Home>Finance>Custom Adjustable Rate Debt Structure (CARDS) Definition

Finance

Custom Adjustable Rate Debt Structure (CARDS) Definition

Published: November 7, 2023

Learn about the definition of Custom Adjustable Rate Debt Structure (CARDS) in finance, offering flexible terms for managing debt

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Custom Adjustable Rate Debt Structure (CARDS) Definition: What You Need to Know

When it comes to managing your finances, it’s important to stay informed about the various tools and strategies available to you. In the world of personal finance, one term that you may have come across is the Custom Adjustable Rate Debt Structure (CARDS). But what exactly does it mean? And how can it benefit you? In this blog post, we will define CARDS and explore its potential advantages. So, let’s dive in!

Key Takeaways:

- CARDS is a financial strategy that helps individuals manage their debt by customizing their adjustable rate terms.

- It offers flexibility in adjusting interest rates, payment schedules, and principal amounts.

Custom Adjustable Rate Debt Structure, often referred to as CARDS, is a financial strategy designed to help borrowers manage their debt more effectively. Unlike traditional debt structures with fixed interest rates, CARDS allows borrowers to customize their adjustable rate terms based on their financial needs and goals. This innovative approach provides individuals with the flexibility to adjust interest rates, payment schedules, and even principal amounts over time.

But how does CARDS work? Let’s break it down:

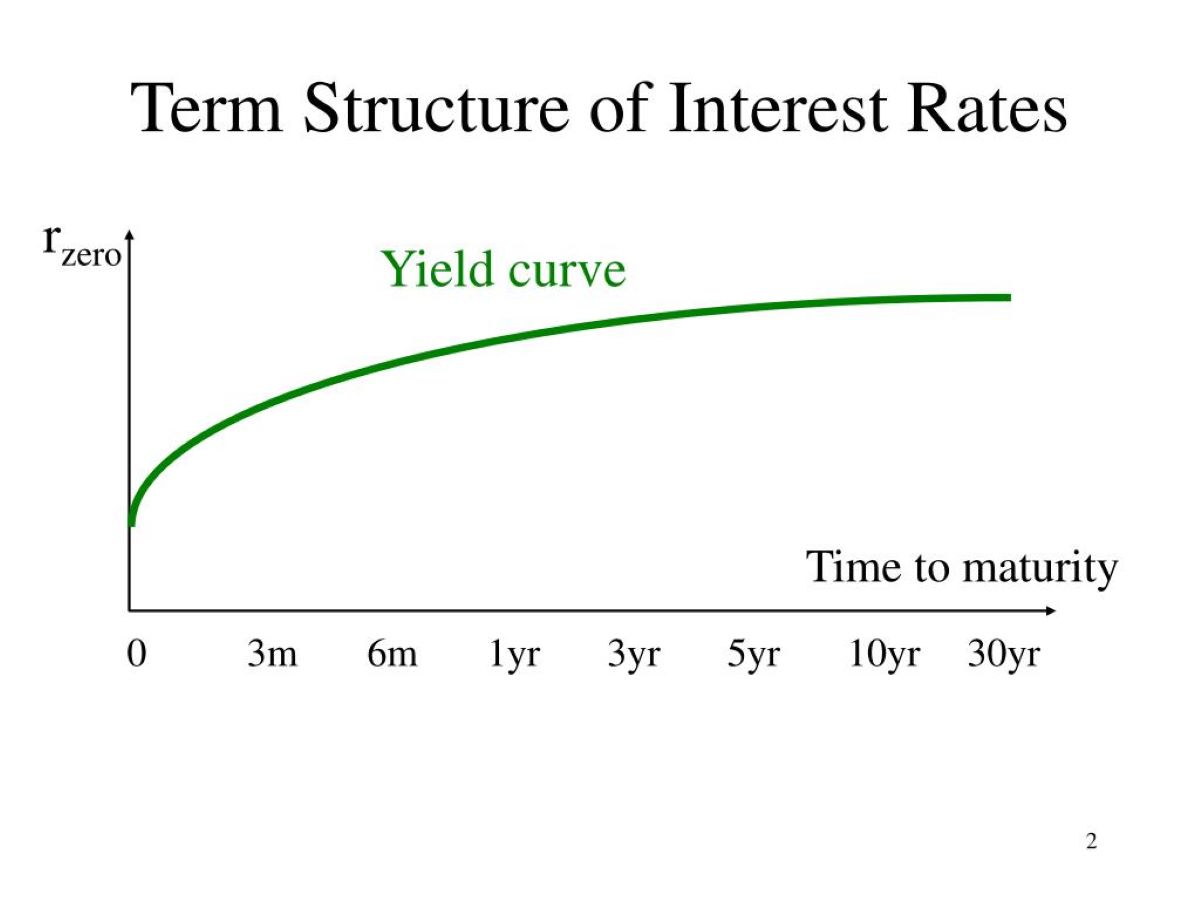

1. Flexibility in Interest Rates:

With CARDS, borrowers have the ability to adjust the interest rates on their debts periodically. This means that if market conditions change and interest rates drop, borrowers can take advantage of lower rates and potentially save money in interest payments. Conversely, if rates increase, borrowers can choose to lock in a higher rate to protect themselves from potential future rate hikes.

2. Customized Payment Schedules:

CARDS also allows borrowers to customize their payment schedules. This means that individuals can align their debt repayments with their cash flow, making it easier to manage their monthly expenses. By adjusting the timing and frequency of their payments, borrowers can avoid financial strain and ensure that their debt obligations fit within their budget.

Benefits of CARDS:

Now that we understand how CARDS works, let’s explore some of the key benefits it offers:

- Increased Financial Flexibility: By customizing interest rates and payment schedules, CARDS provides individuals with increased flexibility in managing their debt. This can help borrowers better navigate financial ups and downs and adapt to changes in their financial situation.

- Potential Savings: CARDS allows borrowers to take advantage of lower interest rates, potentially leading to long-term savings on interest payments. By regularly reviewing and adjusting their rates, borrowers can optimize their debt structure and save money over time.

In conclusion, Custom Adjustable Rate Debt Structure (CARDS) is a financial strategy that offers borrowers greater control and flexibility over their debt. By customizing interest rates and payment schedules, individuals can better manage their financial obligations and potentially save money in the process. If you’re interested in exploring this debt management strategy further, it’s always a good idea to consult with a financial advisor who can provide you with personalized guidance tailored to your specific financial situation.