Home>Finance>Hard Inquiry: Definition, How It Works, Impact On Credit Score

Finance

Hard Inquiry: Definition, How It Works, Impact On Credit Score

Published: December 4, 2023

Learn about hard inquiries in finance: definition, how they work, and their impact on credit scores. Understand how these inquiries can affect your financial standing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Hard Inquiry: Definition, How It Works, Impact on Credit Score

Welcome to another informative blog post from our FINANCE category. Today, we’re diving into the world of credit scores and exploring a crucial aspect that can affect your financial well-being – hard inquiries. What are they, how do they work, and what impact can they have on your credit score? We’ll answer these questions and more, so let’s get started!

Key Takeaways:

- Hard inquiries occur when a lender or creditor checks your credit report after you apply for credit.

- These inquiries are recorded on your credit report and may affect your credit score, but the impact is usually temporary and minimal.

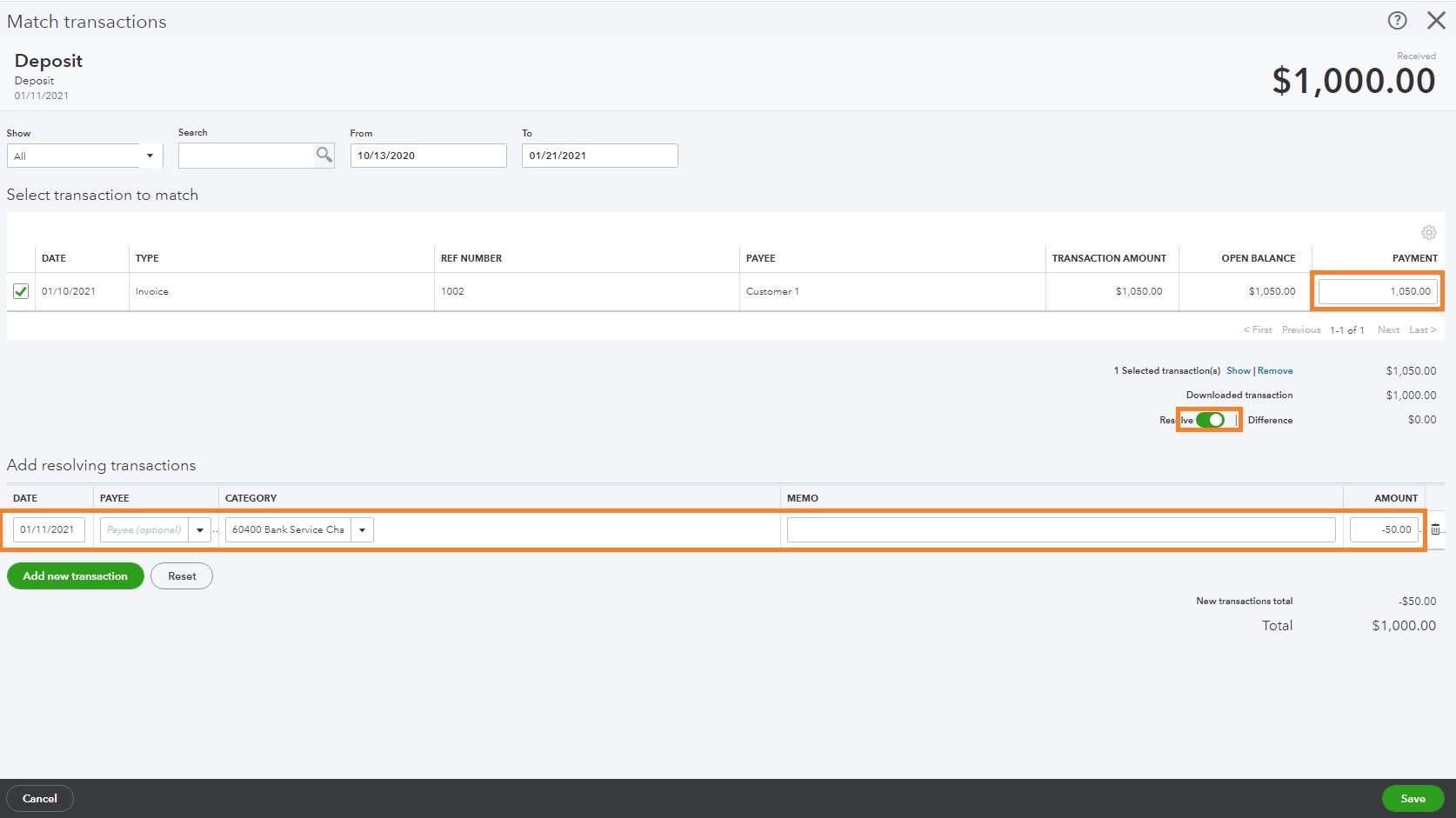

So, what exactly is a hard inquiry? When you apply for credit, whether it’s a new credit card, an auto loan, or a mortgage, the lender will typically request to check your credit report to assess your creditworthiness. This credit check is known as a hard inquiry.

How does it work? Hard inquiries are conducted by pulling your credit report from one or more credit bureaus, such as Experian, Equifax, or TransUnion. The inquiry will be recorded on your credit report, indicating that you’ve applied for new credit.

Now, you might be wondering about the impact of these hard inquiries on your credit score. While hard inquiries can have a slight negative effect on your credit score, keep in mind that the impact is usually temporary and minimal.

Here are a few things you should know about the impact of hard inquiries on your credit score:

- Multiple hard inquiries within a short period can be seen as a red flag by lenders, potentially signaling a higher risk borrower.

- Each hard inquiry typically lowers your credit score by a few points, but this impact is usually small and fades over time.

- If you’re shopping for the best interest rates on a loan, multiple inquiries within a short timeframe (usually around 30 days) for the same purpose are usually treated as a single inquiry and won’t harm your credit score significantly.

So, while it’s important to be mindful of hard inquiries and avoid unnecessary credit applications, the impact they have on your credit score is generally manageable and short-lived.

In conclusion, understanding hard inquiries and their impact on your credit score is crucial if you want to make informed financial decisions. By being aware of how they work and knowing the factors that affect your credit score, you can take control of your financial health and maintain a good credit standing.

That’s it for this blog post! We hope you found this information valuable. Stay tuned for more insightful content from our FINANCE category. If you have any questions or topics you’d like us to cover, feel free to reach out to us. Happy financial planning!