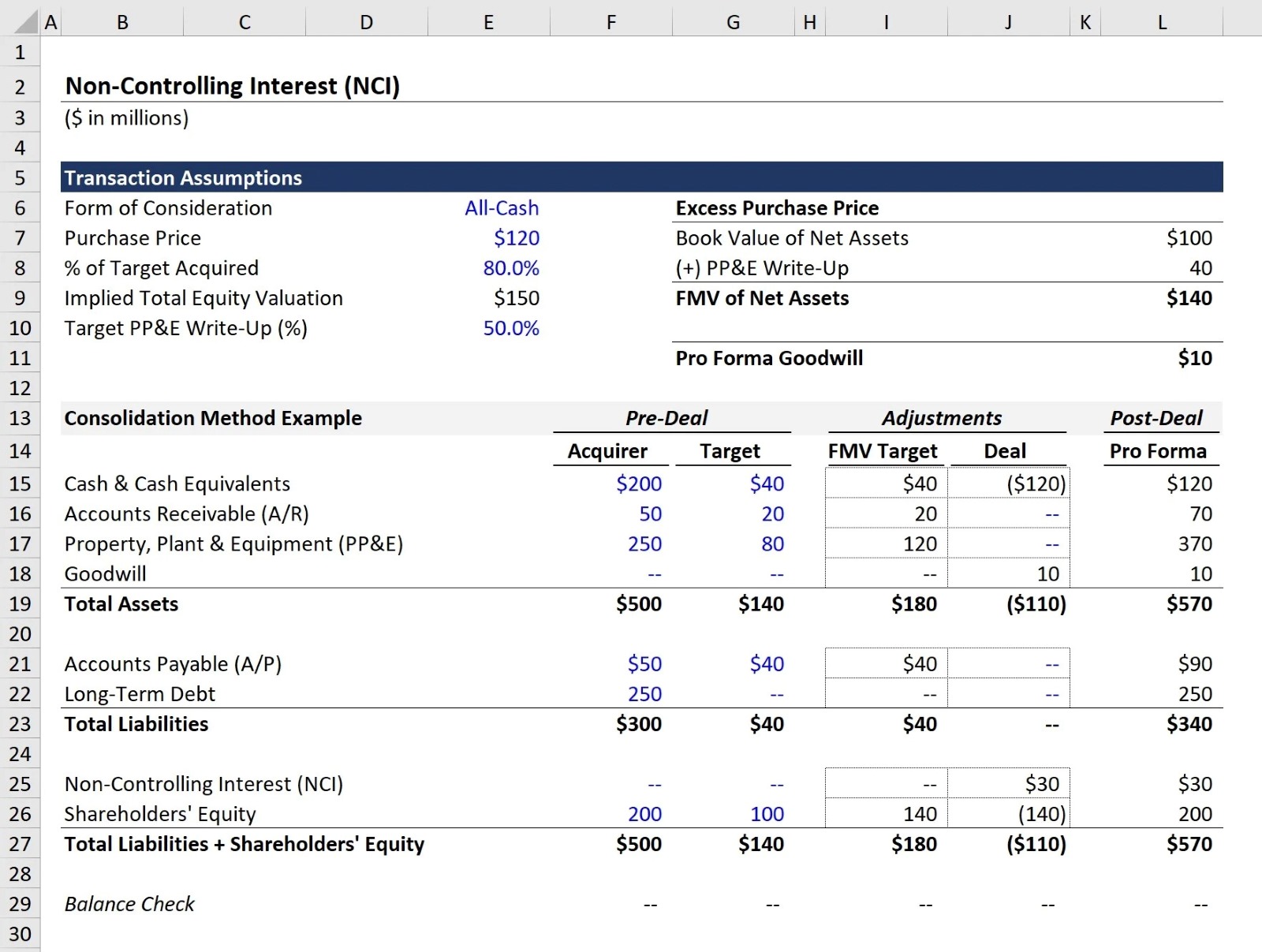

Mortgage-backed securities are financial instruments that derive their value from the underlying pool of mortgage loans. These securities are created when mortgage loans are pooled together, and the cash flows from the loan repayments are distributed to the investors. The process of securitization enables lenders to mitigate risk and optimize their balance sheets, while providing investors with an avenue for diversifying their investment portfolios.

Furthermore, the secondary mortgage market plays a vital role in promoting liquidity and competition within the mortgage industry. By enabling the transfer of mortgage assets, this market fosters a more efficient allocation of capital and risk, ultimately benefiting both lenders and borrowers. However, it is crucial to acknowledge the inherent complexities and risks associated with this market, which can significantly influence the decision-making processes of lenders when it comes to selling their loans.

Benefits of Selling Loans on the Secondary Mortgage Market

Participating in the secondary mortgage market offers lenders a myriad of advantages that significantly impact their financial standing and operational capabilities. One of the primary benefits is the ability to enhance liquidity. By selling loans on the secondary market, lenders can convert illiquid assets, such as long-term mortgage loans, into cash. This influx of liquidity empowers lenders to originate new loans, thereby fueling the continuous cycle of lending and bolstering their revenue streams.

Moreover, selling loans on the secondary mortgage market allows lenders to mitigate risk and optimize their balance sheets. Through the process of securitization, lenders can transfer the credit risk associated with the mortgage loans to the investors purchasing the mortgage-backed securities. This risk transfer mechanism enables lenders to free up capital that would otherwise be tied up in the form of mortgage loans, reducing their exposure to potential credit losses and enhancing their overall financial resilience.

Furthermore, participating in the secondary market provides lenders with the opportunity to diversify their funding sources. Instead of solely relying on deposits or other traditional funding channels, lenders can access additional capital by selling loans to investors in the secondary market. This diversification of funding not only reduces dependency on a single funding avenue but also fosters a more robust and adaptable financial structure, especially in dynamic economic environments.

Another significant benefit of selling loans on the secondary mortgage market is the potential to improve profitability. By offloading loans and generating additional income from the sale, lenders can optimize their return on assets and capitalize on new lending opportunities. This enhanced profitability can contribute to the long-term sustainability and growth of lending institutions, reinforcing their position in the competitive financial landscape.

Additionally, participating in the secondary market can lead to improved regulatory compliance and capital efficiency. By adhering to regulatory requirements and capital guidelines, lenders can streamline their operations and ensure adherence to industry standards, ultimately fostering a more stable and compliant lending environment.

Overall, the benefits of selling loans on the secondary mortgage market are multifaceted, encompassing enhanced liquidity, risk mitigation, funding diversification, improved profitability, and regulatory compliance, all of which are instrumental in shaping the strategic decisions of lenders in the mortgage industry.

Risks and Challenges Associated with Selling Loans

While the secondary mortgage market offers compelling benefits for lenders, it is crucial to acknowledge the inherent risks and challenges associated with selling loans in this complex financial arena. One of the primary risks is the potential impact on the lender’s customer relationships. When lenders sell loans on the secondary market, the servicing rights associated with those loans may also be transferred to the new loan owners or servicers. This transition can lead to a disruption in communication and customer experience, potentially affecting the lender’s reputation and relationship with borrowers.

Furthermore, the fluctuating interest rate environment poses a significant challenge for lenders selling loans on the secondary market. Interest rate risk arises when the market interest rates differ from the interest rates on the loans being sold. This disparity can affect the market value of the loans and mortgage-backed securities, potentially leading to valuation losses for the lender. Mitigating interest rate risk requires sophisticated hedging strategies and ongoing monitoring of market conditions, adding a layer of complexity to the loan sale process.

Another critical risk is the potential impact on the lender’s balance sheet and capital adequacy. When loans are sold on the secondary market, the resulting cash inflow may lead to changes in the lender’s capital structure and liquidity position. Managing these changes effectively is essential to ensure that the lender maintains regulatory compliance and sustains a robust financial footing. Additionally, the accounting treatment of loan sales and securitization can introduce complexities in financial reporting and regulatory compliance, requiring meticulous attention to detail and adherence to accounting standards.

Moreover, operational and technological challenges can emerge when navigating the process of selling loans on the secondary market. From data management and loan documentation to compliance with investor requirements, lenders must ensure seamless operational execution to facilitate successful loan sales. Embracing advanced technology and robust infrastructure is crucial in overcoming these challenges and optimizing the efficiency of loan sale transactions.

Lastly, market liquidity and investor demand fluctuations can pose challenges for lenders seeking to sell loans on the secondary market. The ability to find willing buyers at favorable prices can be influenced by market dynamics and investor preferences, impacting the timing and execution of loan sales. Adapting to these fluctuations and maintaining flexibility in loan sale strategies is essential to navigate the ever-changing landscape of the secondary mortgage market.

Addressing these risks and challenges requires a comprehensive understanding of the market dynamics and a proactive approach to risk management and operational excellence. By effectively mitigating these challenges, lenders can harness the benefits of the secondary market while safeguarding their financial stability and customer relationships.

Factors Influencing Lenders to Sell Loans

The decision of lenders to sell their loans on the secondary mortgage market is influenced by a confluence of factors that encompass financial, regulatory, and strategic considerations. One of the primary drivers is the pursuit of liquidity. Lenders often seek to optimize their capital and liquidity positions to support ongoing lending activities and meet regulatory requirements. By selling loans on the secondary market, lenders can unlock the value of their loan portfolios, converting illiquid assets into cash to fund new loan originations and enhance their overall liquidity position.

Additionally, risk management plays a pivotal role in influencing lenders to sell loans. Through the process of securitization, lenders can transfer a portion of the credit risk associated with their loans to investors in the secondary market. This risk transfer mechanism enables lenders to mitigate their exposure to potential credit losses, thereby bolstering their risk management framework and regulatory compliance. By offloading risk, lenders can optimize their balance sheets and allocate capital more efficiently, strengthening their financial resilience.

Regulatory and capital considerations also weigh heavily on the decision to sell loans on the secondary market. Regulatory guidelines such as capital adequacy requirements and risk-based capital standards incentivize lenders to assess their capital allocation and seek avenues for capital optimization. Selling loans on the secondary market can contribute to capital efficiency and regulatory compliance, aligning with the broader strategic objectives of lenders in navigating the evolving regulatory landscape.

Market conditions and interest rate dynamics exert significant influence on lenders’ decisions to sell loans. In a rising interest rate environment, lenders may proactively sell loans to mitigate interest rate risk and capitalize on favorable market conditions. Conversely, in a declining interest rate environment, lenders may evaluate the potential impact on the valuation of their loan portfolios and adjust their loan sale strategies accordingly. Adapting to market fluctuations and interest rate movements is integral to the strategic management of loan assets in the secondary market.

Furthermore, strategic portfolio management and business expansion initiatives drive lenders to assess their loan portfolios and consider opportunities for optimization. Selling loans on the secondary market can enable lenders to reallocate capital towards strategic growth areas, diversify their funding sources, and enhance their competitive positioning in the mortgage lending landscape. This strategic realignment of loan portfolios aligns with the long-term objectives of lenders in fostering sustainable growth and operational excellence.

Ultimately, the interplay of liquidity needs, risk management, regulatory compliance, market dynamics, and strategic imperatives shapes the multifaceted decision-making process of lenders when it comes to selling loans on the secondary mortgage market. By carefully evaluating these factors and aligning their loan sale strategies with broader business objectives, lenders can navigate the complexities of the secondary market while optimizing their financial performance and market competitiveness.

Conclusion

The secondary mortgage market serves as a vital component of the global financial landscape, enabling the efficient flow of capital and risk within the mortgage industry. As lenders navigate the intricate dynamics of this market, the decision to sell loans on the secondary market is shaped by a diverse array of factors, each carrying significant implications for the financial stability and operational agility of lending institutions.

By participating in the secondary market, lenders can harness a multitude of benefits, including enhanced liquidity, risk mitigation, funding diversification, improved profitability, and regulatory compliance. These advantages empower lenders to optimize their balance sheets, support ongoing lending activities, and fortify their market position, ultimately contributing to a more resilient and adaptable financial framework.

However, the pursuit of these benefits is accompanied by inherent risks and challenges, encompassing customer relationship management, interest rate dynamics, balance sheet optimization, operational efficiency, and market liquidity fluctuations. Effectively navigating these risks requires a comprehensive understanding of market dynamics and a proactive approach to risk management and operational excellence.

Amidst these complexities, the decision to sell loans on the secondary market is influenced by the pursuit of liquidity, risk management imperatives, regulatory considerations, market dynamics, and strategic portfolio optimization. By carefully evaluating these factors and aligning loan sale strategies with broader business objectives, lenders can effectively leverage the opportunities presented by the secondary market while safeguarding their financial stability and customer relationships.

As the financial landscape continues to evolve, the strategic management of loan portfolios in the secondary mortgage market remains a critical aspect of lenders’ operations. By embracing a holistic approach to decision-making, grounded in a deep understanding of market intricacies and a proactive stance towards risk management, lenders can navigate the complexities of the secondary market while driving sustainable growth and long-term value creation.

In essence, the secondary mortgage market stands as a dynamic and influential arena that shapes the strategies and operations of lending institutions, underscoring the pivotal role it plays in fostering a resilient and vibrant mortgage industry.