Finance

Where Is Unearned Revenue On The Balance Sheet

Modified: December 30, 2023

Learn about the placement of unearned revenue on the balance sheet and its impact on financial statements. Explore this finance topic in detail.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on unearned revenue and its placement on the balance sheet. Unearned revenue is a crucial concept in finance and accounting that plays a significant role in determining a company’s financial health and liabilities. In this article, we will delve into the definition of unearned revenue, how it is accounted for, and where it appears on the balance sheet.

Unearned revenue, also known as deferred revenue or advance payments, represents money received by a company for goods or services that have not yet been delivered. It arises when a company receives payment upfront before providing the product or service to the customer. This commonly happens in industries such as software, subscription-based services, real estate, and airlines, where companies often require advance payments or deposits from customers.

Accounting for unearned revenue is essential as it affects a company’s financial statements, including the income statement and balance sheet. It is crucial to accurately record and categorize unearned revenue to reflect the company’s financial obligations and performance accurately.

On the balance sheet, unearned revenue is classified as a liability. It represents the company’s obligation to provide goods or services in the future. As the company delivers the product or service, unearned revenue is gradually recognized as revenue on the income statement, and the corresponding liability decreases.

Understanding the placement of unearned revenue on the balance sheet is vital for investors, analysts, and stakeholders to assess a company’s financial stability and future cash flows. By analyzing the unearned revenue balance, they can gain insights into a company’s ability to fulfill commitments, its revenue recognition policies, and its overall financial health.

In the following sections, we will explore in further detail how unearned revenue is accounted for, its appearance on the balance sheet, the significance it holds, and provide examples to illustrate its practical application.

What is Unearned Revenue?

Unearned revenue, also referred to as deferred revenue or advance payments, is a financial term used to describe the income received by a company in advance of delivering products or services to its customers. In simpler terms, it represents the money a company receives for goods or services it has not yet provided.

Unearned revenue typically arises in industries where companies require upfront payments or deposits to secure future sales or services. Common examples include software as a service (SaaS) subscriptions, magazine subscriptions, prepaid insurance premiums, and pre-booked airline tickets.

When a company receives unearned revenue, it classifies the funds as a liability on its balance sheet. This is because the company is obligated to fulfill its promise of delivering the product or service to the customer in the future. As time passes and the company fulfills its obligation, the liability is then recognized as revenue on the income statement.

Accounting for unearned revenue follows the accrual method, which aims to match revenues and expenses to the period in which they are incurred rather than when cash exchanges hands. This means that even though the company has received cash upfront, it cannot recognize it as revenue until it has fulfilled its obligation to the customer.

It is important to note that unearned revenue is distinct from earned revenue. Earned revenue refers to the income a company has recognized as revenue for the products or services it has already delivered to customers.

Unearned revenue plays a vital role in financial reporting and analysis. It helps provide an accurate representation of a company’s financial position, revenue recognition policies, and future cash flows. Investors and stakeholders rely on information about unearned revenue to assess a company’s ability to fulfill its obligations and generate consistent revenue over time.

In the next section, we will explore how unearned revenue is accounted for in financial statements and its implications for a company’s balance sheet.

How Unearned Revenue is Accounted for

Accounting for unearned revenue requires careful consideration to accurately represent a company’s financial position and performance. Here, we will outline the general process of how unearned revenue is accounted for.

When a company initially receives unearned revenue, it records the amount as a liability on its balance sheet. This liability is typically classified as “Unearned Revenue” or “Deferred Revenue.” By doing so, the company acknowledges its obligation to provide goods or services in the future.

As time passes and the company fulfills its obligation to deliver the product or service, it recognizes revenue on the income statement and reduces the corresponding liability of unearned revenue on the balance sheet. The amount of unearned revenue that is recognized as revenue depends on the specific terms of the agreement with the customer.

For example, if a company receives a $1,200 prepayment from a customer for a one-year software subscription, it would initially record the $1,200 as unearned revenue on the balance sheet. Over the course of the year, as the company provides the software services month by month, it would recognize $100 of revenue each month on the income statement and reduce the unearned revenue by $100 on the balance sheet.

It is important to note that the recognition of earned revenue from unearned revenue should adhere to the principles of revenue recognition outlined in the applicable accounting standards, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

In some cases, unexpected circumstances may prevent a company from fulfilling its obligation to provide the goods or services. In these situations, the company may be required to refund a portion or the entire unearned revenue to the customer. This would result in an adjustment on the balance sheet to reduce the liability of unearned revenue.

Accurately accounting for unearned revenue is crucial for a company’s financial statements, as it influences the depiction of its financial position, revenue recognition patterns, and overall profitability. Proper tracking and management of unearned revenue enable investors, analysts, and stakeholders to gain insights into a company’s financial health and future cash flow projections.

Next, we will explore where unearned revenue appears on the balance sheet and its significance in assessing a company’s financial stability.

Where Unearned Revenue Appears on the Balance Sheet

Unearned revenue, also known as deferred revenue, is classified as a liability on the balance sheet. It represents the company’s obligation to provide goods or services in the future to its customers who have made upfront payments.

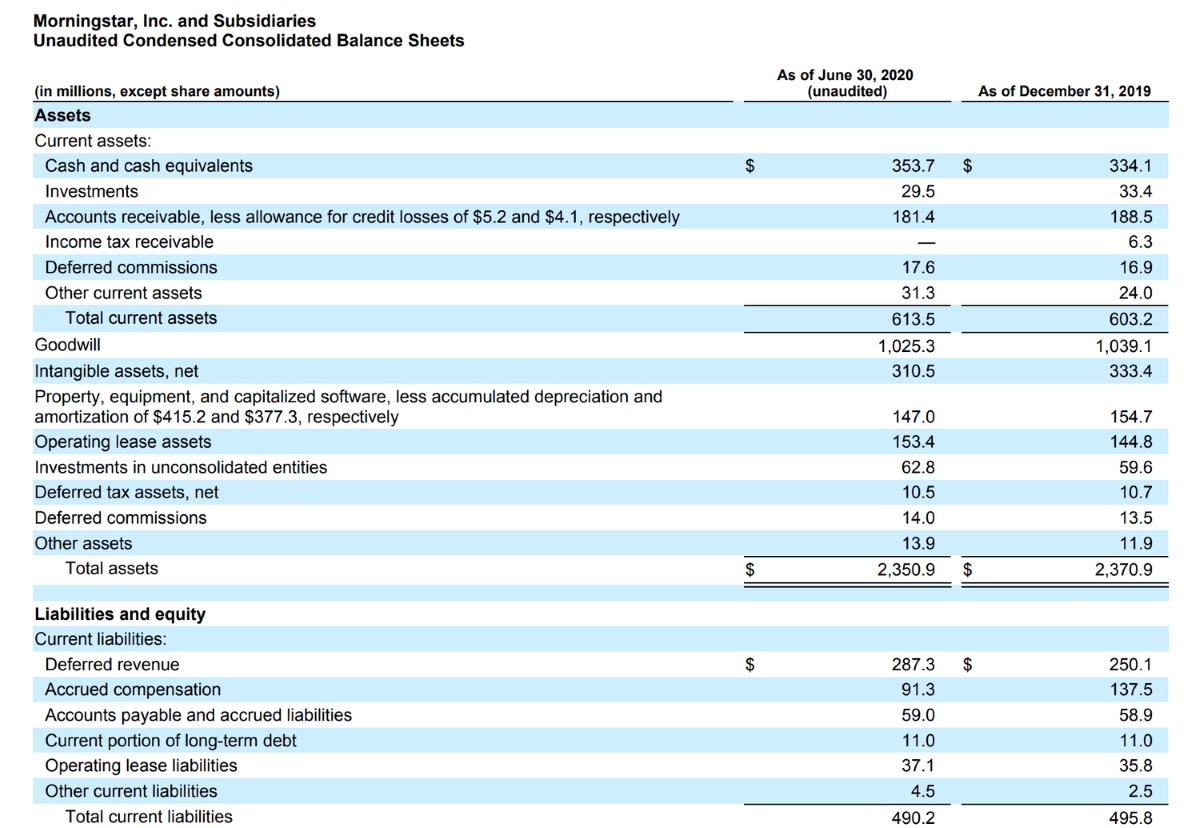

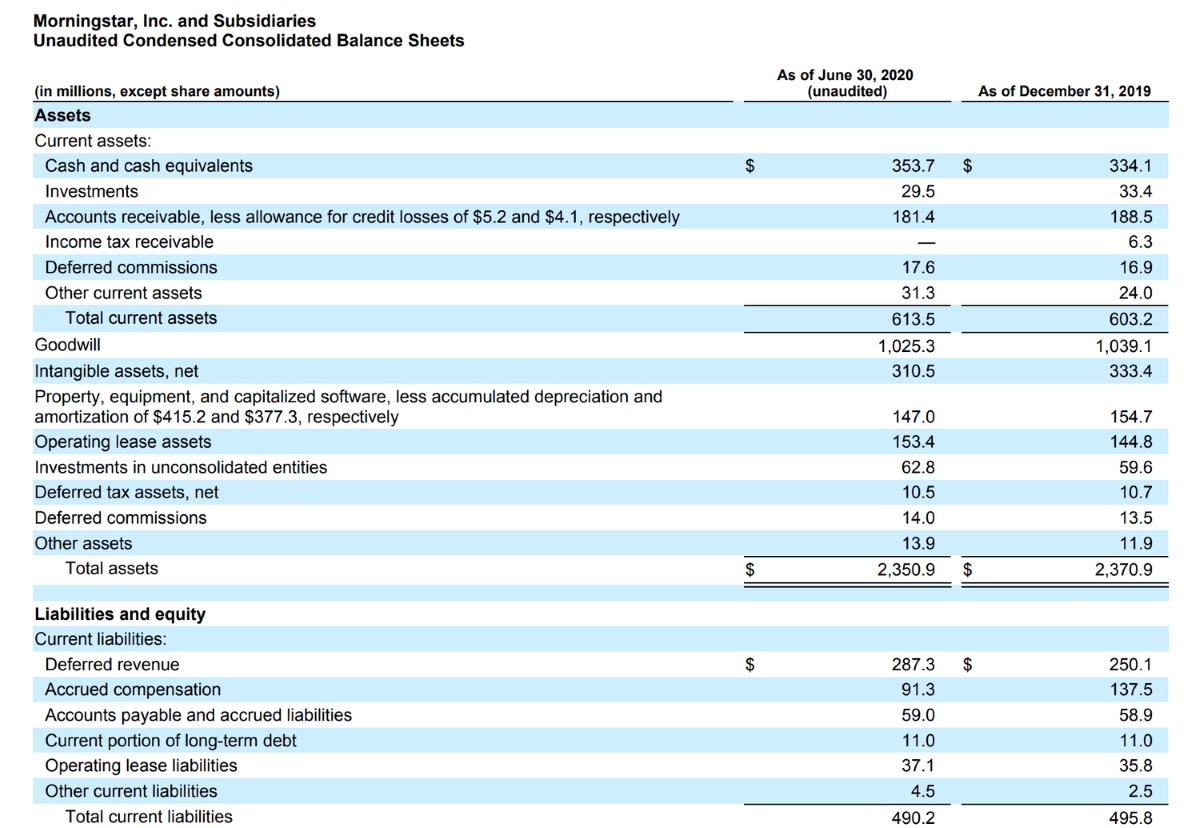

Specifically, unearned revenue is typically listed under the current liabilities section of the balance sheet if the revenue is expected to be recognized within a year. If the unearned revenue represents long-term obligations that will be fulfilled beyond one year, it will be categorized as a non-current liability.

Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “Unearned Revenue,” “Deferred Revenue,” or “Advances from Customers.” This distinguishes it from other types of liabilities, such as accounts payable or accrued expenses.

The amount of unearned revenue reported on the balance sheet will depend on the terms and duration of the prepayment agreements with customers. As the company fulfills its obligations and recognizes revenue, the unearned revenue balance will decrease accordingly.

It’s worth noting that the balance sheet provides a snapshot of the company’s financial position at a specific point in time. As unearned revenue is gradually recognized as revenue over time, it will flow from the balance sheet to the income statement, impacting the company’s profitability.

The significance of unearned revenue on the balance sheet lies in its representation of future obligations and the company’s ability to convert those obligations into revenue. High levels of unearned revenue indicate strong prepayment agreements and potential revenue streams for the company in the future. On the other hand, a decrease in unearned revenue may suggest successful completion of obligations or a change in customers’ payment patterns.

Investors, analysts, and stakeholders closely monitor unearned revenue on the balance sheet to assess a company’s financial stability, revenue recognition policies, and future cash flows. It provides insights into the company’s ability to meet its commitments and generate consistent revenue over time.

In the next section, we will examine the importance of unearned revenue on the balance sheet and its implications for financial analysis.

Importance of Unearned Revenue on the Balance Sheet

Unearned revenue plays a significant role on the balance sheet, providing valuable insights into a company’s financial stability, revenue recognition policies, and future cash flows. Here, we will explore the importance of unearned revenue on the balance sheet and its implications for financial analysis.

1. Financial Stability: Unearned revenue is an indicator of a company’s financial stability. High levels of unearned revenue suggest strong prepayment agreements and a reliable customer base. It demonstrates that the company has secured future revenue streams, increasing its financial stability and reducing the dependency on future sales or services.

2. Revenue Recognition: The presence of unearned revenue on the balance sheet reflects the company’s revenue recognition policies. It ensures that revenue is recognized in the period when goods or services are delivered to customers, aligning with the principles of accurate financial reporting. This transparency and adherence to accounting standards enhance the credibility and integrity of a company’s financial statements.

3. Future Cash Flows: Unearned revenue also provides insights into a company’s future cash flows. As the company fulfills its obligations and recognizes revenue, the unearned revenue liability decreases, indicating that cash will be received in the future. This helps analysts and investors assess the company’s cash flow projections and forecast its ability to meet financial obligations.

4. Performance Analysis: Unearned revenue can be used as a performance metric to evaluate the effectiveness of a company’s sales and marketing strategies. By comparing the growth or decline in unearned revenue over time, stakeholders can assess the success of the company’s efforts in securing advance payments from customers. It can also indicate changes in customer behavior, such as shifts in payment patterns or changes in demand for the company’s products or services.

5. Forecasting and Valuation: Unearned revenue is a crucial component in forecasting and valuing a company. Analysts may consider unearned revenue as part of their projection models to estimate future revenues and cash flows. Additionally, unearned revenue is often factored into valuation methods, such as discounted cash flow analysis, to determine the intrinsic value of a company.

In summary, unearned revenue on the balance sheet is of great importance in assessing a company’s financial stability, revenue recognition practices, future cash flows, and overall performance. It provides valuable information for stakeholders to make informed decisions, evaluate investment opportunities, and understand the financial health of a company.

In the next section, we will provide examples to illustrate how unearned revenue appears on the balance sheet in different industries.

Examples of Unearned Revenue on the Balance Sheet

Unearned revenue, also known as deferred revenue or advance payments, can be found on the balance sheets of various industries. Here, we will provide examples to illustrate how unearned revenue appears on the balance sheet in different sectors.

1. Software as a Service (SaaS) Companies: SaaS companies often require customers to pay upfront for their software subscriptions. The prepayment is recorded as unearned revenue on the balance sheet until the software services are delivered over the agreed-upon period. As the company fulfills its obligation, the unearned revenue is recognized as revenue on the income statement, and the liability decreases on the balance sheet.

2. Magazine Publishers: Magazine publishers often offer annual subscription packages. When a customer pays upfront for a year-long subscription, the payment is recorded as unearned revenue. As each issue is delivered, a portion of the unearned revenue is recognized as revenue, and the liability reduces accordingly.

3. Real Estate Developers: Real estate developers may require buyers to make advance payments or deposits for properties that are under construction. The prepayments are classified as unearned revenue on the balance sheet until the properties are completed and handed over to the buyers. As each milestone is achieved, a portion of the unearned revenue is recognized as revenue, and the liability decreases.

4. Airlines: Airlines often receive advance payments or deposits for future flight bookings, travel packages, or loyalty programs. These payments are initially recorded as unearned revenue. As the flights are taken or services are provided, the airline recognizes the portion of the unearned revenue as revenue on the income statement and reduces the liability on the balance sheet.

5. Education Institutions: Educational institutions, such as universities or training centers, may receive upfront payments or tuition fees for courses that will be delivered in the future. The funds received are recorded as unearned revenue until the courses are completed. As each course session is conducted, a portion of the unearned revenue is recognized as revenue, and the liability decreases accordingly.

These examples demonstrate how unearned revenue is categorized as a liability on the balance sheet until the products or services are delivered to the customers. As the company fulfills its obligations, the unearned revenue is gradually recognized as revenue, and the liability decreases over time.

The presence of unearned revenue on the balance sheet provides transparency and helps stakeholders understand the company’s revenue recognition policies, financial obligations, and future cash flows. It allows for accurate analysis and assessment of a company’s financial health and stability.

Next, we will conclude the article by summarizing the key points discussed and emphasizing the importance of proper accounting for unearned revenue on the balance sheet.

Conclusion

Unearned revenue is a vital concept in finance and accounting, representing the income received by a company in advance of delivering goods or services to its customers. It plays a significant role on the balance sheet, reflecting the company’s obligations and future revenue streams.

In this article, we explored the definition of unearned revenue, how it is accounted for, and its placement on the balance sheet as a liability. Proper accounting for unearned revenue ensures accurate financial reporting and adherence to revenue recognition policies.

The presence of unearned revenue on the balance sheet provides valuable insights into a company’s financial stability, revenue recognition practices, and future cash flows. It helps stakeholders assess a company’s ability to meet obligations, generate consistent revenue, and make informed decisions.

Throughout the examples provided, we observed how unearned revenue appears on the balance sheet in various industries such as SaaS companies, magazine publishers, real estate developers, airlines, and education institutions. In each case, unearned revenue gradually transforms into recognized revenue as the company fulfills its obligations.

In conclusion, accurately accounting for unearned revenue on the balance sheet is essential for portraying a company’s financial position and performance accurately. It provides transparency, enables effective financial analysis, and contributes to investor confidence.

As businesses continue to evolve and adopt revenue models involving advance payments, understanding the concept of unearned revenue becomes even more critical. By recognizing the implications of unearned revenue on the balance sheet, companies can effectively manage their liabilities, plan for future obligations, and drive sustainable growth.

By reviewing a company’s balance sheet and analyzing its unearned revenue, investors, analysts, and stakeholders can gain valuable insights into its financial health, revenue recognition practices, and future prospects.

In conclusion, a clear understanding of unearned revenue and its impact on the balance sheet is essential for making informed financial decisions and assessing the long-term viability of a company.