Finance

How To Write Late Fee Charge On Invoice

Published: February 22, 2024

Learn how to write a late fee charge on an invoice to effectively manage your finances. Understand the importance of including late fees to ensure timely payments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Late payments can pose significant challenges for businesses, impacting their cash flow and overall financial stability. As a result, many companies opt to include late fee charges on their invoices to incentivize clients to settle their accounts promptly. This article aims to provide a comprehensive guide on how to effectively incorporate late fee charges onto invoices, ensuring that businesses can mitigate the adverse effects of delayed payments. By understanding the legal considerations, best practices, and the precise methods for implementing these charges, businesses can safeguard their financial interests while maintaining positive client relationships.

Late fee charges serve as a crucial tool for businesses to encourage timely payments, as they convey the message that prompt settlement is essential for maintaining a healthy business relationship. However, it is imperative to strike a balance between incentivizing prompt payments and avoiding potential strain on client relationships. This delicate balance underscores the importance of articulating late fee charges clearly and professionally on invoices, which will be explored in detail throughout this article.

By delving into the legal aspects, best practices, and the precise methods for incorporating late fee charges onto invoices, businesses can fortify their financial position while fostering positive and transparent relationships with their clients. This comprehensive guide will equip businesses with the knowledge and strategies necessary to implement late fee charges effectively, ultimately promoting financial stability and healthy business relationships.

Importance of Including Late Fee Charges

Integrating late fee charges into invoices is a strategic approach that holds significant importance for businesses across various industries. The inclusion of these charges serves as a powerful deterrent against delayed payments, thereby promoting financial stability and ensuring the smooth operation of the business. Several key reasons underscore the importance of including late fee charges on invoices:

-

Cash Flow Management: Late payments can disrupt a company’s cash flow, impeding its ability to meet financial obligations such as paying suppliers, employees, and overhead expenses. By incorporating late fee charges, businesses can encourage clients to adhere to payment deadlines, thus facilitating consistent cash flow and financial stability.

-

Incentivizing Timely Payments: Late fee charges serve as a compelling incentive for clients to settle their invoices promptly. This proactive approach fosters a culture of timely payments, reducing the occurrence of overdue accounts and minimizing the associated financial strain on the business.

-

Transparent Business Practices: Including late fee charges on invoices promotes transparency and clarity in financial transactions. It communicates to clients that timely payments are integral to maintaining a mutually beneficial business relationship, thereby establishing clear expectations and fostering accountability.

-

Mitigating Administrative Burdens: Pursuing overdue payments can be time-consuming and resource-intensive for businesses. By incorporating late fee charges, companies can mitigate the administrative burden associated with managing overdue accounts, allowing them to allocate resources more efficiently.

-

Preserving Client Relationships: While late fee charges act as a deterrent against delayed payments, they also convey the message that prompt settlement is crucial for sustaining a positive business relationship. This delicate balance helps preserve client relationships by encouraging timely payments without compromising rapport.

By recognizing the significance of including late fee charges on invoices, businesses can proactively address the challenges posed by delayed payments, fortify their financial position, and cultivate a culture of accountability and prompt payment within their client base.

Legal Considerations

When incorporating late fee charges onto invoices, businesses must navigate legal considerations to ensure compliance with relevant regulations and safeguard their financial interests. Understanding the legal framework surrounding late fee charges is essential for businesses to implement these charges effectively and mitigate potential disputes or non-compliance issues. Several key legal considerations merit attention:

-

Regulatory Compliance: Businesses must familiarize themselves with the legal requirements and regulations governing late fee charges within their jurisdiction. This includes understanding any statutory limitations on the imposition of late fees, as well as any specific guidelines or restrictions outlined by regulatory authorities.

-

Transparency and Disclosure: Clarity and transparency in communicating late fee charges are paramount. Businesses should ensure that their invoicing practices adhere to disclosure requirements, clearly outlining the conditions under which late fees apply, the calculation method, and any additional terms or conditions relevant to late payments.

-

Contractual Agreements: For businesses operating under contractual agreements with clients, it is imperative to align the incorporation of late fee charges with the terms stipulated in the contract. This entails ensuring that the contract explicitly addresses late payment penalties, providing a legal foundation for the imposition of late fees.

-

Fair and Reasonable Charges: Legal considerations also encompass the assessment of late fee charges to ensure they are fair and reasonable. Exorbitant or unjustifiable late fees may raise legal concerns and trigger disputes, underscoring the importance of setting late fee amounts that align with industry standards and the nature of the business relationship.

-

Dispute Resolution Mechanisms: Businesses should establish clear mechanisms for addressing disputes related to late fee charges, encompassing avenues for mediation, arbitration, or legal recourse. By outlining the dispute resolution process in their terms and conditions, businesses can mitigate potential conflicts arising from late fee disputes.

By diligently addressing these legal considerations, businesses can navigate the complexities of incorporating late fee charges onto invoices while upholding legal compliance, mitigating risks, and fostering transparent and equitable financial practices within their business operations.

How to Write Late Fee Charge on Invoice

Effectively articulating late fee charges on invoices is essential to convey the terms and conditions governing late payments clearly. By adopting a structured and transparent approach, businesses can ensure that clients understand the implications of delayed payments and the corresponding late fee charges. The following steps outline how to write late fee charges on invoices:

-

Clear and Conspicuous Language: The language used to communicate late fee charges should be clear, concise, and prominently displayed on the invoice. Clearly state the conditions under which late fees apply, the percentage or flat rate of the late fee, and the applicable grace period, if any.

-

Itemized Breakdown: Provide an itemized breakdown of the late fee charges, specifying the original invoice amount, the date from which the late fee accrues, and the total amount due after incorporating the late fee. This breakdown enhances transparency and enables clients to comprehend the calculation of late fees.

-

Incorporate Terms and Conditions: Include a section on the invoice that outlines the terms and conditions related to late payments and late fee charges. This may encompass details regarding the grace period, the method of late fee calculation, and any additional repercussions of delayed payments.

-

Consistent Invoicing Practices: Maintain consistency in invoicing practices by incorporating late fee charges across all relevant invoices. Consistent presentation reinforces the expectation of timely payments and fosters clarity in financial transactions.

-

Compliance with Regulations: Ensure that the inclusion of late fee charges aligns with legal requirements and regulatory guidelines specific to the jurisdiction in which the business operates. Adhering to regulatory compliance mitigates the risk of legal disputes and non-compliance issues.

By adhering to these steps, businesses can effectively communicate late fee charges on invoices, promoting transparency, accountability, and a clear understanding of the consequences of delayed payments among their clients.

Best Practices for Implementing Late Fee Charges

Implementing late fee charges entails a strategic approach that aligns with best practices to optimize effectiveness while maintaining positive client relationships. By integrating the following best practices, businesses can navigate the implementation of late fee charges with proficiency and professionalism:

-

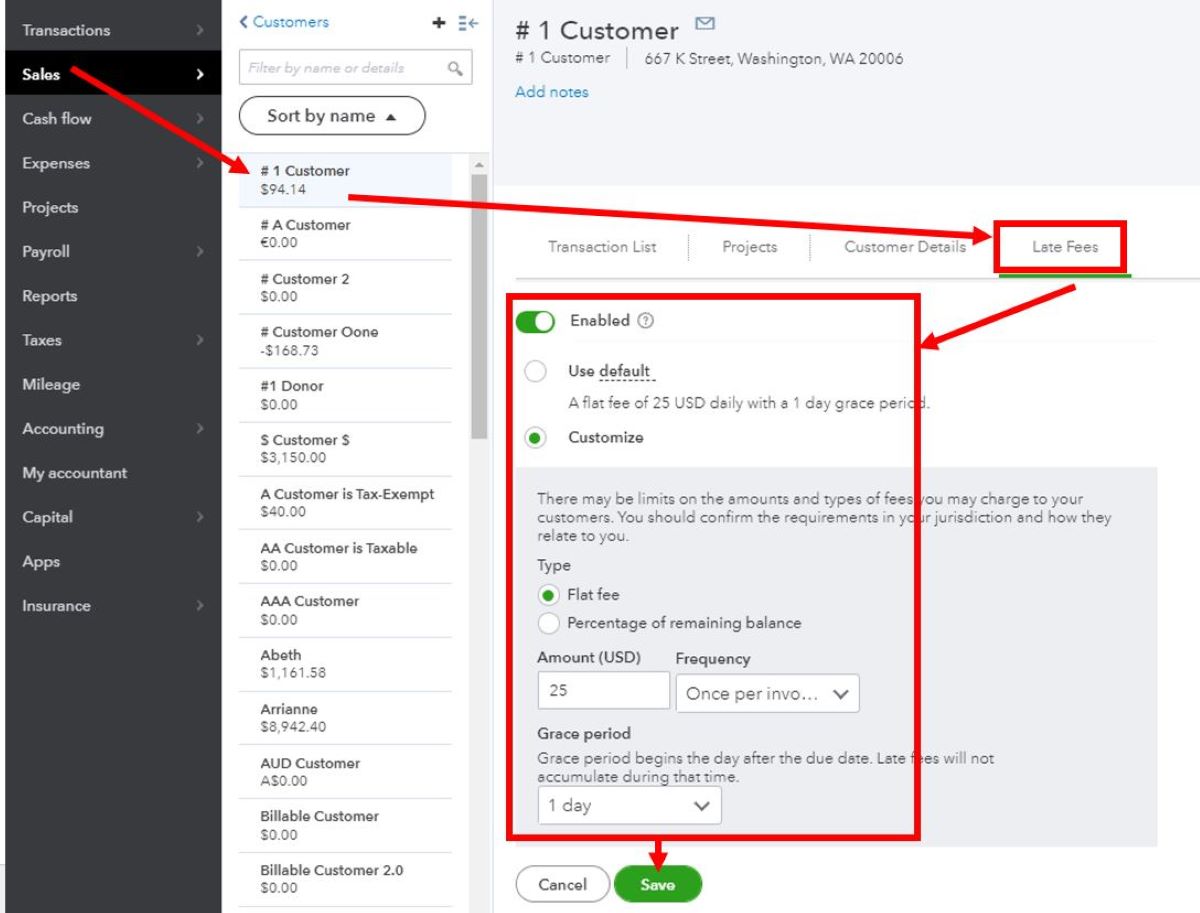

Clarity and Transparency: Maintain clarity and transparency in communicating late fee charges, ensuring that clients fully comprehend the conditions under which late fees apply, the calculation method, and any associated terms and conditions. Transparent communication fosters understanding and accountability.

-

Grace Period Consideration: Incorporate a reasonable grace period before late fees are imposed, allowing clients a window of opportunity to settle their invoices without incurring additional charges. A well-defined grace period demonstrates a balanced approach to late fee enforcement.

-

Consistent Application: Apply late fee charges consistently across all client accounts to uphold fairness and equity. Consistency reinforces the expectation of timely payments and mitigates potential discrepancies or disputes related to late fees.

-

Professional Communication: When addressing late payments and associated late fee charges, maintain a professional and courteous tone in all communications with clients. Professionalism fosters positive client relationships while emphasizing the importance of prompt payment.

-

Documentation and Record-Keeping: Maintain comprehensive records of late fee charges and related communications, documenting the application of late fees and any interactions with clients regarding late payments. Robust documentation serves as a safeguard in the event of disputes or inquiries.

-

Regular Review and Adjustment: Periodically review the effectiveness of late fee charges and consider adjustments based on evolving business needs and industry standards. Regular review ensures that late fee policies remain aligned with the business’s financial objectives.

By embracing these best practices, businesses can implement late fee charges judiciously and effectively, promoting financial stability while nurturing positive and transparent relationships with their clients.

Conclusion

The inclusion of late fee charges on invoices serves as a pivotal strategy for businesses to mitigate the challenges associated with delayed payments, uphold financial stability, and foster a culture of accountability within their client base. By navigating the legal considerations, articulating late fee charges effectively, and embracing best practices, businesses can optimize the implementation of late fee charges while maintaining positive client relationships.

It is imperative for businesses to recognize the multifaceted impact of late payments on their cash flow, operational efficiency, and overall financial health. Through the inclusion of late fee charges, businesses convey the message that timely payments are integral to sustaining a mutually beneficial business relationship, thereby promoting transparency and accountability in financial transactions.

Furthermore, the strategic incorporation of late fee charges necessitates a balanced approach that prioritizes clarity, consistency, and professionalism. By adopting best practices such as transparent communication, grace period consideration, and diligent record-keeping, businesses can navigate the implementation of late fee charges with proficiency and integrity.

In conclusion, businesses must approach the inclusion of late fee charges on invoices as a proactive and strategic measure to safeguard their financial interests while nurturing positive client relationships. By adhering to legal considerations, articulating late fee charges effectively, and embracing best practices, businesses can fortify their financial position and cultivate a culture of prompt payment, ultimately contributing to sustained financial stability and robust client partnerships.