Finance

3/27 Adjustable-Rate Mortgage (ARM) Definition

Published: September 24, 2023

Learn about 3/27 Adjustable-Rate Mortgages (ARMs) in finance, their benefits, and risks. Understand how this type of mortgage affects your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the 3/27 Adjustable-Rate Mortgage (ARM) Definition

Are you exploring different options for financing a home purchase or refinancing your existing mortgage? Understanding the various types of mortgages available to you is crucial in making an informed decision. One popular option to consider is the 3/27 Adjustable-Rate Mortgage (ARM), and in this blog post, we will provide you with a comprehensive definition and explanation of its key features.

Key Takeaways:

- A 3/27 ARM is a type of mortgage loan that offers an initial fixed interest rate for the first three years, followed by annual adjustments for the remaining 27 years.

- These mortgages typically have lower initial interest rates compared to fixed-rate mortgages but come with the risk of potentially higher payments in the future.

At its core, a 3/27 ARM is a mortgage loan with an adjustable interest rate. This means that the rate you initially agree to is fixed for a specific period, in this case, three years. After the initial fixed period, the interest rate is adjusted annually based on an index and margin determined by your lender. The index used could be the U.S. Treasury Bill rate or the London Interbank Offered Rate (LIBOR), among others.

Now, let’s delve deeper into the unique features and potential advantages and risks associated with a 3/27 ARM:

1. Lower Initial Interest Rates

One of the primary benefits of a 3/27 ARM is the lower initial interest rate compared to a fixed-rate mortgage. This lower rate can make your monthly mortgage payments more affordable during the fixed period, allowing you to allocate funds towards other financial goals or investments.

2. Annual Adjustments and Future Rate Risks

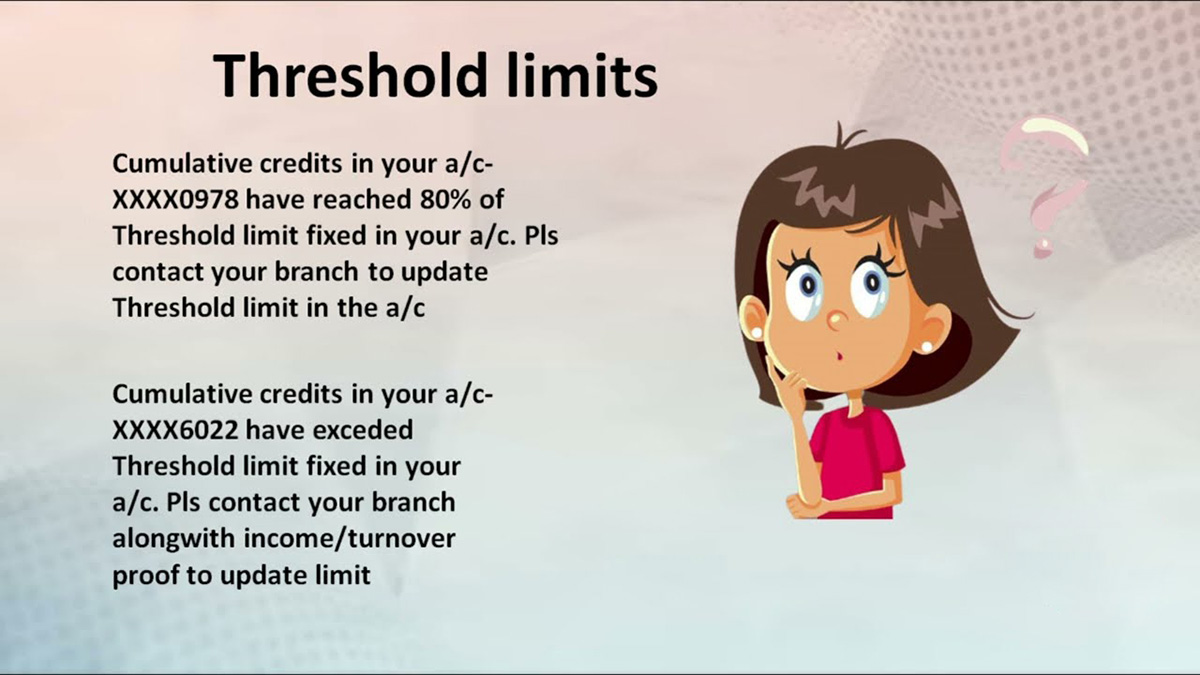

Once the initial fixed period ends, the interest rate on a 3/27 ARM is subject to adjustments every year. The rate adjustments are typically predetermined, consisting of an index plus a margin. While there is a cap on how much your rate can increase in a single year and over the life of the loan, there is still a risk that your future payments may become higher if interest rates rise.

This potential increase in payments is an important factor to consider when opting for a 3/27 ARM. As a borrower, you need to assess your long-term financial stability and ability to handle potentially higher mortgage payments in the future.

In Conclusion

A 3/27 Adjustable-Rate Mortgage (ARM) can be an attractive option for borrowers looking to benefit from lower initial interest rates, especially if they plan to sell or refinance before the fixed period ends. However, it’s essential to understand the potential risks involved when considering an ARM, such as the possibility of higher payments in the future.

As with any financial decision, it’s important to weigh the pros and cons and consider your individual financial circumstances and goals. Consulting with a mortgage professional can help you navigate the various mortgage options and provide you with personalized advice based on your unique needs.