Finance

Which Tax Return Form Should I File

Published: October 28, 2023

Confused about which tax return form to file? Our comprehensive guide on finance will help you navigate through the options and make the right choice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Tax Return Forms

- Form 1040

- Form 1040A

- Form 1040EZ

- Factors to Consider When Choosing a Form

- Income and Deduction Limitations for Each Form

- Filing Status Requirements for Each Form

- Tax Credits and Deductions Available on Each Form

- Special Considerations for Self-Employed Individuals

- Conclusion

Introduction

When it comes to filing taxes, navigating through the various tax return forms can be overwhelming. Understanding which form to file is crucial for ensuring accurate reporting of income, deductions, and credits, which can ultimately affect the amount of tax you owe or the refund you receive.

In the United States, there are three main tax return forms: Form 1040, Form 1040A, and Form 1040EZ. Each form has its own set of criteria and eligibility requirements, designed to accommodate different types of taxpayers and their specific financial situations. By familiarizing yourself with the differences among these forms, you can make an informed decision about which one to use for your tax filing.

In this article, we will provide you with a comprehensive overview of each tax return form and help you determine which one is most suitable for your needs. We will explore the income and deduction limitations for each form, the filing status requirements, as well as the tax credits and deductions available.

Whether you are an individual with a simple tax situation or a self-employed individual with more complex financial affairs, understanding the options available to you will enable you to file your tax return accurately and efficiently.

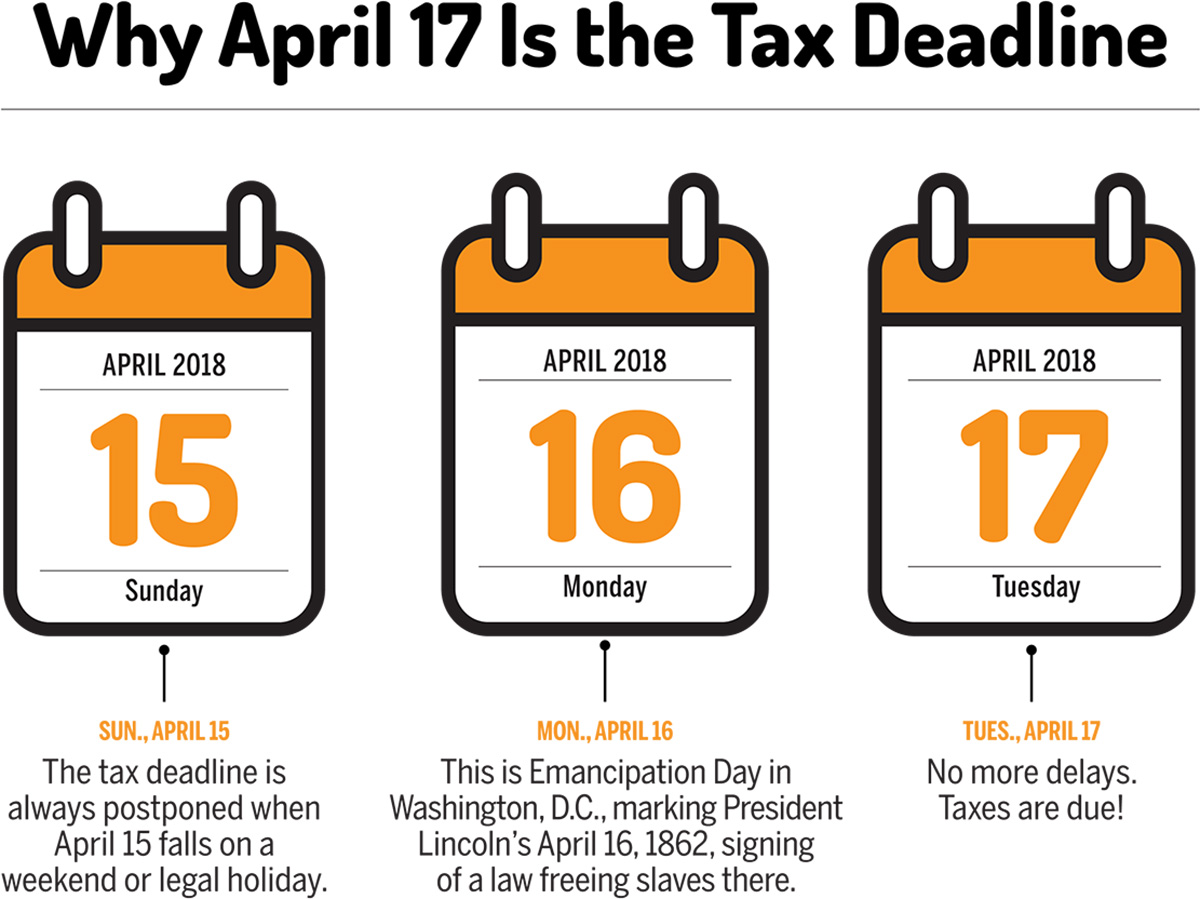

Before we dive into the specifics of each form, it’s important to note that the Internal Revenue Service (IRS) has made efforts to streamline and consolidate the tax return forms over the years. As a result, the Form 1040EZ and Form 1040A are no longer available starting from the tax year 2018. However, it’s still important to understand the differences among these forms as they may impact prior years’ tax returns or serve as a reference for future changes in the tax filing process.

Overview of Tax Return Forms

Before delving into the specifics of each tax return form, let’s take a moment to understand the purpose of these forms and how they differ from one another.

Form 1040:

Form 1040 is the most comprehensive tax return form and is suitable for individuals with more complex financial situations. It allows for a detailed reporting of income, deductions, and credits. This form provides the most flexibility in terms of the types of income and deductions you can claim. It also accommodates various filing statuses, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

Form 1040A:

Form 1040A is a simplified version of Form 1040 and is designed for individuals with a relatively straightforward tax situation. It offers fewer deductions and credits compared to Form 1040, but still provides enough flexibility for most taxpayers. This form is limited to specific types of income and deductions and is not available for certain types of filers, such as those with self-employment income or income from rental properties.

Form 1040EZ:

Form 1040EZ is the simplest tax return form and is intended for individuals with very basic tax situations. This form is limited to individuals with no dependents, taxable income below a certain threshold, and only certain types of income, such as wages, salaries, and unemployment compensation. It offers limited deductions and credits, making it a quick and easy option for eligible taxpayers.

Now that we have a general understanding of each tax return form, let’s explore the specific criteria and eligibility requirements for each form in more detail. By understanding the limitations and benefits of each form, you can make an informed decision on which one to use for your tax filing.

Form 1040

Form 1040 is the most comprehensive and versatile tax return form offered by the Internal Revenue Service (IRS). It is suitable for individuals with more complex financial situations and allows for a detailed reporting of income, deductions, and credits.

One of the main advantages of filing Form 1040 is the flexibility it offers in terms of the types of income and deductions you can report. This form accommodates a wide range of income sources, including wages, self-employment income, capital gains, rental income, and more. It also allows for various deductions, such as home mortgage interest, state and local taxes, charitable contributions, and medical expenses.

Form 1040 supports multiple filing statuses, making it suitable for individuals in different marital and household circumstances. The filing statuses include single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Each filing status has its own set of criteria and determines the tax rates and eligibility for certain credits and deductions.

In addition to income and deductions, Form 1040 also provides space to claim tax credits, which can directly reduce your tax liability. Some common tax credits include the Child Tax Credit, the Earned Income Tax Credit, and the American Opportunity Credit for education expenses.

Form 1040 is also used to report other important tax-related information, such as foreign accounts, foreign earned income, and self-employment tax. It allows for detailed reporting and ensures compliance with IRS regulations.

It’s important to note that Form 1040 can be more time-consuming and complex to complete compared to other tax return forms. However, it provides the most comprehensive reporting options, making it suitable for individuals with diverse sources of income and various deductions and credits.

If you choose to file Form 1040, be sure to gather all the necessary documentation, including income statements (such as W-2 forms or 1099s) and documentation for deductions and credits. Keeping detailed records and utilizing available tax resources can help ensure accurate reporting and potentially maximize your tax benefits.

Next, let’s explore Form 1040A, a simplified version of Form 1040, and its eligibility requirements and limitations.

Form 1040A

Form 1040A is a simplified version of the Form 1040 and is designed for individuals with a relatively straightforward tax situation. It offers fewer deductions and credits compared to Form 1040 but still provides enough flexibility for most taxpayers.

One of the main advantages of filing Form 1040A is its simplicity. The form provides a shorter and easier-to-understand format compared to Form 1040, making it a convenient option for eligible taxpayers. Additionally, Form 1040A allows for faster processing by the IRS, potentially resulting in a quicker refund.

Form 1040A is limited to specific types of income and deductions. Income sources such as wages, salaries, tips, dividends, and interest are eligible to be reported on this form. However, it does not accommodate certain types of income, such as self-employment income or income from rental properties. If you have such income, you will need to use Form 1040 instead.

Deductions on Form 1040A are also more limited compared to Form 1040. While it allows for common deductions such as the student loan interest deduction and the IRA deduction, it does not support certain itemized deductions, such as medical expenses or mortgage interest. If you have significant itemized deductions, it may be more advantageous to file Form 1040 and itemize your deductions.

Form 1040A supports three filing statuses: single, married filing jointly, and head of household. This means that if you are married and filing separately, you will not be eligible to use Form 1040A.

It’s important to note that the IRS has discontinued the use of Form 1040A starting from the tax year 2018. However, it may still be relevant for prior years’ tax returns or serve as a reference for future changes in the tax filing process.

If you are eligible to use Form 1040A, it can simplify your tax filing process and save you time. However, be sure to review the eligibility requirements and limitations to ensure it is the right form for you. Consider consulting with a tax professional or utilizing available tax resources to ensure accurate filing and maximize your tax benefits.

Next, let’s explore Form 1040EZ, which is the simplest tax return form available for eligible taxpayers.

Form 1040EZ

Form 1040EZ is the simplest tax return form offered by the Internal Revenue Service (IRS). It is designed for individuals with very basic tax situations and offers a quick and straightforward way to file taxes.

One of the main advantages of filing Form 1040EZ is its simplicity. The form is shorter and easier to complete compared to other tax return forms, making it a convenient option for eligible taxpayers. It also allows for faster processing by the IRS, potentially resulting in a quicker refund.

In order to be eligible to use Form 1040EZ, you must meet several criteria. Firstly, your filing status must be either single or married filing jointly. If you are married filing separately or head of household, you cannot use Form 1040EZ.

Secondly, your taxable income must be below a certain threshold, which is determined annually by the IRS. This threshold ensures that Form 1040EZ is intended for individuals with lower income levels and less complex financial situations.

Form 1040EZ is limited in terms of the types of income it allows you to report. It only accommodates income from wages, salaries, tips, and unemployment compensation. It does not support reporting of self-employment income or income from rental properties, among others. If you have income from these sources, you will need to use a different tax return form.

Similar to its limited income reporting, Form 1040EZ also offers fewer deductions compared to other forms. It allows for the standard deduction, but certain itemized deductions cannot be claimed on this form. For example, deductions for mortgage interest or medical expenses are not available for individuals filing Form 1040EZ.

Form 1040EZ is also limited in terms of tax credits. While it allows for the Earned Income Tax Credit (EITC), other tax credits may not be claimable on this form. If you are eligible for other tax credits, such as the Child Tax Credit or the American Opportunity Credit, you may need to consider using a different form.

It’s important to note that starting from the tax year 2018, the IRS has discontinued the use of Form 1040EZ. However, it is still relevant for prior years’ tax returns or as a reference for future changes in the tax filing process.

If you meet the eligibility requirements for Form 1040EZ, it can provide a quick and straightforward way to file your taxes. However, be sure to review the limitations and consult with a tax professional or utilize available tax resources to ensure accurate filing and take advantage of all available tax benefits.

Next, let’s explore the factors to consider when choosing a tax return form that is most suitable for your needs.

Factors to Consider When Choosing a Form

Choosing the right tax return form is crucial for accurately reporting your income, deductions, and credits. Consider the following factors to help determine which form is most suitable for your needs:

Income Complexity:

Consider the complexity of your income sources. If you have diverse income streams, such as self-employment income or income from rental properties, Form 1040 may be the best choice. However, if you have a straightforward income from wages or salaries, Form 1040A or Form 1040EZ might be sufficient.

Deduction Availability:

Evaluate the deductions you qualify for. If you have significant itemized deductions, such as mortgage interest or medical expenses, Form 1040 allows for more comprehensive reporting. However, if you have fewer deductions and can opt for the standard deduction, Form 1040A or Form 1040EZ may be more suitable.

Filing Status:

Consider your filing status. Certain tax return forms may have limitations on the filing statuses they accommodate. Be sure to choose a form that aligns with your marital and household circumstances to ensure accurate reporting.

Tax Credits:

Review the tax credits for which you may qualify. Different forms provide varying options for claiming tax credits. If you are eligible for specific tax credits, such as the Child Tax Credit or the Lifetime Learning Credit, ensure that the form you choose allows for their reporting.

Time and Convenience:

Consider the time and convenience aspects. If you have a simple tax situation and prefer a quick and easy filing process, Form 1040EZ may be the best option. However, if you are willing to invest more time and effort for potentially greater tax benefits, Form 1040 might be more appropriate.

It’s important to note that the IRS no longer offers Form 1040A starting from the tax year 2018. However, understanding the differences among these forms can still provide insights applicable to prior years’ tax returns or serve as a reference for potential changes in the tax filing process.

Take the time to review your financial situation, consult with a tax professional, or utilize available tax resources to determine the most appropriate tax return form for your specific needs. Accurate and timely tax filing ensures compliance with IRS regulations and helps you maximize your tax benefits.

Next, let’s explore the income and deduction limitations for each tax return form in more detail.

Income and Deduction Limitations for Each Form

Each tax return form has specific limitations on the types of income you can report and the deductions you can claim. Understanding these limitations will help you determine which form is most appropriate for your financial situation. Let’s explore the income and deduction limitations for each form:

Form 1040:

Form 1040 has the broadest range of income and deduction options. You can report various types of income, including wages, self-employment income, rental income, capital gains, and more. This form also allows for a wide range of deductions, including itemized deductions such as mortgage interest, medical expenses, and state and local taxes.

Form 1040A:

Form 1040A has more limitations compared to Form 1040. You can report income from wages, salaries, tips, interest, dividends, and unemployment compensation. However, this form does not accommodate certain types of income, such as self-employment income or income from rental properties. Additionally, deductions on Form 1040A are more limited, and itemized deductions are not allowed.

Form 1040EZ:

Form 1040EZ has the most significant limitations on income and deductions. You can only report income from wages, salaries, tips, and unemployment compensation. Other sources of income, such as self-employment income or income from rental properties, cannot be reported on this form. Deductions on Form 1040EZ are also limited, and certain itemized deductions are not available.

It’s important to note that starting from the tax year 2018, the IRS no longer offers Form 1040A and Form 1040EZ. However, understanding the income and deduction limitations for these forms is still valuable for prior years’ tax returns or as a reference for potential changes in the tax filing process.

When determining which tax return form to use, carefully review the income and deduction limitations to ensure accurate reporting. Keep in mind your specific sources of income and the deductions you qualify for. Consulting with a tax professional or utilizing available tax resources can help ensure you choose the form that best suits your financial situation.

Next, let’s explore the filing status requirements for each tax return form.

Filing Status Requirements for Each Form

Each tax return form has specific requirements for filing statuses. Your filing status is determined by your marital status and household circumstances, and it affects your tax rates, deductions, and eligibility for certain credits. Let’s explore the filing status requirements for each tax return form:

Form 1040:

Form 1040 accommodates all filing statuses. Whether you are single, married filing jointly, married filing separately, head of household, or a qualifying widow(er) with dependent child, you can use Form 1040 to report your income and claim deductions and credits associated with your filing status.

Form 1040A:

Form 1040A supports three filing statuses: single, married filing jointly, and head of household. If you are married filing separately or a qualifying widow(er) with dependent child, you cannot use Form 1040A. Ensure that your marital and household circumstances align with the filing status options available on Form 1040A.

Form 1040EZ:

Form 1040EZ has the most limited options for filing statuses. You can only use this form if your filing status is single or married filing jointly. If you are married filing separately or a head of household, Form 1040EZ is not applicable. It’s important to choose the correct filing status that accurately represents your marital and household situation when using Form 1040EZ.

Choosing the appropriate filing status is crucial for accurate tax reporting. Ensure that your chosen tax return form aligns with your marital status and household circumstances. Consider consulting with a tax professional or utilizing available tax resources to determine the correct filing status and maximize your tax benefits.

Next, let’s explore the tax credits and deductions available on each tax return form.

Tax Credits and Deductions Available on Each Form

Each tax return form provides different options for tax credits and deductions, which can help reduce your overall tax liability or increase your potential refund. Understanding the tax credits and deductions available on each form will help you make informed decisions. Let’s explore the options:

Form 1040:

Form 1040 provides the most comprehensive range of tax credits and deductions. Some common tax credits you can claim on Form 1040 include the Child Tax Credit, the Earned Income Tax Credit (EITC), the American Opportunity Credit for education expenses, and the Lifetime Learning Credit. Additionally, you can take advantage of a wide variety of deductions, including itemized deductions such as mortgage interest, medical expenses, state and local taxes, and charitable contributions.

Form 1040A:

Form 1040A offers fewer options for tax credits and deductions compared to Form 1040. While it still allows for the Child Tax Credit and the EITC, it may not support certain other tax credits available on Form 1040. Deductions on Form 1040A are also more limited compared to Form 1040. You can claim deductions such as the student loan interest deduction and the IRA deduction, but certain itemized deductions are not available on Form 1040A.

Form 1040EZ:

Form 1040EZ has the most limitations when it comes to tax credits and deductions. While you can still claim the EITC, other tax credits may not be available on this form. In terms of deductions, Form 1040EZ only allows for the standard deduction and does not support itemized deductions. This form is designed for individuals with simple tax situations and a straightforward income structure.

When choosing a tax return form, consider whether the available tax credits and deductions align with your specific financial situation. If you have significant educational expenses, for example, you may need to use Form 1040 to claim the American Opportunity Credit. On the other hand, if your tax situation is relatively simple, Form 1040EZ may provide sufficient options for tax credits and deductions.

Remember to consult with a tax professional or utilize available tax resources to ensure you maximize your eligible tax credits and deductions. Properly utilizing these benefits can help reduce your overall tax liability or increase your potential refund.

Next, let’s discuss important considerations for self-employed individuals when choosing a tax return form.

Special Considerations for Self-Employed Individuals

Self-employment comes with unique tax considerations that self-employed individuals need to be aware of when choosing a tax return form. Operating as a self-employed individual means you are responsible for reporting and paying taxes on your own income. Here are some important considerations for self-employed individuals:

Form 1040:

Form 1040 is the most comprehensive tax return form and is suitable for self-employed individuals with more complex financial situations. It allows for reporting various self-employment income sources, such as freelance work, independent contracting, or running your own business. Form 1040 provides ample space to report your income and deduct related business expenses.

Form 1040A and Form 1040EZ:

Neither Form 1040A nor Form 1040EZ accommodates self-employment income. If you are self-employed, you cannot use these forms to report your income or claim deductions related to your business activities. Instead, you will need to use Form 1040 to accurately report your self-employment income and claim appropriate deductions.

It’s important for self-employed individuals to keep detailed records of their income and expenses throughout the year. This includes tracking business income, recording expenses related to the business, and maintaining proper documentation of all financial transactions. By staying organized, you can ensure accurate reporting and potentially maximize your allowable deductions.

Self-employed individuals also need to pay self-employment taxes, which include both the employer and employee portions of Social Security and Medicare taxes. These taxes are not automatically withheld from self-employment income, unlike income tax withholding from traditional employment. Therefore, it’s essential to calculate and pay estimated taxes throughout the year to avoid penalties when filing your tax return.

Consider consulting with a tax professional who specializes in self-employed taxation or utilizing available tax resources to ensure compliance with all tax regulations and take full advantage of potential deductions and credits available to self-employed individuals.

Understanding these special considerations for self-employed individuals will help you choose the appropriate tax return form and ensure accurate reporting of your self-employment income and deductions.

Finally, let’s summarize the key points discussed in this article.

Conclusion

Choosing the right tax return form is essential for accurately reporting your income, deductions, and credits. It’s important to understand the differences among the available forms and consider various factors when making your selection. Here are the key points to remember:

Form 1040 is the most comprehensive form, accommodating diverse income sources, extensive deductions, and multiple filing statuses.

Form 1040A is a simplified version with fewer deductions and limitations on income sources and filing statuses.

Form 1040EZ is the simplest form, suitable for individuals with very basic tax situations and limited income types.

Consider factors such as income complexity, deduction availability, filing status, tax credits, and time and convenience when choosing a form.

Review the income and deduction limitations for each form to ensure accurate reporting.

Determine which tax credits and deductions are available on each form and align with your financial situation.

Self-employed individuals should carefully consider the special considerations and reporting requirements associated with self-employment income.

Remember to gather all necessary documentation and consult with a tax professional or utilize available tax resources to ensure accurate filing and maximize your eligible tax benefits.

While the IRS has simplified and consolidated the tax return forms, it’s still important to understand the options available for prior years’ tax returns or as a reference for potential future changes in the tax filing process.

By selecting the most appropriate tax return form, you can navigate the tax filing process with confidence, ensure compliance with IRS regulations, and potentially optimize your tax obligations and refunds.

Be sure to review the latest tax guidelines and consult with a tax professional for personalized advice based on your specific financial situation. Happy filing!