Home>Finance>What Is A Standard Late Fee For Business Invoice

Finance

What Is A Standard Late Fee For Business Invoice

Published: February 22, 2024

Learn about standard late fees for business invoices and how they affect your finances. Find out the best practices for implementing late fees to improve your cash flow and financial management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Late payments can be a significant challenge for businesses of all sizes. When clients fail to settle their invoices within the agreed-upon timeframe, it can disrupt a company's cash flow and create operational difficulties. To mitigate the impact of late payments, many businesses implement standard late fees as part of their invoicing terms. These late fees serve as a financial incentive for clients to honor their payment obligations promptly. In this article, we will explore the concept of standard late fees for business invoices, their importance, industry standards, legal considerations, and effective communication strategies.

Late fees are a crucial component of the invoicing process, as they encourage clients to prioritize timely payments. By delving into the intricacies of late fees, businesses can establish fair and transparent policies that protect their financial stability while maintaining positive client relationships. Throughout this article, we will uncover the factors that businesses should consider when determining standard late fees, the prevailing industry standards, and the legal implications associated with implementing such fees. Additionally, we will discuss the best practices for communicating late fees to clients, ensuring clarity and understanding from both parties.

Understanding the nuances of standard late fees is essential for businesses seeking to optimize their cash flow and maintain healthy financial practices. By examining the multifaceted aspects of late fees, businesses can establish effective invoicing protocols that promote timely payments and foster strong partnerships with their clients. Let's delve into the significance of late fees, the key considerations for implementing them, and the best approaches to communicate these policies to clients.

Importance of Late Fees

Late fees play a pivotal role in incentivizing clients to meet their payment deadlines. By incorporating standard late fees into their invoicing terms, businesses can deter late payments and mitigate the adverse effects of delayed cash inflows. These fees serve as a financial safeguard, encouraging clients to honor their financial commitments within the stipulated time frame. Furthermore, late fees underscore the importance of timely payments, reinforcing the mutual understanding between businesses and their clients regarding the significance of honoring payment obligations.

From a financial standpoint, the implementation of late fees can significantly improve a company’s cash flow management. By deterring late payments, businesses can ensure a consistent inflow of funds, thereby facilitating seamless operational processes and enabling timely disbursement of payments to suppliers, employees, and other stakeholders. This, in turn, contributes to the overall stability and sustainability of the business.

Moreover, the presence of standard late fees in invoicing terms fosters accountability and discipline among clients. It emphasizes the mutual respect for agreed-upon payment timelines and encourages clients to prioritize their financial responsibilities. This not only benefits the invoicing business but also cultivates a culture of financial integrity and reliability within the broader business ecosystem.

Additionally, late fees serve as a deterrent against chronic late payments, reducing the administrative burden associated with chasing overdue invoices. By establishing clear consequences for late payments, businesses can streamline their receivables management processes, freeing up valuable time and resources that would otherwise be spent on pursuing delinquent payments.

Overall, the importance of late fees extends beyond their monetary implications. They underscore the value of prompt payment, contribute to a healthy cash flow, foster financial discipline, and streamline receivables management, ultimately promoting a more stable and sustainable business environment.

Factors to Consider

When determining the appropriate standard late fees for business invoices, several key factors should be taken into account to ensure fairness and effectiveness. Understanding these factors is crucial for businesses to establish late fee policies that strike a balance between incentivizing timely payments and maintaining positive client relationships.

Invoice Amount: The magnitude of the invoice amount can influence the structure of late fees. For larger invoices, a flat late fee or a percentage-based fee may be more appropriate, whereas smaller invoices may benefit from a fixed late fee to avoid disproportionate penalties.

Industry Norms: It is essential to consider the prevailing late fee practices within the specific industry. While maintaining flexibility, aligning late fees with industry standards can help businesses remain competitive while deterring late payments effectively.

Client Relationships: Businesses should assess their client relationships and tailor late fees accordingly. Long-standing, valued clients may warrant more lenient late fee structures to preserve rapport, while new or high-risk clients may necessitate stricter penalties to enforce payment discipline.

Regulatory Compliance: Adhering to legal regulations and consumer protection laws is paramount. Businesses must ensure that their late fee policies comply with relevant legislation to avoid potential legal repercussions and maintain ethical invoicing practices.

Communication and Transparency: Clearly communicating late fee policies to clients from the outset is crucial. Transparency regarding late fee structures, payment deadlines, and the consequences of late payments can help manage client expectations and minimize disputes.

Impact on Cash Flow: Assessing the impact of late fees on cash flow is essential. While late fees aim to improve cash flow by incentivizing timely payments, excessively high fees may strain client relationships and lead to potential revenue loss if clients opt to discontinue business relations.

Flexibility and Fairness: Balancing the need for timely payments with empathy towards clients’ occasional challenges is vital. Offering grace periods, installment options, or waivers in exceptional circumstances demonstrates flexibility and fosters goodwill while maintaining payment discipline.

By carefully considering these factors, businesses can devise standard late fee structures that not only encourage prompt payments but also promote fairness, transparency, and sustainable client relationships.

Industry Standards

Industry standards play a significant role in shaping the framework for standard late fees in business invoicing. While businesses have the autonomy to establish their late fee policies, aligning these policies with prevailing industry practices can enhance competitiveness and streamline payment processes. Understanding and adhering to industry standards regarding late fees is crucial for businesses seeking to strike a balance between incentivizing timely payments and maintaining positive client relationships.

Across various industries, standard late fees typically range from a fixed amount to a percentage of the outstanding balance. The choice between these structures often depends on the nature of the industry, the typical invoice amounts, and the prevalent payment behaviors within the sector.

In industries where invoices tend to be of relatively low value and are issued frequently, a fixed late fee may be more common. This approach provides a clear and predictable penalty for late payments, incentivizing clients to honor their payment obligations promptly without disproportionately penalizing smaller transactions.

Conversely, industries dealing with larger invoice amounts may opt for percentage-based late fees. This method ensures that late fees scale proportionally with the outstanding balance, aligning the penalty with the financial impact of the late payment on the invoicing business.

Furthermore, certain industries may have established customary practices regarding grace periods for late payments. Offering a brief grace period before late fees are imposed can be a common industry practice, providing clients with a reasonable window to settle their invoices without incurring penalties.

It is essential for businesses to research and benchmark industry-specific late fee practices to ensure that their policies remain competitive and fair. While maintaining flexibility to accommodate unique business dynamics, aligning with industry standards can help businesses deter late payments effectively while demonstrating an understanding of the broader industry landscape.

By leveraging industry standards as a reference point, businesses can refine their late fee structures to align with prevailing practices, enhancing their competitiveness, and fostering positive relationships with clients within their respective industries.

Legal Considerations

When implementing standard late fees for business invoices, it is imperative for businesses to navigate the legal landscape to ensure compliance with relevant regulations and consumer protection laws. Failing to adhere to legal considerations can expose businesses to potential disputes, financial liabilities, and reputational risks. Therefore, a comprehensive understanding of the legal framework surrounding late fees is essential for businesses to establish fair and enforceable invoicing practices.

Regulatory Compliance: Businesses must familiarize themselves with local, state, and federal regulations governing late fees. These regulations may stipulate maximum allowable late fees, disclosure requirements, grace period regulations, and other pertinent guidelines that businesses must adhere to when imposing late fees on clients.

Consumer Protection Laws: In many jurisdictions, consumer protection laws dictate the fairness and transparency of late fee policies. Businesses should ensure that their late fee structures do not infringe upon consumer rights and are not deemed unconscionable or predatory, which could lead to legal challenges and reputational damage.

Contractual Agreements: The terms and conditions outlining late fees must be clearly articulated in contractual agreements and terms of service. Clarity and transparency regarding late fee structures, payment deadlines, and potential consequences for late payments are critical to preempt potential disputes and legal complications.

Dispute Resolution Mechanisms: Businesses should establish effective mechanisms for addressing disputes related to late fees. This may involve outlining the process for addressing client grievances, offering mediation or arbitration options, and ensuring that clients have avenues to contest late fees that they deem unjust or erroneous.

Professional Legal Counsel: Seeking guidance from legal professionals specializing in business law and invoicing practices is advisable. Legal counsel can provide invaluable insights into navigating the complexities of late fee regulations, drafting legally sound contractual terms, and mitigating legal risks associated with late fees.

By proactively addressing legal considerations, businesses can fortify their late fee policies within the bounds of the law, mitigate legal risks, and cultivate a reputation for ethical and compliant invoicing practices. Adhering to legal guidelines not only safeguards businesses from potential legal entanglements but also fosters trust and confidence among clients, underpinning the integrity of the business-client relationship.

Communicating Late Fees to Clients

Effectively communicating late fee policies to clients is integral to establishing transparency, managing expectations, and fostering positive relationships. Clear and proactive communication regarding late fees can mitigate misunderstandings, minimize disputes, and encourage clients to prioritize timely payments. Employing strategic communication practices ensures that clients are well-informed about late fee structures, payment deadlines, and the consequences of delayed payments, thereby promoting a harmonious and mutually beneficial business-client dynamic.

Clarity and Transparency: When onboarding new clients or initiating business relationships, it is essential to explicitly outline the late fee policies in contractual agreements, terms of service, or invoicing documentation. Clearly articulating the late fee structures, grace periods, and the escalation of penalties for persistent late payments sets the stage for transparent and informed client engagements.

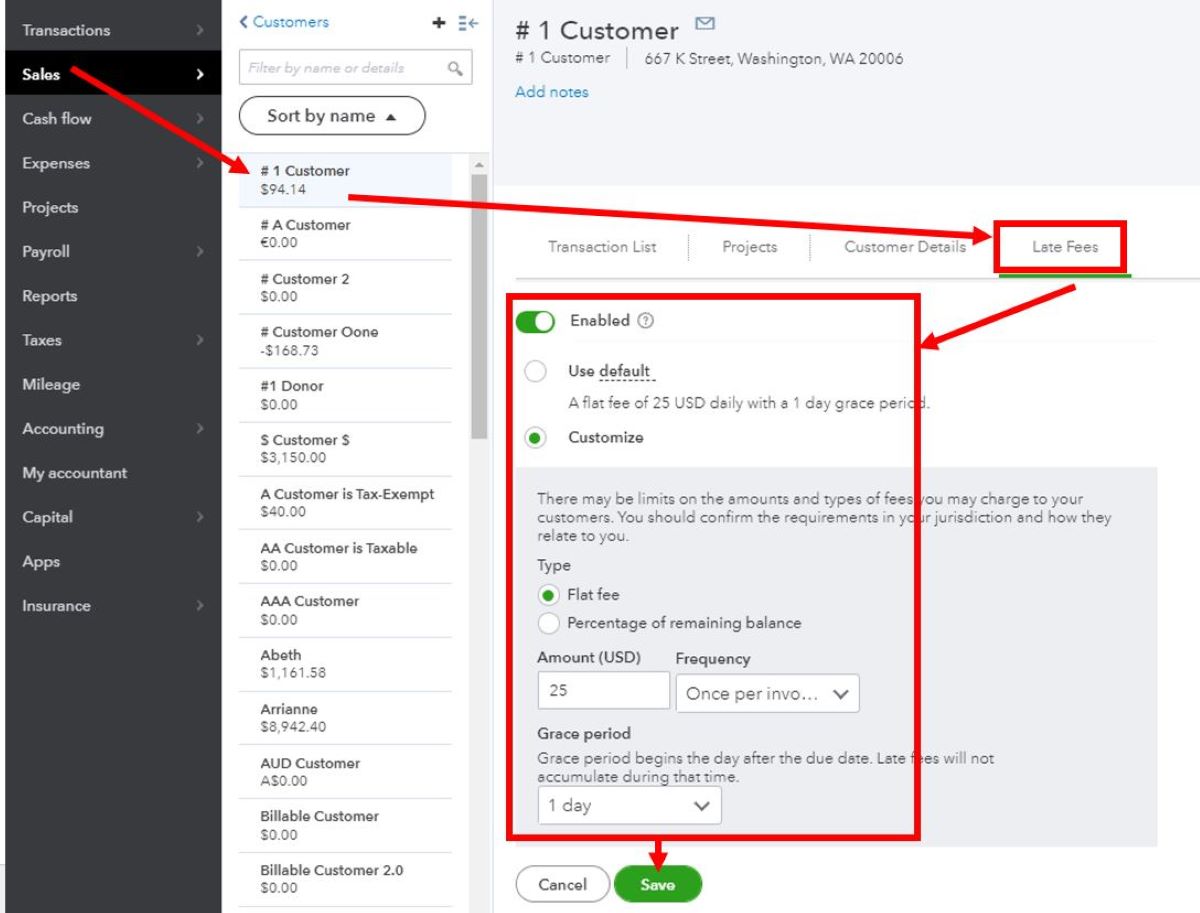

Proactive Notifications: Sending timely reminders and notifications regarding upcoming payment deadlines and potential late fees can prompt clients to prioritize their payments. Automated reminders, personalized emails, or SMS alerts can serve as gentle nudges to ensure that clients are cognizant of their payment obligations and the implications of late payments.

Education and Explanation: Providing educational materials or explanatory resources that elucidate the rationale behind late fees and their role in maintaining business operations can engender understanding and cooperation from clients. Clearly articulating the impact of late payments on cash flow, operational efficiency, and the broader business ecosystem can underscore the mutual benefits of adhering to payment timelines.

Flexibility and Exception Handling: While communicating late fee policies, businesses should convey their willingness to entertain exceptional circumstances and provide flexibility when warranted. Offering avenues for clients to communicate unforeseen challenges, request payment extensions, or discuss alternative arrangements demonstrates empathy while reinforcing the importance of open dialogue and mutual respect.

Personalized Engagement: Tailoring communication to align with the preferences and communication channels favored by individual clients can enhance receptiveness to late fee policies. Understanding and accommodating clients’ communication preferences fosters a sense of attentiveness and consideration, nurturing stronger client relationships.

By adopting a proactive, transparent, and client-centric approach to communicating late fees, businesses can cultivate an environment of mutual understanding, accountability, and cooperation. Effective communication not only mitigates potential disputes and misunderstandings but also reinforces the professionalism and integrity of the business, laying the groundwork for sustained client satisfaction and loyalty.

Conclusion

Standard late fees for business invoices are a vital tool for promoting timely payments, safeguarding cash flow, and nurturing robust client relationships. By recognizing the importance of late fees and carefully considering the factors that influence their implementation, businesses can strike a balance between incentivizing prompt payments and accommodating clients’ unique circumstances. Adhering to industry standards and navigating legal considerations ensures that late fee policies are fair, compliant, and conducive to sustainable business practices.

Furthermore, effective communication of late fee policies to clients is paramount, fostering transparency, understanding, and cooperation. By proactively engaging clients, businesses can mitigate disputes, minimize late payments, and fortify the integrity of their invoicing practices.

Ultimately, the judicious implementation of standard late fees harmonizes the financial interests of businesses with the expectations and obligations of clients. It underscores the mutual respect for payment timelines, cultivates financial discipline, and contributes to a more stable and resilient business ecosystem.

As businesses navigate the complexities of invoicing and receivables management, standard late fees serve as a linchpin for sustaining healthy cash flow, mitigating late payment risks, and fortifying the financial foundation of the business. By integrating fair, transparent, and communicative late fee policies, businesses can foster enduring client partnerships and fortify their position in the marketplace, ensuring sustained growth and stability.