Home>Finance>Aleatory Contract Definition, Use In Insurance Policies

Finance

Aleatory Contract Definition, Use In Insurance Policies

Published: October 5, 2023

Discover the meaning and application of aleatory contracts in insurance policies. Explore how these contracts play a crucial role in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Aleatory Contract Definition, Use in Insurance Policies

When it comes to understanding finance, it’s important to be aware of various terms and concepts that play a significant role in the industry. One such concept is an aleatory contract, which is commonly used in insurance policies. In this blog post, we will delve into the definition of an aleatory contract, its use in insurance policies, and its implications for both insurers and policyholders.

Key Takeaways:

- An aleatory contract is a type of agreement where the performance or outcome is uncertain and depends on an uncertain event.

- In insurance policies, aleatory contracts help protect policyholders against unexpected financial losses by providing compensation in the event of a covered loss.

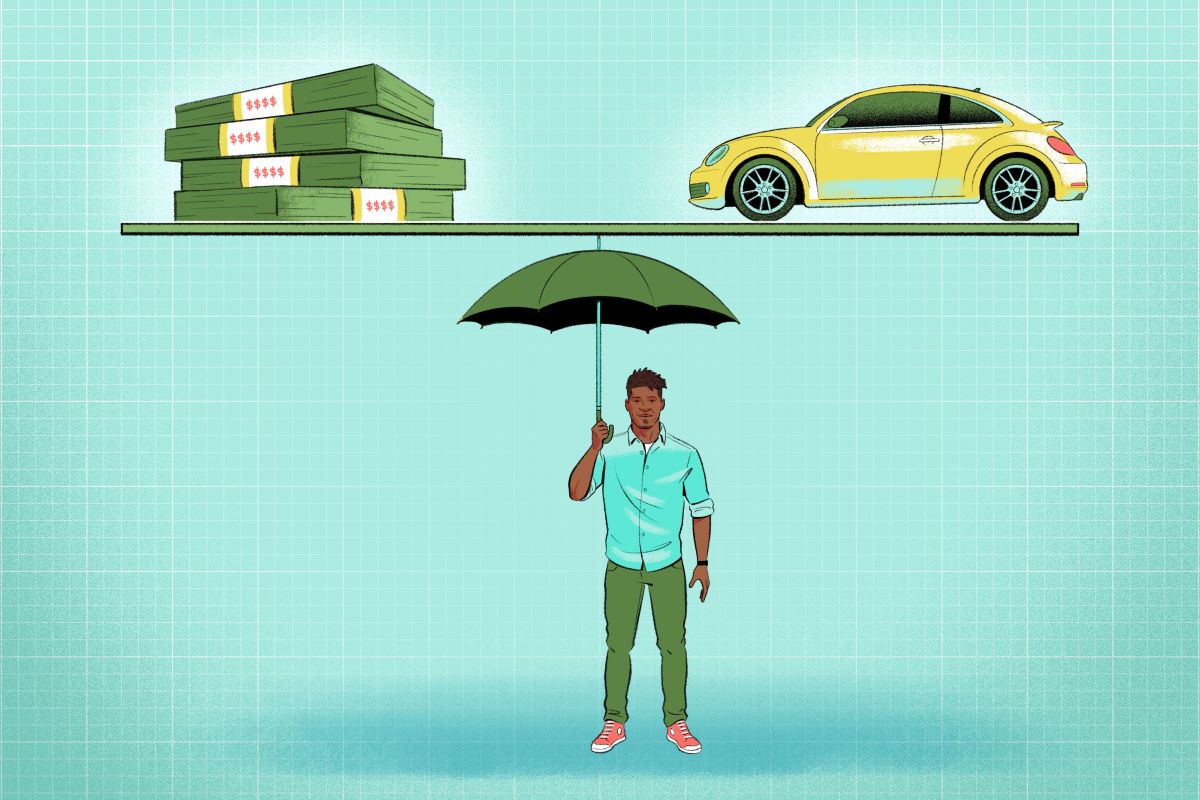

An aleatory contract is characterized by its uncertain nature. Unlike a commutative contract, where the performance or outcome is predetermined and fixed, an aleatory contract’s performance is contingent on an uncertain event. This uncertainty makes the contract inherently risky for both parties involved. In the context of insurance, the uncertain event is typically a covered loss, such as a car accident or property damage.

Insurance policies are a prime example of aleatory contracts. Policyholders pay premiums to the insurance company to secure financial protection against potential future losses. If a covered loss occurs, the insurer is obligated to provide compensation to the policyholder, up to the agreed-upon coverage limit. However, if no loss occurs during the policy period, the insurer retains the premiums paid, making the contract beneficial for the insurer.

The use of aleatory contracts in insurance has several implications for both insurers and policyholders:

- Risk Distribution: Aleatory contracts help distribute the risk of potential losses among a large pool of policyholders. This allows for the sharing of risks and prevents individuals from bearing the full financial burden in the event of a loss.

- Uncertainty: The uncertain nature of aleatory contracts means that policyholders cannot rely on insurance payouts as a guaranteed source of income. Adequate risk management and financial planning are crucial to mitigate potential financial hardships.

- Fair Premiums: Insurance companies determine premiums based on various factors, including the likelihood of a covered loss occurring. By utilizing aleatory contracts, insurers can calculate premiums that reflect the level of risk associated with the policy, ensuring fairness for all policyholders.

In conclusion, aleatory contracts are an essential part of the insurance industry and provide financial protection to policyholders in the face of uncertainty. Understanding the concept and implications of aleatory contracts helps individuals make informed decisions when it comes to buying insurance policies and managing their financial risks. By recognizing the role of aleatory contracts in insurance, both insurers and policyholders can navigate the complexities of the finance industry more effectively and secure their financial future.