Home>Finance>When Preparing A Bank Reconciliation, Should Interest Earned Be Added To The Bank Statement Balance

Finance

When Preparing A Bank Reconciliation, Should Interest Earned Be Added To The Bank Statement Balance

Published: March 2, 2024

Learn the proper handling of interest earned when preparing a bank reconciliation. Understand the impact on the bank statement balance. Explore finance tips now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Bank reconciliation is a crucial financial process that ensures the accuracy and reliability of a company's financial records. It involves comparing the balances of a company's accounting records with the balances shown on its bank statements. This process is essential for identifying discrepancies, such as outstanding checks, bank errors, and unauthorized transactions. One common question that arises during bank reconciliation is whether interest earned on bank accounts should be added to the bank statement balance. In this article, we will explore the concept of bank reconciliation, the significance of this financial practice, the nature of interest earned on bank accounts, and whether it should be factored into the bank statement balance.

In the realm of finance, bank reconciliation is a fundamental aspect of maintaining accurate and transparent financial records. It serves as a safeguard against errors, discrepancies, and potential fraud, providing businesses with a clear and up-to-date understanding of their financial standing. As such, understanding the intricacies of bank reconciliation, including the treatment of interest earned, is essential for businesses and financial professionals. Let's delve deeper into the significance of bank reconciliation and the role of interest earned in this process.

What is a Bank Reconciliation?

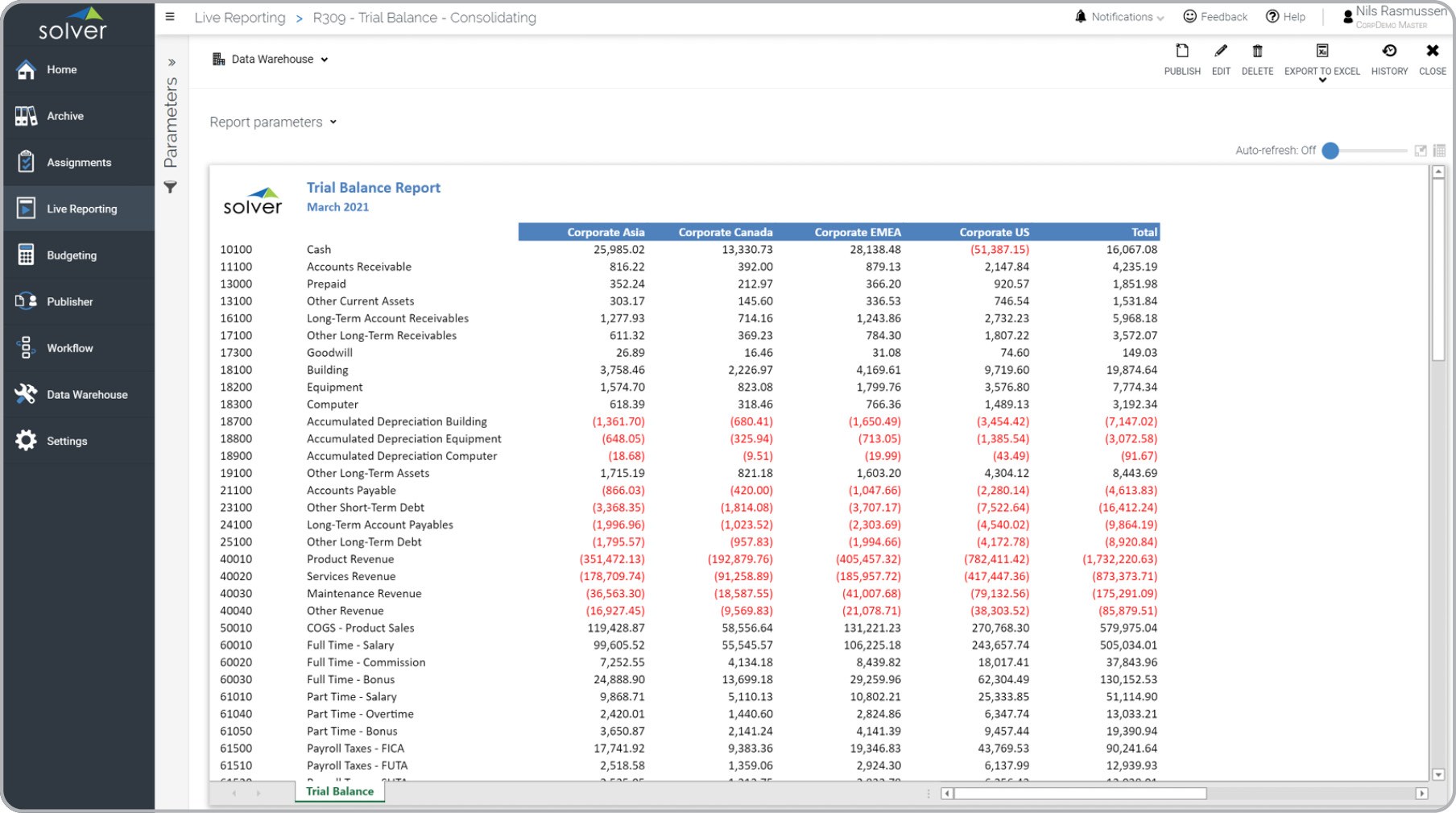

Bank reconciliation is a critical process that involves comparing the financial records of a company with the information provided in its bank statements. The primary objective of bank reconciliation is to ensure that the company’s internal records accurately reflect its financial transactions and that the balances align with the bank’s records. This involves meticulously examining each transaction to identify any discrepancies, such as outstanding checks, deposits in transit, bank fees, and errors. By conducting a thorough bank reconciliation, businesses can detect and rectify any inconsistencies, thereby ensuring the accuracy and integrity of their financial data.

During the bank reconciliation process, the company’s accounting records, including its general ledger, cash disbursements journal, and cash receipts journal, are compared with the corresponding information in the bank statement. Discrepancies may arise due to timing differences, errors, or omissions, and it is the responsibility of financial professionals to reconcile these variations. This meticulous process not only enhances the accuracy of financial reporting but also plays a crucial role in fraud detection and prevention.

Bank reconciliation typically involves comparing the ending balance of the company’s bank account, as per its records, with the ending balance indicated in the bank statement. Discrepancies may emerge due to outstanding checks that have not yet cleared, deposits that have not been processed by the bank, or bank fees that have been levied. By identifying and addressing these variations, businesses can ensure that their financial records provide an accurate reflection of their liquidity and financial position.

Furthermore, bank reconciliation serves as a vital internal control mechanism, allowing businesses to identify and rectify errors promptly. This process not only enhances the accuracy of financial reporting but also facilitates informed decision-making and strategic planning. In the context of financial management, bank reconciliation is an indispensable practice that contributes to the overall integrity and reliability of a company’s financial records.

The Importance of Bank Reconciliation

Bank reconciliation holds immense significance in the realm of financial management and accounting. Its primary importance lies in ensuring the accuracy and integrity of a company’s financial records. By meticulously comparing the company’s internal records with the information presented in the bank statements, bank reconciliation serves as a critical control mechanism, allowing businesses to identify and rectify discrepancies promptly.

One of the key benefits of bank reconciliation is its role in fraud detection and prevention. Through this process, businesses can uncover unauthorized transactions, irregularities, and potential errors that may indicate fraudulent activity. By promptly addressing such discrepancies, companies can mitigate the risk of financial malfeasance and uphold the trust and confidence of stakeholders.

Moreover, bank reconciliation facilitates the detection and resolution of errors and omissions. Whether due to timing differences, data entry mistakes, or bank processing errors, discrepancies between a company’s records and its bank statements can arise. By conducting regular bank reconciliations, businesses can promptly rectify these variations, ensuring the accuracy of their financial reporting and decision-making processes.

Additionally, bank reconciliation contributes to the optimization of cash management. By identifying outstanding checks, deposits in transit, and bank fees, businesses can gain a clear understanding of their actual cash position. This insight is invaluable for effective cash flow management, as it enables businesses to make informed decisions regarding expenditures, investments, and strategic planning.

Furthermore, bank reconciliation plays a pivotal role in ensuring compliance with regulatory requirements and accounting standards. By maintaining accurate and reconciled financial records, businesses can demonstrate transparency and accountability, thereby fulfilling their obligations to regulatory authorities, auditors, and stakeholders.

Overall, the importance of bank reconciliation cannot be overstated. This essential financial practice not only safeguards businesses against errors, discrepancies, and fraud but also enhances the accuracy, reliability, and transparency of their financial records. By conducting regular and meticulous bank reconciliations, businesses can uphold the integrity of their financial data and make informed decisions that drive sustainable growth and success.

Interest Earned on Bank Accounts

Interest earned on bank accounts represents the return that account holders receive for depositing funds in a bank or financial institution. When individuals or businesses deposit money into a savings account, money market account, or certificate of deposit (CD), they often earn interest on their deposits. This interest is typically calculated based on the account’s average daily balance and the prevailing interest rate, and it is credited to the account periodically, such as monthly or quarterly.

Interest earned on bank accounts serves as a form of passive income, allowing account holders to accrue additional funds on their deposits over time. This can be particularly advantageous for individuals and businesses seeking to grow their savings or maximize the return on their idle funds. Furthermore, the compounding effect of interest can significantly enhance the overall value of the deposited funds, contributing to long-term financial stability and wealth accumulation.

From a financial perspective, interest earned on bank accounts represents a vital component of overall investment and cash management strategies. It provides account holders with a source of income that is relatively low-risk and easily accessible. Moreover, interest earned on bank accounts can serve as a hedge against inflation, helping to preserve the purchasing power of the deposited funds over time.

For businesses, interest earned on bank accounts can contribute to their overall revenue and financial performance. By optimizing cash management and strategically allocating funds to interest-bearing accounts, businesses can leverage interest earnings to bolster their liquidity and support operational and investment activities.

It is important to note that the taxation of interest earned on bank accounts varies by jurisdiction and the type of account. In many cases, interest income is subject to taxation, and account holders are responsible for reporting it accurately in their tax returns. Understanding the tax implications of interest earnings is essential for individuals and businesses to ensure compliance with applicable tax laws and optimize their overall financial planning.

In summary, interest earned on bank accounts represents a valuable mechanism for individuals and businesses to generate passive income and maximize the return on their deposited funds. By leveraging interest-bearing accounts and understanding the dynamics of interest earnings, account holders can enhance their financial stability, support their long-term financial goals, and optimize their overall cash management strategies.

Should Interest Earned Be Added to the Bank Statement Balance?

When preparing a bank reconciliation, the question often arises as to whether interest earned on bank accounts should be added to the bank statement balance. The treatment of interest earned in the bank reconciliation process depends on the specific circumstances and the accounting practices followed by the business or organization.

In general, interest earned on bank accounts represents an increase in the account holder’s funds. However, it is important to differentiate between the timing of when the interest is earned and when it is recorded in the company’s financial records. When reconciling the bank statement, it is crucial to account for any interest income that has been earned but not yet recorded in the company’s books. This may involve adjusting the bank statement balance to include the interest earned but not yet reflected in the company’s records.

It is essential to consider the nature of the interest earned, the accounting period to which it pertains, and the timing of its crediting to the account. For instance, if the bank statement date falls within the accounting period for which interest has been earned but not yet credited, the interest amount should be added to the bank statement balance to ensure that the reconciled balance accurately reflects the company’s actual financial position.

Moreover, when interest is credited to the account after the bank statement date, it may not be reflected in the bank statement balance. In such cases, the interest earned should be accounted for in the subsequent bank reconciliation, ensuring that the company’s financial records accurately capture the impact of the interest income on the account balance.

Ultimately, the decision to add interest earned to the bank statement balance during the reconciliation process hinges on aligning the reconciled balance with the company’s actual financial position. This necessitates a thorough understanding of the timing and treatment of interest income, as well as adherence to accounting principles and regulatory requirements.

As with any aspect of bank reconciliation, clear documentation and transparent accounting practices are essential to ensure the accuracy and reliability of the reconciled balances. By carefully considering the treatment of interest earned and adhering to best practices in financial reporting, businesses can maintain the integrity of their financial records and make informed decisions based on a clear and accurate understanding of their financial position.

Conclusion

Bank reconciliation is a fundamental practice that underpins the accuracy and reliability of a company’s financial records. It serves as a vital control mechanism, allowing businesses to detect and rectify discrepancies between their internal records and bank statements. The importance of bank reconciliation in fraud detection, error resolution, and cash management cannot be overstated, making it an indispensable aspect of financial management.

Interest earned on bank accounts represents a valuable source of passive income for individuals and businesses, contributing to their overall financial stability and cash management strategies. The treatment of interest earned in the bank reconciliation process depends on the specific circumstances and the timing of its crediting to the account. Whether interest earned should be added to the bank statement balance hinges on aligning the reconciled balance with the company’s actual financial position and adhering to accounting principles and regulatory requirements.

By conducting regular and meticulous bank reconciliations, businesses can uphold the integrity of their financial records, mitigate the risk of fraud, and make informed decisions based on accurate and transparent financial data. Clear documentation, adherence to best practices, and a thorough understanding of the treatment of interest earned are essential for maintaining the accuracy and reliability of reconciled balances.

In conclusion, bank reconciliation, when performed diligently and in accordance with established accounting principles, enhances the transparency, accuracy, and reliability of a company’s financial records. It is a cornerstone of financial management, contributing to the detection and resolution of discrepancies, the optimization of cash management, and the overall integrity of financial reporting. By integrating the treatment of interest earned into the bank reconciliation process, businesses can ensure that their financial records provide a true and fair view of their financial position, supporting informed decision-making and sustainable growth.