Home>Finance>How Is The Minimum Payment Calculated On A Credit Card

Finance

How Is The Minimum Payment Calculated On A Credit Card

Published: February 25, 2024

Learn how the minimum payment on a credit card is calculated and understand its impact on your finances. Get insights into managing credit card payments effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Minimum Payment on Credit Cards

Credit cards have become an integral part of modern-day financial transactions, offering convenience and flexibility to users. However, it's crucial to comprehend the nuances of credit card management to avoid potential pitfalls. One of the key aspects of responsible credit card usage is understanding the calculation and implications of the minimum payment.

When individuals utilize credit cards for purchases or cash advances, they are required to make periodic payments to the card issuer. The minimum payment represents the smallest amount a cardholder must pay by the due date to keep the account in good standing. While it may seem like a manageable obligation, the minimum payment has significant implications for the cardholder's financial well-being.

This article aims to delve into the intricacies of credit card minimum payments, shedding light on the factors that influence their calculation, the potential long-term consequences of paying only the minimum, and practical tips for managing credit card payments effectively. By gaining a comprehensive understanding of these aspects, individuals can make informed decisions regarding their credit card usage and cultivate healthy financial habits.

Understanding Credit Card Minimum Payments

Deciphering the Significance of Minimum Payments

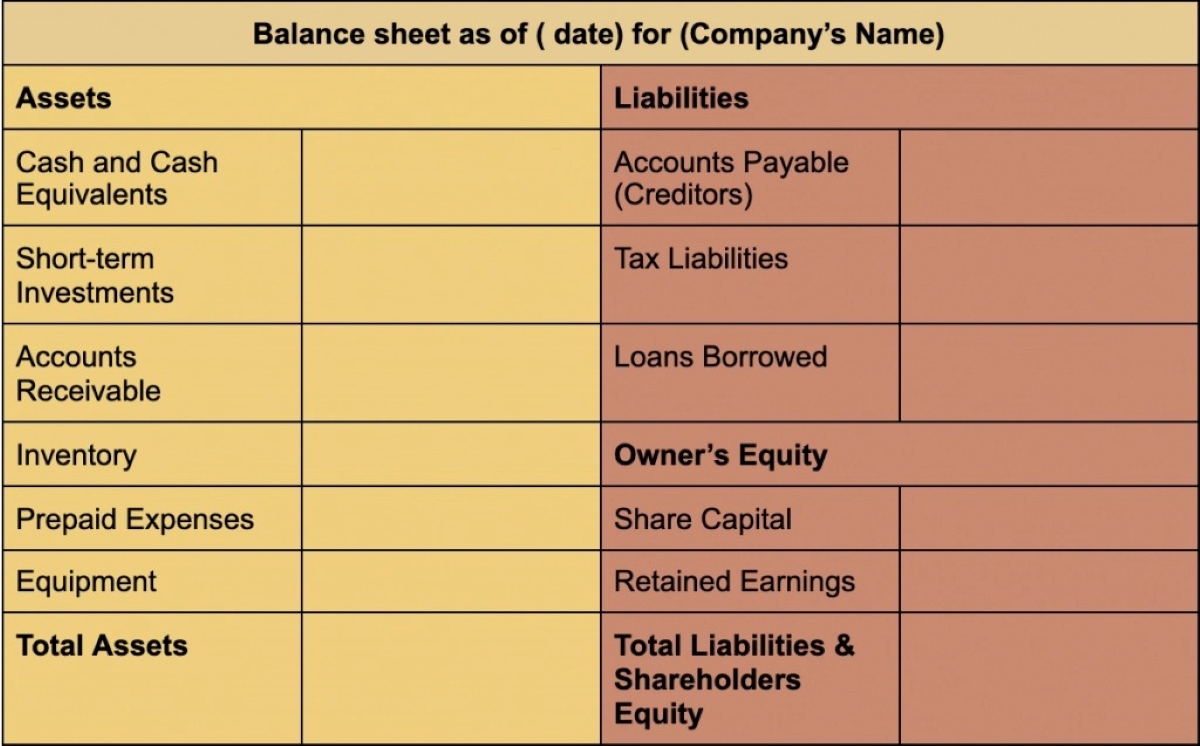

Minimum payments on credit cards play a pivotal role in maintaining the financial health of cardholders. When individuals receive their credit card statements, they are presented with the outstanding balance, the minimum payment due, and the due date. It’s essential to comprehend that while making the minimum payment keeps the account in good standing, it may lead to long-term financial repercussions.

By paying only the minimum amount, cardholders are essentially carrying forward a portion of their balance to the next billing cycle. This triggers the accrual of interest on the remaining balance, leading to an increase in the overall debt. Consequently, the cost of the purchase or cash advance is amplified by the accruing interest, potentially resulting in a prolonged repayment period and higher total repayment amount.

Moreover, consistently making minimum payments can hinder individuals from making substantial progress in reducing their outstanding balance. This perpetuates a cycle of debt, wherein the cardholder may find it challenging to break free from the burden of high-interest debt and achieve financial freedom.

Understanding the implications of minimum payments empowers individuals to make informed decisions regarding their credit card usage. By recognizing the potential drawbacks of paying only the minimum, cardholders can proactively manage their finances and strive to pay more than the minimum to expedite debt repayment and minimize interest costs.

Factors Affecting Minimum Payment Calculation

Insights into the Determinants of Minimum Payments

The calculation of minimum payments on credit cards is influenced by various factors, each contributing to the overall amount due. Understanding these determinants is crucial for cardholders seeking to comprehend the rationale behind their minimum payment obligations.

1. Outstanding Balance: The outstanding balance on a credit card is a primary factor in minimum payment calculation. Typically, the minimum payment is calculated as a percentage of the total balance, ensuring that cardholders contribute a minimum amount towards reducing their debt each month.

2. Interest Rate: The annual percentage rate (APR) associated with the credit card significantly impacts the minimum payment. Higher interest rates result in larger portions of the minimum payment being allocated to interest, potentially extending the time required to pay off the balance.

3. Fixed Minimum Amount: Some credit card issuers impose a fixed minimum payment amount, ensuring that cardholders pay a predetermined sum, regardless of their outstanding balance. This approach provides consistency and predictability in minimum payment obligations.

4. Fees and Penalties: Incurred fees and penalties, such as late payment fees or over-limit charges, may contribute to an increase in the minimum payment due. Cardholders should strive to avoid these additional costs to minimize the impact on their financial obligations.

5. Regulatory Requirements: In certain jurisdictions, regulatory authorities may stipulate guidelines for minimum payment calculations to safeguard consumers’ interests. Compliance with these regulations ensures that minimum payments are structured to facilitate responsible debt management.

By recognizing these factors, cardholders can gain insights into the dynamics of minimum payment calculation and proactively manage their credit card obligations. Moreover, understanding the interplay between these determinants empowers individuals to make informed financial decisions and take steps to mitigate the long-term impact of carrying a balance on their credit cards.

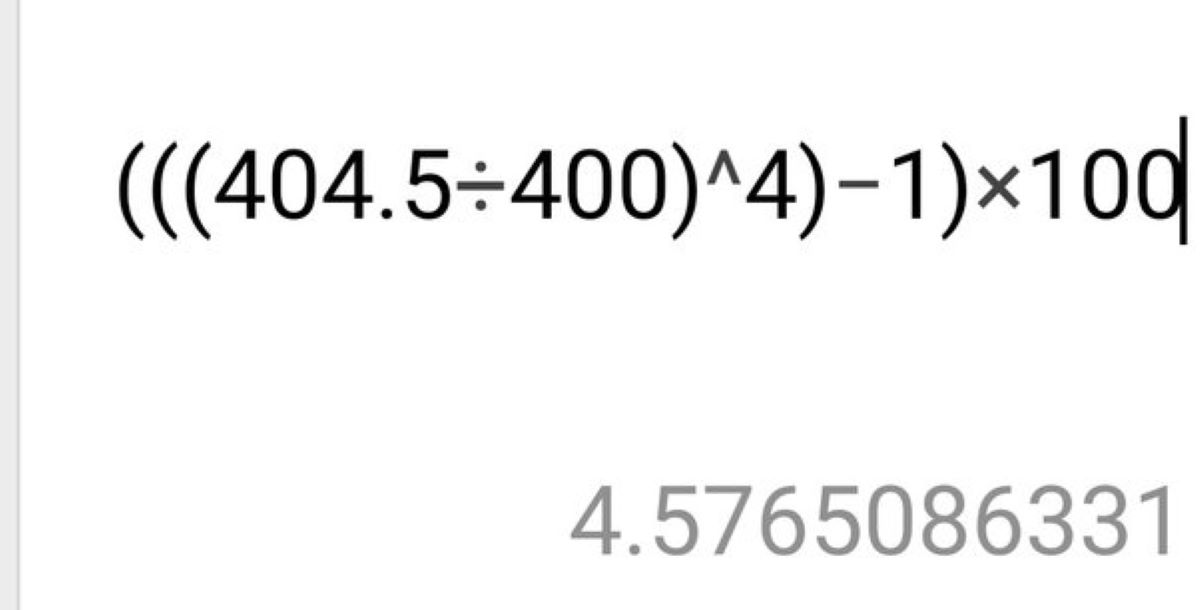

How to Calculate Minimum Payment on a Credit Card

Navigating the Formulas and Variables

Calculating the minimum payment on a credit card involves a blend of specific formulas and variables, each contributing to the determination of the required payment amount. While credit card issuers employ distinct methodologies for minimum payment calculation, several common approaches provide insight into the process.

1. Percentage of the Balance: One prevalent method for calculating the minimum payment involves a percentage of the outstanding balance. This percentage, typically ranging from 1% to 3% of the total balance, serves as the foundational component of the minimum payment formula. For example, if the outstanding balance on a credit card is $1,500, and the minimum payment percentage is 2%, the minimum payment due would amount to $30.

2. Interest and Fees: In addition to the percentage-based component, credit card issuers may factor in accrued interest and applicable fees when computing the minimum payment. This ensures that cardholders address not only the principal balance but also the associated interest and charges, contributing to responsible debt management.

3. Fixed Minimum Amount: Some credit card companies establish a fixed minimum payment amount, irrespective of the outstanding balance. This approach provides consistency in minimum payment obligations, offering cardholders predictability in their monthly financial commitments.

4. Regulatory Guidelines: Regulatory authorities may impose specific guidelines dictating the minimum payment calculation methodology to protect consumers from excessive debt burdens. Compliance with these regulations ensures that minimum payments are structured in a manner that aligns with responsible lending practices.

By understanding the elements involved in minimum payment calculation, cardholders can gain clarity on the factors shaping their financial obligations. Moreover, this comprehension equips individuals with the knowledge to proactively manage their credit card payments, make informed financial decisions, and strive to minimize the long-term impact of carrying a balance on their credit cards.

Tips for Managing Credit Card Minimum Payments

Empowering Financial Wellness and Responsible Credit Card Usage

Effectively managing credit card minimum payments is essential for maintaining financial stability and mitigating the risk of accumulating excessive debt. By implementing strategic approaches and cultivating responsible financial habits, individuals can navigate their credit card obligations adeptly while working towards debt reduction and long-term financial well-being.

1. Pay More Than the Minimum: Whenever feasible, strive to pay more than the minimum amount due on your credit card. By allocating additional funds towards reducing the outstanding balance, you can expedite debt repayment and minimize the accrual of interest, ultimately saving money in the long run.

2. Create a Budget: Establishing a comprehensive budget that prioritizes credit card payments enables you to allocate sufficient funds towards meeting your minimum payment obligations. By integrating credit card payments into your budget, you can proactively manage your finances and ensure timely payments.

3. Avoid Unnecessary Spending: Limit discretionary spending to focus on meeting your credit card payment obligations. By exercising restraint in non-essential purchases, you can allocate more resources towards reducing your outstanding balance, thereby accelerating debt repayment.

4. Monitor Your Statements: Regularly review your credit card statements to track your spending, monitor interest charges, and verify the accuracy of transactions. This proactive approach helps identify any discrepancies and ensures that you are aware of your financial standing.

5. Explore Balance Transfer Options: If feasible, consider transferring high-interest credit card balances to a card with a lower interest rate. This strategic move can reduce interest costs and facilitate more efficient debt repayment, potentially alleviating the burden of minimum payments.

6. Seek Financial Guidance: If you encounter challenges in managing your credit card payments, don’t hesitate to seek financial counseling or guidance from reputable sources. Professional assistance can provide valuable insights and strategies for navigating your credit card obligations effectively.

By adopting these proactive measures and embracing responsible financial practices, individuals can enhance their ability to manage credit card minimum payments, reduce debt burdens, and cultivate a solid foundation for long-term financial wellness.

Conclusion

Navigating the Path to Financial Empowerment

Understanding the intricacies of credit card minimum payments is a fundamental aspect of responsible financial management. By delving into the factors influencing minimum payment calculation, recognizing the implications of paying only the minimum, and implementing strategic approaches to manage credit card obligations, individuals can proactively navigate their financial journeys and strive for long-term stability.

It is imperative for cardholders to comprehend that while the minimum payment ensures the account remains in good standing, it may lead to prolonged debt repayment periods and increased interest costs. By proactively addressing their credit card payments and striving to pay more than the minimum, individuals can expedite debt reduction and minimize the impact of accruing interest.

Furthermore, leveraging budgeting strategies, monitoring statements, and exploring potential balance transfer options empowers individuals to take control of their credit card obligations and work towards financial freedom. Seeking professional guidance when encountering challenges in managing credit card payments can provide invaluable support and insights, facilitating informed decision-making and effective debt management.

Ultimately, by fostering a proactive and informed approach to credit card usage, individuals can cultivate healthy financial habits, reduce debt burdens, and pave the way for sustained financial wellness. Empowered with knowledge and strategic financial practices, individuals can navigate their credit card minimum payments with confidence, working towards a future characterized by financial stability and empowerment.