Home>Finance>How Is A Collateral Assignment Used In A Life Insurance Contract?

Finance

How Is A Collateral Assignment Used In A Life Insurance Contract?

Modified: February 21, 2024

Learn how collateral assignments are used in life insurance contracts to secure financing and protect financial interests. Understanding the role of finance in these arrangements is crucial for individuals and businesses alike.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Collateral Assignment in a Life Insurance Contract

- How Does a Collateral Assignment Work?

- Parties Involved in a Collateral Assignment

- Benefits of a Collateral Assignment in a Life Insurance Contract

- Risks and Considerations Associated with a Collateral Assignment

- Types of Collateral Assignments

- Process of Setting Up a Collateral Assignment

- Examples of Situations Where Collateral Assignments are Used

- Conclusion

Introduction

Welcome to the world of life insurance and finance! In the realm of insurance contracts, there are various aspects and nuances that play a crucial role in determining the coverage and benefits you receive. One such aspect is a collateral assignment in a life insurance contract.

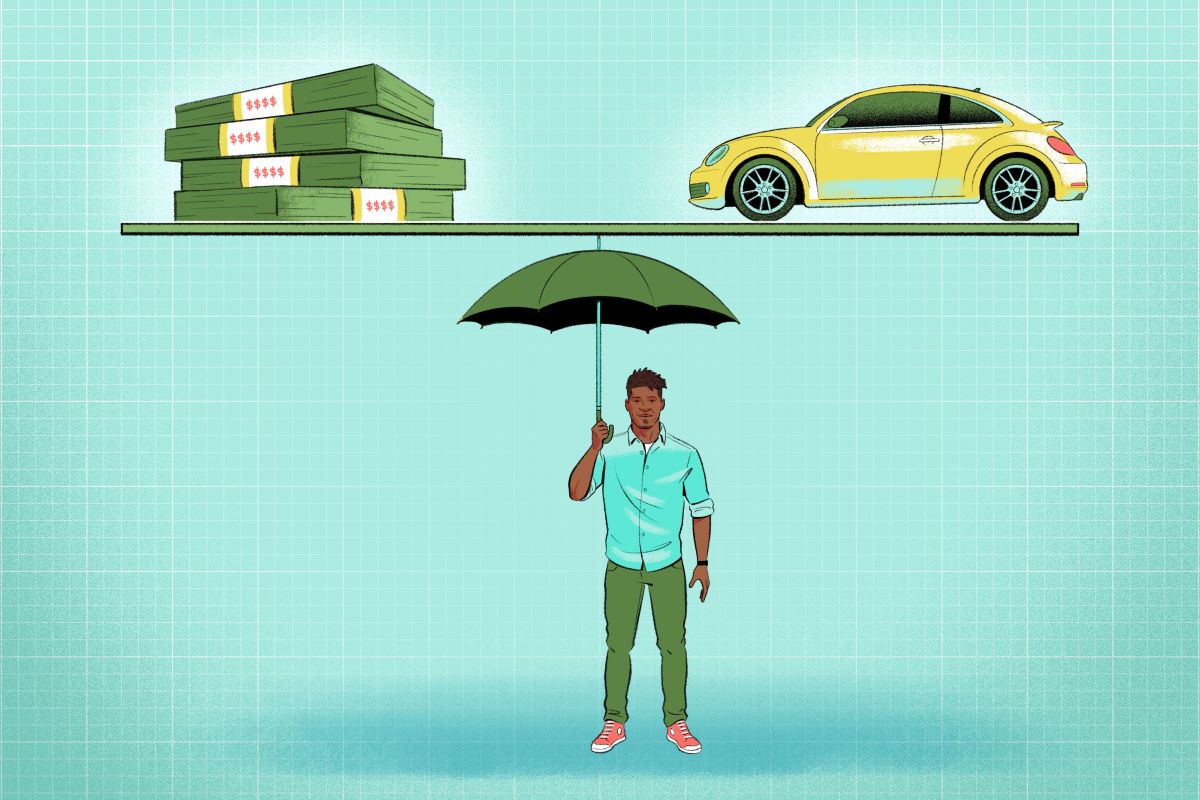

A collateral assignment refers to the process of assigning a portion or the entirety of your life insurance policy as collateral for a loan or other financial arrangement. This means that you can use your life insurance policy as security to obtain funds or fulfill certain financial obligations.

Understanding how a collateral assignment works and its implications is important, as it can provide you with financial flexibility and peace of mind. In this article, we will delve into the intricacies of collateral assignments in life insurance contracts, exploring the parties involved, the process of setting it up, and various benefits and risks associated with it.

Whether you are a policyholder seeking to unlock the value of your life insurance policy or a financial institution considering utilizing life insurance as collateral, this article will provide you with a comprehensive understanding of collateral assignments and how they can be effectively utilized.

Definition of a Collateral Assignment in a Life Insurance Contract

A collateral assignment in a life insurance contract is a legal mechanism that allows a policyholder to use their life insurance policy as collateral for a loan or other financial transaction. It involves assigning a portion or the entirety of the policy’s death benefit to a lender or creditor as security.

When a collateral assignment is made, the policyholder is essentially granting the lender or creditor an interest in the policy. This interest gives the lender the right to receive the death benefit payout to cover the outstanding loan balance or fulfill the financial obligation in the event of the policyholder’s death.

It is important to note that a collateral assignment is not a transfer of ownership of the policy. The policyholder still maintains control over the policy, including the ability to make changes, name beneficiaries, and access any available cash value. The assignment is solely for the purpose of securing the debt or obligation.

Collateral assignments are commonly used in situations where a policyholder wants to borrow against the cash value of their life insurance policy. By assigning a portion of the death benefit as collateral, the lender can have confidence in the repayment of the loan, as the funds will be obtained from the policy proceeds if necessary.

In addition to loans, collateral assignments can be utilized for other financial arrangements, such as fulfilling a legal obligation, securing a business loan, or providing assurance to a business partner or investor. The flexibility of collateral assignments makes them a valuable tool in managing financial obligations and leveraging the value of a life insurance policy.

How Does a Collateral Assignment Work?

Now that we have an understanding of what a collateral assignment is, let’s explore how it actually works in practice. When a policyholder decides to create a collateral assignment, they must follow a specific process to ensure the assignment is properly executed.

The first step is for the policyholder to approach the lender or creditor with whom they wish to enter into a financial arrangement. This could be a bank, financial institution, or even a business partner. The policyholder and lender will negotiate the terms of the loan or obligation, including the amount, interest rate, repayment schedule, and any other relevant conditions.

Once the terms are agreed upon, the policyholder will need to submit a formal request to their life insurance provider. This request will outline the details of the collateral assignment, including the amount or percentage of the policy’s death benefit that will be assigned as collateral.

The life insurance provider will then assess the request and determine whether they are willing to accept the collateral assignment. This evaluation typically involves a review of the policy’s terms and conditions and an analysis of the policy’s cash value and death benefit.

If the insurance provider approves the collateral assignment, they will provide the necessary documentation for the assignment to be executed. This documentation may include an assignment form or agreement that specifies the details of the assignment, such as the lender’s information, the assigned amount, and any conditions or restrictions.

Once the assignment is formalized, the lender or creditor will have a collateral interest in the policy, meaning they will have a legal claim to the assigned portion of the death benefit in the event of the policyholder’s death. This interest provides the lender with the assurance that the funds required to satisfy the loan or obligation will be available.

It is important for the policyholder to regularly communicate with both the lender and the life insurance provider to ensure that the assignment remains in effect and that any changes or updates are properly documented. This helps to maintain the integrity and validity of the collateral assignment.

It is worth noting that a collateral assignment does not impact the policyholder’s ability to name beneficiaries or access the cash value of the policy. The assignment only comes into effect if the policyholder passes away and there is an outstanding loan or obligation to be fulfilled.

Now that we understand the mechanics of how a collateral assignment works, let us explore the parties involved in this process in the next section.

Parties Involved in a Collateral Assignment

A collateral assignment in a life insurance contract involves several parties, each playing a distinct role in the process. Let’s take a closer look at these parties:

- Policyholder: The policyholder is the individual who owns the life insurance policy and wishes to create a collateral assignment. They are responsible for initiating the process and obtaining the necessary approvals from both the lender and the insurance provider.

- Lender or Creditor: The lender or creditor is the party providing the loan or with whom the policyholder has a financial arrangement. They require collateral to secure their position and ensure repayment of the debt or fulfillment of the obligation. The lender can be a financial institution, bank, business partner, or any other entity providing the funds.

- Life Insurance Provider: The life insurance provider is the company that issued the life insurance policy to the policyholder. They play a vital role in the collateral assignment process by evaluating the request, approving the assignment, and providing the necessary documentation. The insurance provider will also be responsible for disbursing the death benefit in accordance with the assignment in case of the policyholder’s death.

- Assignee: The assignee is the party to whom the collateral assignment is made. In the context of a collateral assignment, the assignee is typically the lender or creditor. They hold the collateral interest in the policy and have a legal claim to receive a portion or the entirety of the death benefit to satisfy the outstanding loan or obligation.

- Beneficiaries: Beneficiaries are individuals or entities named by the policyholder to receive the death benefit in the event of their death. It is important to note that the collateral assignment does not affect the beneficiaries’ rights or entitlements. The beneficiaries will receive any remaining portion of the death benefit after the assigned amount is paid to the assignee.

The collaboration and cooperation among these parties are essential to successfully execute a collateral assignment. Effective communication and documentation are vital throughout the process to ensure clarity, enforceability, and the fulfillment of obligations by all parties involved.

Now that we have explored the parties involved, let’s move on to the next section, where we will discuss the benefits of a collateral assignment in a life insurance contract.

Benefits of a Collateral Assignment in a Life Insurance Contract

Collateral assignments in a life insurance contract offer several benefits to both the policyholder and the lender or creditor involved. Let’s explore some of these advantages:

- Access to Funds: For the policyholder, one of the main benefits of a collateral assignment is the ability to access funds when needed. By assigning a portion of the death benefit as collateral, the policyholder can secure a loan or fulfill a financial obligation without having to liquidate other assets or disrupt their financial plans.

- Lower Interest Rates: Lenders often view collateral assignments as a lower-risk form of lending. As a result, they may offer more favorable interest rates compared to unsecured loans. This can result in cost savings for the policyholder and lower interest expenses over the life of the loan.

- Flexible Repayment Terms: Collateral assignments can provide flexibility in terms of repayment. Lenders are more likely to offer longer repayment periods and more lenient terms when the loan is secured by a collateral assignment. This can help the policyholder manage their cash flow and make payments that align with their financial situation.

- Preservation of Policy Benefits: With a collateral assignment, the policyholder can still retain control over their life insurance policy. This means they can continue to benefit from features like cash value accumulation and potential dividend payments. Additionally, the policyholder can still name beneficiaries who will receive the remaining death benefit after the assigned amount is paid to the lender or creditor.

- Assurance to the Lender or Creditor: From the lender or creditor’s perspective, a collateral assignment provides added security and assurance. They have the guarantee that if the policyholder passes away, the funds required to repay the loan or fulfill the financial obligation will be available through the assigned portion of the death benefit.

By leveraging a collateral assignment, both the policyholder and the lender can benefit from the arrangement. The policyholder gains access to funds and favorable loan terms, while the lender or creditor gains the assurance of repayment through the collateralized life insurance policy.

It is important to note that the benefits of a collateral assignment may vary depending on the specific terms and conditions set by the lender and the insurance provider. Policyholders should carefully review and understand the terms of the collateral assignment before entering into any financial arrangements.

Now that we have explored the benefits, let’s move on to the next section, where we will discuss the risks and considerations associated with a collateral assignment in a life insurance contract.

Risks and Considerations Associated with a Collateral Assignment

While collateral assignments in a life insurance contract offer benefits, there are also risks and considerations that should be taken into account by both the policyholder and the lender or creditor. It is crucial to fully understand these factors before entering into a collateral assignment. Let’s explore some of the key risks and considerations:

- Potential Impact on Death Benefit: A collateral assignment reduces the available death benefit to the policyholder’s beneficiaries. The assigned portion of the death benefit will be paid to the lender or creditor to repay the loan or fulfill the financial obligation. As a result, the policyholder should carefully evaluate the impact of this reduction on the intended financial protection for their loved ones.

- Limited Flexibility: Once a collateral assignment is in place, it can limit the policyholder’s ability to make changes to the life insurance policy. This includes reducing coverage, surrendering the policy, or making alterations to beneficiaries or ownership. It is important for the policyholder to consider their long-term financial goals and potential future needs before creating a collateral assignment.

- Risk of Policy Lapse: If the policyholder fails to meet the loan repayment obligations, there is a risk that the policy could lapse, leading to a loss of coverage. This could occur if the assigned portion of the death benefit is insufficient to cover the outstanding loan balance. Policyholders should ensure they have a repayment strategy in place and understand the consequences of not meeting their obligations.

- Change in Risk Profile: For the lender or creditor, a collateral assignment carries the risk of changes in the policyholder’s health or insurability. If the policyholder’s health deteriorates significantly, they may become uninsurable or face higher premiums. This may impact the lender’s ability to recover their funds in the event of the policyholder’s death.

- Consideration of Alternatives: Before entering into a collateral assignment, both the policyholder and the lender should consider alternatives for securing funds or managing financial obligations. This could include exploring traditional loan options, seeking collateral options other than a life insurance policy, or even engaging in a different financial arrangement that reduces risk and provides flexibility.

It is crucial that both parties carefully assess the risks and considerations associated with a collateral assignment and seek professional advice if necessary. Understanding the potential downsides and making informed decisions can help mitigate risks and ensure the desired outcomes are achieved.

Now that we have examined the risks and considerations, let’s move on to the next section, where we will explore the types of collateral assignments in a life insurance contract.

Types of Collateral Assignments

Collateral assignments in a life insurance contract can take different forms, depending on the specific needs and circumstances of the policyholder and the lender or creditor. Let’s explore some of the common types of collateral assignments:

- Partial Assignment: In a partial assignment, the policyholder assigns only a portion of the death benefit as collateral. This allows them to retain a portion of the death benefit to protect their beneficiaries while still providing security to the lender or creditor.

- Complete Assignment: In a complete assignment, the policyholder assigns the entire death benefit as collateral. This means that the full payout of the policy will go towards repaying the loan or fulfilling the financial obligation, leaving no remaining death benefit for beneficiaries.

- Revolving Assignment: A revolving assignment allows the policyholder to borrow against the life insurance policy multiple times over a specified period. As the policyholder repays the loan, the collateral assignment is adjusted accordingly, making the remaining death benefit available for future borrowing.

- Irrevocable Assignment: An irrevocable assignment means that the collateral assignment cannot be changed or canceled by the policyholder without the consent of the lender or creditor. This provides additional security to the lender, ensuring the continuity of the collateralized coverage.

- Conditional Assignment: A conditional assignment involves specific conditions that must be met for the collateral assignment to take effect. For example, the assignment may only be triggered if the policyholder defaults on the loan, or if certain events, such as bankruptcy, occur.

It is important for the policyholder and the lender to discuss and decide on the most appropriate type of collateral assignment based on their specific needs and objectives. The type of collateral assignment chosen will have implications on the level of coverage for the policyholder’s beneficiaries and the level of security for the lender or creditor.

Before entering into a collateral assignment, it is advisable to consult with financial and legal professionals who can provide guidance on the various types and help determine the best-suited option for the specific situation.

Now that we have explored the types of collateral assignments, let’s move on to the next section, where we will discuss the process of setting up a collateral assignment in a life insurance contract.

Process of Setting Up a Collateral Assignment

The process of setting up a collateral assignment in a life insurance contract involves several steps to ensure its proper establishment. Let’s break down the process:

- Identify the Need: The first step is for the policyholder to identify the need for a collateral assignment. This could include the desire to secure a loan, fulfill a financial obligation, or meet other specific requirements.

- Seek Professional Advice: It is advisable for the policyholder to seek guidance from financial and legal professionals who can provide expert advice on the collateral assignment process, review the terms and conditions, and ensure that all legal requirements are met.

- Negotiate with the Lender: The policyholder will need to negotiate the terms of the loan or financial arrangement with the lender or creditor. This includes discussing the loan amount, interest rate, repayment schedule, and any other relevant conditions.

- Consult with the Insurance Provider: The policyholder should reach out to their life insurance provider to inquire about the collateral assignment process. The insurance provider will provide the necessary information, documentation, and requirements for the assignment.

- Submit a Formal Request: The policyholder will need to submit a formal request to the insurance provider, outlining the details of the collateral assignment. This may include the amount or percentage of the death benefit to be assigned, along with any other necessary information requested by the insurance provider.

- Insurance Provider Evaluation: The insurance provider will evaluate the collateral assignment request, considering factors such as the policy’s terms and conditions, the policy’s cash value, and the potential impact on the policyholder’s coverage and beneficiaries.

- Approval and Documentation: If the insurance provider approves the collateral assignment, they will provide the necessary documentation for the assignment to be executed. This may include an assignment form or agreement, which outlines the details of the assignment and any specific conditions or restrictions.

- Review and Sign: Both the policyholder and the lender or creditor should carefully review the assigned documentation. Once satisfied, they will sign the necessary paperwork to formalize the collateral assignment.

- Communicate with All Parties: It is essential for the policyholder to maintain open lines of communication with both the lender or creditor and the insurance provider to ensure the collateral assignment remains in effect and any updates or changes are properly documented.

Following these steps will help ensure a smooth and efficient process for setting up a collateral assignment. It is crucial to adhere to the guidelines provided by the insurance provider and seek professional advice to navigate any complexities or legal considerations.

Now that we have covered the process of setting up a collateral assignment, let’s move on to the next section, where we will explore examples of situations where collateral assignments are commonly used.

Examples of Situations Where Collateral Assignments are Used

Collateral assignments in a life insurance contract can be utilized in various situations where accessing funds or securing a financial obligation is necessary. Let’s explore some common examples of when collateral assignments are used:

- Borrowing Against Cash Value: Policyholders who have built up significant cash value in their life insurance policy may choose to use a collateral assignment to borrow against that cash value. By assigning a portion of the death benefit as collateral, they can secure a loan from a lender without depleting their cash reserves or disrupting their long-term financial plans.

- Business Financing: Entrepreneurs or business owners may leverage their life insurance policies as collateral to secure loans for business financing purposes. This could involve obtaining capital to fund business expansions, acquire assets, or navigate temporary cash flow challenges.

- Legal Obligations: In certain legal situations, collateral assignments can be used to satisfy obligations or judgments. For example, a court may require a policyholder to assign a portion of their life insurance policy to fulfill a settlement or pay restitution.

- Partnership Agreements: Collateral assignments can play a role in business partnerships, providing assurance to partners or investors. In case one partner passes away, the assigned portion of the death benefit can be used to buy out their stake in the business or fulfill any financial commitments outlined in the partnership agreement.

- Estate Planning: Policyholders may choose to create a collateral assignment as part of their estate planning strategy. By assigning a portion of the death benefit as collateral, they can secure funding for potential estate taxes or other financial obligations that may arise upon their passing.

These are just a few examples of situations where collateral assignments can be beneficial. The flexibility and security provided by collateral assignments make them a valuable tool in managing various financial scenarios.

It is important for policyholders to assess their specific needs, consult with professionals, and consider the potential implications and risks associated with collateral assignments before making any decisions.

Now, let’s move on to the final section of this article, where we will conclude our discussion on collateral assignments in life insurance contracts.

Conclusion

Collateral assignments in a life insurance contract provide policyholders with a unique ability to leverage the value of their policy for various financial needs. By assigning a portion or the entirety of the death benefit as collateral, policyholders can access funds, secure loans, fulfill obligations, and provide reassurance to lenders or creditors.

Throughout this article, we have explored the definition of a collateral assignment, how it works, the parties involved, benefits, risks, types, and the process of setting up such an assignment. We’ve also looked at examples of situations where collateral assignments are commonly used.

It is important for policyholders to carefully consider their specific circumstances and consult with financial and legal professionals before pursuing a collateral assignment. Evaluating the potential impact on beneficiaries, understanding the risks and limitations, and exploring alternative options are crucial steps in making an informed decision.

Collateral assignments can provide financial flexibility, lower interest rates, and more favorable loan terms, while still allowing policyholders to retain control over their life insurance policy and preserve some level of coverage for their beneficiaries.

As with any financial decision, it is essential to conduct thorough research, seek expert advice, and fully understand the terms and conditions associated with a collateral assignment. This ensures that the policyholder’s financial goals are met while mitigating potential risks and drawbacks.

In conclusion, collateral assignments in life insurance contracts serve as a valuable tool for policyholders and lenders alike, striking a balance between accessing funds and maintaining financial security. When utilized wisely and with a clear understanding of the implications, collateral assignments can be a beneficial strategy in navigating various financial scenarios.

Remember, each situation is unique, and it is crucial to tailor the use of collateral assignments to fit individual needs and objectives. By doing so, policyholders can unlock the value of their life insurance policies while protecting their financial interests for the future.