Home>Finance>What Is Credit Card Refinancing Vs Debt Consolidation

Finance

What Is Credit Card Refinancing Vs Debt Consolidation

Published: March 6, 2024

Learn the key differences between credit card refinancing and debt consolidation in the world of finance. Make an informed decision to manage your debts effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Managing finances can be a daunting task, especially when faced with credit card debt. Many individuals find themselves juggling multiple credit card payments, each with its own interest rate and due date. In such situations, credit card refinancing and debt consolidation can offer viable solutions to help regain control over one’s financial well-being. Understanding the differences between these two options is crucial for making an informed decision that aligns with one’s financial goals and circumstances.

Both credit card refinancing and debt consolidation aim to simplify the repayment process by combining multiple debts into a single, more manageable form. However, the mechanisms and implications of each approach vary, and it’s essential to weigh the pros and cons of both before deciding which path to pursue. This article delves into the intricacies of credit card refinancing and debt consolidation, offering insights into their respective benefits and drawbacks. By gaining a comprehensive understanding of these financial strategies, individuals can make informed decisions to alleviate their credit card debt burden and pave the way toward financial stability.

Understanding Credit Card Refinancing

Credit card refinancing involves transferring high-interest credit card debt to a new credit card with a lower interest rate. This can be achieved through balance transfer offers from credit card issuers or by obtaining a personal loan specifically designed for debt consolidation. By consolidating existing credit card balances onto a single card or loan, individuals can benefit from a reduced overall interest rate, potentially saving money on interest payments over time.

When opting for credit card refinancing, it’s essential to consider the introductory interest rate offered by the new credit card or loan. Many credit card companies provide promotional periods with low or 0% interest rates for a specified duration, typically ranging from 6 to 18 months. During this period, individuals can focus on paying down their principal balance without accruing additional interest, making it an attractive option for those committed to reducing their debt swiftly.

Moreover, credit card refinancing offers the advantage of streamlining multiple credit card payments into a single, consolidated payment. This simplifies the repayment process, reducing the likelihood of missing due dates and incurring late fees. Additionally, individuals may find it easier to track their progress and stay motivated as they witness their debt decreasing through regular payments.

However, it’s important to note that credit card refinancing may involve balance transfer fees or origination fees for personal loans, impacting the overall cost of the consolidation. Furthermore, individuals must exercise discipline and avoid accumulating new debt on the original credit cards after transferring balances to prevent further financial strain.

Ultimately, credit card refinancing presents an opportunity to lower interest rates, consolidate debt, and establish a structured repayment plan. By leveraging this approach, individuals can take proactive steps toward regaining financial stability and reducing the burden of credit card debt.

Understanding Debt Consolidation

Debt consolidation involves combining multiple debts, such as credit card balances, into a single loan or line of credit. This approach aims to simplify debt management by centralizing various obligations into a unified repayment structure. Individuals can pursue debt consolidation through personal loans, home equity loans, or specialized debt consolidation programs offered by financial institutions.

One of the primary benefits of debt consolidation is the potential for securing a lower overall interest rate compared to the individual rates on existing debts. By obtaining a consolidation loan with a favorable interest rate, individuals can reduce the total interest paid over the life of the loan, leading to potential cost savings. Additionally, consolidating debts into a single monthly payment can enhance financial organization and alleviate the stress of managing multiple due dates and payment amounts.

Moreover, debt consolidation can offer the advantage of extended repayment terms, providing individuals with a more manageable monthly payment. This can be particularly beneficial for those struggling with high credit card payments, as it allows for a structured, long-term approach to debt repayment. By extending the repayment period, individuals may experience a reduction in their monthly financial burden, freeing up resources for other essential expenses.

However, it’s crucial for individuals considering debt consolidation to exercise caution and thoroughly assess the terms and conditions of the consolidation loan. Some consolidation options may require collateral, such as home equity, increasing the risk of asset forfeiture in the event of default. Additionally, individuals must be mindful of any origination fees, closing costs, or prepayment penalties associated with the consolidation process, as these factors can impact the overall cost and feasibility of the solution.

Ultimately, debt consolidation presents a strategic approach to simplifying debt management, potentially lowering interest rates, and establishing a more structured repayment plan. By exploring the available consolidation options and understanding their implications, individuals can make informed decisions to address their financial challenges and work toward a debt-free future.

Pros and Cons of Credit Card Refinancing

Credit card refinancing offers several potential advantages for individuals seeking to manage their credit card debt more effectively. One of the primary benefits is the opportunity to secure a lower interest rate, especially through promotional balance transfer offers that feature reduced or 0% interest rates for a specified period. By capitalizing on these introductory rates, individuals can focus on reducing their principal balance without accruing additional interest, potentially accelerating their debt repayment progress.

Moreover, credit card refinancing enables the consolidation of multiple credit card balances into a single, streamlined payment. This simplifies the repayment process, reducing the likelihood of missed payments and late fees. Additionally, it provides individuals with a clear overview of their debt reduction journey, fostering motivation and financial discipline.

However, it’s essential to consider the potential drawbacks of credit card refinancing. Balance transfer fees or origination fees for personal loans may impact the overall cost of consolidation, potentially offsetting the benefits of lower interest rates. Furthermore, individuals must exercise caution to avoid accumulating new debt on the original credit cards after transferring balances, as this can exacerbate their financial burden.

While credit card refinancing can offer a pathway to lower interest rates and simplified debt management, individuals should carefully evaluate the associated costs and commit to responsible financial habits to maximize its benefits.

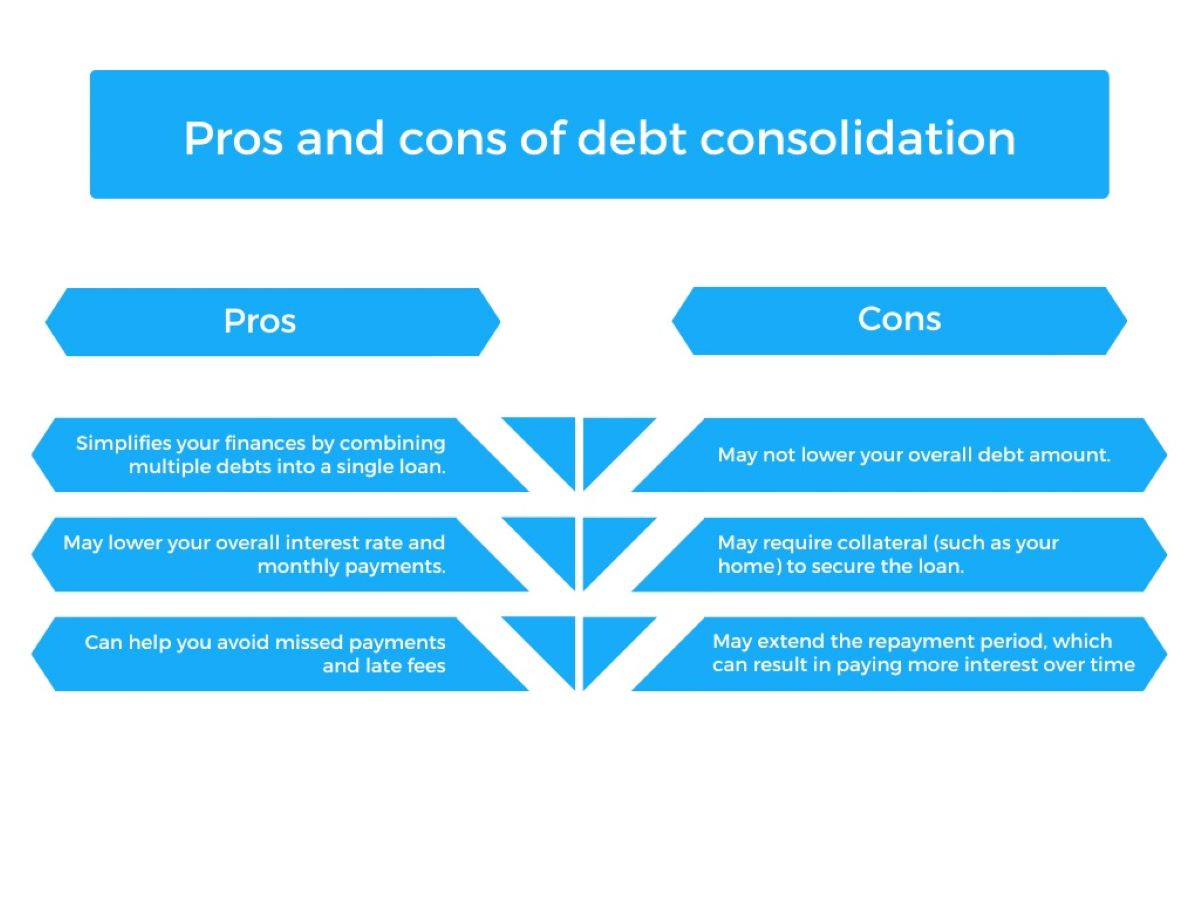

Pros and Cons of Debt Consolidation

Debt consolidation presents a range of potential benefits for individuals grappling with multiple debts, including credit card balances. One of the primary advantages is the opportunity to secure a lower overall interest rate, potentially leading to cost savings over the life of the consolidated loan. By centralizing various debts into a single, manageable repayment structure, individuals can streamline their financial obligations and simplify their debt management process.

Furthermore, debt consolidation can offer extended repayment terms, resulting in a more affordable monthly payment. This can alleviate the strain of high credit card payments and provide individuals with a structured, long-term approach to debt repayment. Additionally, consolidating debts into a single monthly payment can enhance financial organization and reduce the likelihood of missed payments, contributing to improved credit management.

However, it’s important to consider the potential drawbacks of debt consolidation. Some consolidation options may require collateral, such as home equity, increasing the risk of asset forfeiture in the event of default. Additionally, individuals must carefully assess any associated fees, such as origination fees, closing costs, or prepayment penalties, as these factors can impact the overall cost and feasibility of the consolidation solution.

While debt consolidation offers the potential for lower interest rates, extended repayment terms, and simplified debt management, individuals should conduct thorough evaluations of the available options and consider the associated costs and risks before committing to this financial strategy.

Which Option Is Right for You?

Choosing between credit card refinancing and debt consolidation hinges on individual financial circumstances, goals, and preferences. To determine the most suitable option, individuals should consider several key factors.

- Interest Rates: If the primary concern is reducing interest costs, credit card refinancing may be an attractive choice, particularly if promotional balance transfer offers with low or 0% interest rates are available. On the other hand, debt consolidation can also lead to interest savings if a lower overall interest rate is secured.

- Repayment Structure: Individuals who prefer a structured, long-term approach to debt repayment may find debt consolidation appealing, as it often offers extended repayment terms, resulting in a more manageable monthly payment. Credit card refinancing, on the other hand, may provide a focused strategy for paying down debt during promotional low-interest periods.

- Financial Discipline: Those considering credit card refinancing must be committed to responsible financial habits and avoid accumulating new debt on the original credit cards after transferring balances. Debt consolidation requires similar discipline, as it involves managing a single, consolidated payment and refraining from accruing additional debt.

- Associated Costs: Both credit card refinancing and debt consolidation may entail fees, such as balance transfer fees, origination fees, closing costs, or prepayment penalties. Individuals should carefully assess these costs to determine the overall impact on their financial situation.

Ultimately, the decision between credit card refinancing and debt consolidation should align with an individual’s financial objectives and capacity to adhere to the chosen repayment structure. It’s advisable to conduct a thorough evaluation of the available options, considering factors such as interest rates, repayment terms, associated costs, and personal financial discipline. Seeking guidance from financial advisors or credit counselors can also provide valuable insights to support informed decision-making.

By carefully weighing these considerations and understanding the nuances of credit card refinancing and debt consolidation, individuals can select the option that best suits their financial needs and sets them on a path toward effective debt management and financial well-being.