Finance

Why Do Banks Transfer Mortgage Loans?

Published: February 18, 2024

Learn why banks transfer mortgage loans and the impact on your finances. Understand the reasons behind this common practice in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Dynamics of Mortgage Loan Transfers

When you secure a mortgage to purchase a home, you establish a financial relationship with a specific lender. However, it’s not uncommon for this arrangement to undergo changes over time. One of the most significant alterations that can occur is the transfer of your mortgage loan from one financial institution to another. This process, known as mortgage loan transfer, can raise questions and concerns for borrowers. Understanding the reasons behind these transfers and their potential impact is crucial for homeowners.

Throughout the lifespan of a mortgage, it’s not unusual for borrowers to receive notifications informing them that their loan has been transferred to a different lender. This development can be perplexing and may prompt borrowers to wonder why such transfers occur and how they might affect their financial obligations. In this article, we will delve into the intricacies of mortgage loan transfers, exploring the underlying reasons for these transfers, their implications for borrowers, and the regulatory considerations that govern this practice.

Understanding Mortgage Loan Transfers

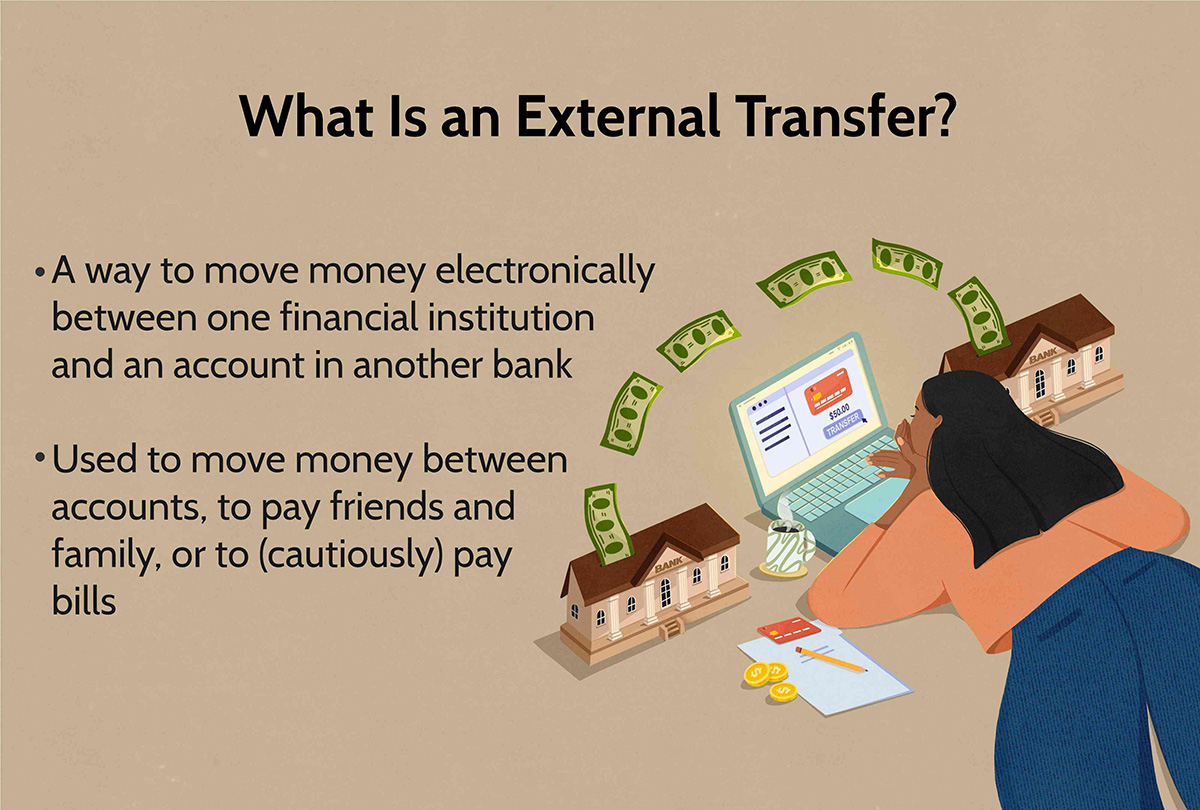

At its core, a mortgage loan transfer involves the assignment of the rights to receive payment on a mortgage from one lender or servicer to another. This means that the entity to which you initially owed the money no longer holds that debt, and a new entity assumes the responsibility for managing and collecting payments on the loan. It’s important to note that while the ownership of the loan may change, the terms and conditions of the mortgage, including the interest rate, repayment schedule, and other essential details, generally remain unchanged for the borrower.

Mortgage loan transfers can occur for various reasons, and they are a common practice within the financial industry. These transfers can involve the sale of mortgage loans to other financial institutions, the assignment of servicing rights from one loan servicer to another, or the restructuring of a lender’s portfolio. While borrowers may not have a say in these transfers, it’s essential for them to be aware of the implications and ensure that their rights are protected throughout the process.

One key aspect to understand is the distinction between the lender and the loan servicer. The lender is the entity that initially provided the funds for the mortgage, while the loan servicer is responsible for collecting payments, managing escrow accounts, and handling other administrative aspects of the loan. It’s common for the loan servicer to change as a result of a mortgage loan transfer, leading to adjustments in the process of making payments and communicating with the entity managing the loan.

Reasons for Banks to Transfer Mortgage Loans

Several factors drive the decision of banks and financial institutions to transfer mortgage loans. Understanding these reasons can provide valuable insights into the dynamics of the lending industry and the motivations behind loan transfers. Here are some common reasons for banks to transfer mortgage loans:

- Portfolio Diversification: Banks often engage in portfolio diversification to manage risk and optimize their asset allocation. By transferring mortgage loans, they can adjust the composition of their loan portfolios, balancing the distribution of assets and potentially reducing exposure to specific types of loans or geographic regions.

- Liquidity and Capital Management: Mortgage loan transfers can be driven by the need to enhance liquidity and manage capital effectively. Banks may opt to sell mortgage loans to free up capital for other lending activities or to meet regulatory requirements, thereby improving their overall financial position.

- Operational Efficiency: Loan servicing operations require significant resources, including personnel, technology, and infrastructure. Transferring mortgage loans allows banks to streamline their operations by consolidating servicing activities, leveraging economies of scale, and focusing on core business functions.

- Risk Mitigation: Banks assess and mitigate various types of risk associated with mortgage loans, including credit risk, interest rate risk, and prepayment risk. Transferring loans can help banks reduce their exposure to specific risks, adjust their risk profiles, and align their lending activities with their risk tolerance and strategic objectives.

- Regulatory Compliance: Regulatory requirements and guidelines, such as those related to capital adequacy, asset quality, and risk management, can influence banks’ decisions to transfer mortgage loans. Adhering to regulatory standards and ensuring compliance with supervisory expectations are critical considerations for financial institutions.

These reasons underscore the complex interplay of financial, operational, and regulatory factors that drive mortgage loan transfers. By recognizing the underlying motives behind these transfers, borrowers can gain a deeper appreciation of the broader financial landscape and the forces shaping the management of mortgage assets by banks and financial institutions.

Impact on Borrowers

When a mortgage loan is transferred from one lender to another, borrowers may experience several implications that warrant their attention. It’s essential for homeowners to understand the potential impact of these transfers on their financial obligations and the management of their mortgage. Here are key considerations regarding the impact of mortgage loan transfers on borrowers:

- Payment Processing and Communication: A transfer of mortgage loan ownership or servicing rights can lead to changes in payment processing and communication channels for borrowers. It’s crucial for borrowers to stay informed about where and how to submit their payments, as well as whom to contact for inquiries and assistance regarding their loan.

- Escrow Account Management: If the transfer involves a change in loan servicers, borrowers with escrow accounts for property taxes and insurance should ensure a seamless transition in managing these accounts. Any adjustments to escrow payments and the handling of related funds should be clearly communicated and diligently monitored.

- Contractual Terms and Obligations: While the terms and conditions of the mortgage generally remain unchanged for borrowers, it’s advisable to review the loan documents and confirm that all contractual obligations, including interest rates, repayment schedules, and other provisions, are accurately reflected in the transfer process.

- Customer Service and Support: Borrowers may encounter differences in customer service standards and support mechanisms when dealing with a new loan servicer. Understanding the procedures for addressing concerns, seeking assistance, and accessing relevant resources is crucial for maintaining a positive borrower experience.

- Regulatory Safeguards: Regulatory safeguards exist to protect borrowers during mortgage loan transfers. These safeguards include requirements for notifying borrowers about the transfer, ensuring the continuity of loan servicing, and safeguarding the rights of borrowers to dispute errors and seek resolution for servicing-related issues.

By being proactive and vigilant, borrowers can navigate the impact of mortgage loan transfers with greater confidence and ensure that their rights and financial interests are upheld throughout the process. Staying informed, maintaining open communication with the involved parties, and seeking clarification on any changes or concerns are essential steps for borrowers facing a mortgage loan transfer.

Regulatory Considerations

Regulatory oversight plays a crucial role in governing mortgage loan transfers to safeguard the interests of borrowers and ensure the stability and integrity of the lending market. Various regulations and guidelines are in place to address the legal and procedural aspects of mortgage loan transfers, emphasizing transparency, consumer protection, and compliance with industry standards. Here are key regulatory considerations related to mortgage loan transfers:

- Notice Requirements: Regulatory frameworks typically mandate that borrowers receive timely and comprehensive notifications regarding the transfer of their mortgage loans. These notifications should include details about the new loan servicer, contact information, any changes in payment processing, and other pertinent information to facilitate a smooth transition.

- Continuity of Servicing: Regulations emphasize the continuity of loan servicing to ensure that borrowers’ rights and obligations remain unaffected by the transfer. Loan servicers are required to maintain accurate records, process payments without disruption, and honor the terms of the original mortgage agreement, providing consistency and reliability for borrowers.

- Consumer Protections: Regulatory frameworks incorporate consumer protection measures to safeguard borrowers from unfair or deceptive practices during mortgage loan transfers. These protections encompass the handling of escrow accounts, the resolution of servicing errors, the treatment of sensitive borrower information, and the accessibility of recourse mechanisms for addressing grievances.

- Compliance Standards: Banks and financial institutions involved in mortgage loan transfers are subject to compliance standards established by regulatory authorities. These standards encompass financial reporting requirements, risk management protocols, internal controls, and adherence to ethical business practices, ensuring the integrity and accountability of the transfer process.

- Legal Documentation: Regulatory considerations dictate the proper documentation and recording of mortgage loan transfers to validate the legal transfer of ownership or servicing rights. Compliance with legal formalities and documentation standards is essential to uphold the validity and enforceability of the transferred mortgage loans.

By adhering to regulatory considerations, lenders, loan servicers, and other entities involved in mortgage loan transfers uphold the principles of transparency, accountability, and consumer protection. These regulatory frameworks serve to instill confidence in borrowers, mitigate potential risks, and uphold the fair and equitable treatment of homeowners throughout the transfer process.

Conclusion

Understanding the intricacies of mortgage loan transfers is essential for borrowers as they navigate the dynamics of homeownership and financial obligations. The transfer of mortgage loans from one bank to another or from one loan servicer to a different entity is a common occurrence within the lending industry, driven by a variety of financial, operational, and regulatory factors.

For borrowers, the impact of mortgage loan transfers encompasses considerations related to payment processing, communication channels, escrow account management, contractual terms, and customer service standards. By remaining informed, proactive, and attentive to the details of the transfer process, borrowers can mitigate potential disruptions and ensure the continuity of their mortgage obligations.

Regulatory considerations play a pivotal role in safeguarding the rights of borrowers and maintaining the integrity of mortgage loan transfers. Notice requirements, continuity of servicing, consumer protections, compliance standards, and legal documentation are fundamental aspects of the regulatory framework governing these transfers, providing essential safeguards for borrowers.

In essence, mortgage loan transfers are a reflection of the dynamic nature of the lending industry, influenced by strategic, operational, and regulatory imperatives. By gaining insights into the reasons behind these transfers and their implications, borrowers can navigate this aspect of homeownership with confidence, ensuring that their rights are protected and their financial interests are upheld throughout the transfer process.

Ultimately, staying informed, maintaining open communication with the involved parties, and being aware of regulatory protections are essential steps for borrowers facing a mortgage loan transfer, empowering them to manage this aspect of their homeownership journey effectively.