Home>Finance>Why Would An Investor Want To Make Stock Market Investments?

Finance

Why Would An Investor Want To Make Stock Market Investments?

Modified: December 30, 2023

Discover the benefits of making stock market investments and how it can help grow your finances as an investor. Explore the potential returns and opportunities in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Investing in the stock market has long been considered one of the most lucrative and rewarding ways to grow wealth. It offers individuals the opportunity to participate in the growth and success of businesses, thereby potentially reaping substantial financial gains. While stock market investments do carry risks, they also offer numerous advantages that make them attractive to investors of all backgrounds and experience levels.

In this article, we will explore the reasons why investors choose to make stock market investments. From the potential for high returns to the ability to diversify portfolios and generate passive income, there are a variety of compelling factors that draw individuals towards investing in stocks. Understanding these advantages can help investors make informed decisions and utilize the stock market to reach their financial goals.

Before delving into the specific benefits of stock market investments, it is important to note that investing in the stock market requires careful consideration and research. It is advisable to consult with a financial advisor or do thorough market analysis before making any investment decisions. With that being said, let us now explore the reasons why investors are drawn to stock market investments.

Potential for High Returns

One of the primary reasons why investors are attracted to the stock market is the potential for high returns. Unlike traditional savings accounts or fixed-income investments, such as bonds, stocks have historically outperformed other asset classes over the long term. This means that investors have the opportunity to grow their wealth at a faster rate through stock market investments.

When investors make well-informed decisions and choose stocks of companies that experience significant growth, they can reap substantial financial rewards. It is not uncommon for stocks to generate returns of 10% or more annually, far surpassing the returns offered by more conservative investment options. The key is to identify companies that have strong fundamentals, growth potential, and a competitive advantage in their respective industries.

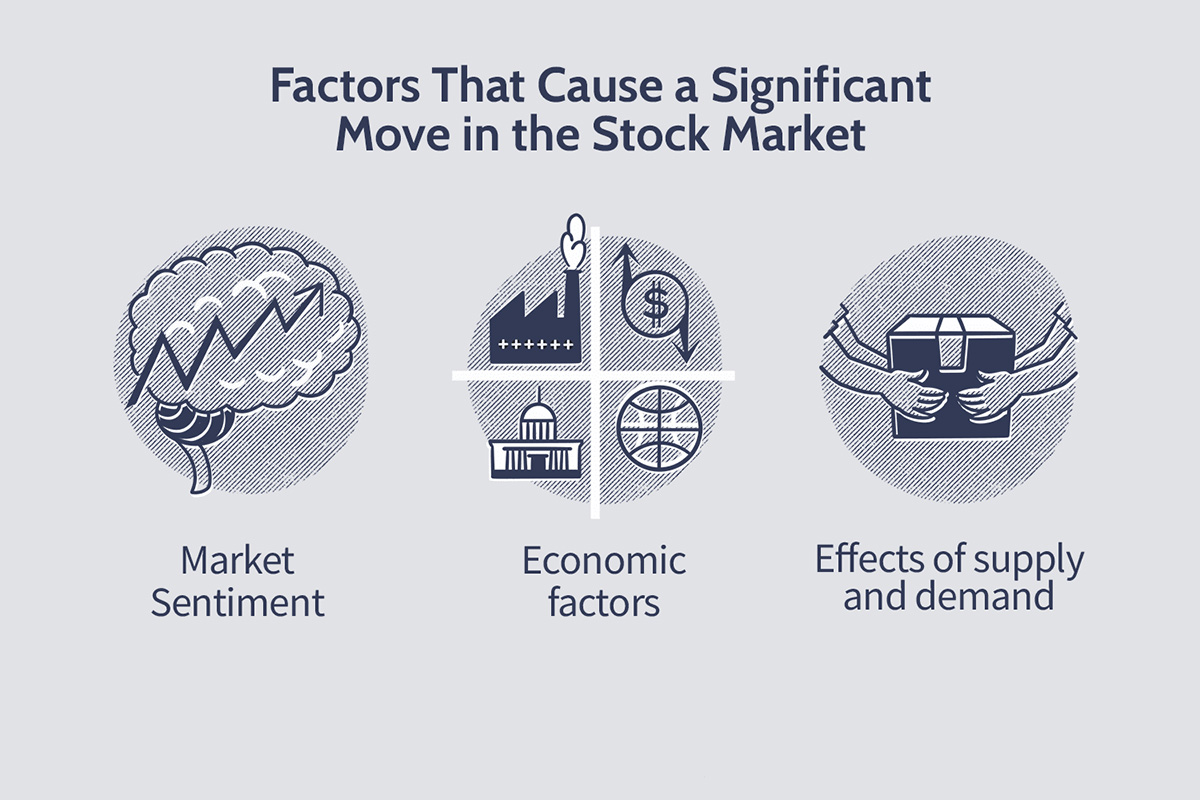

However, it is important to note that the stock market is inherently volatile, and investment returns are not guaranteed. Stock prices can fluctuate based on a variety of factors including economic conditions, market sentiment, company performance, and global events. Therefore, it is crucial for investors to have a long-term perspective and to diversify their portfolio to mitigate risk.

For those willing to accept the risks and volatility, the stock market offers the potential for significant financial gains. Whether through capital appreciation or dividend payments, investors have the opportunity to achieve a higher return on their investment compared to other asset classes. This potential for high returns is what makes the stock market an enticing option for individuals seeking to grow their wealth over time.

Diversification of Investment Portfolios

Another compelling reason for investors to make stock market investments is the ability to diversify their investment portfolios. Diversification is a risk management strategy that involves spreading investments across different asset classes, sectors, and regions to reduce the impact of any individual investment’s performance on the overall portfolio.

The stock market provides investors with a wide range of investment options, from large-cap stocks of established companies to small-cap growth stocks and even international stocks. By investing in stocks from different industries and regions, investors can reduce the risk of their portfolio being negatively impacted by the performance of a single stock or sector.

When one investment underperforms, others may offset the losses, potentially leading to more stable and consistent overall returns. This diversification strategy can help protect investors from significant financial losses and enhance the overall risk-adjusted return of their portfolio.

Furthermore, diversification in the stock market can also offer exposure to various sectors and industries, allowing investors to capitalize on different market trends and economic cycles. For example, during periods of economic expansion, certain industries like technology or consumer discretionary may experience significant growth, while defensive sectors like utilities or healthcare may perform better during economic downturns. By diversifying their stock holdings across different sectors, investors can take advantage of these market dynamics and potentially optimize their returns.

It is important to note that diversification does not guarantee against losses, and it is still possible for investments in multiple stocks to decline simultaneously. However, the goal of diversification is to reduce the overall risk of the portfolio and increase the likelihood of achieving positive long-term returns.

By including a mix of stocks from various sectors and regions in their investment portfolios, investors can benefit from the potential returns of stock market investments while reducing the overall risk. Diversification is a key strategy for building a resilient and balanced investment portfolio, and the stock market offers ample opportunities for investors to achieve this diversification.

Opportunity for Passive Income

One of the advantages of stock market investments is the potential to generate passive income. Passive income refers to income that is earned with little to no effort on the investor’s part, apart from the initial investment and periodic monitoring of the portfolio. This is in contrast to active income, which is earned through direct involvement in a job or business.

Stock market investments can generate passive income in the form of dividends. Dividends are a portion of a company’s profits that are distributed to its shareholders, typically on a regular basis. Many established companies, especially in sectors such as utilities, real estate, and consumer goods, have a history of paying dividends to their shareholders.

Investors who own dividend-paying stocks can enjoy a steady stream of income without having to actively work for it. These dividend payments can be reinvested into additional shares of the same stock, thereby compounding the returns over time. Alternatively, investors can use the dividends to supplement their regular income or reinvest in other investment opportunities.

It is important to note that not all stocks pay dividends, and companies can choose to adjust or suspend dividend payments based on their financial performance or other factors. However, dividend-paying stocks can be an attractive option for investors seeking regular income, especially those approaching retirement or looking to add stability to their investment portfolio.

Moreover, the stock market also provides opportunities for passive income through other means, such as rental income from real estate investment trusts (REITs) or income generated from selling covered call options. These strategies require a deeper understanding of the market and may involve more active management, but they can provide additional avenues for investors to generate passive income.

Overall, the stock market offers investors the potential for passive income through dividends and other investment strategies. By including dividend-paying stocks or other income-generating securities in their portfolio, investors can benefit from a regular stream of income without requiring active involvement in their investments.

Liquidity

Liquidity refers to the ease and speed with which an investment can be bought or sold without significantly impacting its price. Compared to other investment options such as real estate or private equity, stock market investments offer high levels of liquidity, making them an attractive choice for investors.

When investors buy shares of a publicly traded company, they can easily sell those shares on the stock exchange whenever they want, as long as there is sufficient market demand. Unlike real estate, which can take time and effort to sell, or private equity investments, which often require holding periods of several years, stocks can be bought and sold with just a few clicks.

The liquidity of stock market investments brings multiple benefits to investors. Firstly, it provides flexibility and the ability to respond quickly to changing market conditions or financial needs. If an investor requires immediate access to cash or wants to take advantage of an investment opportunity, they can sell their stocks and convert them into cash within a short period of time.

Additionally, the liquidity of the stock market ensures transparent pricing. The constant buying and selling of stocks on the exchange helps establish fair market prices based on supply and demand. Investors can readily obtain information about the current market price of a stock and execute trades at fair and competitive prices.

The liquidity of stocks also allows investors to implement different trading strategies. They can choose between long-term investing, where stocks are held for extended periods to capture potential price appreciation, or short-term trading, where stocks are bought and sold quickly to take advantage of short-term price fluctuations.

However, it is essential to note that while stocks offer high liquidity, there can still be variations in liquidity levels among individual stocks. Stocks with high trading volumes and market capitalization tend to have greater liquidity compared to smaller, less-traded stocks. It is important for investors to consider the liquidity of a stock before making an investment decision, especially if they anticipate needing to sell the stock quickly in the future.

In summary, the liquidity of the stock market provides investors with flexibility, transparency, and the ability to execute trades quickly. The ease of buying and selling stocks makes them a highly liquid investment option, allowing investors to access their funds when needed or capitalize on investment opportunities as they arise.

Ownership in Companies

Investing in the stock market offers individuals the opportunity to become owners of established companies or emerging businesses. When investors purchase shares of a company’s stock, they acquire ownership stakes in that organization, giving them the ability to participate in its success and growth.

This ownership aspect of stock market investments provides several advantages. Firstly, owning stocks gives investors a sense of ownership and pride in supporting companies they believe in or admire. It allows them to align their investments with their personal values or interests. For example, an environmentally conscious investor may choose to invest in renewable energy companies, while a technology enthusiast may opt for tech giants.

Secondly, owning shares in a company can provide individuals with financial benefits. As the company generates profits and experiences growth, the value of its stock may appreciate, leading to potential capital gains for investors. This can result in increased wealth and a positive return on investment.

Furthermore, shareholders may have the opportunity to receive dividends, as mentioned earlier. Dividends are a distribution of a company’s profits to its shareholders, providing direct financial rewards to owners of the stock. Dividends can be a valuable source of passive income or a means of reinvesting in additional shares of the company.

Moreover, being a shareholder often grants individuals certain rights and privileges. For instance, shareholders may have the right to vote on important matters or elect members of the company’s board of directors. This gives investors a voice in influencing the company’s decisions and direction. In some cases, shareholders may have the opportunity to attend shareholder meetings and directly engage with company management.

It is worth noting that the level of ownership and influence in a company is typically proportional to the number of shares owned. Larger shareholders often have more voting rights and the ability to exert greater influence on company policies. Nevertheless, even investors with relatively small ownership stakes can benefit from their association with the company and its potential for success.

Owning shares in companies not only provides financial benefits but also allows investors to have a stake in the businesses they support. Whether it’s a personal connection, the potential for financial gains, or the ability to influence company decisions, ownership in companies is a key advantage of investing in the stock market.

Influence on Company Decisions

One of the unique advantages of investing in the stock market is the potential to have a say in the decision-making processes of the companies in which one owns shares. As shareholders, investors have the opportunity to influence company decisions and policies through various means.

One way shareholders can have a say in company decisions is through voting rights. When companies make significant strategic decisions, such as the election of board members, mergers and acquisitions, or changes to corporate governance practices, they often seek shareholder approval. Shareholders are given the opportunity to vote on these matters, with each share typically equating to one vote. Therefore, owning a significant number of shares can give an investor more influence and voting power in shaping the company’s future.

Moreover, shareholders can express their opinions and concerns through initiatives such as shareholder proposals. Shareholder proposals are formal requests made by shareholders to company management or the board of directors to take certain actions or address specific issues. These proposals can cover a wide range of topics, including corporate governance, environmental practices, executive compensation, or social responsibility. By submitting shareholder proposals, investors can raise awareness about important issues and potentially influence company policies.

In addition to direct influence, shareholders can indirectly influence company decisions through their buying and selling behavior. When shareholders express dissatisfaction with a company’s performance or actions, they may choose to sell their shares, which can potentially impact the stock price. A decline in the stock price can alert company management and the board of directors to the need for change or improvement in order to attract and retain investors.

It is important to note that the level of influence that individual shareholders have on company decisions may vary based on the size of their investment and the company’s structure. Major shareholders, such as institutional investors or activist shareholders holding large stakes, often have a greater ability to influence decision-making compared to individual retail investors with smaller holdings.

Nonetheless, even individual investors with relatively small ownership stakes have the opportunity to voice their opinions and potentially impact company decisions. Additionally, advancements in technology and the rise of online shareholder platforms have made it easier for individual investors to collaborate and amplify their voices, creating a collective force that can shape corporate behavior.

Overall, investing in the stock market grants shareholders the chance to influence company decisions through voting rights, shareholder proposals, and buying/selling behavior. Whether it’s advocating for better governance practices, environmental sustainability, or social responsibility, investors can use their ownership stake to champion causes they believe in and shape the trajectory of the companies they invest in.

Information and Market Research

Investing in the stock market provides individuals with access to a wealth of information and market research that can help inform their investment decisions. Whether it’s financial statements, analyst reports, or general market trends, having access to timely and accurate information is crucial in making informed investment choices.

Publicly traded companies are required to disclose their financial information, including quarterly and annual reports, to the public. These reports provide detailed insights into the company’s financial health, performance, and future prospects. Investors can analyze this information to assess the company’s profitability, cash flow, debt levels, and overall stability. By staying updated on a company’s financial status, investors can make more informed decisions about buying or selling its stock.

In addition to company-specific information, the stock market provides a wide range of resources for market research. Investors can access financial news, market analysis, and expert opinions to gain insights into broader market trends and developments. This information can help investors identify potential investment opportunities, understand market dynamics, and make strategic investment decisions.

Moreover, brokerage firms and financial institutions often provide research reports and recommendations on various stocks. These reports are compiled by experienced analysts who analyze companies and industries in-depth, offering insights into their growth potential, valuation, and risks. Investors can use these reports as a valuable resource to guide their investment decisions and evaluate the potential of specific stocks.

Furthermore, technological advancements have made it easier for investors to access and analyze market data. Online platforms and financial news websites provide real-time stock prices, historical data, and trading volumes. Charting tools and various financial indicators can assist investors in identifying patterns and trends in stock prices, enabling them to make more informed decisions based on technical analysis.

However, it is important for investors to exercise caution and conduct thorough research before making investment decisions. Not all information available may be reliable or accurate, and market conditions can change rapidly. It is wise to verify information from multiple sources and consult with financial advisors or professionals to gain a more comprehensive understanding of the stock market and its dynamics.

In summary, investing in the stock market grants individuals access to a wealth of information and market research. Through company financial reports, market news, research reports, and technological tools, investors can gather the necessary information to make informed decisions and stay updated with the latest market trends. Utilizing this information can enhance the ability to choose stocks strategically and optimize investment returns.

Flexibility in Investment Options

Investing in the stock market provides investors with a high degree of flexibility in choosing their investment options. The stock market offers a wide range of investment opportunities that can cater to different investment preferences, goals, and risk appetites.

One of the key flexibilities offered by the stock market is the ability to invest in companies of various sizes and industries. There are large-cap stocks of well-established companies, mid-cap stocks of growing businesses, and small-cap stocks of emerging companies. This variety allows investors to tailor their portfolios based on their risk tolerance and investment preferences. They can choose to focus on stable blue-chip companies, innovative tech startups, or industry-specific sectors.

Furthermore, the stock market provides investors with the flexibility to adjust their portfolios based on market conditions and their investment strategies. Investors can buy and sell stocks at any time, allowing them to capitalize on short-term price movements or align their portfolio with changing market trends. For example, during an economic upswing, investors may allocate more funds to growth stocks, while during market downturns, they may shift towards defensive stocks or value-oriented investments.

Additionally, the stock market offers investors the flexibility to customize their risk exposure through different investment instruments. Investors can choose to invest directly in individual stocks, allowing for a more targeted approach and the potential for higher returns. Alternatively, they can invest in exchange-traded funds (ETFs), which offer diversification across a group of stocks or a specific index, providing a more balanced and lower-risk investment option.

Investors can also opt for different investment strategies within the stock market. They can choose to be active traders, frequently buying and selling stocks based on short-term price movements or market conditions. On the other hand, they can adopt a long-term investment strategy, holding onto stocks for extended periods and focusing on the fundamental value and growth potential of companies.

In addition to the flexibility in investment options, the stock market allows investors to start with various capital levels. While some stocks may have a higher price per share, there are many stocks available at more affordable prices, allowing investors to start small and gradually build their portfolios over time. This accessibility makes stock market investing inclusive and attainable for a wide range of individuals.

It is important for investors to assess their financial goals, risk tolerance, and investment preferences before making investment decisions. Seeking guidance from financial advisors or engaging in thorough research can help investors navigate the stock market’s flexibility and make the most suitable investment choices.

In summary, the stock market offers flexibility in investment options, allowing investors to customize their portfolios based on their objectives, risk tolerance, and market conditions. The ability to invest in different companies, industries, and investment instruments, along with the flexibility to adopt various investment strategies, makes the stock market an adaptable and versatile platform for investors seeking to grow their wealth.

Long-Term Wealth Creation

Investing in the stock market has long been recognized as a powerful tool for long-term wealth creation. Through strategic and disciplined investing, individuals have the potential to grow their wealth significantly over time.

One of the key advantages of the stock market is the potential for capital appreciation. Over the long term, stock prices can increase, leading to substantial gains for investors. By investing in fundamentally strong companies with solid growth prospects, investors have the opportunity to benefit from the company’s success and the appreciation of their stock holdings.

Historically, the stock market has outperformed other investment options, such as bonds or savings accounts, over extended periods. While short-term fluctuations can occur, the overall trend of the stock market has been upward, reflecting the growth of economies, businesses, and innovation. This long-term upward trend can provide investors with the potential for significant returns on their investments.

Moreover, investors who adopt a buy-and-hold strategy can benefit from the power of compounding. By reinvesting dividends or capital gains back into the stock market, investors can generate additional returns. Over time, the compounding effect can accelerate the growth of their wealth and lead to substantial gains. The longer the investment horizon, the more pronounced the compounding effect becomes.

Furthermore, the stock market allows individuals to take advantage of long-term economic trends and growth sectors. For example, investing in sectors such as technology, healthcare, or renewable energy can offer exposure to industries poised for significant growth. As these sectors continue to expand, investors can capitalize on their long-term potential and benefit from the companies driving innovation and capturing market share.

It is important to note that investing in the stock market carries risks, and there can be periods of volatility and decline. However, by taking a long-term perspective and staying committed to their investment strategy, investors can ride out market fluctuations and potentially realize substantial gains over time.

Successful long-term wealth creation in the stock market requires careful research, diversification, and discipline. It is advisable to create a well-balanced portfolio that aligns with one’s financial goals and risk tolerance. Monitoring the portfolio periodically and making adjustments as necessary can help investors stay on track towards their long-term wealth accumulation objectives.

In summary, investing in the stock market provides individuals with the opportunity for long-term wealth creation. By investing in fundamentally strong companies, harnessing the power of compounding, and staying committed to a long-term investment strategy, individuals can potentially grow their wealth significantly over time. However, it is essential to approach stock market investing with diligence, prudence, and a long-term mindset to maximize the potential for long-term wealth accumulation.

Conclusion

Investing in the stock market can be a rewarding and effective way to grow wealth over the long term. The potential for high returns, diversification of investment portfolios, opportunity for passive income, liquidity, ownership in companies, influence on company decisions, access to information and market research, flexibility in investment options, and the potential for long-term wealth creation are key reasons why investors choose to participate in the stock market.

The stock market offers the potential for significant financial gains through capital appreciation and dividend payments. Investors have the ability to diversify their portfolios across different sectors, sizes, and regions, mitigating risk and capturing opportunities for growth. The stock market also allows for passive income through dividends, providing investors with a steady stream of earnings or the option to reinvest into additional shares. The liquidity of the stock market ensures that investors can easily buy and sell their investments, providing flexibility and responsiveness to changing market conditions.

Investing in stocks provides individuals with ownership in companies, enabling them to align their investments with their interests and values. Shareholders can have an influence on company decisions through voting rights, shareholder proposals, and their buying and selling behavior. Access to information and market research equips investors with the tools and knowledge to make informed investment decisions, staying abreast of company performance and market trends.

Additionally, the stock market offers flexibility in investment options, allowing individuals to tailor their portfolios to their specific objectives and risk appetite. Investing in the stock market can also be a pathway to long-term wealth creation, with the potential for capital appreciation, compounding, and the opportunity to capitalize on long-term economic trends.

However, it is essential to understand that investing in the stock market comes with risks. Market volatility, economic uncertainties, and individual company performance can impact investment returns. Therefore, it is important for investors to conduct thorough research, diversify their portfolios, and seek professional advice when necessary. Developing a disciplined approach to investing and maintaining a long-term perspective can help navigate fluctuations and maximize the potential for success in the stock market.

In conclusion, the stock market offers a wide array of benefits and opportunities for investors. By understanding and leveraging these advantages, individuals can harness the potential of the stock market to grow their wealth, achieve their financial goals, and pave the way for a more secure and prosperous future.