Finance

Advertised Price Definition

Published: October 3, 2023

Learn the meaning of advertised price in finance. Understand how this pricing strategy impacts consumers and businesses.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Advertised Price Definition: The Key to Making Informed Financial Decisions

When it comes to personal finance, staying informed is crucial. Whether you’re looking to purchase a new car or simply trying to make smart choices with your budget, understanding the advertised price definition can significantly impact your decision-making process. In this blog post, we will explore the concept of advertised price, why it matters, and how it can help you take control of your finances.

Key Takeaways:

- An advertised price refers to the price of a product or service that is publicly displayed or promoted.

- It’s important to consider all factors that may affect the total cost, such as taxes, fees, and any additional add-ons.

What is Advertised Price?

Advertised price is the price that is publicly displayed or promoted for a product or service. It is the amount that the seller presents to potential buyers as the cost of the item. When browsing through different financial options, it’s essential to understand that the advertised price may not always reflect the final cost you’ll have to pay. Various factors, such as taxes, fees, and additional add-ons, can significantly impact the total amount.

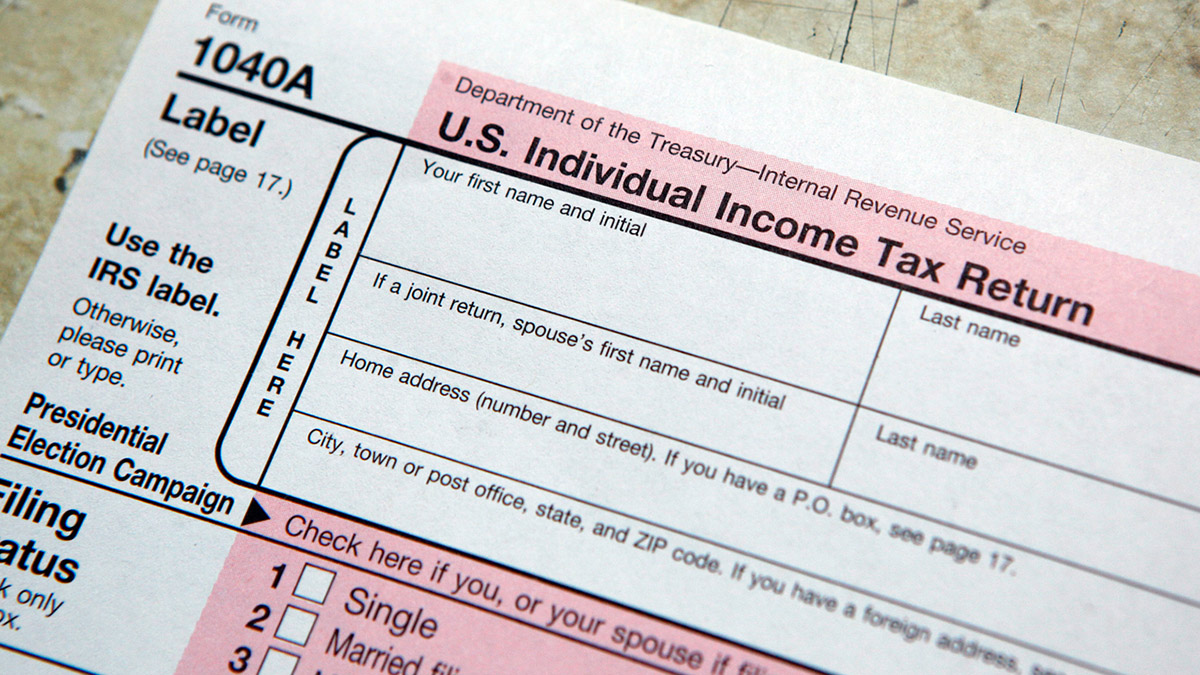

To make informed financial decisions, it’s vital to dig deeper and consider additional costs that may not be explicitly mentioned in the advertisement. For example, when purchasing a car, the advertised price may not include taxes, title fees, or any optional add-ons like extended warranties or accessories.

Why Does Advertised Price Matter?

Understanding the advertised price definition is essential because it allows you to make more accurate comparisons when shopping for products or services. By knowing that the advertised price may not be the final cost, you can budget accordingly and make a more informed decision.

Additionally, being aware of the components that may affect the overall cost can help you negotiate a better deal. For instance, if you’re looking to buy a new smartphone and notice that the advertised price does not include shipping fees, you can factor that into your decision-making process and potentially negotiate a better deal with the seller.

Tips for Evaluating Advertised Prices:

- Read the fine print: Always review the terms and conditions to uncover any hidden costs or fees.

- Consider additional expenses: Factor in taxes, shipping fees, insurance, and any other additional charges that may apply.

- Compare prices: Research and compare the advertised price with similar products or services to ensure you are getting the best deal.

- Ask questions: If something is unclear or not explicitly mentioned in the advertisement, don’t hesitate to reach out to the seller for clarification.

- Negotiate when possible: Take advantage of the knowledge that the advertised price may not be the final cost to negotiate a better deal.

In Conclusion

Advertised prices can be misleading if you don’t fully comprehend the concept. By understanding the advertised price definition and considering all the factors that may affect the final cost, you can make better financial decisions and avoid any unpleasant surprises. Remember to read the fine print, evaluate additional expenses, compare prices, ask questions, and negotiate when possible. Armed with this knowledge, you’ll be better equipped to navigate the financial landscape and make choices that align with your goals and budget.