Home>Finance>What Is The Minimum Payment On A Credit Card With US Bank

Finance

What Is The Minimum Payment On A Credit Card With US Bank

Published: February 25, 2024

Learn about the minimum payment on a credit card with US Bank and how it impacts your finances. Manage your credit card payments effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Basics of Minimum Credit Card Payments

Welcome to the world of credit cards and the crucial concept of minimum payments. Whether you’re a seasoned credit card user or just starting your financial journey, understanding the dynamics of minimum payments is essential for maintaining a healthy financial profile. In this article, we will delve into the intricacies of minimum payments on credit cards, particularly with US Bank, shedding light on how they are calculated and why paying more than the minimum is a prudent financial move.

Credit cards offer unparalleled convenience and flexibility, allowing you to make purchases and manage expenses with ease. However, it’s imperative to grasp the significance of making timely payments and comprehending the minimum payment requirement to avoid potential pitfalls such as accruing high-interest charges and damaging your credit score.

As we navigate through the specifics of minimum payments, we’ll explore the factors that influence these payments, gain insights into how US Bank calculates minimum payments, and underscore the importance of exceeding the minimum payment threshold. Additionally, we’ll equip you with valuable tips for effectively managing your credit card payments with US Bank, empowering you to take control of your financial well-being.

Understanding Minimum Payments on Credit Cards

Minimum payments on credit cards represent the lowest amount you are required to pay each month to keep your account in good standing. While this may seem like a manageable obligation, it’s crucial to comprehend the implications of making only the minimum payment. By paying only the minimum, you are essentially extending the repayment period and incurring substantial interest charges, ultimately resulting in a higher overall cost for your purchases.

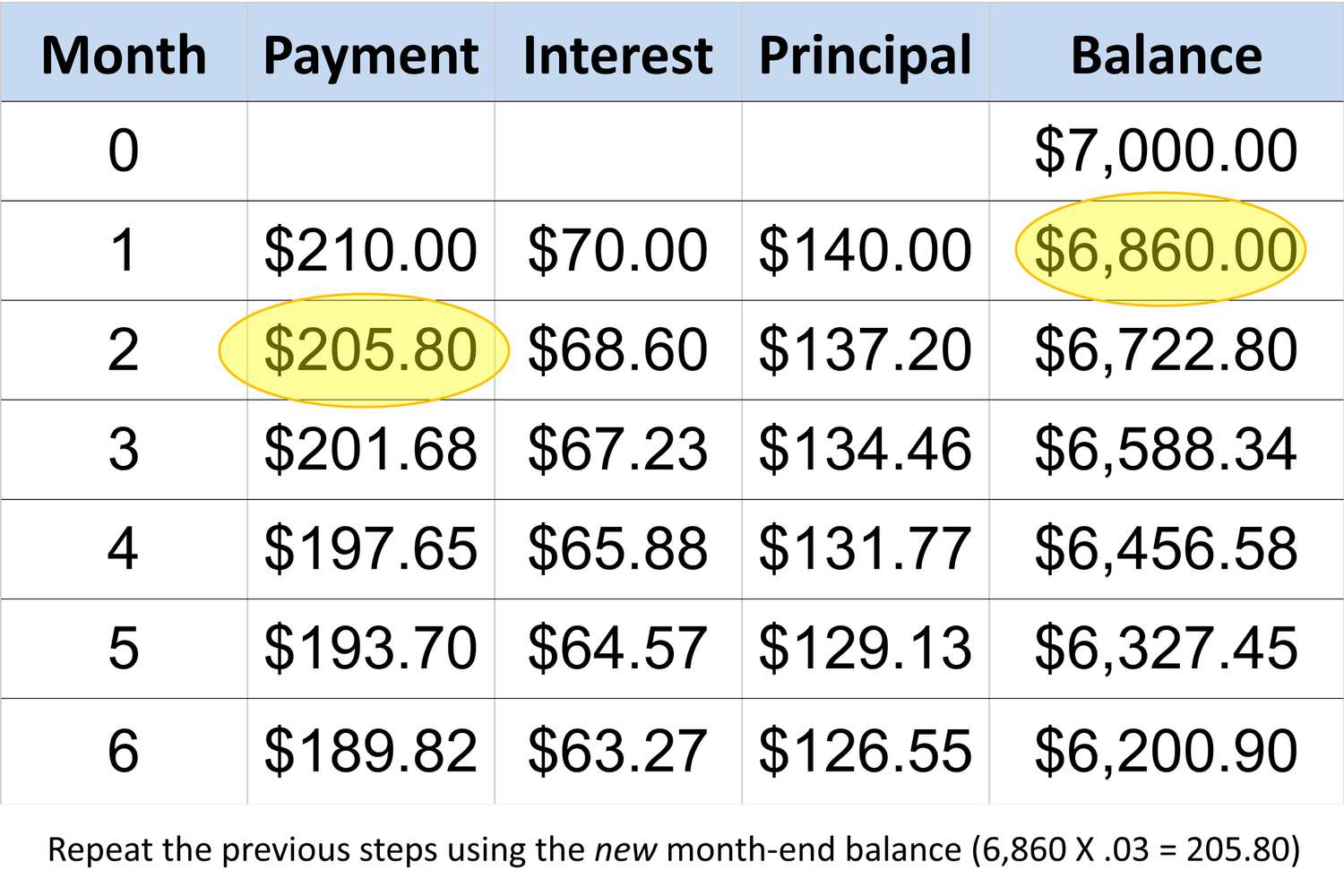

When you receive your credit card statement, the minimum payment is typically calculated as a percentage of your outstanding balance, subject to a minimum amount, often around 1-3% of the total balance. It’s important to note that making only the minimum payment can prolong the repayment period, leading to a cycle of debt accumulation and increased interest expenses.

Understanding the dynamics of minimum payments empowers you to make informed decisions about managing your credit card debt. By gaining clarity on the impact of minimum payments, you can take proactive steps to mitigate interest costs and expedite your journey toward financial freedom. As we delve deeper into this topic, we will explore the factors that influence minimum payments and shed light on how US Bank calculates these crucial financial obligations.

Factors Affecting Minimum Payments

Several key factors influence the calculation of minimum payments on credit cards, playing a pivotal role in determining the amount you are required to pay each month. Understanding these factors is essential for gaining insight into the dynamics of minimum payments and their impact on your overall financial well-being.

- Outstanding Balance: The outstanding balance on your credit card directly affects the minimum payment amount. Typically, the minimum payment is calculated as a percentage of the total balance, often ranging from 1-3% of the outstanding amount. As the balance fluctuates, so does the minimum payment requirement.

- Interest Rate: The interest rate associated with your credit card is a significant determinant of the minimum payment. Higher interest rates result in increased minimum payments, amplifying the financial burden on cardholders. It’s important to be mindful of the interest rate’s impact on minimum payments and overall debt management.

- Fixed Fees and Charges: Certain credit card issuers impose fixed fees and charges, which can contribute to the minimum payment amount. These fees, such as annual fees or service charges, are factored into the minimum payment calculation, influencing the total amount due each month.

- Payment History: Your payment history, including any missed or late payments, can impact the minimum payment requirement. In some cases, a history of delinquent payments may lead to an increase in the minimum payment amount as the issuer seeks to mitigate the perceived risk associated with the account.

By taking these factors into account, credit card users can gain a comprehensive understanding of the variables that shape minimum payments. This knowledge empowers individuals to make informed financial decisions and strategically manage their credit card obligations, ultimately fostering a more secure and stable financial future.

How US Bank Calculates Minimum Payments

When it comes to understanding how US Bank calculates minimum payments on credit cards, it’s essential to grasp the methodology employed by the bank to determine the minimum amount due from cardholders each month. US Bank, like many other financial institutions, utilizes a formula that considers various factors to compute the minimum payment, ensuring adherence to regulatory guidelines and prudent risk management.

Typically, US Bank calculates the minimum payment as a percentage of the outstanding balance, subject to a minimum amount. This percentage often ranges from 1-3% of the total balance, providing cardholders with a baseline for their minimum payment obligation. Additionally, US Bank may factor in any accrued interest, fees, and charges, further influencing the minimum payment requirement.

It’s important to note that US Bank, in compliance with regulatory standards, ensures that the minimum payment covers at least the interest charges accrued during the billing cycle, along with a portion of the principal balance. This approach aligns with responsible lending practices and aims to facilitate the gradual reduction of outstanding balances, ultimately benefiting cardholders by mitigating long-term interest costs.

Furthermore, US Bank may consider the cardholder’s payment history and overall creditworthiness when determining the minimum payment amount. Individuals with a history of delinquent payments or higher perceived risk may be subject to increased minimum payment requirements as the bank seeks to mitigate potential credit losses.

By understanding the methodology behind US Bank’s minimum payment calculations, cardholders can gain clarity on their financial obligations and make informed decisions regarding their credit card management. This insight enables individuals to proactively navigate their credit card payments, optimize debt repayment strategies, and work towards achieving greater financial stability.

Importance of Making More than the Minimum Payment

While making the minimum payment on your credit card may fulfill the basic requirement, it’s imperative to recognize the substantial benefits of consistently paying more than the minimum amount due. By exceeding the minimum payment threshold, you can significantly impact your financial well-being and expedite your journey towards debt freedom. Here are compelling reasons why making more than the minimum payment is a prudent financial strategy:

- Interest Savings: Paying more than the minimum amount allows you to reduce the outstanding balance faster, resulting in lower overall interest charges. By tackling the principal balance more aggressively, you can minimize the long-term cost of borrowing and potentially save a significant amount in interest expenses.

- Accelerated Debt Repayment: Making larger payments enables you to expedite the repayment of your credit card debt. This proactive approach not only reduces the duration of debt accumulation but also alleviates the financial burden associated with prolonged repayment periods.

- Improved Credit Score: Consistently paying more than the minimum amount demonstrates responsible credit management and can positively impact your credit score. By showcasing a proactive approach to debt repayment, you can enhance your creditworthiness and strengthen your financial standing.

- Financial Freedom: By allocating more funds towards credit card payments, you move closer to achieving financial freedom. Liberating yourself from high-interest debt empowers you to reallocate resources towards savings, investments, and other financial goals, fostering long-term stability and prosperity.

Embracing the practice of making more than the minimum payment reflects a proactive and disciplined approach to managing your credit card obligations. It empowers you to take control of your financial destiny, reduce the burden of debt, and pave the way for a more secure and prosperous future.

Tips for Managing Credit Card Payments with US Bank

Effectively managing credit card payments with US Bank is integral to maintaining financial stability and optimizing your overall credit card experience. By implementing strategic approaches and leveraging prudent financial practices, you can navigate your credit card payments with confidence and ease. Here are valuable tips for managing your credit card payments with US Bank:

- Monitor Your Spending: Keep a close eye on your credit card expenditures and strive to maintain a balanced and sustainable approach to spending. Regularly reviewing your transactions can help you identify any potential issues and ensure that your purchases align with your financial goals.

- Create a Payment Schedule: Establish a consistent payment schedule to ensure that you meet your credit card payment deadlines. Whether it’s setting up automatic payments or creating calendar reminders, a structured payment schedule can help you stay on track and avoid late fees.

- Pay More than the Minimum: Whenever possible, endeavor to pay more than the minimum amount due. By exceeding the minimum payment, you can expedite debt repayment, minimize interest charges, and make meaningful progress towards financial freedom.

- Utilize Digital Banking Tools: Take advantage of US Bank’s digital banking tools to conveniently manage your credit card payments, track your spending, and set up payment alerts. Leveraging these resources can streamline your payment process and enhance your overall financial management.

- Seek Financial Guidance: If you encounter challenges or have questions about your credit card payments, don’t hesitate to reach out to US Bank’s customer support or seek guidance from financial advisors. Clarifying any uncertainties can provide you with the confidence and knowledge needed to navigate your credit card payments effectively.

- Review Your Statements: Regularly review your credit card statements to verify the accuracy of charges, identify any unauthorized transactions, and gain a comprehensive understanding of your financial activity. This practice can help you detect potential issues early on and maintain financial vigilance.

- Explore Balance Transfer Options: If feasible, consider exploring balance transfer options offered by US Bank to consolidate high-interest balances and potentially reduce interest costs. However, carefully evaluate the terms and conditions associated with balance transfers to make informed decisions.

By incorporating these tips into your credit card management approach, you can proactively navigate your payments with US Bank and cultivate a strong foundation for responsible financial stewardship. Empower yourself with knowledge, discipline, and a strategic mindset to optimize your credit card experience and achieve long-term financial well-being.