Finance

403b vs 401k: Which Is Better?

Modified: September 6, 2023

The 403b vs 401k are two of the most common retirement plans for employees. Learn how each of these plans work and which one is better for you.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

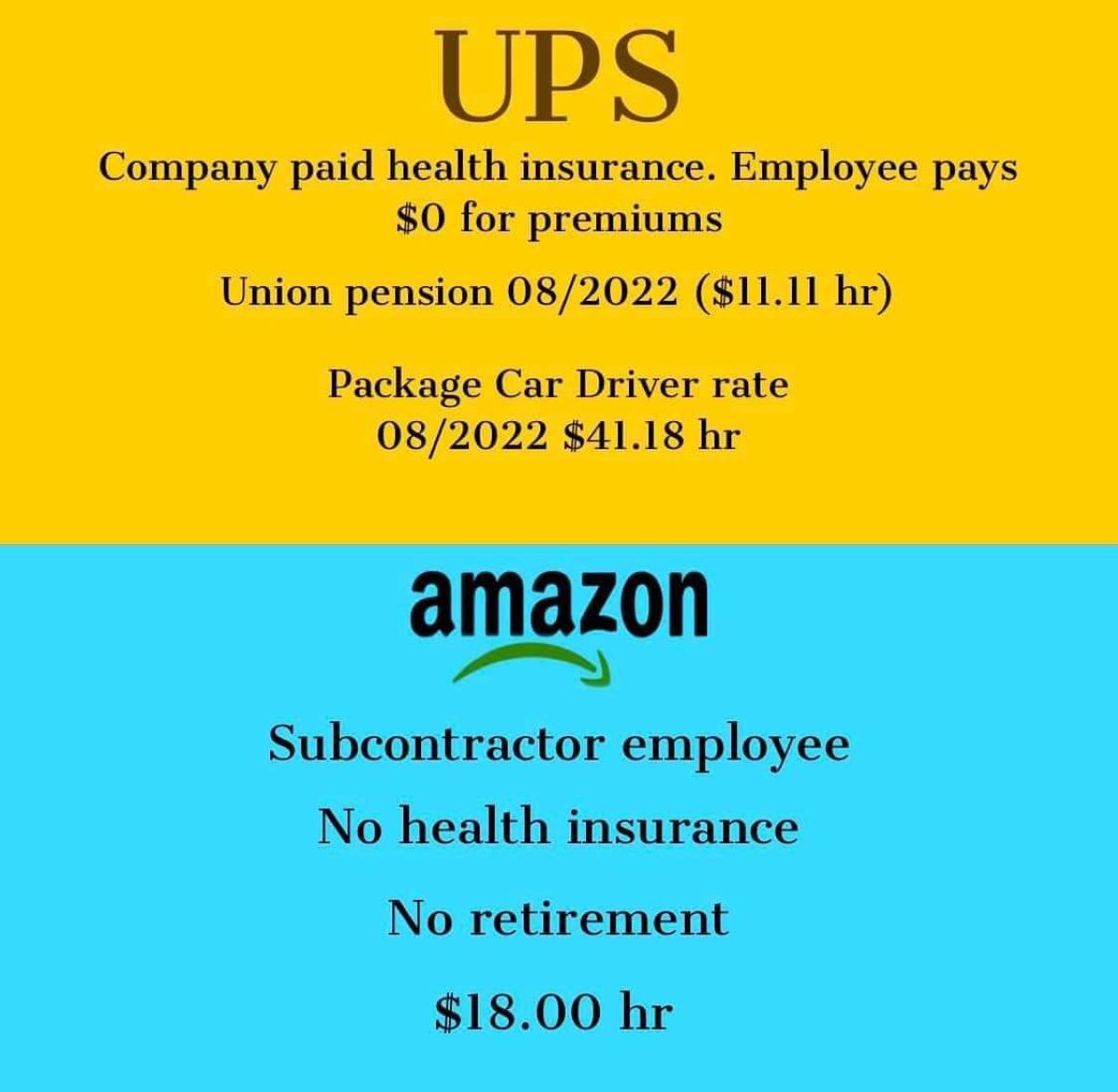

There are a number of different retirement plans to choose from. But if you are an employee, the two qualified tax-advantaged retirement vehicles offered by employers are the 403b vs 401k plans. Both of these plans are named after sections 401k and 403b of the tax code.

In general, private and for-profit companies offer 401k plans. 403b plans, on the other hand, are only available to government employers and nonprofit organizations. Let us look at each retirement plan and how they work to find out if one is better than the other.

The 401k Retirement Plan

Decades ago, companies used to offer their employees a pension. But the Congress passed the Revenue Act of 1978, giving birth to the Section 401k of the tax code. By 1983, nearly half of all large profit companies invested in 401k plans. And today, more than $4.8 trillion of them offer 401k.

The 401k retirement plan is offered mostly and sponsored by employers to assist their employees in their retirement savings. Eligible employees can make tax-deferred contributions from their wages or salary on a pretax and/or post-tax basis. On behalf of these employees, their employers may also make matching or non-elective contributions and add a profit-sharing feature to the plan.

Photo by Marco Verch from Flickr

In IRS lingo, a 401k is called a qualified plan. A company gets a tax benefit for contributing money to the employee’s account on their behalf. The employee can contribute part of his or her paycheck to the plan before the IRS taxes the funds.

In 2018, qualified plans allowed contributions of up to $18,500. You cannot withdraw money out of most 401k plans until you reach age 59 ½ or meet certain IRS conditions. You can only start taking withdrawals by age 70 ½. When you take distributions or withdraw funds from your 401k, you begin to enjoy the retirement income and face its tax consequences.

Photo by maxpixels.net

401k’s for most people have distributions taxed as ordinary income, just like a paycheck. But depending on the type of 401k and on how and when you withdraw funds from it, the tax burden you will incur will vary.

The 403b Retirement Plan

The 403b plan is a retirement plan offered to specific employees by non-profit and tax-exempt organizations such as schools, hospitals, and religious groups. This plan is also known as Tax-Sheltered Annuities (TSA). It allows employees to invest in annuities and mutual funds (depending on the employer).

The features of a 403b plan can be compared to those found in a 401k plan. The 403b has the same contribution limits and the same withdrawal rules as the 401k. It also allows you to make tax-deferred deposits.

Photo by Chris Potter from Flickr

Because 403b’s are limited to non-profits that are smaller and have fewer resources, this plan has a reputation of having higher fees. Recent trends, though, have shown 403b plans emerge with lower fees.

Aside from 403b, some employees, such as public school teachers can also enroll in the 457 plan. The 457 retirement plan is similar to a 403b and 401k plan, except that you can make early withdrawals without the 10% penalty.

401k vs 403b: Differences Between The Two

Eligibility

The 401k is available to any company regardless of its type. For the average employee, there are almost no differences when it comes to 403b vs. 401k. Although non-profit companies like public schools, hospitals, and governmental organizations offer their employees 403b retirement accounts instead of 401k.

Photo from Max Pixel

Because of this, the law allows them to be exempt from certain administrative processes that apply to 401k plans. This makes the administrative costs for a 403b lower and helps organizations with small budgets help their employees save for retirement.

Elective Deferral Limits

Both retirement plans have contribution limits that tell an employee how much they can contribute. In 2011, for example, the standard elective deferral limit is $16,500 for both 401k and 403b. Both also allow “catch-up” contributions for employees age 50 and older. These employers can contribute up to a total of $22,000 or an additional $5,500.

Some workers with at least 15 years of service can add another $3,000 to their deferral limit each year in a 403b plan. They are no longer eligible once they have contributed a total of $15,000, according to the rule. This option is not available to employees with a 401k plan.

Photo from Pixabay

Subject To ERISA

The Employee Retirement Income Security Act (ERISA) governs qualified, tax-deferred retirement investments including 403b vs 401k plans. Mostly, the 401k plan is subject to ERISA, unless otherwise exempt.

The 403b plans do not have to comply with many of the ERISA regulations. This plan is also exempt from nondiscrimination testing.

Cost

The cost difference of 403b vs 401k can either be small or substantial. Different factors will determine the cost: what you invest in, who the company is, and the level of service the management company provides. In that case, the administrative costs of a 403b vs 401k can be much lower, regardless of the investment.

Photo by rawpixel from Pixabay

You can find out how much you are paying for your plan’s administration. The information usually is not visible in your statement, so you will probably have to look beyond it. For both plans, find out also how much the investment (whether mutual fund or annuity) is charging.

Investment Options

The investment options available inside the 401k plan are usually selected by your employer or the financial management company. But you can also opt for different investment options by asking your employer to make them available to you.

Before, the investment options of 403b plans are restricted primarily to variable annuities. But they removed these restrictions years ago, and now most of the 403b plans enable you to invest in a wide variety of annuities and mutual funds.

Photo by 401(K) 2012 from Flickr

Which is the Better Retirement Plan?

In reality, the type of retirement plan does not matter to the vast majority of employees. One plan is no better than the other, as there are some benefits that might appeal to each different needs. The larger the company, the lower the plan fees will be. This is because there are more people taking part that bring the costs down. In contrast, you can find lower-cost index funds as investment options if you work for a smaller company.

Rather than comparing 403b vs 401k, proceed with evaluating the investment options within the plan. It is also important to understand its expenses and administrative costs. By being informed, you can best decide where and how to best invest your money for your retirement plan.