Home>Finance>Discretionary Expense Definition, Examples, Budgeting

Finance

Discretionary Expense Definition, Examples, Budgeting

Published: November 12, 2023

Discover the definition and examples of discretionary expenses in finance. Learn how to budget and manage your discretionary spending effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Discretionary Expenses: Definition, Examples, and Budgeting

In our day-to-day lives, we have different types of expenses. Some are essential, like food and shelter, while others are more flexible and optional, known as discretionary expenses. But what exactly are discretionary expenses, and how can we manage them effectively in our budget? In this blog post, we will delve into the world of discretionary expenses, exploring their definition, providing examples, and offering practical tips for budgeting.

Key Takeaways:

- Discretionary expenses are non-essential purchases that provide enjoyment or personal satisfaction.

- Examples of discretionary expenses include dining out, vacations, entertainment, and hobbies.

What are Discretionary Expenses?

Discretionary expenses are expenditures that are not necessary for our basic needs but rather relate to our wants and desires. They include various discretionary purchases that provide enjoyment, entertainment, or personal satisfaction. While discretionary expenses may differ from person to person based on their preferences and lifestyle, they generally encompass expenses that are not essential for our daily survival.

Examples of Discretionary Expenses

Now that we understand the concept of discretionary expenses, let’s explore some common examples:

- Dining Out: Eating at restaurants or ordering takeout is considered a discretionary expense since we have the option to cook our meals at home.

- Travel and Vacations: Going on a vacation or taking a weekend getaway falls under discretionary spending since it is not necessary for our basic survival.

- Entertainment: Purchasing movie tickets, streaming subscriptions, attending concerts, or engaging in recreational activities are discretionary expenses that provide enjoyment and entertainment.

- Hobbies and Recreational Activities: Visiting a gym, participating in sports, or pursuing hobbies such as painting or playing a musical instrument are examples of discretionary expenses.

- Shopping and Fashion: Buying new clothes, accessories, or luxury items are discretionary expenses that contribute to our personal style and preferences.

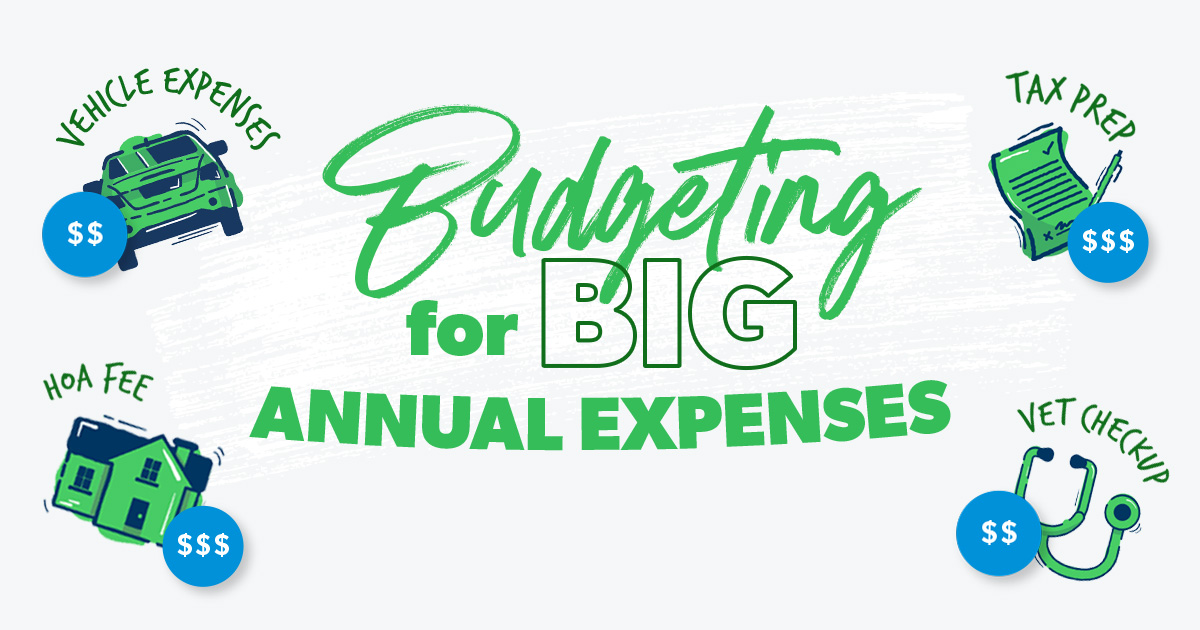

Budgeting for Discretionary Expenses

While it’s important to enjoy life and indulge in discretionary expenses, it’s equally crucial to manage them effectively within our budget. Here are some practical tips to help you budget for discretionary expenses:

- Set Priorities: Determine your financial goals and priorities. Allocate a specific portion of your monthly income for discretionary expenses to ensure you are making mindful choices.

- Create a Discretionary Expense Category: Within your budgeting system, create a separate category for discretionary expenses. This will allow you to track your spending and make adjustments when necessary.

- Monitor and Track: Keep a record of your discretionary expenses and regularly review them. This will help you identify areas where you can cut back or make adjustments if needed.

- Practice Self-Control: Before making a discretionary purchase, ask yourself if it aligns with your financial goals and priorities. Consider potential alternatives or more affordable options.

- Consider the Long-Term Impact: Evaluate the long-term consequences of your discretionary spending. Could you invest the money saved into something more meaningful or important?

Remember, managing discretionary expenses is all about finding a balance between enjoying your life and being financially responsible. By budgeting effectively and making mindful choices, you can ensure your discretionary spending aligns with your financial goals.

So, whether it’s taking a well-deserved vacation, exploring a new hobby, or enjoying a night out on the town, embrace and manage your discretionary expenses while keeping an eye on your overall financial well-being!