Home>Finance>Agency Cost Of Debt: Definition, Minimizing, Vs. Cost Of Equity

Finance

Agency Cost Of Debt: Definition, Minimizing, Vs. Cost Of Equity

Published: October 4, 2023

Learn the definition of agency cost of debt in finance, how to minimize it, and understand the difference between cost of debt and cost of equity.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Agency Cost of Debt: Definition, Minimizing, Vs. Cost of Equity

Welcome to our finance category blog post! In today’s article, we are going to delve into the concept of agency cost of debt and explore its definition, how to minimize it, and determine how it differs from the cost of equity. If you’re looking to gain a better understanding of financial management and the intricacies of debt and equity financing, then you’ve come to the right place!

Key Takeaways:

- The agency cost of debt refers to the costs incurred by a company due to the conflicts of interest between shareholders and debtholders.

- Minimizing agency cost of debt involves implementing mechanisms to align the interests of shareholders and debtholders, such as debt covenants and monitoring systems.

What is Agency Cost of Debt?

The agency cost of debt is a term used in finance to describe the expenses and potential losses a company may experience due to conflicts of interest between shareholders and debtholders. When a company raises debt capital by issuing bonds or taking on loans, it becomes obligated to pay interest and principal on those debts. However, debtholders do not have a direct say in the company’s operations and decision-making process, leaving them vulnerable to potential actions by management or controlling shareholders that may not be in their best interest.

Minimizing Agency Cost of Debt

Companies can take several steps to minimize the agency cost of debt and ensure the alignment of interests between shareholders and debtholders:

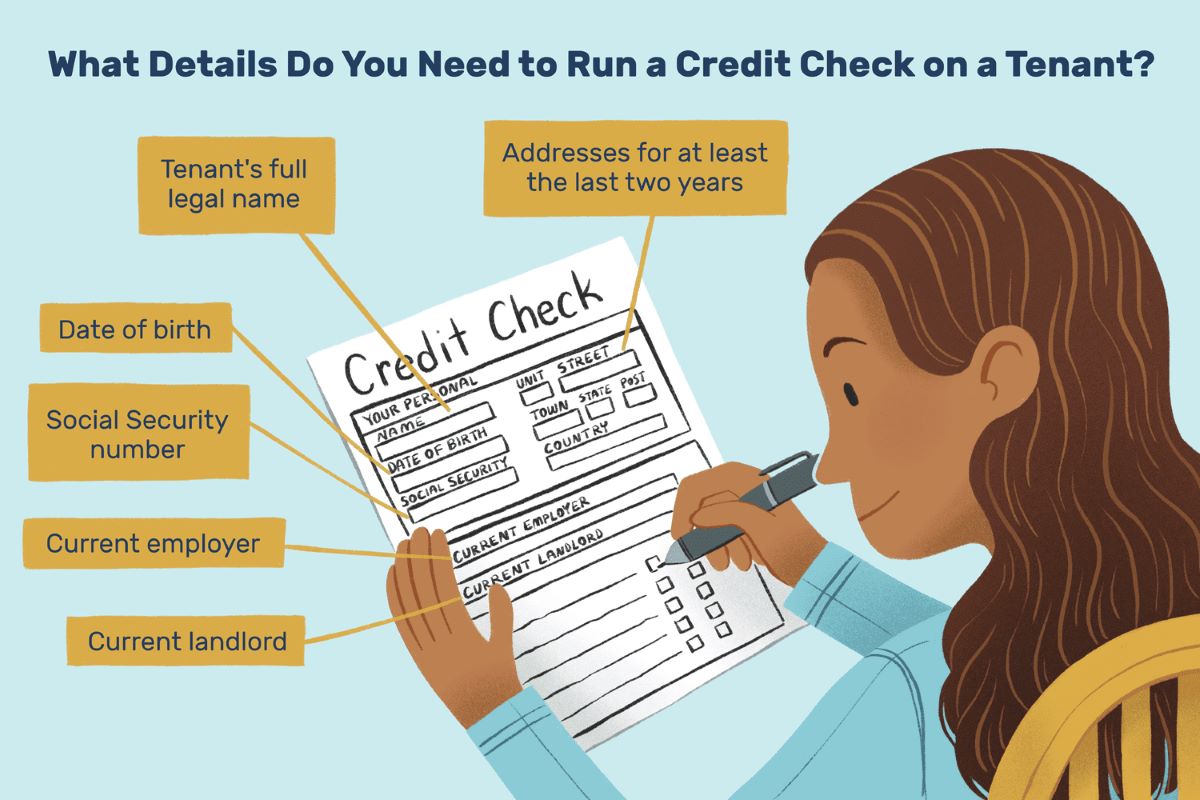

- Debt Covenants: Implementing debt covenants or clauses in loan agreements can help protect the interests of debtholders. These covenants may include restrictions on certain activities, such as asset sales or incurring additional debt, ensuring that the company’s financial decisions are in line with the debtholders’ best interests.

- Monitoring Systems: Establishing effective monitoring systems can help identify any potential conflicts or actions that may harm debtholders. Independent auditors, board oversight, and transparent reporting processes can contribute to reducing agency costs by increasing accountability.

- Executive Compensation: Designing executive compensation packages that align management’s interests with those of debtholders can incentivize responsible financial decision-making.

- Good Corporate Governance: Implementing strong corporate governance practices, such as an independent board of directors and effective internal controls, can help mitigate agency cost of debt by ensuring transparency, accountability, and ethical decision-making.

Agency Cost of Debt vs. Cost of Equity

While both agency cost of debt and cost of equity are components of a company’s cost of capital, they differ in their nature and the stakeholders involved:

- Agency Cost of Debt: As discussed earlier, agency cost of debt refers to the expenses and potential losses borne by a company due to conflicts of interest between shareholders and debtholders. It primarily affects the debtholders’ interests, who demand compensation for taking on additional risks associated with the company’s financial decisions.

- Cost of Equity: The cost of equity represents the return expected by shareholders or equity investors for the risks associated with their investment. It takes into account the opportunity cost of investing in a particular company’s shares instead of alternative investment options with similar risk profiles.

In simpler terms, agency cost of debt focuses on minimizing conflicts between debtholders and shareholders, while the cost of equity concerns the return expected by shareholders for their investment in the company. Both factors are crucial in determining a company’s overall cost of capital and play a vital role in financial decision-making and capital structure optimization.

Conclusion

Understanding the concept of agency cost of debt and its implications is essential for any business aiming to effectively manage its financial obligations. By implementing strategies to minimize agency costs, such as debt covenants, monitoring systems, and strong corporate governance practices, companies can protect the interests of both shareholders and debtholders. Balancing the agency cost of debt with the cost of equity ensures a healthy capital structure and facilitates better financial decision-making.

We hope this article has provided you with valuable insights into the agency cost of debt, its minimization strategies, and its differences from the cost of equity.