Home>Finance>Account Inquiry: Definition, Purposes, & Effect On Credit Scores

Finance

Account Inquiry: Definition, Purposes, & Effect On Credit Scores

Modified: March 5, 2024

Discover the meaning, importance, and impact of account inquiries on credit scores with our comprehensive guide in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Account Inquiry: Definition, Purposes, & Effect on Credit Scores

When it comes to managing our finances, understanding the impact of various financial activities is crucial. One such activity that often raises questions among individuals is account inquiry. What exactly is account inquiry, and how does it affect our credit scores? In this blog post, we will dive into the world of account inquiry, shed light on its definition, purposes, and explore its implications on credit scores. So, let’s get started!

Key Takeaways:

- Account inquiries refer to the instances when a creditor or financial institution accesses your credit report.

- There are two types of account inquiries: hard inquiries and soft inquiries.

The Definition

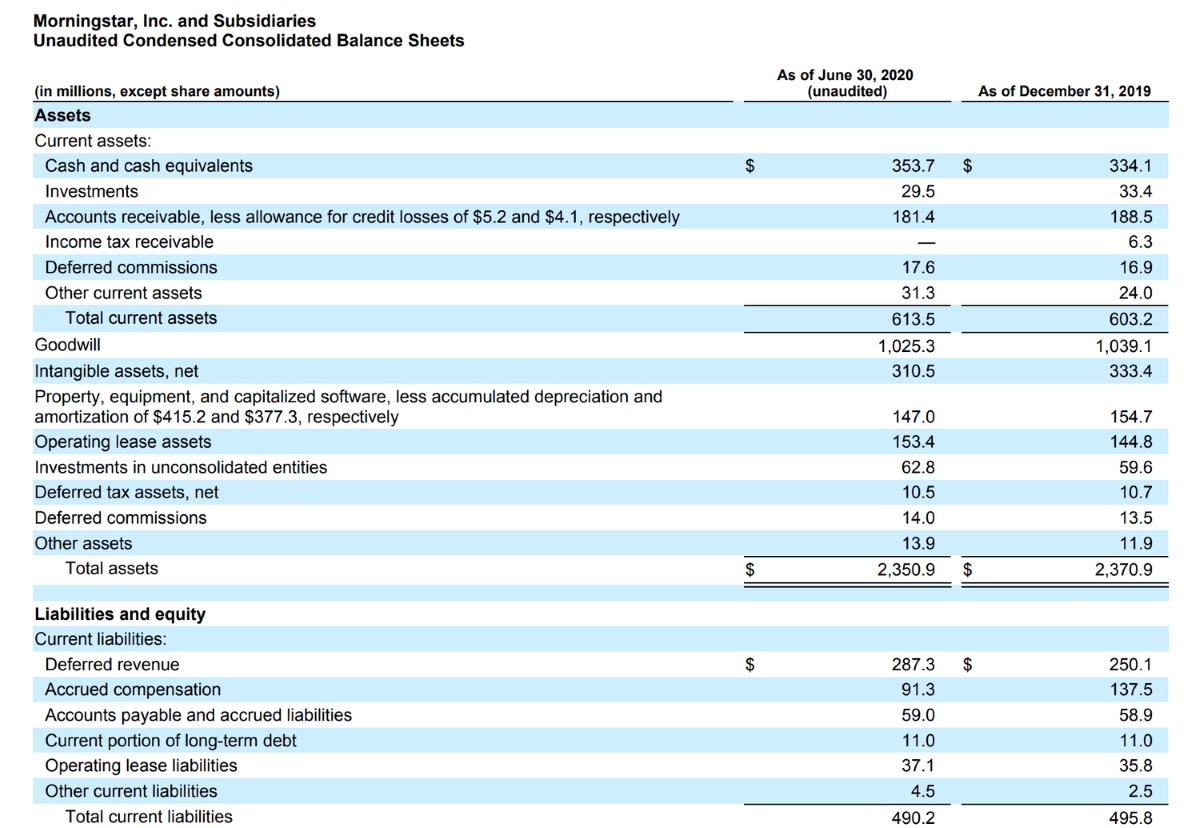

Account inquiry, in simple terms, refers to the process of a creditor or financial institution requesting access to your credit report. When you apply for credit, such as a loan or credit card, the lender will often pull your credit report to evaluate your creditworthiness. This inquiry helps them assess the level of risk associated with lending you money. Creditors use the information obtained from your credit report to make informed decisions regarding your application.

Purposes of Account Inquiry

Account inquiries serve several purposes and play a significant role in the world of finance. Some common reasons why creditors or financial institutions initiate account inquiries include:

- Assessing Creditworthiness: Creditors rely on account inquiries to evaluate your creditworthiness and determine the risk involved in granting you credit. They consider factors such as your credit history, outstanding debts, and payment history.

- Verifying Identity: Account inquiries are also conducted to verify your identity. Lenders need to confirm that the personal information provided in your application matches the information on your credit report.

- Offering Pre-approved Credit: In certain cases, financial institutions may use account inquiries to extend pre-approved credit offers to individuals who meet specific criteria. These offers simplify the credit application process, making it more convenient for the consumer.

Effect on Credit Scores

Understanding the effect of account inquiry on credit scores is crucial as this can impact your financial standing. It’s important to note that there are two types of account inquiries: hard inquiries and soft inquiries.

Hard inquiries: These occur when you apply for credit, such as a loan or credit card. Hard inquiries are visible on your credit report and may slightly impact your credit score. Multiple hard inquiries over a short period can signal to lenders that you are seeking credit frequently, which could raise concerns about your financial stability.

Soft inquiries: These occur when your credit report is accessed for reasons that do not involve a credit application. Examples of soft inquiries include background checks conducted by employers or when you check your own credit report. Soft inquiries do not impact your credit score.

It’s essential to be mindful of the number of hard inquiries you have on your credit report, as excessive inquiries may lead to a temporary decrease in your credit score. It’s recommended to only apply for credit when necessary and avoid numerous credit applications within a short time frame.

In Conclusion

Account inquiry is a significant component of the credit evaluation process. By understanding what account inquiry is, its purposes, and its impact on credit scores, you can make informed financial decisions. Remember to be mindful of the type and frequency of credit applications to maintain a healthy credit score. Your creditworthiness is an essential aspect of your financial well-being, so always approach credit applications and inquiries with care.